Dennis Diatel Photography/iStock Editorial via Getty Images

Ethereum (ETH-USD) heads for a blockchain update in September and this article explains the recent developments and outlook for the coin.

Ethereum breaks market correlation ahead of the Merge

The Ethereum price was around 7% higher over the last week ahead of the blockchain’s imminent Merge upgrade. The price was able to break its correlation with Bitcoin (BTC-USD) and the broader market with the former losing nearly 1%.

Ether is moving towards a momentous switch from a Proof of Work to Proof of Stake architecture and developers have touted a 99.95% reduction in energy usage for the chain. The network’s developers have been planning the transition for years and on December 1, 2020, the Beacon Chain was created, which has run as a parallel chain to the Mainnet.

The date set for the Merge is around September 15th and there has been much speculation about how the token would behave in the days running up to the event.

Developers shoot down hopes of lower gas fees

One of the many benefits that have been touted for the Merge upgrade is a reduction in gas fees. Ethereum users have had to stomach problems with high costs for transacting on the blockchain. That became more of a problem after the 2020 rise in decentralized finance projects. Many new projects began to shun the chain and build on rival chains after ETH fees soared above $100 per transaction. An upgrade that solves this problem would’ve added to the attractiveness of ETH but this has now been clarified. Ethereum developers said:

Gas fees are a product of network demand relative to the network’s capacity. The Merge deprecates the use of proof-of-work, transitioning to proof-of-stake for consensus, but does not significantly change any parameters that directly influence network capacity or throughput.

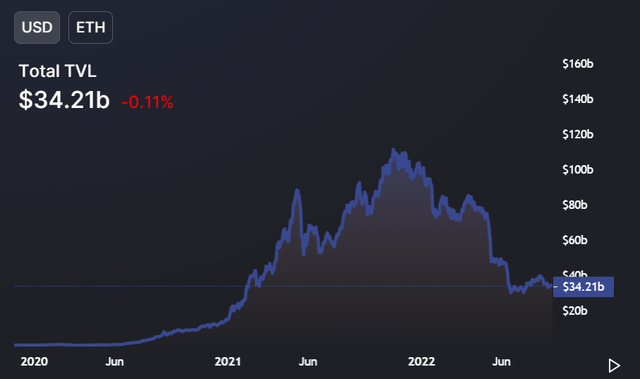

That could be a disappointment for many and there had been talk of lower gas fees ahead of the upgrade. That is likely down to the cryptocurrency bear market with less volume and less demand for Ethereum and other projects or apps built on the chain. The chart below from DefiLlama shows that activity on the chain has dropped from around $100bn in late 2021 to $34.21bn now. A return in demand for ETH could simply mean a return to high gas fees.

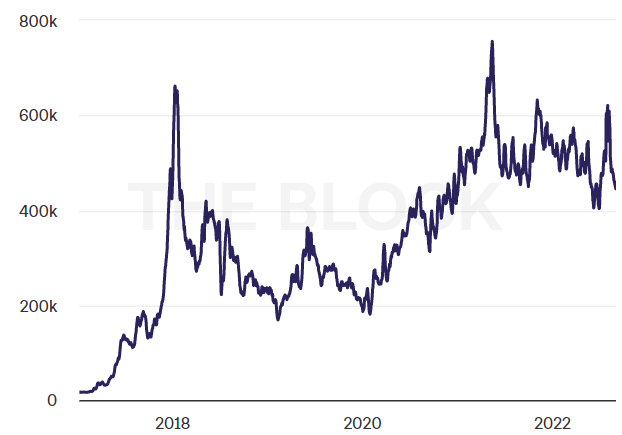

Active Ethereum addresses have been slowing and that can also be related to miners switching across to other networks to continue PoW mining.

ETH Active Addresses (Glassnode)

Another two misconceptions that were debunked by developers were faster speeds on Ethereum and an ability to withdraw staked tokens.

Historically, on proof-of-work, the target was to have a new block every ~13.3 seconds. On the Beacon Chain, slots occur precisely every 12 seconds, each of which is an opportunity for a validator to publish a block. Most slots have blocks, but not necessarily all (i.e. a validator is offline). On proof-of-stake blocks will be produced ~10% more frequently than on proof-of-work. This is a fairly insignificant change and is unlikely to be noticed by users.

It was clarified that investors will have to wait for a further update named Shanghai before staked coins can be withdrawn.

Futures market open interest hits an all-time high

Despite the lack of real fireworks in Ethereum, we have seen open interest on futures markets touch an all-time high. That could be a sign of volatility to come and possibly around the time of the upgrade.

Futures have seen almost $140 million in liquidations in a recent 24-hour period which suggests some traders are getting nervous. The funding rate also turned negative in Ethereum futures as more bearish bets were placed. Similar levels were last seen in June 2021 and were followed by a massive short squeeze the following month, according to analysts.

According to data from The Block, aggregated open interest in Ethereum options across major exchanges hit $9.15 billion at the end of July. That marked a near 100% rise from the end of June.

That brings a risk of a sharp drop in the ETH price if the Merge is delayed, suffers technical problems, or disappoints investors.

Risk and reward could come down to outside factors

The buildup in Ethereum futures brings interest in the coin close to Bitcoin’s $11.67bn on Sept. 4.

So the real problem for Ethereum investors is that stock markets and alternative investments are still being weighed down by central bank rate hikes. That has led to a surge in the U.S. dollar to 20-year highs and there is a risk of another wave lower in risk assets through September as I discussed in a recent SPY article. As I also said in a recent Bitcoin article there has been serious sentiment damage done in crypto markets. A slicker Ethereum chain will not be a magic wand that brings volumes back to decentralized finance projects when U.S. Treasury yields are surging.

What is more disappointing is that the hopes for a faster and cheaper blockchain from Ethereum have been debunked. If the Merge transition goes ahead as scheduled then the real benefits may not be seen until later. Future developers and creators of non-fungible token drops would see value in using a chain that is over 99% less energy intensive. Ethereum can also avoid the potential for negative developments driven by government action against energy usage. That could even intensify this winter if Europe continues to struggle with gas supplies and higher energy prices. Again, that would be months away and the near-term trend for ETH is a decline in active addresses. That could strengthen when the blockchain makes the switch and miners move to other coins. Some miners are maybe waiting for the final realization of the Merge to decide. There have been rumors of a hard fork that would keep an Ethereum PoW option, while others have been moving to the likes of Ethereum Classic (ETC-USD).

Conclusion

Ethereum is only around ten days away from its long-awaited Merge upgrade. However, there is already some disappointment with developers stating that speed and gas costs will not be improved. Staked coins will also be locked up until a later upgrade, which could be another slow-moving change. Ethereum will benefit from having a 99% reduction in energy usage but that won’t happen overnight. Sentiment has been damaged in the cryptocurrency sector and it is the lost confidence in crypto staking that has led to a decline in ETH activity. In the near term, we could see a further reduction in ETH addresses as PoW miners flee. There is also the risk of a further decline in Bitcoin and that would come with around $20bn of open futures positions between the two coins. If the crypto market saw a revival then the gas fee issue could remain. Being a greener chain will help Ethereum but that may not see real benefits immediately.

Be the first to comment