sbayram

Background

Recently, natural gas prices domestically and abroad have been at or near all-time highs on increased demand and limited supply. Russia’s invasion of Ukraine exacerbated tight supply in global markets when Russia severely limited flows of natural gas to Europe in response to European sanctions. TELL has benefitted from momentum in the broader natural gas market and is now severely overvalued.

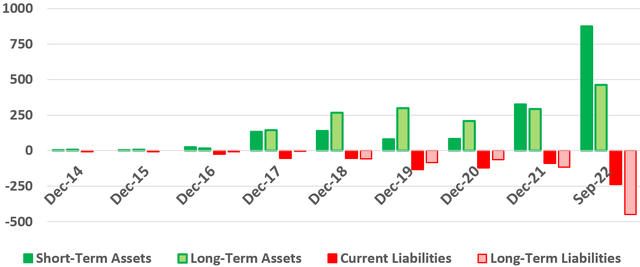

Tellurian (NYSE:TELL) is a development stage company working to build a liquid natural gas (LNG) export facility integrated with upstream natural gas production, pipelines, and an LNG marketing & trading operations. Over the last 8 years, TELL shares have returned less than 4% while share count has increased almost 1000%. TELL’s financial history and present standing are summarized in the plot below.

TELL Balance Sheet: 2014 – Present (M)

Short and long-term assets are represented by dark and light green columns while short and long-term liabilities are represented by dark and light red columns respectively. Current short-term assets (mostly cash) are 877.7M, raised in part by the recent sale of 500M in 3-yr convertible notes at 6%. Long-term assets include upstream production in the Haynesville shale acquired for 125.5M in August.

TELL’s most critical asset is the proposed Driftwood LNG export facility, and limited construction began there last spring, including demolition and site preparation. However, a final investment decision has not been reached, as TELL has not been able to secure $12.8B in financing required for Driftwood construction. According to Cowen analyst Jason Gabelman, TELL is facing financing uncertainty in an LNG market with a growing number of projects under construction and many proposed projects. Financial backers are favoring other projects with lesser risk than the Driftwood project.

While TELL’s Driftwood project languishes, domestic and international competitors are quickly progressing with projects that could quickly saturate LNG markets.

Domestic Competition

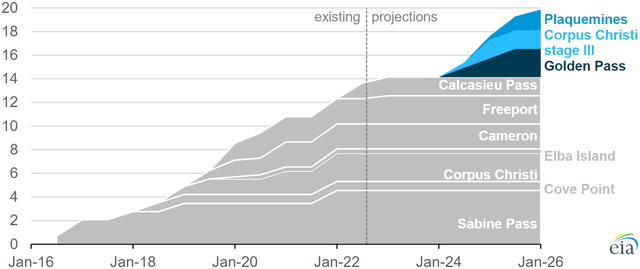

On September 6th, U.S. EIA reported increasing U.S. LNG export capacity as three new projects are under construction. By 2025, these three projects will add 5.7 Bcf/d of capacity, or about 41% to existing U.S. capacity.

U.S. LNG Export Capacity (Billion cf/day)

The Plaquemines, Corpus Christi, and Golden Pass projects are owned by Venture Global LNG, Corpus Christi Liquefaction, and Qatar Petroleum/Exxon Mobil respectively. According to EIA, the Driftwood project is not yet under construction.

International Competition

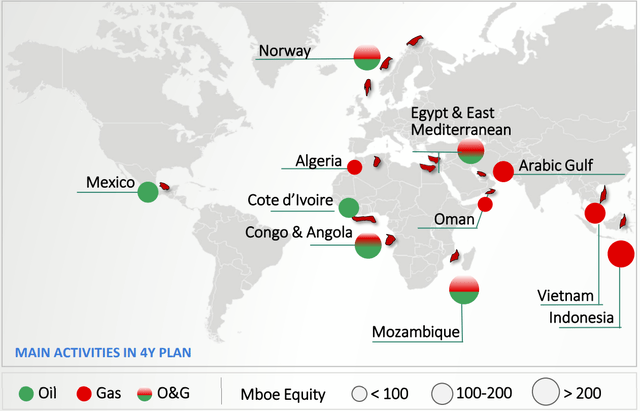

International exploration and production companies, including Eni S.p.A (E) and Shell plc (SHEL), are accelerating plans to produce more LNG and natural gas.

Eni S.p.A. New Production: 4-Yr Plan

Eni has 50 TCF of proven natural gas (NG) reserves globally and plans average annual capex of €4.5B (≈$4.48B) through 2025. Eni expects to add about 2 Bcf/d of capacity to global LNG markets by 2025.

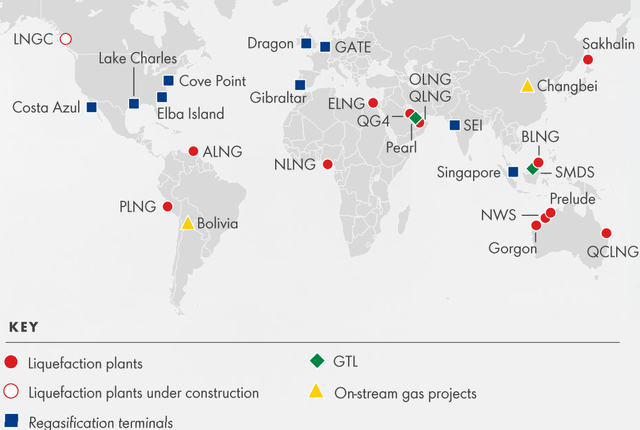

Shell plc is also planning to increase LNG production, with new capacity planned globally.

Shell plc Global Gas Portfolio

In 2021, SHEL had capacity was about 9 Bcf/d and plans capacity increases of 1 Bcf/d or about 11%.

TELL vs Peers

With financing proving elusive, it appears the Driftwood LNG export facility will not be built soon. Therefore, it makes sense to compare TELL to other small production companies with similar market caps.

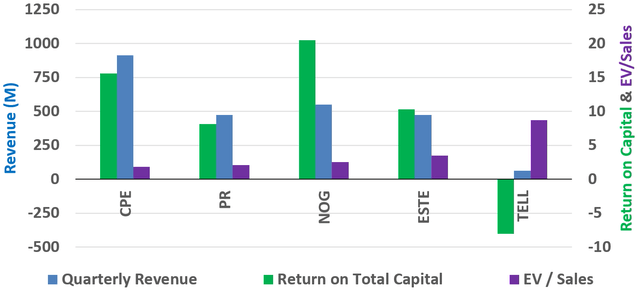

Revenue (M), Return on Capital (%), and EV/Sales

Four small oil and gas producers (Callon Petroleum (CPE), Permian Resources (PR), Northern Oil and Gas (NOG), and Earthstone Energy (ESTE)) were selected based on similar market cap of about $2.5B and are plotted with TELL. TELL quarterly revenue is only about 10% of the average for the other producers while TELL’s return on capital is negative. At the same time, TELL EV/Sales is more than 3X the average for the other producers. As a small producer, TELL compares very poorly to its peers.

Some readers may suggest that comparing TELL with oil and gas producers is unfair, as TELL is promoted as an LNG export company.

For the sake of comparison, the top photo shows the Golden Pass LNG facility under construction by Qatar Petroleum and ExxonMobil in Sabine Pass, Texas. This facility is expected to be operational in 2024.

The lower photo is an artist’s rendering of TELL’s Driftwood project. Currently, TELL has 877.7M in current assets and no additional financing for the $12.8B project. TELL has delayed its final investment decision because, so far, it has not been able to secure financing. As long as the Driftwood LNG facility remains only an artist’s rendering, TELL is a small producer that compares very poorly to its peers.

Further Risks and Cash Burn

Since 2014, TELL has a mixed record of creating shareholder value, with equity/share rising recently to near an all-time high.

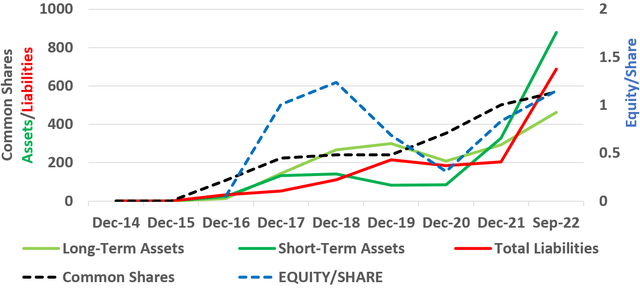

TELL: Assets, Liabilities, Common Shares, and Equity/Share

Total common equity per share ($) is represented by the dashed blue line and plotted against the left axis while share count is represented by the dashed black line. Short and long-term assets are represented by dark and light green lines respectively while total liabilities are represented by the red line. Share count is also at an all-time high.

Both short-term assets (mostly cash) and total liabilities are at their all-time highs. Currently, shareholder equity is $1.15/share or $653.7M total. I think TELL shareholder equity can only go down from here. Driftwood financing and final investment decision are likely to be delayed further or TELL could continue issuing more new shares and dilute shareholder equity. Further, TELL’s operating income was -$98.5M dollars last quarter and I expect similar results next quarter to burn cash and reduce shareholder equity.

Investor Takeaways

TELL is promoting itself based on an LNG export facility, the Driftwood project, that may not be completed anytime soon or ever. I think the market will soon recognize that the TELL is not likely to deliver, and share prices are likely to decline going forward. Shareholder equity is $653.7M versus a market cap of $2.36B. At the current share price, the market is valuing the proposed Driftwood project and its potential revenues at $1.71B.

I recommend those investors who are holding TELL sell at current market prices.

I would compare stock pickers to astrologers but I don’t want to bad mouth astrologers. – Eugene Fama

Be the first to comment