Kevin Frayer

Apart from the general market attraction towards EV companies (which has faded significantly as of late), I recently saw the opinion that NIO’s (NYSE:NIO) and XPeng’s (NYSE:XPEV) inclusion of autonomy features in their cars was a reason to buy the stocks. I disagree, and will explain why in this article.

NIO and XPeng’s Autonomy Technology

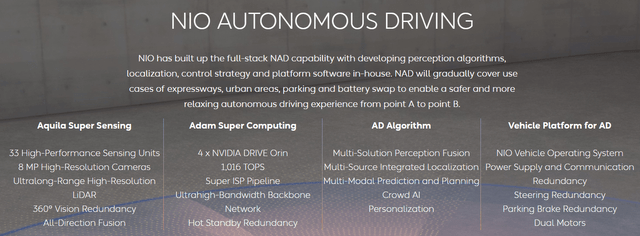

NIO has its own driver assistance features. The same thing goes for XPeng. Both are developed in-house. NIO has NIO Autonomous Driving (NAD), and XPeng has XPNG (formerly XPilot).

From NIO:

NIO NAD (NIO)

As for XPeng:

XNGP is supported by significant hardware upgrades, including 508 TOPS of computing power, dual-LiDAR system, 8-megapixel HD cameras and a new software architecture XNet, backed by a closed-loop, self-evolving AI and data system.

Both are credible driver assistance systems and both claim a path to autonomy in the future. Indeed, both systems are higher-spec’d (hardware-wise) than any current Tesla (TSLA) system, since Tesla doesn’t include LIDAR in its sensor set, and Tesla’s D1 chip in Hardware 3 (2022 revision) provides “only” 362 TOPS (versus 1,016 TOPS for NIO’s latest incarnation, and 508 TOPs for XPeng’s).

It would thus seem that, provided NIO and XPeng got their software / AI right, they could indeed be at the forefront of some kind of autonomy revolution. And thus, their stocks would merit some kind of premium for it.

But Here’s The Problem

The problem with NIO and XPeng’s autonomy effort is simple, and similar to Tesla’s. If most rational observers did some digging into the actual autonomy competitive landscape, they would immediately observe that:

- These companies are not at the forefront of developing autonomy.

- And they’re also not as well financed as at least some of those at the forefront.

For Tesla, this conclusion is usually reached by checking California’s disengagement reports and noticing that Tesla doesn’t even show up (shyness). At the same time, a sampling of drivers using Tesla’s FSD Beta immediately seems rates of disengagement many orders of magnitude worse than those experienced by the companies leading in self-driving under testing.

Indeed, some of those companies, like Waymo or Cruise, already offer self-driving services without a driver, or test without a driver, in some geographies in the US. This includes San Francisco, Phoenix, etc.

For NIO and XPeng, the same conclusion is also reached, because:

- NIO and XPeng are only recently getting their licenses to even test their own self-driving abilities.

- While several Chinese players, including Baidu’s (BIDU) Apollo Go, AutoX, WeRide, etc. already operate self-driving services in several Chinese cities including Beijing, Shanghai, Guangzhou, Wuhan, etc. These are the actual leaders in Chinese self-driving.

Apollo Go As An Example

Apollo Go bills itself the largest autonomous ride hailing globally, already operating in 10 cities. Apollo Go’s testing and deployment mileage closely rivals Waymo’s, so this might be true. Apollo already operates fully driverless robotaxis. Apollo recently claimed it has travelled 36 million kilometers autonomously, which is similar to Waymo’s 20 million miles claim. Apollo Go did 474,000 autonomous rides in Q3 2022 alone, bringing it to 1.4 million rides.

Apollo Go’s ride hailing service vehicles in Beijing were already doing 15 rides per day on average. This is already comparable to a typical human-operated ride hailing service. Apollo is charging for rides in 7 of the 10 cities it serves. Apollo is accruing mileage faster than Waymo, since it’s significantly more recent, larger in scale, and already operating commercially.

Apollo, for its part, is also competing with WeRide and AutoX, among other large Chinese self-driving projects which already include several cities in their ride hailing networks. For instance, AutoX now operates in 4 cities with more than 1,000 vehicles, including fully driverless cars (without safety driver) in Shenzhen. WeRide has now run over 13 million autonomous miles.

The point, though, is that these are the most advanced Chinese companies in terms of autonomy technology – not NIO or XPeng, which only recently even asked for self-driving licenses.

Then, another factor beckons:

- These leaders, or at least AutoX and Baidu’s Apollo, have decided to sell their technology to established automakers for models hitting the market in 2023, 2024 and beyond. Hence, car models with advanced autonomy technology, or advanced driver assistance technology, from these actual autonomy leaders are set to hit the market in the coming years. This will negate a commercial advantage from NIO and XPeng in this area. BYD (OTCPK:BYDDF), the actual EV market leader in China, is one such company which partnered with Baidu’s Apollo.

Typically, these autonomy leaders are being financed by much stronger companies. Baidu is highly profitable and sits on lots of cash, and it backs Apollo. Alibaba (BABA) is highly profitable and sits on an immense cash pile, while backing AutoX.

NIO and XPeng are unprofitable, and have to husband their resources carefully. This is incompatible with the costly endeavor large-scale competitive autonomy development entails. Eventually, it will be easier for NIO and XPeng to simply buy the technology from the autonomy leaders, instead of developing it themselves. BYD, a much richer company than both, seems to have realized it quicker.

China Is Favoring EVs A Lot, Creating A Massively Competitive EV Market

China has special incentives in place to favor EV adoption, which has turned its EV market into the largest in the world (at more than half all EVs sold worldwide). Some of these incentives are set to fade.

This has favored NIO and XPeng a lot, but it has also created a massively competitive EV market – there are now more than 450 Chinese EV manufacturers in the market (versus 32 models in the US), and more are entering the market, including successful ICE-powered brands. This is likely a recipe for economic disaster for Chinese EV brands in general. A shakeout is bound to happen.

This reality tells us two things:

- That NIO and XPeng are not printing profits in the most favorable environment possible, when it comes to state incentives.

- That the extreme competition and presence of large, established players encroaching on the EV market, won’t make it easy for these two brands to be any more profitable in the future (though, of course, it could happen). Quite the opposite, an EV shakeout will happen in China, with an incredibly high failure rate among EV brands. One cannot expect the market to be very positive about EV brands (including NIO and XPeng, even if they survive), when 80+% of EV brands existing now will likely be wiped out in such a shakeout.

Hence, we saw that autonomy isn’t going to save NIO and XPeng, and outside of autonomy considerations, things don’t look rosy either.

Conclusion

NIO and XPeng aren’t autonomy leaders in China. While both are set to deploy some of the most advanced driver-assistance features in new models being launched now, other entities, like Baidu’s Apollo and Alibaba-backed AutoX, actually dominate when it comes to the most advanced autonomy tech (already being deployed in actual ride hailing operations).

Come 2023 and 2024, these autonomy leaders are starting to sell their technology to be incorporated into commercial vehicles. Hence, NIO’s and XPeng’s apparent advantage is set to disappear quickly. Instead of being an advantage, funding the development of these features internally will become a cost drag, just as major competitors will simply be paying for the inclusion of such features in their cars while not fully supporting their development.

At the same time, China’s EV market is brutally competitive, with 450 registered EV manufacturers. NIO and XPeng are not leaders in this brutal market. Such a competitive environment is sure to lead to a significant shakeout where 80+% of players will be forced to exit the market under the duress of heavy losses.

In such an environment, EV assets like NIO and XPeng cannot be considered attractive, and autonomy, as we saw, isn’t going to change that picture.

Be the first to comment