maxkabakov/iStock via Getty Images

Canada is Hiding an Incredible Growth Stock

As Seeking Alpha now lists Canadian tickers, I will begin a small series discussing some strong Canadian stocks to consider.

First in line is an interesting take on the cybersecurity industry with digital forensics leader Magnet Forensics (TSX:MAGT:CA)(OTCPK:MAGTF). This $898 million market cap company is under the radar in terms of the rest of the cybersecurity industry names such as CrowdStrike (CRWD) or Palo Alto Networks (PANW), but offers an arguably better financial profile for savvy investors.

One reason why is that the company is not a flashy consumer name as they predominantly work with public entities. Also, digital forensics is a segment that does not hold the same flashy keywords as preventative cybersecurity providers, and this helps keep Magnet’s valuation down. Although, it is always important to consider that you get what you pay for, either at a premium or cheap!

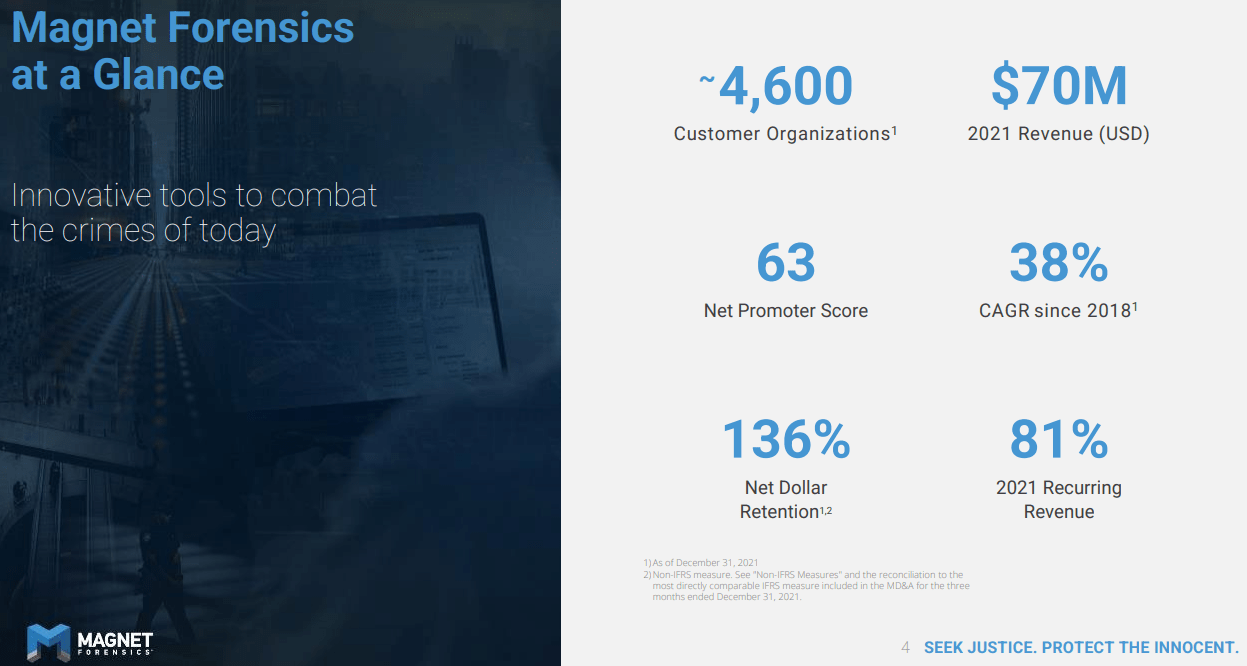

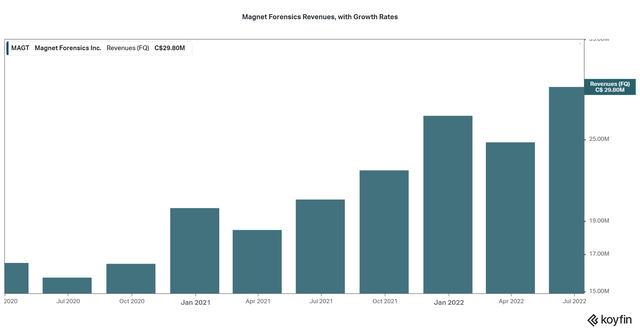

While less than $1 billion in market cap, Magnet is quite widespread with over 4,600 customers worldwide. However, this only leads to $70 million in revenues, as digital forensics is usually a single contract on a case-by-case basis. However, recently, the company has looked to form long-term or perpetual contracts in order to drive recurring revenues and grow net dollar retention.

So far, so good, as net dollar retention is at 136% for 2021, while over 80% of revenues are recurring. While investors should not expect growth on pace with ultra-growth firms CRWD, etc., MAGT does offer a significant runway for the future.

Magnet Forensics June Investor Presentation

You may be asking what digital forensics entails. Interestingly, the applications are wider than just traditional cybersecurity, and move into the domain of public safety and crime analysis. As a key example, Magnet Forensics was used to for the investigation into the Boston Marathon Bombing suspect and their ties to extremism (refer to slide 11 of the June presentation). The company played a role in finding data that led to the suspect being charged, and there are many case studies to peruse on the company website.

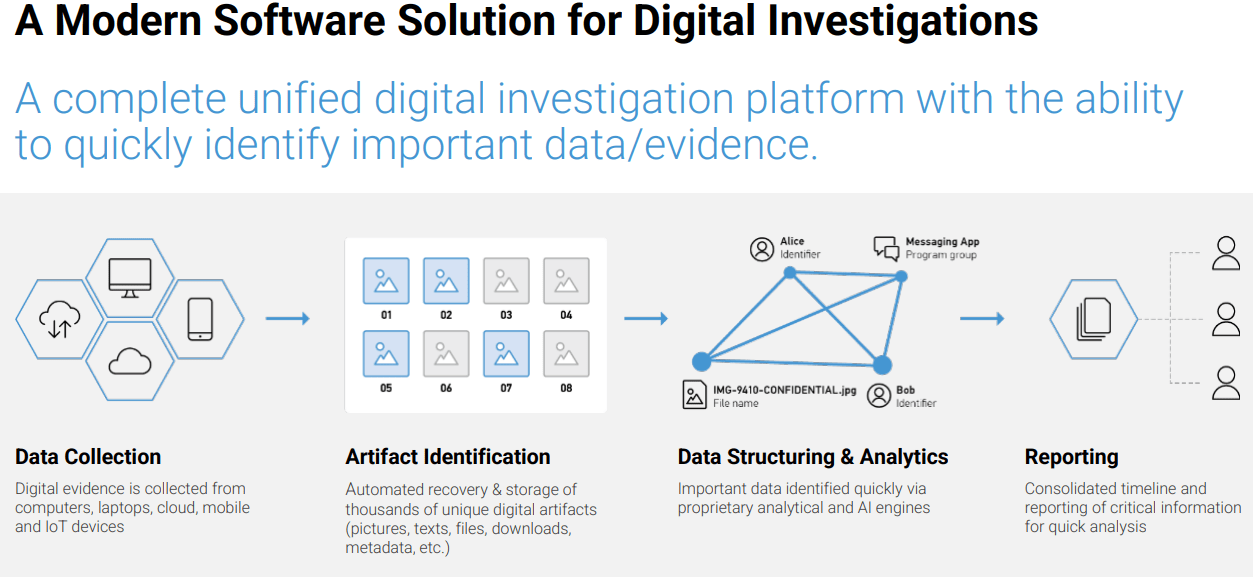

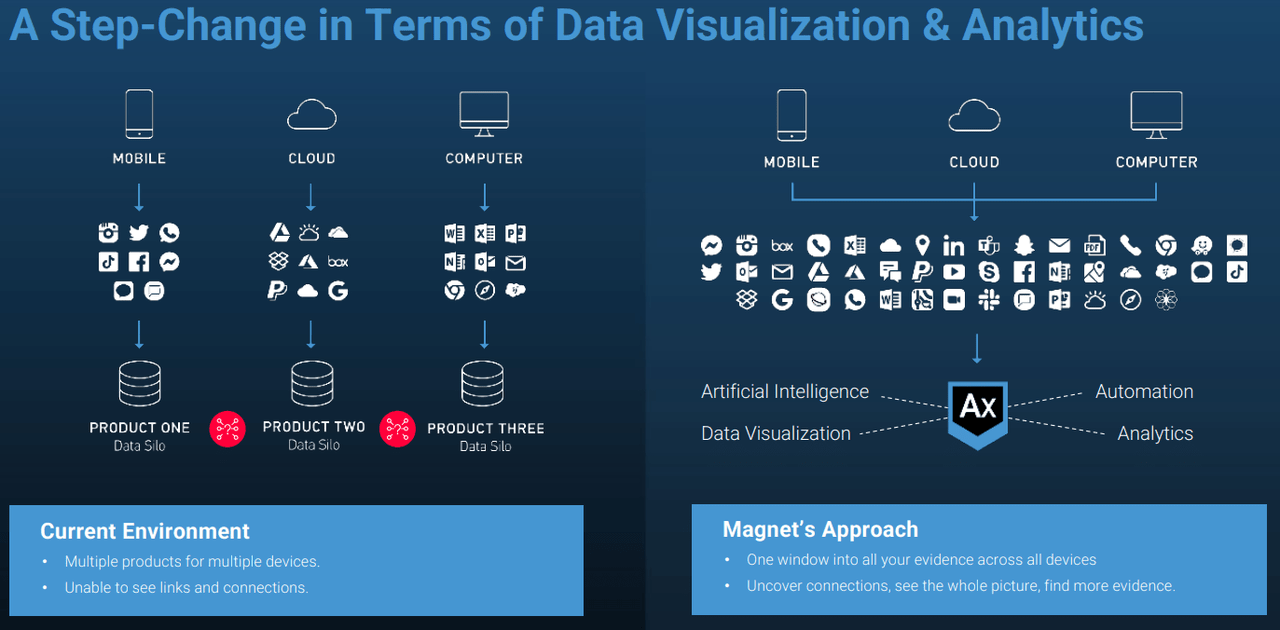

The basis for the platform is for driving quick and efficient digital investigation. This predominately is after an issue arises, and so Magnet does not compete with prevention software providers. Instead, the focus is on data extraction, identification, and analysis, all automatically or augmented, and this allows for detailed reports to be made. Historically, software was made to tailor to each form of application, whether mobile, cloud, or computer-based. Now, Magnet Forensics wants to be the one-stop leader in all solutions on one integrated platform.

Magnet Forensics June Investor Presentation Magnet Forensics June Investor Presentation

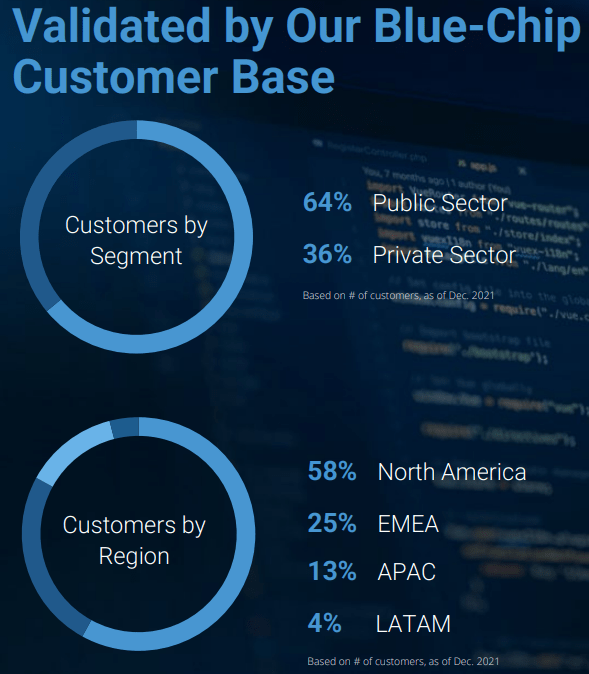

Due to the nature of Magnet Forensics’ platform, the majority of customers are from the public sector, whether defense & intelligence, law enforcement, or regulatory agencies. Then, a third of clients are from private enterprise but there seems to be no sector that is the majority. In order to drive recurring revenue growth, MAGT is expanding their platform in both scope and depth. Recent solutions added include field and video extraction, along with significant upgrades to case analytics & intelligence.

‘The attack surface of organizations has drastically increased, and organizations are experiencing more cyberattacks than ever before. The data that forensics teams need to find and analyze is no longer stored on premises within the four walls of the organization, but distributed across a spiderweb of devices, endpoints, and network connections. The right software can reduce the complexity facing modern forensics teams and enable the practitioners to be more efficient,’ says Ryan O’Leary, Research Manager, Privacy and Legal Technology at IDC.

As cybercrime becomes more commonplace and damaging, forensics tools are seen as an integral and necessary component of global cyber security. Magnet then expects most growth to be found from the private sector moving forward as use applications move beyond evidence collection and into intelligence analytics. I do not expect any significant decrease in the viability or growth of the industry, and so Magnet Forensics should be able to maintain their exponential growth for at least the next few years.

Magnet Forensics June Investor Presentation

Financial Details

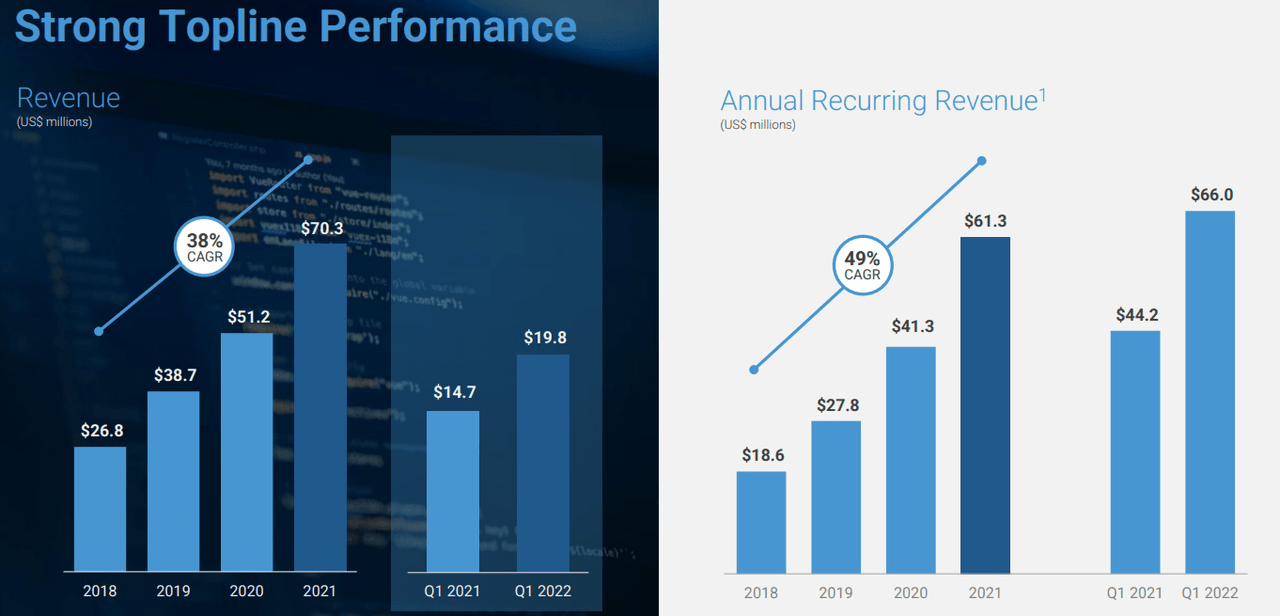

Moving on to the details, we can see that Magnet has a strong annual growth rate of 38% between 2018 and the end of 2021. This is bolstered by recurring revenues increasing at 49% per year, reaching the current 80%+ revenue share, or $61 million in yearly revenues. As the platform expands and recurring revenues drive the majority of growth, I believe that it is possible for the annual growth to exceed the current 38% rate. However, as a fairly young, small company, it is important to hold unbiased expectations for the growth rate, and take the other financial data into consideration.

Magnet Forensics June Investor Presentation

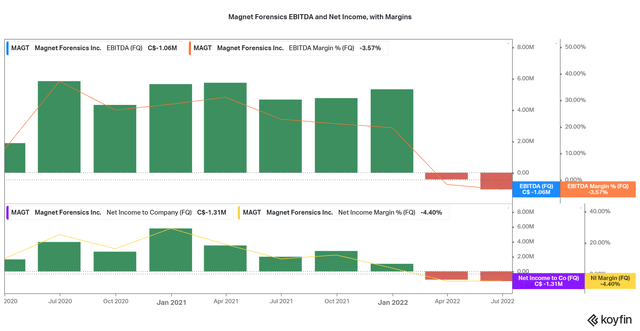

One of the key factors moving forward in an age of high interest payments and economic weakness will be profitability. In terms of profits, Magnet Forensics looks extremely strong. Over the past twelve months, the company has maintained a 92% gross margin, ~20% EBTIDA margin, and over 5% net income margin. However, it is important to note that the most recent quarters of May and July may have had a dip in profitability that is the result of temporary issues. One factor I will be watching closely moving forward is stock-based compensation.

As long as the company can return to and maintain positive income and still drive 30%+ revenue growth, investors will be quite happy. I find this a bullish indicator as most companies across the industry suffer from losses year after year. However, the balance sheet may not be up to par to support these losses for long.

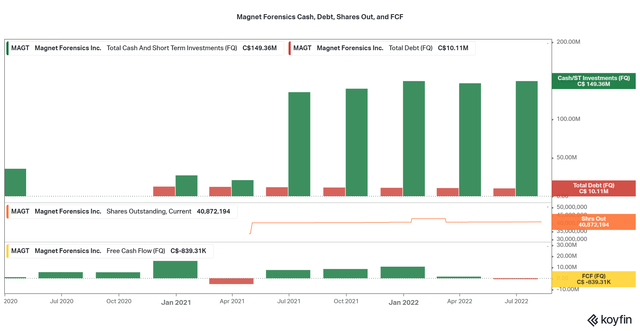

Thankfully, a unique part of Magnet’s success is a strong balance sheet bolstered by cash from an IPO in 2021. There are also no major quantities of debt issued. The current cash on hand is $146 million CAD, $114.7 million USD, as of 8/11/2022 exchange rates. As both net income and free cash flow have historically been positive, I find little risk in the company needing to dilute or issue debt anytime soon, unless performing an acquisition. However, as profitability trends downwards, the odds of either dilution or debt increase.

As such, I hope profitability trends upwards soon, and remain relatively tame at only a few million in total losses. As the costs seem to be onetime due to IPO stock grant awards and acquisition fees, I feel confident that debt and dilution will remain off the table.

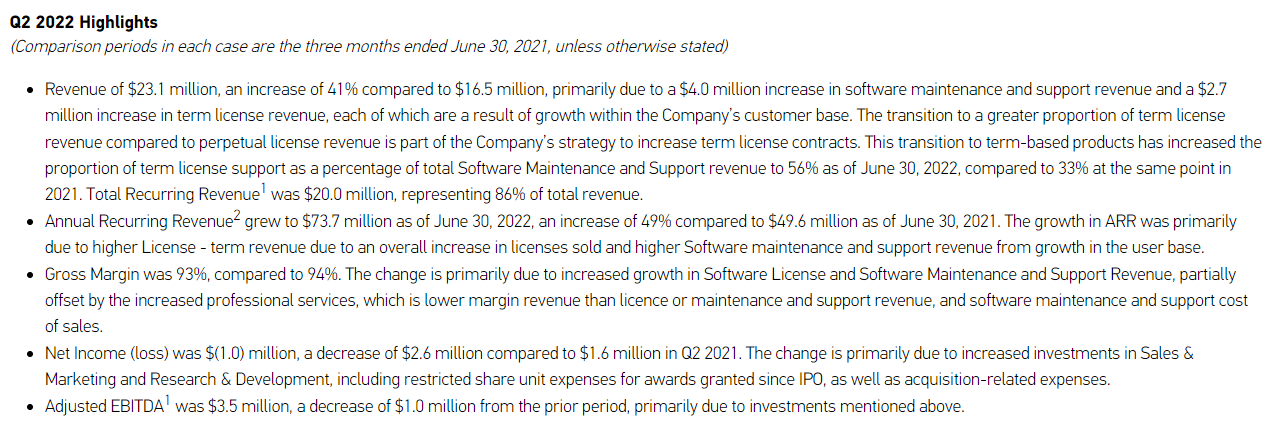

Magnet Forensics 2Q22 Press Release

The Strength of the Investment

The bane to any company’s existence is competition. Thankfully, Magnet Forensics has found their own lane in digital investigations, intelligence, and analysis. The field is quite new and has a tremendous growth trajectory as the world becomes more digital. In fact, according to IDC:

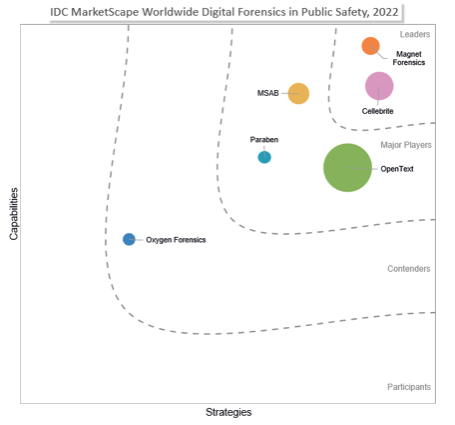

‘Magnet Forensics is a worldwide leader in the digital forensics industry for its innovative automation technology, outstanding customer service and advanced cloud capabilities,’ said Dr. Alison Brooks, research vice president at IDC. ‘Globally, police agencies are handling increasing volumes of digital evidence and Magnet AUTOMATE and Magnet AXIOM are helping alleviate that burden by automating rudimentary tasks, enabling greater collaboration between the forensics lab and non-technical investigators and providing them analytics solutions to help identify critical digital evidence in their investigation in a timely fashion.’

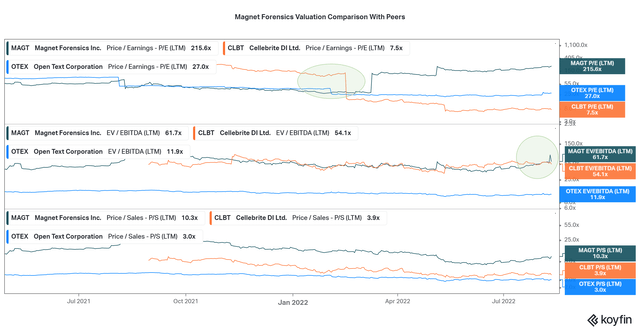

The research group lists two main public competitors, both of which rank below MAGT in terms of capability, Cellebrite (CLBT) and OpenText (OTEX). The financial differences are also quite extreme, as MAGT sees far higher revenue growth. On the other hand, OpenText is quite stable financially, offering a non-speculative and more predictable investment for those who seek less risk.

Magnet Forensics Press Release

Considering the valuations of each, including adjusting for Cellebrite’s onetime boost to net income, I find that MAGT currently slightly overvalued. As shown in the chart below, Magnet Forensics has had periods of a competitive valuation when compared to the underperforming peers. However, losses of late have caused the company to look expensive on paper. I believe that the profitability will be fixed soon, and the valuation may lower accordingly, but due to strong revenue growth, the share price may increase from the current overvalued levels. For long-term investors, I would consider beginning to initiate recurring investments on the company to negate volatile pricing.

Measured Expectations

As you can see, Magnet Forensics offers a unique investment into digital investigations. With competition by only three peers, each of which seeing lower growth, I find the premium valuation to be acceptable. However, there are risks to consider. It will be important to take it one quarter at a time to determine if patterns exist.

High valuation assets will always be volatile, as any minor changes to the growth prospects may lead investors to sell. Second, as Magnet is now facing declining profitability, it is unknown whether I am correct in assuming profits will rise again. While competition seems minor according to the IDC rankings, the field of digital forensics is niche and may not be as profitable or growing as fast as assumed. Due to the reliance on public entities, reduction spending may lead to volatile growth.

I personally will be looking to invest, but I will be taking my time to establish an extremely long-oriented position. I would recommend other investors to also take their time in researching and examining the holding, as the market still remains volatile. I will also not make the company a major holding until the issues I discussed are resolved. However, I believe MAGT is a considerable company from a financial standpoint, and I look forward to the future performance.

Thanks for reading.

Be the first to comment