CHUNYIP WONG

By The Valuentum Team

In the wake of major inflationary pressures, supply chain issues, and geopolitical tensions boiling over, Exxon Mobil Corporation (NYSE:XOM) offers investors substantial capital appreciation upside and income generation potential. We provided our thoughts on Exxon Mobil in our January 6 article on Seeking Alpha, Exxon Mobil Is A Valuentum Style Stock With A Hefty Dividend Yield (link here), and will follow up on that note highlighting some key recent events and why they are significant for the energy giant.

Energy Markets Overview

Plenty has already been said about the February 2022 Russian invasion of Ukraine, and while we hope peace prevails in the end, for now it does not look like the end is in sight. Raw energy resources prices were already on a powerful upward climb heading into 2022 due to tightening supply-demand dynamics, and after the Russian invasion of Ukraine, energy prices surged higher before pulling back more recently due to recessionary fears. In our view, the outlook for energy prices still has an upward bias.

Exxon Mobil announced it was exiting its Russian investments in March 2022 and recorded a relatively modest impairment from the move. The company’s direct exposure to Russia is limited, something we really appreciate.

After the oil pricing bust of 2015-2020, investment towards upstream operations (those involved in extracting raw energy resources from the ground) dried up according to data provided by the International Energy Agency. Even to this day, global upstream investment levels are still relatively modest when considering where energy prices have been trading currently, something the research firm Wood Mackenzie commented on recently.

Production declines from mature fields combined with a lack of new fields coming online have significantly hindered supply. The outlook for supply growth remains muted as Russian energy production will likely shift lower going forward, offsetting growth elsewhere.

Investments towards “fracking” opportunities (combining horizontal drilling with hydraulic fracturing), which are short-cycle projects, are picking up though not at a pace that would be able to quickly replace lost barrels from Russia. The OPEC+ oil cartel has been limiting supplies since 2020 through a collective agreement. While the group has been steadily increasing its monthly production quota over the past two years (rolling back the cuts made in 2020), only a handful of member countries truly have the ability to increase output in a short period of time. It is an open question how much spare capacity the OPEC+ oil cartel truly has. OPEC+ agreed to increase their collective supply limit by just 100,000 barrels per day in September 2022, a much smaller boost than in previous months.

The situation extends far beyond crude oil. As the European Union (“EU”) seeks to limit its consumption of Russian natural gas, EU member countries are turning to liquified natural gas (“LNG”) supplies to fill the gap. This has seen LNG prices hit record highs this year as EU member nations are effectively competing with major LNG importers in East Asia for a limited amount of supplies. Regional natural gas prices are also quite dear with near term futures for Henry Hub trading north of $7 per million British thermal units (“mmBtu”) as of this writing, something that was largely unthinkable (outside of major weather events) during most of the past decade.

Prices for natural gas liquids (“NGLs”), such as propane, butane, and ethane, are on the rise alongside crude oil prices. NGLs sales are often based on a percentage of WTI or Brent (the leading oil pricing benchmarks). In short, a combination of global energy demand snapping back sharply from the depths of the COVID-19 pandemic, subdued investment in upstream activities during the 2015-2020 period, disruptions caused by major geopolitical events, and the OPEC+ group’s commitment to its ongoing supply curtail deal have created a perfect storm for elevated raw energy resources pricing.

Earnings Update

On July 29, Exxon Mobil reported second quarter 2022 earnings that flew past consensus top- and bottom-line estimates. Last quarter, Exxon Mobil posted $115.7 billion in “total revenues and other income” which was up 71% year-over-year. Its oil & gas production rose by 2% year-over-year to ~3.6 million net barrels of oil equivalent per day, and when removing special items was up 4% year-over-year. Exxon Mobil’s operations in Guyana and the Permian Basin were key to driving this upstream production growth and should remain two of the firm’s top oil & gas production growth drivers over the next decade.

The energy giant noted that “crude realizations improved 15% and gas realizations increased 23% compared to the first quarter driven by tight supply,” which helped drive adjusted earnings at its Upstream business reporting segment up to $11.1 billion in the second quarter of 2022 versus $3.2 billion in the same period in 2021. While energy prices have softened somewhat of late, Exxon Mobil’s Upstream segment should remain incredibly profitable in the current environment.

Please note that Exxon Mobil recently completed a reorganization of its business reporting segments, specifically for its refining, petrochemical, and alternative energy operations. Exxon Mobil’s Energy Products business reporting segment (includes its large refining presence) saw its adjusted earnings come in at $5.3 billion last quarter versus a loss of $0.9 billion in the same period in 2021. Higher oil refinery utilization rates and sales volumes combined with strong crack spreads (refining margins) were key.

Exxon Mobil’s Chemical Products business reporting segment posted $1.1 billion in adjusted earnings last quarter, down from $2.2 billion in the same period in 2021. Foreign currency headwinds and reduced margins for petrochemical product sales weighed negatively on this segment’s financial performance in the second quarter.

The firm generated $17.9 billion in GAAP net income in the second quarter of 2022 up almost four-fold from last year’s levels as strength at its upstream and refining operations more than offset weakness at its petrochemical operations. Exxon Mobil’s GAAP and non-GAAP adjusted diluted EPS stood at $4.21 and $4.14, respectively, last quarter, with both of these metrics up almost four-fold on a year-over-year basis.

Looking ahead, as the outlook for raw energy resources pricing remains robust and crack spreads have been quite strong of late, Exxon Mobil’s financial performance should continue to impress in the current environment.

Financial Strength Grows

During the first half of 2022, Exxon Mobil generated $27.0 billion in free cash flow (defined here as net operating cash flow less capital expenditures) and spent $7.6 billion covering its total payout obligations along with another $6.0 billion buying back its stock. Exxon Mobil is keeping a lid on its capital expenditures, when compared to its large net operating cash flow generating abilities, to better enable it to churn out free cash flow in the current environment. Management reiterated the firm’s capital expenditure guidance of ~$21-$24 billion for 2022 during Exxon Mobil’s latest earnings call.

Exxon Mobil has been aggressively improving its balance sheet since the end of December 2020, aided by the global energy complex staging an impressive rebound starting in early 2021. At the end of December 2020, Exxon Mobil had $63.8 billion in net debt on the books (inclusive of short term debt), which had dropped down to a net debt load of $28.0 billion by the end of June 2022. As Exxon Mobil had $18.9 billion in cash and cash equivalents on hand at the end of the second quarter of this year, it has ample liquidity to meet its near term funding needs. We are huge fans of Exxon Mobil’s past deleveraging efforts.

Major cost structure improvements are playing a key role in bolstering Exxon Mobil’s ability to generate cash flows in any operating environment. By the second quarter, the firm had realized ~$6 billion in structural cost savings when using 2019 levels as a baseline and is on-track to secure ~$9 billion in annualized cost savings by 2023. Recent corporate reorganization efforts, operational efficiencies learned during the 2015-2020 downturn, digital and automation initiatives, and headcount reductions are all part of the company’s strategy on this front. While energy prices have softened somewhat, as we noted, please note that these ongoing cost structure improvements will provide a powerful uplift to Exxon Mobil’s future financial performance.

Exxon Mobil announced in October 2021 that starting this year, it intended to resume share repurchases. Back then, the goal was to repurchase up to $10.0 billion of its stock through the end of December 2023 at the latest. However, Exxon Mobil has since boosted its share buyback target. Now the firm aims to repurchase up to $30.0 billion of its stock by the end of December 2023, with management recently noting Exxon Mobil was “on track” to achieve that goal.

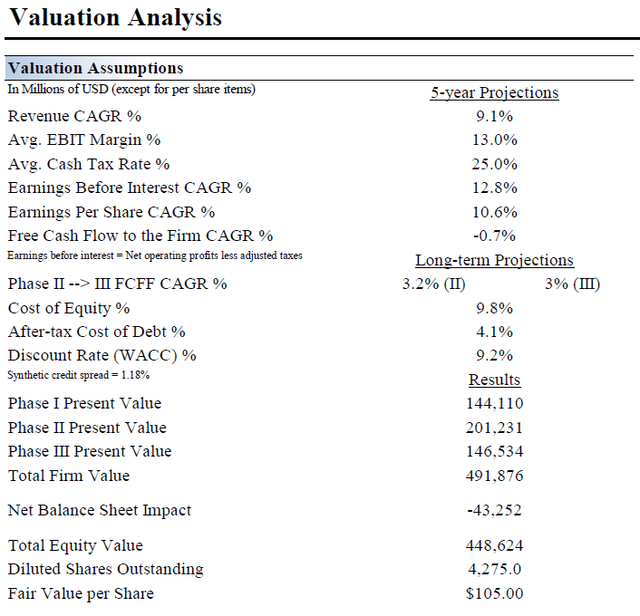

Our fair value estimate for Exxon Mobil, derived through our enterprise cash flow process (please see above graphic), sits at $105 per share and the top end of our fair value estimate range sits at $136 per share. We view Exxon Mobil’s share repurchases quite favorably as in our view, shares of XOM are trading meaningfully below their intrinsic value as of this writing, last exchanging hands at ~$90 per share.

We assign Exxon Mobil a fair value estimate of $105 per share with room for upside. (Valuentum)

As it concerns Exxon Mobil’s dividend growth potential, the company’s past deleveraging efforts are key. Having a smaller net debt load while its free cash flows swell higher puts Exxon Mobil in a much better position to grow its per share dividend in a financially sustainable manner. While recent dividend increases have been relatively modest, we expect that Exxon Mobil will take advantage of its financial strength and improving cost structure to push through larger payout increases going forward. Shares of XOM yield a nice ~3.9% as of this writing.

Dividend Analysis

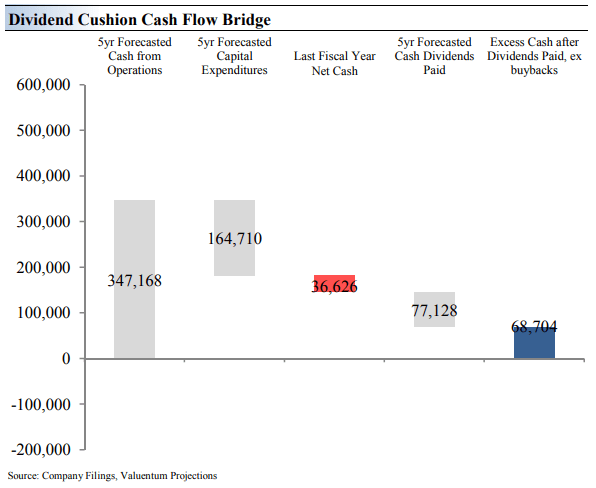

The Dividend Cushion Cash Flow Bridge (Image Source: Valuentum)

The Dividend Cushion Cash Flow Bridge, shown in the image above, illustrates the components of the Dividend Cushion ratio and highlights in detail the many drivers behind it. Exxon Mobil’s Dividend Cushion Cash Flow Bridge reveals that the sum of the company’s 5-year cumulative free cash flow generation, as measured by cash flow from operations less all capital spending, plus its net cash/debt position on the balance sheet, as of the last fiscal year, is greater than the sum of the next 5 years of expected cash dividends paid. Because the Dividend Cushion ratio is forward-looking and captures the trajectory of the company’s free cash flow generation and dividend growth, it reveals whether there will be a cash surplus or a cash shortfall at the end of the 5-year period, taking into consideration the leverage on the balance sheet, a key source of risk.

On a fundamental basis, we believe companies that have a strong net cash position on the balance sheet and are generating a significant amount of free cash flow are better able to pay and grow their dividend over time. Firms that are buried under a mountain of debt and do not sufficiently cover their dividend with free cash flow are more at risk of a dividend cut or a suspension of growth, all else equal, in our opinion. Generally speaking, the greater the “blue bar” to the right is in the positive, the more durable a company’s dividend, and the greater the “blue bar” to the right is in the negative, the less durable a company’s dividend. Exxon Mobil’s dividend health looks solid, in our view.

Concluding Thoughts

Exxon Mobil is a stellar enterprise and one of the best in the energy business. While energy prices have declined moderately of late, from a high base, Exxon Mobil will remain a free cash flow cow in the current environment. The firm’s dividend growth runway remains firmly intact and its capital appreciation upside is quite robust.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment