lisegagne/E+ via Getty Images

In the article on the iShares U.S. Consumer Staples ETF (IYK), I briefly outlined the reasons for a conservative view on the defensive names that investors are likely following closely amid the stagflation risk and the storm raging on the Street this year.

I emphasized that though playing defense when interest rates are going up fast inviting somber economic forecasts is a totally rational move, valuation is another piece of the puzzle that is not to be forgotten. And ignoring valuation can have severe consequences. The example of Target’s (TGT) swift and devastating price decline that sparked a broad sell-off dragging down even the most resilient players was a warning.

Today, I would like to take a closer look at another passively-managed ETF targeting the seemingly recession-resistant corner of the market, the Invesco Dynamic Food & Beverage ETF (NYSEARCA:PBJ), answering a few questions mostly regarding factor exposure I believe investors should also ask themselves.

Before we proceed to the details, I should highlight that the principal conclusion of the analysis I performed is that the factor mix PBJ has at the moment makes it a Buy. Another way of saying, while acknowledging that the ETF is not completely immune to possible sluggish performance in the short term in case macro data surprise to the downside, I am of the opinion its valuation profile together with the adequate level of quality and an aura of defensiveness make it a better investment in the current environment.

The top line: what is inside PBJ?

What is the investment strategy of the ETF? PBJ is a high-turnover passively-managed fund designed to track the Dynamic Food & Beverage Intellidex Index provided by ICE Data Indices, LLC. Its methodology is guided by the proprietary Revere Hierarchy industry classification system developed by FactSet.

While targeting companies that manufacture, sell, or distribute “food and beverage products, agricultural products and products related to the development of new food technologies,” the index shows the red light to pet supplies stores and tobacco growers and manufacturers. That makes PBJ a comparatively superior pick for investors who are for whatever reason shun exposure to the tobacco industry compared to the Vanguard Consumer Staples ETF (VDC), for example. VDC’s website shows almost 9% allocation to tobacco, with Philip Morris International (PM) being the largest name in the segment. The same is true for IYK which is even heavier in PM, with 7.5% of the net assets deployed.

The PBJ portfolio encompasses 30 equity holdings from the two GICS sectors, namely сonsumer staples and consumer discretionary. Its exposure to the latter is diminutive, with just 2.7% allocated to the one stock, Acros Dorados Holdings (ARCO), a franchisee of McDonald’s (MCD) restaurants with operations in Latin America and the Caribbean.

Is the PBJ portfolio adequately valued in the current iteration?

Sysco (SYY), PBJ’s major investment at the moment with a weight close to 5.4%, does not fit into a value investor’s portfolio. Almost every multiple except for those based on sales is too stretched. Keurig Dr Pepper (KDP), the fund’s second-largest position (5.1%) is trading at a slight premium to the sector medians and 5-year averages, so again, no clear value opportunity is observable. However, this very first impression is misleading.

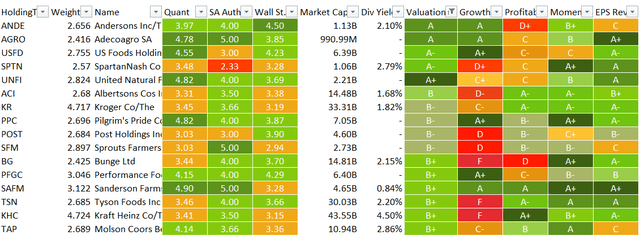

If taken with a due context in mind, the PBJ portfolio does sport value characteristics which are manifested in close to 48% of the holdings (16 stocks in total) having a Quant Valuation grade of B- or better. These stocks with the multiples pointing to underappreciation are presented in the table below.

Created by the author using data from Seeking Alpha and the fund

Yes, these are principally smaller-size, mid-cap names, but the echelon is rife with bargains, so no coincidence here. As a reminder, in May, IYK was burdened with more than 61% of the holdings having a D+ Valuation grade or worse, a precarious proposition as we are navigating the bear market; a due remark here is that since my May note on this ETF, its price has declined by 4%, partly proving my point that valuation matters.

Next, the EV/EBITDA ratios vary from 2.9x in the case of Sanderson Farms (SAFM) to 42.8x in the case of Cal-Maine Foods (CALM). However, the median is just 10x, while the weighted average is teetering marginally above 12x.

And if my dear readers are considering cranking up bets on the defensive plays right now, they should remember that stalwarts from this pool do trade with a solid premium. Coca-Cola (KO) is valued at EV/EBITDA close to 22x, while Procter & Gamble (PG) is offering a debt-adjusted earnings yield of just 6.25% (an around 16x multiple). And the last time it traded with an around 12x ratio was four years ago.

Meanwhile, the consumer staples sector median is standing at 12.6x.

Besides, PBJ’s median EV/Sales, another ratio I would like to address, is just 1.6x. The sector median equals 1.78x. So, it seems that the PBJ mix is valued rather adequately.

Can quality investors be satisfied with PBJ’s characteristics?

Mostly yes, but there is also something to dislike.

Investors who are pondering if PBJ is worth buying right now should understand that it is a mid-caps-heavy mix. It even has a ~16% allocation to small caps. As a rule, quality deteriorates when size goes down, and vice versa. Obviously, there are exceptions, but the tendency is clear.

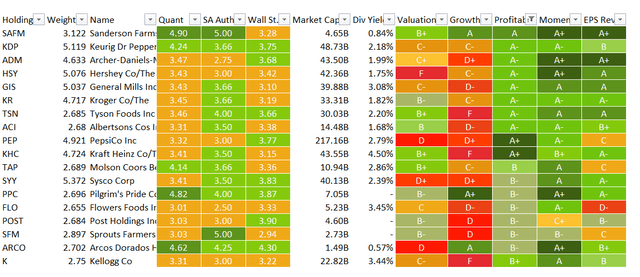

Specifically, we see around 67.2% of the net assets parked in high-quality names or those with a Profitability grade of at least B-. This group is presented below:

Created by the author using data from Seeking Alpha and the fund

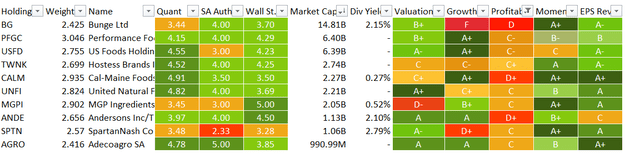

Of those ten stocks with a D+ rating or worse, 9 are mid-caps; only Bunge (BG) is in the large-cap league, valued at $14.8 billion.

Created by the author using the data from the fund and Seeking Alpha

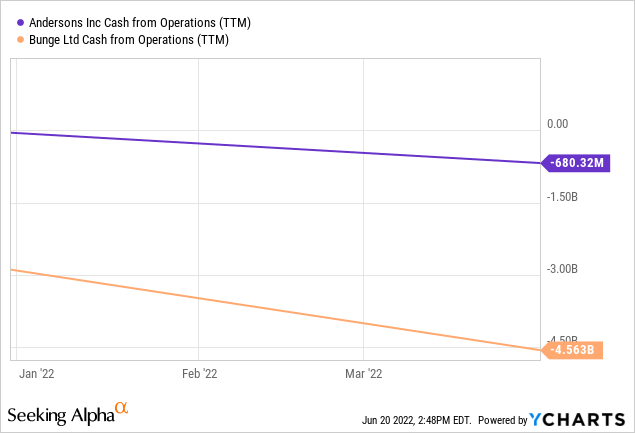

Delving deeper, we can find two cash flow-negative companies, namely Bunge again and The Andersons (ANDE).

That is why I have opted for EV/EBITDA above: all the PBJ holdings have delivered earnings before interest, tax, depreciation & amortization, but two still failed to convert positive EBITDA into the net operating cash flows. Anyway, though a minor disappointment, this should not pose material threats to returns given the duo has just a 5% weight.

Summing up

We all love resilient margins, especially when they are expanding, better at a faster pace compared to the top-line improvements. We all love companies that sell products with inelastic demand. Should recession strike, they would chug along. What is even better is when an equity mix with such desirable characteristics is adequately priced or even undervalued. And I reckon PBJ does have a margin of safety, though not an ideal one.

As I have explained in a few articles earlier this year, the best combination of factors to weather the climbing rates era is value plus quality. PBJ has exposure to both.

It goes without saying that its performance during the previous decade is rather lackluster if compared to the bellwether funds. Its CAGR delivered from May 2012 to June 2022 is just 10%, while the iShares Core S&P 500 ETF (IVV) achieved 14.4%. Its racier counterparts from the S&P 500 league did better for a gamut of reasons. Simply put, the zeitgeist, especially with ultra-loose monetary policy during the pandemic, favored them.

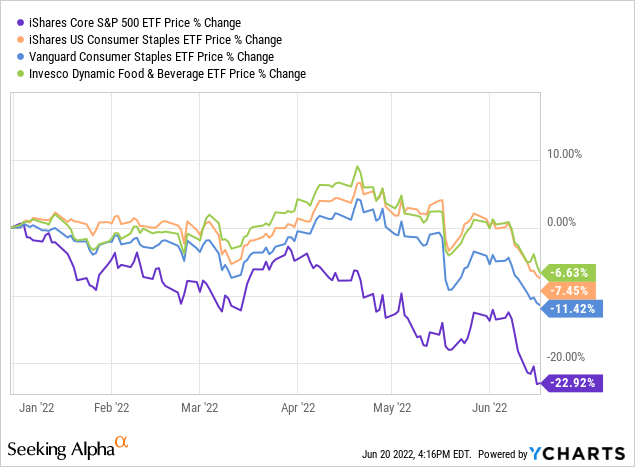

This year, PBJ has fared much better than IVV, with a single-digit decline vs. the bellwether’s double-digit decline. It has also outperformed VDC and IYK. Its A- Momentum grade is not coincidental.

Of course, there are downsides. The primary vulnerability of the fund is its expense ratio of 63 bps. It has an intricate methodology and high turnover, so higher fees look justified. But that by no means nullifies the issue that such burdensome expenses would eat into returns, especially over longer timeframes. Hence, PBJ is more of a tactical, not a strategic play.

However, PBJ’s positives outweigh the negatives. With this in mind, I am cautiously optimistic about its performance.

Be the first to comment