brightstars

Thesis

Caught in the crosshairs of a punishing market for high-multiple, technology stocks, Magnite (NASDAQ:MGNI), the digital advertising solutions provider, has seen a dramatic stock price downfall, despite overall solid financial performance and good future prospects. In this analysis, the firm’s financial performance and recently released Q2 2022 results are discussed, while a forward perspective on the company’s valuation is also given.

Brief Business Overview

Magnite offers a range of solutions and services regarding the purchase and sale of digital advertising. After completing 3 major acquisitions (Telaria, Inc in 2020 and SpotX, Inc in 2021 and SpringServe, Inc in 2021), Magnite has effectively become one of the world’s largest sell-side advertising platforms.

A sell-side ad platform (SSP) is essentially a technology that connects publishers with advertisers. The extensive use and popularity of SSPs has followed an evolution from direct-sales advertising as online advertising grew and publishers were struggling to manage effectively their advertising inventory. The network we describe was developed to act as an intermediary to optimize ad sales.

Magnite operates through CTV channels, applications, websites and other media properties, offering transparent, comprehensive and automated solutions. Through the company’s platform buyers can manage their advertising budget, efficiently reach target audiences, simplify ad-campaign tracking and receive meaningful, actionable feedback.

Stock Price Free Fall

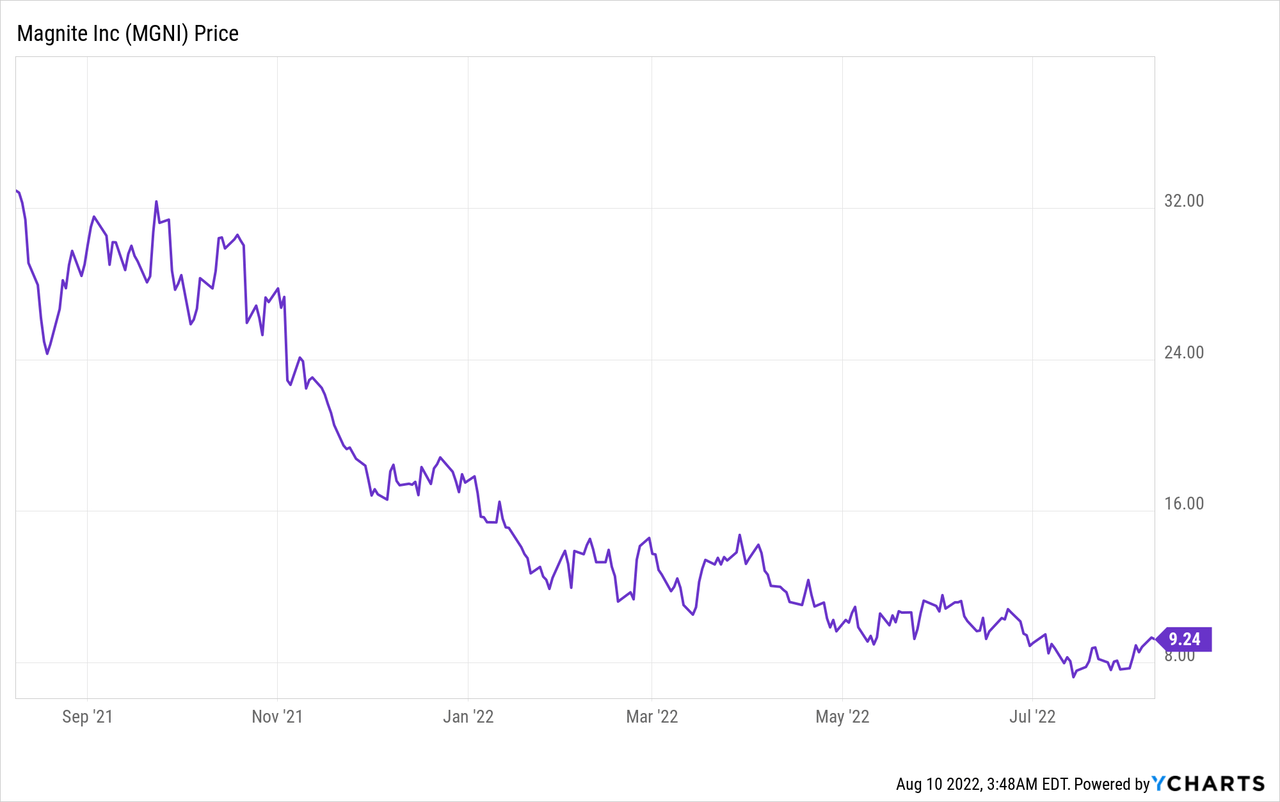

Praised for its innovative practices and prospects in a fast-growing industry, Magnite stood at the forefront of the tech-led rally that dominated the markets in late 2020 and 2021. The stock went from trading at under $10 in late 2019 to an all-time high of $61.70 in February, 2021.

From there, however, a continuous decline has taken over. Over the trailing 1-year period Magnite has retreated more than 70%, reaching lows of $7.10, earlier this summer. YTD the stock has seen a -48.18% decline. Currently, Magnite trades at $9.24 ($1.23B market cap) and pays no dividend. MGNI is also heavily sorted, with a 7.81% short interest currently identified. The stock has been moving further to the downside, after the August 10th close, on poor Q2 results and is expected to open 6-7% lower.

As the market’s rotation away from high-multiple, growth stocks has been evident for months now, stocks like Magnite have been hurt the most. While stock owners are overall disappointed by the mounting losses and have most likely exited their positions, more value-oriented investors that have previously avoided companies like Magnite due to their extreme valuations are starting to become interested.

Just In: Q2 2022 Results

Magnite released Q2 results on August 9, 2022 (after-market), with shares trading lower as a result of top and bottom-line misses. Quarterly earnings of $0.14 per share came $0.04 below estimates, while revenue of $123.3M missed expectation by approximately $3.5M. The underwhelming results come after a positive earnings surprise was posted during Q1, 2022. YoY EPS grew from $0.11 to $0.14. The company also reported operating cash flow of $29.5M.

The current consensus EPS estimate is $0.12 on $115.3 million in revenues for the coming quarter and $0.72 on $495.2 million in revenues for the current fiscal year.

Financial Performance & Outlook

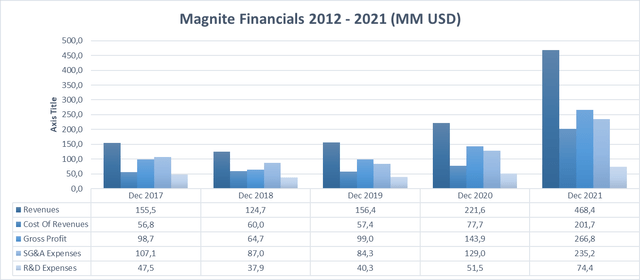

Over the past 5 years, revenue has grown at a 15.6% CAGR, with the company achieving profitability in 2019 (Non-GAAP). Gross margins stand above the 50% level and EBITDA margins at 20%, as of the last fillings. Following the growth trajectory of revenues, SG&A expenses have also grown exponentially, while R&D spending has seen more tapered increases, leaving room for enhancements in profitability.

As far as Cash flows are concerned, Magnite generated $126M in cash from operations for 2021, all spent towards the acquisitions Magnite has made, resulting in a $690M cash outflow from investing activities in 2021. Acquisition expenditure accounted for approximately 95% of cash from investing in 2021. As the company turns to organic growth moving forward, Free cash flow generation should dramatically improve. Accelerating earnings should also assist to that end.

Considering a few negative developments as well, the company has significantly increased its share count over the past few years, mainly in order to fund acquisitions and income losses, further diluting investors. Common shares outstanding have increased from 51M in 2018 to 132M in 2022. At this size, equity issuance should be alarming to stock owners and potential investors. Magnite also raised $720M in debt (more than 50% of market cap) in 2021, after being seemingly unlevered for many years, raising the risk profile of the stock.

For the entire current fiscal year, management remains fairly optimistic regarding Magnite’s financial performance, forecasting over $500M in revenues and $85M in Adjusted EBITDA. For 2022 management’s guidance also looks for $100M in Free cash flow generation and $45M in Capex spending

A Forward Look At Valuation

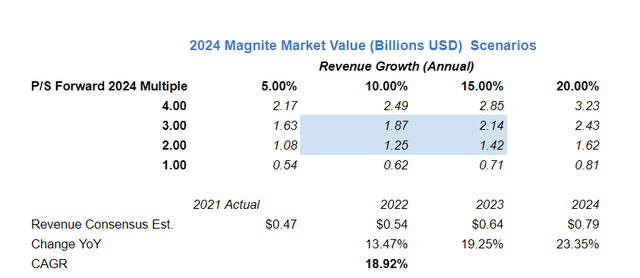

Given that Magnite is still at its growth stage and elevated levels of variability in sales should be expected, in this segment, the potential upside for investors is determined via a forward-looking valuation. Using consensus analysts’ estimates and P/S multiples that fluctuate within a reasonable range from current levels, I examine MGNI’s 3-year forward upside potential. The P/S range selected (1.0-4.0x) is fairly conservative and reflects current multiples, despite the fact that Magnite has traded at P/S multiples over 10x recently. Deviations for forecasted annualized revenue growth are also accounted for.

Seeking Alpha, Author’s research

- Bullish Case: The company exceeds growth expectations and grows Revenue at a 20% per annum rate. In a best-case scenario that the P/S ratio climbs a bit, at levels of around 4.0x, the company will be trading at around a $3.2B Market cap, representing a 3-year 160% upside. If the P/S multiple reaches 3.0x, Magnite will still have a 2.43B Market cap, implying a 3-year 97% upside.

- Base Case: Magnite meets or slightly misses growth expectations and grows Revenue at a 15% CAGR. With a market valuation that will likely range between $1.4B and $1.8B, MGNI’s 3-year upside is still attractive, especially if the company’s valuation multiples slightly increase. The upside, assuming a 3.0x multiple sits at around 75%, which, still, on a CAGR basis could likely underperform the broader market

- Bearish Case: The company fails to meet growth expectations, and grows Revenue at a 5-10% per annum rate. In this case, at a 1.0x or even a 2.0x P/S multiple in 2024, there is no room for gains, with downside potential starting to creep in.

Final Thoughts

After all things are considered, at current valuation levels and after the recent stock price beatdown, Magnite displays some attractive financial attributes for investors to consider. However, as uncertainty continues to loom around the markets and long-term risk factors for the company have increased, over the mid-term it is hard to see a clear winner in the stock. For these reasons, I would assign Magnite a hold rating.

Be the first to comment