XtockImages/iStock via Getty Images

Elevator Pitch

I have a Hold investment rating for Lufax Holding Ltd’s (NYSE:LU) stock. In its media releases, Lufax calls itself a “technology-empowered personal financial services platform in China” offering “credit facilitation services.”

My view of Lufax as a potential investment candidate is mixed, which explains my Hold rating for the company’s shares. LU’s asset quality risks are in the spotlight following a significant increase in credit impairment losses for the company in the recent quarter, and this represents a major downside risk for Lufax’s future earnings in the near term. On the other hand, Lufax has dealt with regulatory issues reasonably well, and I am less concerned about the company’s regulatory risks.

Share Price Underperformance

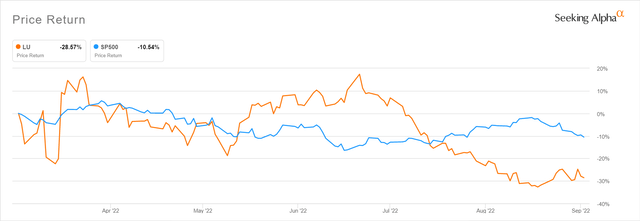

Lufax’s shares have underperformed the S&P 500 in the last six months, as indicated in the chart presented below. In the past half-year period, LU’s stock was down by -28.6%, while the S&P 500 declined by a relatively modest -10.5% in the same time period.

LU’s Historical Six-Month Stock Price Chart

It is noteworthy that Lufax’s substantial underperformance relative to the broader market really began in late-July and early-August, which coincided with Lufax’s Q2 2022 earnings announcement on August 4, 2022.

Lufax’s Historical Earnings Beats And Misses

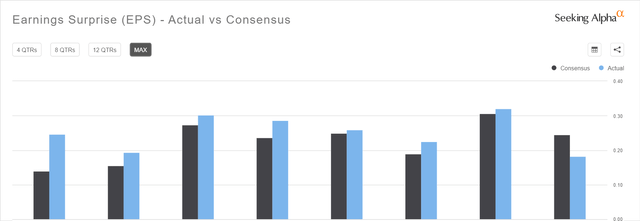

The second quarter of 2022 marked the first time that LU has failed to meet market expectations with its quarterly earnings since its NYSE listing on October 30, 2020 as highlighted in the chart presented above.

In the next section, I discuss about the key reasons for Lufax’s Q2 2022 earnings miss.

Asset Quality

Lufax’s net profit attributable to shareholders fell by -45% QoQ and -39% YoY to RMB2,909 million in the second quarter of this year. The sharp earnings contraction in the most recent quarter was attributable to a more moderate pace of loan growth and an increase in credit impairment losses.

The company’s new loans facilitated declined by -15% YoY from RMB153 billion in Q2 2021 to RMB130 billion in Q2 2022. On a QoQ basis, LU’s new loans facilitated for the recent quarter was -21% lower as compared to the RMB164 billion figure that it achieved for Q1 2022.

The drop in new loans facilitated for Lufax in the second quarter is understandable, as demand for loans will naturally be depressed in the current weak economic environment for China. Moreover, it doesn’t help that “86.1% of new loans facilitated were disbursed to small business owners” in Q2 2022 as highlighted in Lufax’s Q2 2022 earnings announcement. These “small business owners” will be much more badly hit by the tough macroeconomic conditions as compared to larger corporates due to a lack of scale and limited financial resources.

The bigger concern lies with LU’s asset quality. Lufax’s credit impairment losses grew by a significant +152% YoY from RMB1.4 billion for Q2 2021 to RMB3.5 billion in Q2 2022, and this was a substantial drag on LU’s bottom line in the recent quarter. Separately, LU’s days past due 30+ delinquency rate for loans facilitated increased from 2.6% as of end-Q1 2022 to 3.1% as of end-Q2 2022, while its days past due 90+ delinquency rate for loans facilitated also rose from 1.4% to 1.7% over the same period.

At the company’s most recent Q2 2022 earnings briefing on August 6, 2022, Lufax acknowledged that “the current macroeconomic situation environment (in China) is not as good as back in 2020” and stressed that it is adopting a “very prudent stance.”

More importantly, LU doesn’t expect a significant improvement in asset quality or a meaningful decrease in credit impairment losses in 2H 2022. The company noted at its recent quarterly investor call that “we estimate the overall asset quality will remain at current levels in the second half (of 2022) as it relates to our credit impairment cost.”

In conclusion, there are downside risks for Lufax relating to a further deterioration in asset quality for the company going forward, assuming that the weakness associated with the Chinese economy persists for a longer than expected period of time.

Regulatory Issues

Lufax is faced with specific regulatory issues by virtue of operating in the Chinese financial services industry and being a US-listed Chinese company.

In relation to the finance market in China, a key regulatory development has been a 24% interest rate cap guideline put forward by Chinese regulators.

LU previously highlighted at its Q2 2021 results briefing on August 10, 2021 that there were media reports in China mentioning that “regulatory authorities would require financial institutions” to “implement an all-in cost ceiling of 24% for personal lending.” Lufax noted that the company believes this regulatory guidance could possibly become a legal requirement by 2024. As such, it is reassuring to know that LU has been in compliance with this regulatory guidance starting in September 2020, where it has ensured that the interest rates charged on all new loans facilitated are below 24%.

With respect to the delisting risk for US-listed Chinese companies, Lufax is possibly pursuing a listing in Hong Kong.

According to an August 15, 2022 Seeking Alpha News article that cited a report from Bloomberg, Lufax intends to “go public in Hong Kong” with a planned listing application in 2H 2022, so as “to hedge against the risk of being banned from U.S. markets.”

While there hasn’t been any official confirmation from the company with regards to the Hong Kong listing plans for 2H 2022, it is important to note that Lufax has discussed about this in the past.

At the company’s Q4 2021 investor call on March 10, 2022, LU revealed that it has “explored ways for potential listing on the Hong Kong Stock Exchange and engaged in preliminary communications with relevant regulatory departments.” The company also emphasized at the call that it “will not pursue a Hong Kong IPO until we get blessing from those relevant regulators.” As such, it is reasonable to assume that the media report on the proposed Hong Kong listing application is likely accurate.

There is still substantial uncertainty over whether audit access issues can be eventually resolved so as to allow companies from China to remain listed in the US in the future. In that respect, it is positive that Lufax is doing its part to mitigate ADR delisting risks by considering a listing in Hong Kong as indicated by its earlier management comments and the recent media report.

Closing Thoughts

I rate Lufax’s shares as a Hold. Regulatory risks are less of a concern for LU, but there are worries about larger than expected credit impairment losses for the company going forward as a result of asset quality issues. Considering both the positives and negatives for LU, I view a Hold rating for Lufax as fair.

Be the first to comment