mabus13

Investment thesis

The cost of industrial metals, including copper, corrected in the last quarter by an average of 30% compared to its max value. The main reason for the decline was fear of impending recession, QT and Fed rate growth (as DXY increases, raw material prices tend to fall). Since the market includes commonly known factors in the asset price prior to the actual occurrence of the event, we believe that all negative factors are already included in the price. But it is still too early to buy Freeport-McMoRan Inc. (NYSE:FCX), and the ideal entry point should appear around Q4 2022.

Copper is an important indicator of the economy

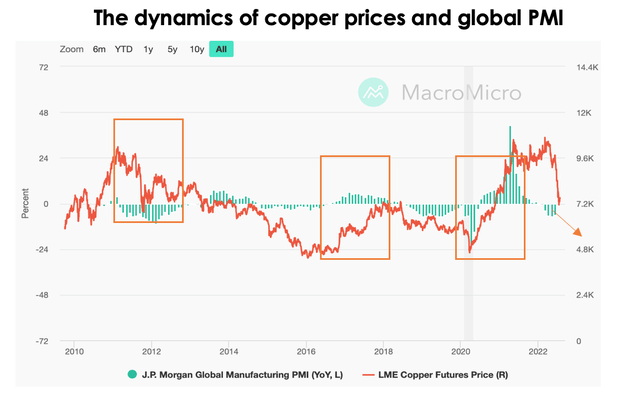

Copper price is the leading indicator of the global economy. According to MacroMicro, the global economy typically has been slowing/accelerating with a time lag of several months following the decline in copper prices. We believe that the current situation is the same, and we have yet to observe a major production decline (Q4 2022-Q1 2023).

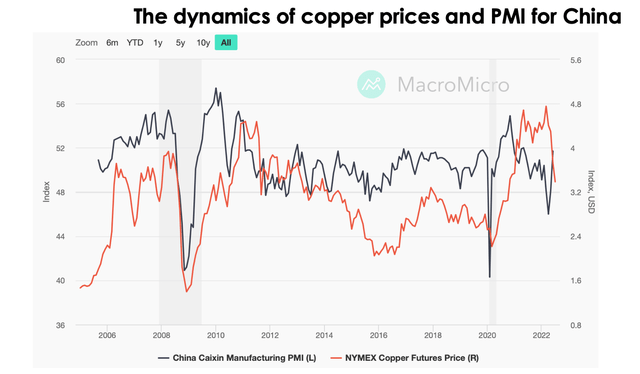

In turn, the copper price is keeping to China’s PMI almost in real-time. Now there is a slight divergence from the index, and we will probably see a “rebound” in the commodity price.

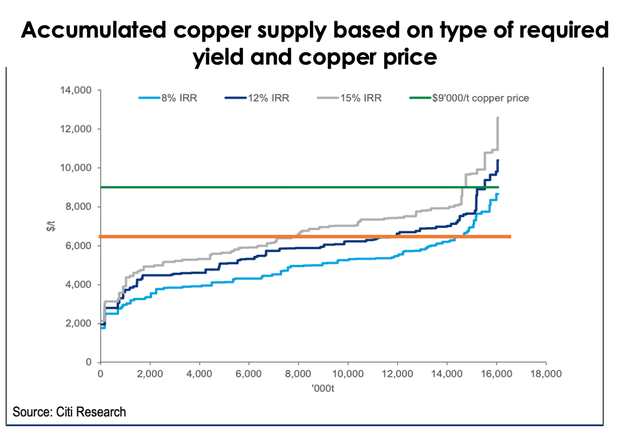

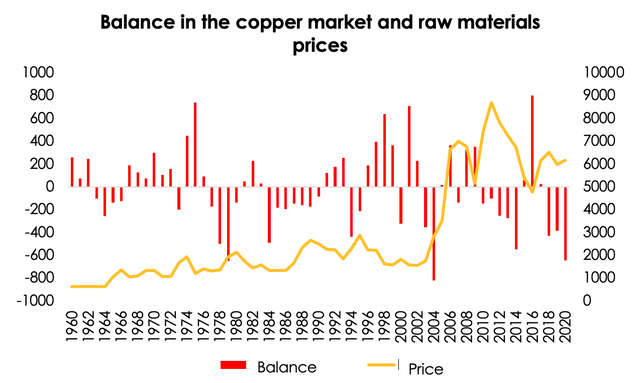

We do not expect the copper price to fall below $6500/ton with the onset of recession. The main reason is the current raw material price (~$7300/ton) removing ~30% of the potential copper supply from the market due to unprofitable projects, according to Citi, and “green shift” of the agenda. However, the market does not assume this and suggests the balance of supply and demand in 2023. CAPEX for copper mining companies and cost with prices below $6500/ton has already become “uncomfortable” for margin.

Green agenda shall generate shortage

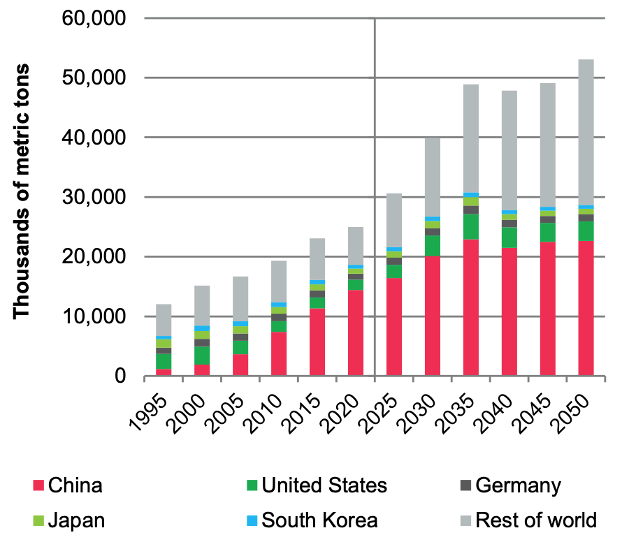

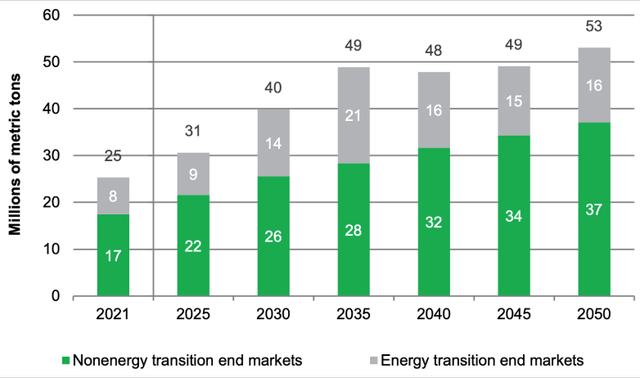

According to S&P Global, copper demand shall increase by 24% by 2025 due to the “green shift,” leading to a nearly twofold increase of copper consumption by 2050.

So far, the bulk of copper consumption has originated from China due to high concentration of production capacity and urgent “green” agenda. The trend is likely to spread into less developed regions, where the issue of building infrastructure as well as “green shift” shall arise.

S&P Global

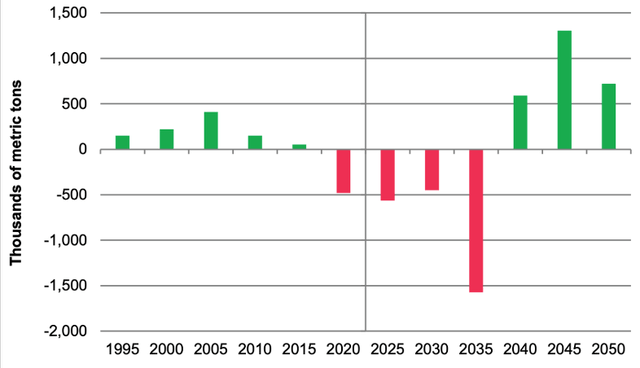

In the long and medium term, commodity shortage is expected to contribute to a new round of price growth.

We expect the current decline in copper price to catch up quickly by the end of 2023 due to its future deficit, as it happened between 2008 and 2010. However, in the short term, we have revised our copper price expectation downwards from $4.68/lb to $4.08/lb due to the global recession starting between Q4 2022 and Q1 2023.

We believe it is too early to bet on copper mining companies now, due to release of negative data on China and the U.S. as for the end of Q3 2022, which may consolidate the price around 6500-7000/ton. However, as the global economy recovers from crisis, demand for raw materials shall be renewed, pushing the copper price and quotes of the companies back to high level.

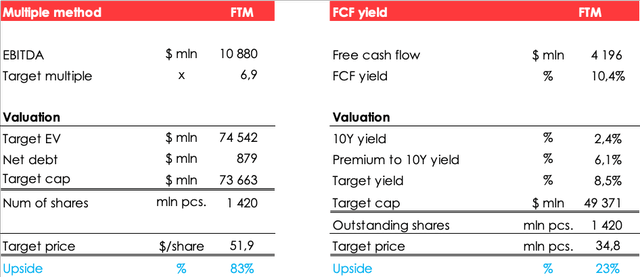

Valuation

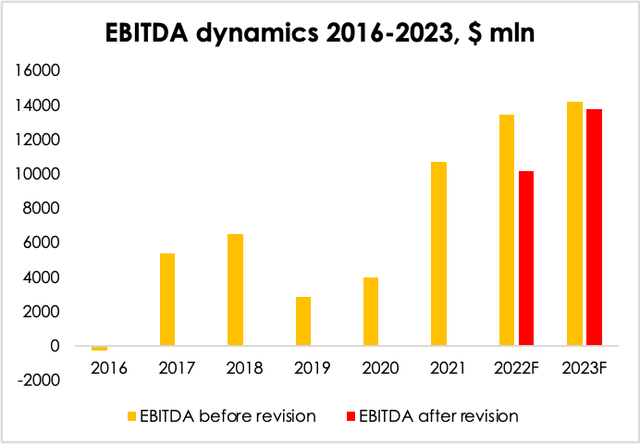

Due to declining copper price, we have revised our 2022 EBITDA forecast downwards from $13411 mln (+25% y/y) to $10165 mln (-5% y/y), and from $14208 mln (+6% y/y) to $13758 mln (+35% y/y) in 2023 due to the gold price increase (from $1784/oz to $1916/oz) and higher extraction rate of gold from ore with ~1 gram of the gold content per ton (77% vs. previous valuation – 75%).

In the long term, copper shall not be subject to a strong price correction due to impressive fundamental support provided by the global shortage of copper. We expect copper prices to remain around 10000$/t for a long time after 2023, while in the short term we expect a price correction due to the upcoming recession.

Our target Freeport stock price is $40. The upside – 53%. However, it is too early to buy Freeport, the best entry point is likely to arise at the time of negative data release in 4Q 2022.

The conclusion

We believe that the market has included almost all well-known negative factors in the current copper price, and we do not expect the metal price to fall below $6500 per ton. It is primarily explained by the fact that ~ 30% of global projected supply is unprofitable at the current copper price, and the current production is becoming “uncomfortable” for margin of the mining companies.

Moreover, we believe that shares of the copper mining companies are not worth buying yet, with negative statistics on U.S. and Chinese GDP the metal price is likely to consolidate in the range of $6500 – $7000 per ton and to put pressure on the quotes. We believe investors shall patiently wait for the world economy to enter recession in Q4 2022-Q1 2023 and create positions then.

The Fed and IHS Markit PMI data can be monitored to understand the economic situation.

Be the first to comment