tomeng

Dear readers,

I’ve reviewed Honda (NYSE:HMC) a few times now. It’s on my list of attractive Japanese companies that should be considered at the right valuation. As the market has been dropping more and more, the time has come to really establish your “BUY” targets for your companies of choice.

Honda could be one of those – and here I’m going to show you why.

Since my last article, this company has seen a further drop of close to 2% – and we have some company news.

Let’s take a look

Honda – Updating and changing my thesis.

So, the main change for this article is that I’m changing my thesis on Honda. I’m finally moving from a “HOLD” to a “BUY” stance. Aside from being one of the largest multinational Japanese conglomerates out there, Honda is also the largest engine (‘ICE’) manufacturer on the planet. It was the first Japanese automotive brand to develop its own luxury brand, Acura, back in 1986. Honda still has almost 200,000 employees worldwide, and despite its terrible share price performance, this hasn’t in any way impacted the company’s credit safety, which stands at an A-.

I already said in my last article that Honda is starting to look interesting at a valuation where the average 5-year of 8-9X P/E is being underscored by the average P/E multiple the company trades at.

While there are risks, there are so many fundamental upsides worth considering which could, provided we see sales stability and some margin protection, deliver Honda into a position where this multiple is extremely cheap.

Why?

Because:

- Honda is the largest motorcycle manufacturer on the planet, and these markets will continue to be major sales drivers for the business. You may think of Honda as cars (and Acura), but for most of the world, Honda is motorcycles.

- The company has near-unassailable market dominance in key markets outside of the main established ones (like Europe)

- In other car markets, like USA/NA, Honda is still very popular and among the first choices for many – and EVs are starting to come in the portfolio, with initial sales numbers very promising.

- The company is taking serious steps to become a leader in EV batteries and motorcycles on an electric basis. These moves include JV’s and plans to launch more than 10 new EV motorcycles globally in only 3 years.

- Plans to achieve Co2-neutrality by the 2040’s.

The company won’t just go one segment either – but push into different customer needs – with models for commuting, personal-use models with swappable batteries, for transport, etc. The company is targeting no less than 1,000,000 motorcycle sales on an electric model basis within only 5 years. The Japanese company’s electric motorcycles will be equipped with solid-state batteries, which are currently under development.

There have also been mumblings about the company seeking to separately list its EV motorcycle business, which could be a major value driver if done correctly, in order for this branch not to be dragged down by some of the issues in legacy.

Unfortunately, the company dispelled these rumors – much like many Japanese companies, Honda is hesitant about cutting parts of its storied legacy from the main tree. The issue may be raised again, and we may see a separate listing, but investors shouldn’t go into the company with this expectation.

Still, even without this target, there are plenty of arguments as to why this company will deliver significant value going forward. While recent quarterly results came in at a slight sales decline, the fundamentals and the company margins remain strong, even with current impacts.

The company is also quick to reduce factory output where needed due to various factors. This includes a 40% production cut in 2 Japanese Plants – the Suzuka plant and north of Tokyo. Now, part of the reason is SCM and logistical issues, because demand for the products actually remains high – but there are also COVID-19 issues and other macro concerns impacting the company.

I would personally argue that Honda is doing all things “right” given the current macro we’re in, and the current challenges we’re seeing. Recent results are not bad per se. Honda experienced firm overall demand but headwinds continued due to overall semi-challenges.

Honda issued a 2023E profit forecast, and it included further uncertainty on supply and production with further cost increases. The company continues to try to improve its profitability, and eventually, this will outweigh the input challenges we’re currently seeing. The company actually boosted its dividend slightly but forecasts a flat dividend for the year 2023. A boosted dividend is usually a sign of some confidence in the company.

Looking at how the valuation has been impacted despite what I would call only moderate forecast impacts, it’s easy for me to change my stance at this time.

Honda’s Valuation

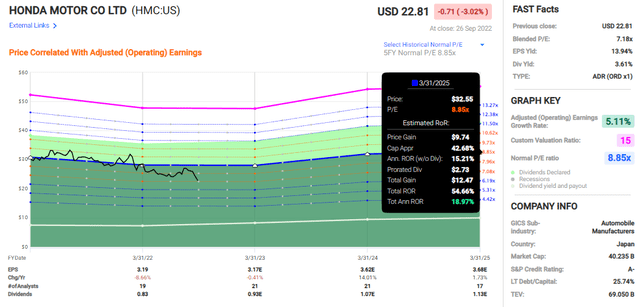

Before, the company was trading closer to 8-9x normalized P/E. Now, this valuation is down to a firm 7.1x P/E, which for an A-rated EV maker with a legacy portfolio like Honda is outside the bounds of normalcy and rationality. I’m stepping in and changing things up here.

Honda is trading at a yield that’s now very close to 3.6%, and even the native ticker of 7267 is starting to look cheap, at single-digit native P/E multiples. There’s only so much discounting I can tolerate before I have to say that things are not “that” bad as the market would suggest.

We have a relatively richly-traded ADR here – it’s HMC. The valuation upside for HMC, even just assuming an 8-9x P/E comes in between 14-19% annually, or a double-digit upside of 55% for a 2024E trading a multiple of 8.9x.

Again, dear readers – it’s getting to be too much here. While Honda could of course drop a lot lower if the market continues its downward spiral or goes into a recession, none of us has a crystal ball or clairvoyance. And at a below 8x P/E, I’m saying that this company is far too cheap for what it offers.

You get near-government bond-like safety at an A-rated credit from a $40B market cap business, one of the largest Japanese conglomerates in the world. My price target in my previous articles was $22-$23/share.

Notice anything?

The price now hovers at the midpoint of that range. The targets I set are never arbitrary or un-researched. I spend a long time estimating each target based on comps, DCF, NAV, and other methods.

Most analysts have a significantly higher upside for Honda. The native ticker is followed by 17 analysts given the company an average of 25.7% upside. The ADR upside based on 3 analyst targets, 2 of which are at “BUY”, are even higher at close to 40%.

I disagree with these.

I say that now Honda is attractively valued enough to give us a high enough upside to be worth investing in – but the upside here is no higher than a couple of percent, to a $23/share PT. There are too many other attractive investments possible for me to accept anything higher at this time, without corresponding margin stability, sales increase, or EV stability on part of the company.

Also, speaking as someone who spends a lot of time looking at the current global supply/demand trends, shortages, inflation, and trade dynamics, I can say with what I feel is a relatively high level of certainty, that shortages in the semiconductor business and uncertainty in terms of trade aren’t going to be clearing up or becoming less opaque anytime soon. This also needs to be considered prior to investing in the business.

We’ve seen Honda drop from rich valuations, to where I basically said “NO”, to valuations now, where I am now for the first time saying “Yes”. The confidence is now high that from this point onward, the company will improve its results and returns. Analysts are forecasting improved results for the coming years, and for the dividend to remain impressively stable.

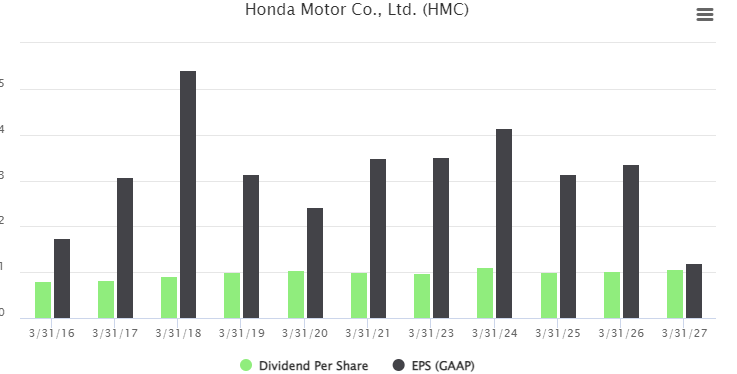

Honda Dividends/EPS (S&P Global/TIKR)

For me, a reversal from this level is enough that I am considering the company as a valid investment from here on out.

My PT is now $23/share, the upper portion of my previous target range.

I’m changing my stance to “BUY”.

I’m also not buying the ADR – I’m buying the native Tokyo ticker due to FX and diversification. Keep that in mind when looking at Honda.

Thesis

My thesis for Honda is now as follows:

- The company is one of the more attractive EV motorcycle and car players around – but unless bought at a discount valuation, you should stay away in this market. Until now, it hasn’t been possible to “BUY” Honda cheap enough, but this has now changed.

- I’m switching my stance on Honda from a “HOLD” to a “BUY”.

- My price target for Honda is $23/share for the ADR, and I recently bought my first stake in Honda.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment