gorodenkoff/iStock via Getty Images

Have you ever tried out smart glasses or augmented reality?

I truly believe it is going to be a game changer in the next decade. These devices still have a ways to go before they become mainstream, but the real-world use cases for a high-tech augmented reality headset (in the form of smart glasses) is honestly endless.

Take everything you have to look down and use your phone for, right at the corner of your view, without changing anything.

I’ve tried out some of the work Magic Leap (private company) has done with its augmented reality headset and I was blown away.

These devices are not mainstream yet, but it is only a matter of time as they keep working to make the headsets slimmer and add more applications to the platforms.

And one company looking to win this race is Vuzix Corporation (NASDAQ:VUZI) – a leading supplier of smart glasses and augmented reality technology and products.

Let’s break down the company’s fundamentals, sentiment and technicals to see if Vuzix is a buy or sell today.

About Vuzix

New York based Vuzix designs, manufactures and markets wearable computing devices and augmented reality wearable display devices all around the globe. These devices include head mounted displays, heads-up displays or near-eye displays as a form of Smart Glasses and Augmented Reality Glasses.

The main consumers of Vuzix smart glasses and AR products are at the enterprise, industrial and commercial levels. Markets include the security sector, first responders, medical markets and defense markets.

They also provide custom solutions and engineering services for other parties, but these are specialized projects that the company expects to advance their technology and lead to long-term supply relationships.

On August 24th, the company introduced its third generation of the Blade model, the Blade 2 smart glasses. This product is primarily designed for commercial use. Upgrades in this model include a host of advanced features and high performance specifically designed to meet the needs of connected workers.

And this is the rat race tech stocks get stuck in. The need to constantly create and keep up with the ever-changing technological landscape.

New models are racing to keep up with those changes, which require companies to revamp and reintroduce lines constantly. As a wearable company, they have to compete with a broad range of technology products, such as increasing screen size on smart phones, work focused tablets and computers, as well as the fact these prices decline compared to the technology that goes into them.

Still, Vuzix is in a unique position among the wearable competitive market, with an intellectual property portfolio that includes micro-display projection engines, waveguides, mechanical packaging, ergonomics and optical systems.

This helps them stay at the front of the pack when it comes to the smart glasses and augmented reality industry.

Let’s take a look at the fundamentals to see how the company has been translating this new technology into some real returns.

Fundamental Analysis

For the fundamental take, I like to look at two main metrics – top of the line numbers with revenues and bottom of the line numbers with earnings per share.

These two numbers tell us the most about the company without getting into the weeds of their accounting processes.

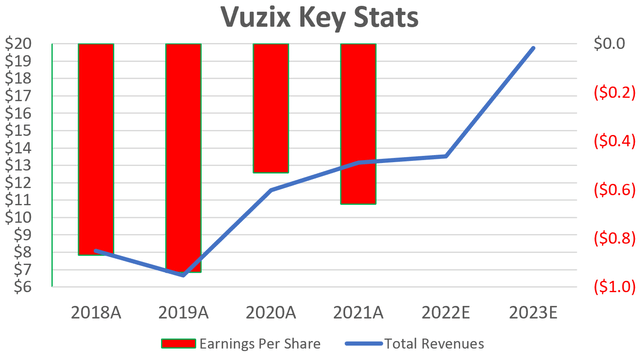

Below, you can see the revenues represented as the blue line on the chart (prices on the left in millions) and earnings per share as the red bars on the chart (prices on right).

Yahoo Finance didn’t have expectations on earnings for 2022 or 2023, but we’ll just assume it’s more of the same – operating at a loss.

A swing to a net profit would be a huge deal for the company at this stage in the growth phase, so it’s not likely in the next two years.

What does stand out on this chart, though, is revenues.

After a slight increase in 2021, and expected slight increase in 2022, analysts are looking for a jump of $6 million, or 46%, in just a years’ time.

That sounds steep, but the company just saw a similar jump in 2020, from $7 million to just under $12 million. That was thanks to the pandemic, this was one of the companies that benefited from the instant shift to a work-from-home environment.

For medical and construction industries, their devices started to spread like wildfire.

Then we see sales growth cool off in 2021 and 2022, before another expected jump in 2023.

A few things could help drive sales in 2023, probably the biggest one is another round of upgrades in its Android operating system for its M400 and M4000 line of products. This is expected to be completed early 2023. The first major upgrade since 2020, when sales experienced the sharp surge.

It’s safe to say their clients are holding off, new clients will likely be interested after seeing what the upgrades bring to the table and it may also help expand into new industries with an upgraded software platform.

It lines up perfectly with the expected jump in revenues and should help support increased exposure for the company.

Next up, we’ll look at a few sentiment indicators to see how investors feel about the stock.

Sentiment Readings

Short interest is a great one to start with.

In general, the higher the short interest, the weaker the sentiment. It’s not every day you get to see a short squeeze play out.

I like to stay on the low end of short interest if I’m looking to go long a stock. Typically, anything under 5% is not meaningful, while more than 20% is a reason to be cautious.

Vuzix short interest as a percent of float is 30.5%. So, plenty of reason for alarm here. Investors are becoming increasingly bearish on the stock and are willing to add leverage (shorting the stock) to profit from a decline. Shares have fallen 75% since the peak in 2021, but it doesn’t mean shares can’t fall another 75% from here. With short interest high, it is going to get a lower sentiment rating today to add to our whole picture of the stock.

Analysts are still bullish, but we only have two that cover the stock. It has an average rating of a buy with an average price target of $12 per share, 61% above the $7.41 per share closing price on September 2nd. Vuzix even got initiated with a buy rating from Dawson James at the end of 2021. Despite a roller coaster ride since then, shares are only 20% below that initiated rating.

That gives us a mixed view based on the sentiment reading, as short interest is alarmingly high, but the few analysts giving coverage on the stock are not bearish at the moment. Next up, let’s see if the price chart paints a different story to help us clarify this mixed messaging.

Price Patterns

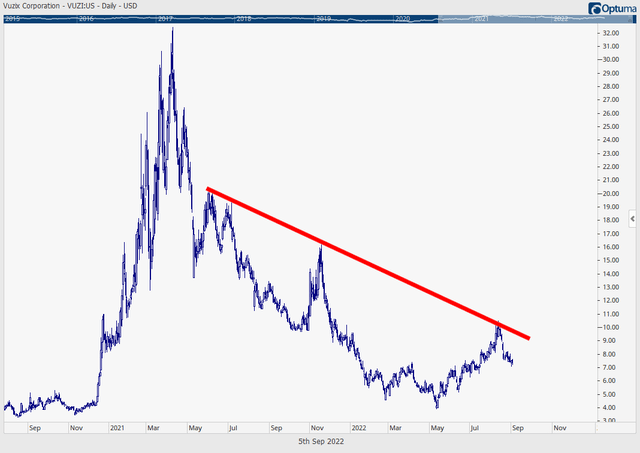

In the chart below, we only have one major level to watch – a falling resistance line in red.

This clearly shows that the stock has been trending lower for the last year and a half, from that peak in 2021, and has resumed falling lower in recent weeks.

Take a look:

It had a strong rally, shooting up 100% in just a few months, but it failed to break that key resistance level. That is not what we wanted to see.

If you are not a bottom fishing type of investor, this is a stock you’ll want to wait on. When it climbs above that resistance level, then you know it’s time to jump in. Right now, any buyer of the stock is betting on the weakness to reverse. For investors to realize what’s coming in just a few months for the stock, that could add a massive jump to sales revenues.

Conclusion

This one was tough.

You have a bigger picture here with augmented reality headsets that feels a lot like buying beaten down tech stocks during the dot com bubble in 2001. But, I’ve studied that bubble and I know it can take years to come back. The stock is in a clear downtrend on its price chart and sentiment was mixed. The question becomes what stands out more, the big picture pushing sales higher in 2023 or the failed break of the resistance level on its price chart.

I think I’m going to take a bullish angle on Vuzix today, just because I know augmented reality is the future of technology and this is a company leading the way. Shares could still fall lower, but the floor could be high, while the upside potential from here is massive. I simply don’t want to miss out when it makes another run like it did from May to August.

We’ll add Vuzix to my Bank It list today and look for its price to rise in the coming months.

Be the first to comment