Derick Hudson

Elon Musk is playing a significant role in turning around Meta Platforms, Inc. (NASDAQ:META) for investors without being directly involved with Meta. By acquiring Twitter and immediately challenging the validity of thousands of high-paying jobs, Musk has put everyone else in this space on notice. And no one else is bigger than Meta on social media, and no one likely has as much room to cut fat as Meta.

Sure enough, Meta is following suit with its own massive layoffs coming up. Layoffs are never good for the employees and their families, but businesses need to be ruthless. Although Twitter seems to be back-pedaling a bit already, it is abundantly clear that the high-flying tech space has now finally caught up with reality. And that is great news for investors.

The adage says, “Pride goes before a fall.” In the stock market, the fact that companies are finally showing humility is a sign of better days to come. Mr. Market did not react kindly to Mark Zuckerberg’s insistence on throwing billions of dollars into fancy projects when Meta investors lost more than 50% YTD. The apparent disdain for investors showed, and in turn, the Market’s reaction reached its nadir (or zenith depending on how you see it) when the company showed no signs of slowing expenses in the recently announced Q3 earnings. SA Author Librarian Capital summed it up perfectly with this article titled “Terrible Investor Messaging.” The company has struggled to convey the right message to the market and has been rightly punished.

But the layoffs are coming in at the right time, both in terms of salvaging the expenses and sending the right message to the market. Meta is finally accepting the reality (not just Virtual Reality or Augmented Reality), and that is great news for investors. Once again, layoffs are hard for employees and their families. And this is not sour grapes, either. But when a starting engineer makes more than three times the U.S. Median Salary and is extremely proud of his/her “achievements” in getting such a job, the downside of it needs to be accepted as well.

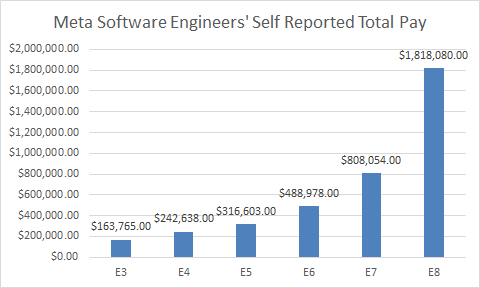

Salaries in the private sector used to be reliant on a few outdated sites like Glassdoor but with the advent of more open sources like Levels, FYI, and Comparably, employees are providing their own direct data. There will be outliers who under or over-report, but the new-age websites more or less show the same range of numbers. These employees want to show off their big pay while some genuinely help the underpaid get their dues. Overall, these numbers are a lot more reliable than old-age websites. Another advantage with the new-age websites is that they account for stock-based compensation, which are expenses for the company. As an example, the chart below shows the average total compensation (salary, bonus, stock) for Software Engineers at 6 different levels at Meta.

Meta Engg Salary (Compiled by Author, with data from Levels.Fyi)

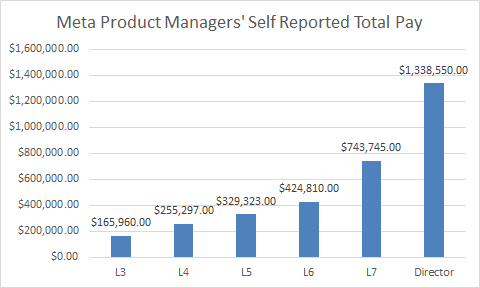

One might think that the Engineers make all the magic happen and deserve all they get. But engineers need support from a well-rounded team, ranging from Product Designers to Software Engineering Managers to Product Managers. Although each job role’s total pay varies a bit, the stark higher (over?) pay compared to the rest of the industry is very clear.

Meta Prod Salary (Compiled by Author with data from Levels.Fyi)

With a total headcount of 87,000, there clearly is room for more than the 10% cut that has been announced. If you don’t think so, this may convince you. Their headcount doubled since 2020. This crazy ramp-up at least makes some sense for someone like Amazon.com, Inc. (AMZN) with their retail needs, but for a company like Meta with mostly very high-paying positions, it was clearly over-expansion even without much of a hindsight bias.

Let’s find out how much Meta stands to benefit with these layoffs.

- 10% reduction would mean 8,700 jobs being reduced.

- Clearly, Meta’s pressing needs for hiring in 2020 and 2021 would have been more in the Technology department than in, say, Legal or Finance. Hence, it is not unreasonable to assume that at least 50% of those 8,700 will be in the highest-paying functions. That’s 4,350.

- Large companies generally get fat in the middle. The freshers take more time to be productive, and no company wants to get too top-heavy. The mid-career engineers and managers tend to be the beneficiaries of hiring as well as victims of firing.

- That would mean the “E5s” and “L5″s in the two graphs shown above, which have an average total pay of $320,000 per year. Multiplying $320K by 4,350, we get roughly $1.4 Billion in annual savings from just direct compensation. When you factor in benefits like 401K matches, health, travel, and other nice perks these large companies offer, the savings will be even more significant.

- The above numbers are extremely conservative, including but not limited to just 50% of the cuts being in high-paying jobs, cost savings from indirect benefits, and perhaps the elimination of positions well above E5 and L5. All these could realistically double the savings to $2.8 Billion. And with 2.65 Billion shares outstanding, that’s already a more than 10% bump to the forward EPS.

Adjusting for excesses? What’s not to like.

Conclusion

The Times They Are A-Changin’. It wasn’t long ago that employers almost had to beg and pray that employees come back to work. Gone are the days of multiple offers and employees having the upper hand. While we don’t support Employers who mistreat their Employees, a balance is welcome. The Meta layoffs will not only enhance the bottom line but also will send the right message to the remaining workforce to not take things for granted and, more importantly, to the market that the company is embracing reality.

As Meta longs, we welcome this news.

Be the first to comment