Sjo/iStock Unreleased via Getty Images

After having reviewed Ryanair’s (RYAAY) latest results, today we move on with the latest development of Air France-KLM (OTCPK:AFRAF; OTCPK:AFLYY). It was a good call to be conservative and to initiate coverage with a no-go opportunity.

Source: Mare Evidence Lab’s previous publication

Here at the lab, we recently commented about ITA Airways’ privatization; however, the new Italian Minister of Economy, Giancarlo Giorgetti, announced the end of the exclusivity negotiations with the consortium led by the US Certares Fund and its partners Delta & Air France-KLM. Therefore, games are reopened for MSC-Lufthansa, who presented a proposal over the summer. Last time, we were more in favor of the MSC-Lufthansa value proposition and so we are not surprised to see this swing.

“Lufthansa has a “multi-hub” structure, while Air France-KLM has a model of strong centralization, in some way that reflects their own form of state. ITA could have represented a strong platform for flights to Africa – a hypothesis that is certainly not viable in the event of a union with the French, who are very strong in the segment. This might create internal friction with a capital structure that is not clear. More importantly together with the MSC group, ITA could have been a local champion in the cargo business, aiming to diversify its airways business model that relies mainly on tourism. This optionality is more limited in the Air France-KLM value proposition“.

As already mentioned, we were not providing any upside on the Air France-KLM investment, assigning a zero value to the ITA Airways equity stake. Going to the positive news, Air France-KLM is finally back to generating profits for the second consecutive quarter and just announced €1 billion repayment on its French state-backed loan (ahead of schedule).

Q3 Results

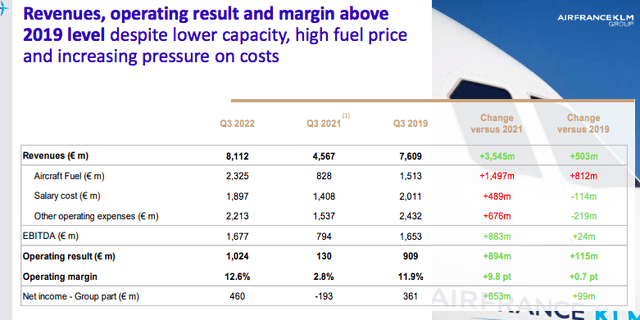

Speaking of numbers, Air France-KLM closed the third quarter with a clear profit, thereby beating Wall Street expectations. In terms of quarterly results, the air travel operator is finally rebounding thanks to strong demand in the intercontinental travel segment. The company achieved an operating result of €1 billion against €894 million during the pre-COVID-19 level, with a turnover of €8.1 billion compared to €7.6 billion in the same pre-COVID period. Going down to the P&L, net profit stood at €460 million versus €361 million in the third quarter of 2019, after having transported more than 25 million passengers.

With the profit recorded in Q3, Air France-KLM is positive at the nine-month aggregate level and expects an operating profit of €900 million by year-end. Despite inflationary pressure from oil prices, the aeronautical giant manages to reduce its debt. As a memo, Air-France-KLM borrowed €7.1 billion in 2020 and €3.3 billion in 2021.

Air France-KLM financial snap (Q3 2019 vs Q3 2022)

Source: Air France-KLM Q3 results presentation

Despite the positive result for the period both in terms of profits and turnover, the market does not believe in Air France-KML’s recovery, fearing fallout from a likely recession and reducing family discretionary expenses with very high bills to pay. In addition to this are the difficulties of the Amsterdam airport, Schiphol, which announced the reduction of the airport’s capacity by a fifth until next March to ensure the safety of employees and passengers. For carriers, and in particular, for KLM, this means a cut in flights and consequently in revenues. Additionally, changes in booking and cancellations have already cost KLM more than €175 million since April (of which €60 in Q3).

Conclusion and Valuation

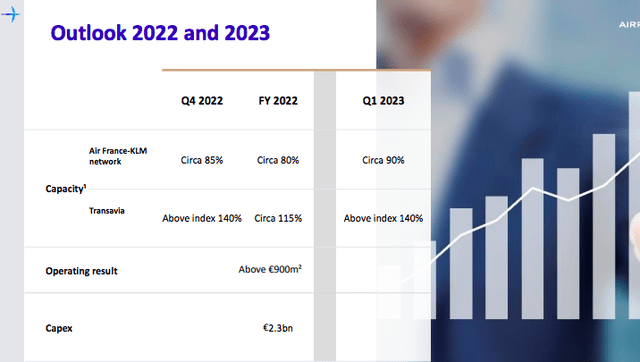

Air France-KLM forecasts continue to be positive on the demand front even in the winter months, forecasting 90% capacity in the first quarter of 2023, compared to the pre-pandemic levels and 85% in the last year’s end quarter. Among other European airlines, IAG which controls British Airways expects to reach around 95% of the 2019 figure in the first 2023 quarter, while the German Lufthansa has forecast a still high demand because the desire to travel “does not subside” with the ongoing macroeconomic challenges. We still prefer Ryanair’s investment opportunity, preferring short-haul rather than long-haul, its game-changer strategy, and more hedging in place both at €/$ development on the CAPEX side as well as related to fuel costs. Despite the negative stock price performance, we continue to maintain a neutral rating on Air France-KLM.

Source: Air France-KLM Q3 results presentation

Be the first to comment