Devon’s $1.8 billion all cash transaction in the Eagle Ford solidifies them as a dominate player in another one of the industry’s key production areas. ttsimaging/iStock via Getty Images

It appears that Devon Energy’s (NYSE:DVN) management team is on a roll with M&A activity. We previously highlighted the company’s acquisition of RimRock in the Williston Basin, which was a good deal financially and operationally for Devon. The bolt-on strategy is a winning strategy in the energy sector and right now Devon certainly appears to have their M&A machine dialed in, with the Validus Energy deal announced this morning as further evidence.

Deal Breakdown

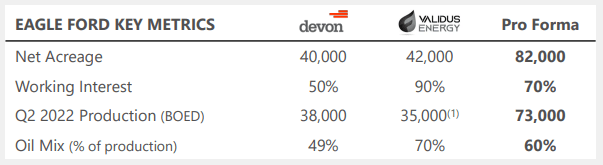

This all cash, $1.8 billion deal is another great bolt-on acquisition for Devon, as Validus actually improves and strengthens the Devon acreage position in Texas’s Eagle Ford play. Below is a chart showing how the deal will improve Devon’s acreage position based off of some key metrics:

Devon Energy Investor Presentation

Notice that the company is doubling its net acreage position, getting production with a higher percentage of oil production and nearly doubling production (it must also be pointed out that Devon’s management believes that production will increase to 40,000 BOED over the next year). So the takeaway is that Devon, a company which already possesses top-tier assets, just enhanced their asset quality and production in the Eagle Ford while also locking up 350 drilling locations and 150 refrac candidates. Validus Energy’s 90% working interest also puts Devon in the driver’s seat for the management of this acreage.

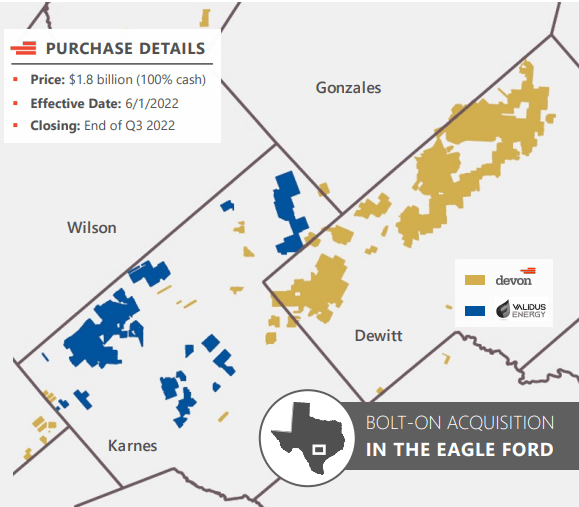

This acquisition dramatically increases Devon’s acreage position in the Eagle Ford, specifically in the Karnes Trough oil window. (Devon Energy Investor Presentation)

There should be considerable cost savings realized on the purchase, with management estimating $50 million in annual cash flow savings through efficiencies/synergies and improvements in operations.

Our Take

This deal has even more attractive metrics than the RimRock purchase as Devon is paying 2x cash flow and the transaction yields a 30% FCF yield (readers will remember that the RimRock deal was at 2.2x cash flow and a 25% FCF yield). Since the deal is being paid for with cash on hand, the acquisition will be immediately accretive over the first year as measured by all important metrics (Earnings Per Share, Free Cash Flow, Net Asset Value, etc.) and will improve the company’s ability to increase the variable rate portion of the quarterly dividend. While this is a decent outflow of the company’s cash and will lower its cash position, management was clear that this will not negatively impact Devon’s $2 billion share repurchase program and should actually allow management to accelerate the pace of the overall program.

The bottom line is that Devon’s management is faced with few options to deploy its cash these days since they have already stated that their goal is to essentially maintain production over the long-term with potential incremental growth. Their CapEx program is funded and FCF is healthy, so aside from returning capital to shareholders via share repurchases and increased dividends Devon’s management is forced to choose between holding low-yielding cash on the balance sheet (least desirable), continuing to pay down debt (more desirable as the company’s weighted average fixed coupon is roughly 5.81%) or find attractive M&A opportunities which can generate significantly more cash flow than the other options for shareholders.

Summary

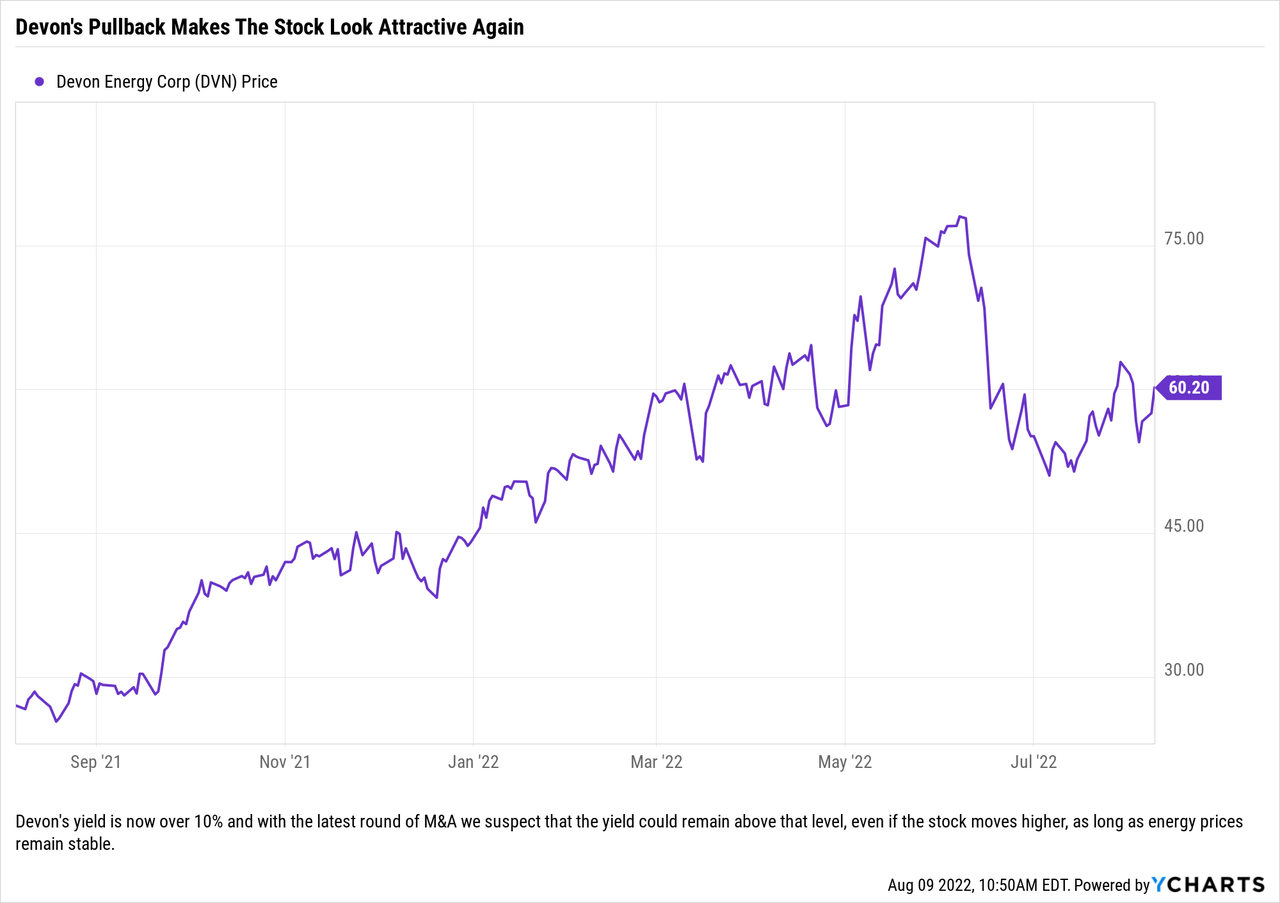

Devon Energy’s shares have pulled back from the highs in June, but at current levels certainly appear attractive based on management’s dividend policy, CapEx plans and current M&A strategy. It is one thing to talk about making good to great acquisitions, it is an entirely different exercise to actually deliver those M&A transactions for shareholders.

Devon shares are higher on the news, rising almost 5% as we write. That move basically accounts for the balance sheet conversion of low yielding cash to higher yielding production assets, but we think that there will be further room for the stock to increase as investors benefit from the 10% increase in cash flow from the deal and management continues to deliver and execute on their plans to pay down debt and further strengthen the company’s ability to generate additional cash flow.

While we still think that this name is a long-term buy, we think that investors might be better served utilizing the options market, via selling puts, to establish a position after this morning’s move higher. The August 19, 2022 $55 Puts currently trade with a bid/ask of $0.57/$0.60 – so even after trading costs, one is able to generate a 1% yield, while potentially being able to purchase the stock about 10% lower and before the stock goes ex-dividend. Purchasing the shares outright is a move we cannot argue against, but in the current volatile market the options market does offer some ability to generate income and potentially lock in a lower price for those looking for a pullback.

Be the first to comment