DNY59/E+ via Getty Images

Thesis

Madison Covered Call & Equity Strategy Fund (NYSE:MCN) is a buy-write equity fund. The fund focuses on current income and current capital gains. As per its literature, the vehicle:

[…] intends to pursue its objective by investing in a portfolio of common stocks and utilizing an option strategy, primarily by writing (selling) covered call options on a substantial portion of the common stocks in the portfolio in order to generate current income and gains from option writing premiums and, to a lesser extent, from dividends.

The fund has a very small amount of equities in its portfolio (only 38 names currently) and has written covered calls on 80% of the holdings. What is also distinctive about this name is the fact that the CEF writes single name covered calls, as opposed to index calls as some of its peers. What does that mean? It means that the fund is exposed to the implied volatility exhibited by the individual names in the portfolio, and the related option premium, rather than the index one. Also, there is no basis between the portfolio and the written index calls. At the end of the day, without going into hard math equations and talking about option skews for individual stocks, suffice to say that performance matters. Irrespective of the chosen strategy in the buy-write space, at the end of the day total returns are the end game, and MCN has delivered.

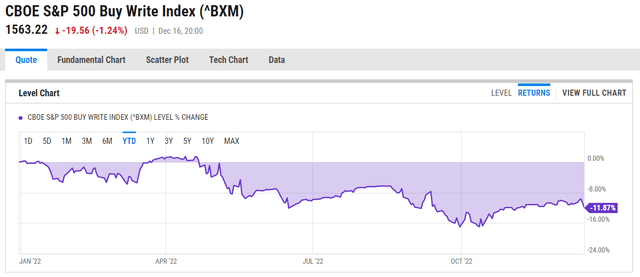

The S&P 500 Buy-Write Index BXM is down almost -12% this year:

Buy-Write Index Performance (YCharts)

The index is a benchmark one, designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index. BXM does monthly rolls for the underlying covered calls.

Compared to the Buy-Write Index, MCN is fairly flat on a total return level this year:

The outperformance is significant, although not linear. We can see how up to May the CEF tracked the index closely, suffering a -15% drawdown, but recovered nicely in July/August, whereas the index did not.

There is value in writing covered calls, if done right, because it monetizes a high level of implied volatility in a down market.

Why did MCN Outperform?

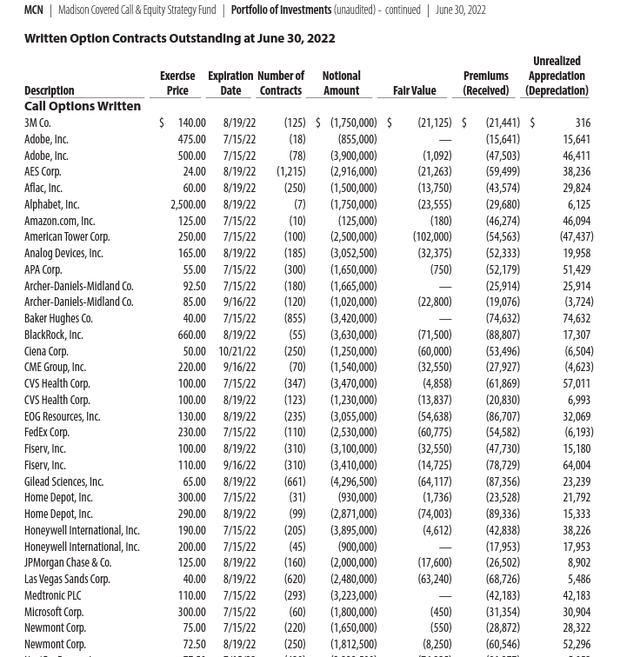

Simplicity and active management in two words. Simplicity through its build – only 38 single name stocks with individual options written against them:

Contracts (Semi-Annual Report)

By choosing a small lot of stocks, the portfolio managers have gone for the outperformers in their book / views. And their views have worked out. Similarly, by doing single name call options, any basis between the individual names and the index is eliminated. What does that mean? Well if you hold 100 names in a portfolio that aims to replicate the S&P 500, and you write covered calls on the index, you will always have a difference between how your 100 names move, versus how the S&P 500 actually behaves. That is called a “basis” in technical terms. It can be in your favor, but it can also go significantly against you.

MCN also engages in active management, in the sense that the time frames for the written calls are not set in stone (management can take an active approach based on skew), and the portfolio can be traded. We like that, because it brings alpha to the table. Savvy portfolio managers can correctly monetize their market views via an active management.

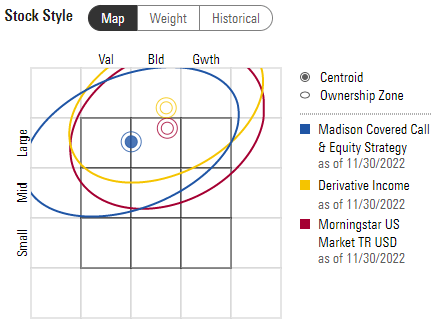

Lastly, via its active management, the CEF has positioned its portfolio towards value stocks in 2022:

Portfolio Type (Morningstar)

Value has outperformed this year, with the Dow Jones Index only marginally lower.

Is it worth buying MCN Now?

MCN is a buy-write fund that has outperformed its index and the broader market in 2022 so far. It has done that by being concentrated in a more value oriented portfolio, and taking a more simplified approach to its portfolio. If you still want to be long equities in this bear market, then MCN is a better proposal than (SPY) or (DIA) in our opinion. However, we are almost flat equity risk in our portfolio, given the view that the next bear market leg is about to develop. So from a macro standpoint we would be as light as possible on equity risk.

The other factor to consider is how to play a potential recovery in the second half of 2023. Buy-write CEFs lag during recoveries:

The Fund Lags During Recoveries (Seeking Alpha)

This is due to the fact that the fund writes covered calls, which limit the upside of the fund. And usually when we see recoveries we see violent moves, not small steps higher for the market. Significant moves tend to take out the call option barriers and thus limit the upside for the fund.

Conclusion

MCN is an equity buy-write CEF. The fund contains only 38 names in the portfolio and writes individual covered calls on 80% of the holdings. This methodology eliminates any basis between the equity holdings and the covered calls, and allows the portfolio managers to focus on individual stocks that, in their view, will outperform. The fund has delivered this year, being flat on a total return basis and outperforming the S&P 500 Buy-Write Index BXM. This feat has been achieved via a value-oriented portfolio, and an active savvy management of the underlying options and equities. Currently MCN represents a better conduit for equity exposure when compared to an index, but it is still subject to downside in the wider markets. A retail investor should also note that during recoveries in equities MCN lags, because it gives up its upside via call options.

Be the first to comment