Evening Standard/Hulton Archive via Getty Images

Today’s article covers the Vanguard Growth ETF (NYSEARCA:VUG) in an attempt to unravel the fund’s relationship to today’s economy. In addition, we assessed the ETF’s performance ratios to deliver an opinion on risk attribution.

Instead of micro-focusing on specific assets, we aim to contextualize the fund as a collective with a twelve-month outlook.

- Here are some of our most recent findings on Vanguard’s Growth ETF.

Management Skills Assessed

The diagram at the end of the section provides a quantitative overview of Vanguard’s risk attribution and its managerial skill. I understand that it makes for tough viewing. However, the image will enlarge if you click on it.

Let’s run through a few of the metrics.

- Maximum Drawdown: The ETF’s maximum annual drawdown of 47.18% might be justified as it hosts growth assets. However, a beta coefficient of 1.06 means it’s not significantly riskier than the S&P 500. Thus, we provide it with a negative score regarding drawdown management.

- Risk-adjusted metrics: Both the ETF’s Sharpe and Sortino ratios look underwhelming. The Sharpe Ratio measures excess return (over the risk-free rate) relative to volatility, and a ratio below one is usually considered poor. The Sortino ratio measures downside risk relative to volatility and needs to be above two to conclude solid risk-adjusted returns.

- Information Ratio: The information ratio (otherwise known as the skill ratio), tracks a portfolio manager’s ability to generate excess returns (above its tracking index) adjusted for excess risk (risk above index risk). We consider Vanguard’s growth ETF Information Ratio of 0.15 as average and don’t see much managerial skill in-store.

- Note: We ran the regression between January 2004 and December 2022 with daily returns plugged into the model.

Risk Attribution & Management Skills (Author in Portfolio Visualizer)

In summary, we see little value-add from a portfolio management level. I would be unhappy if I were paying a premium for this level of fund management.

Growth In Today’s Market

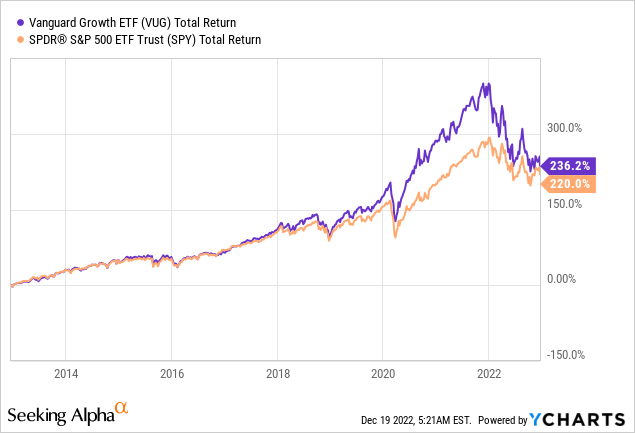

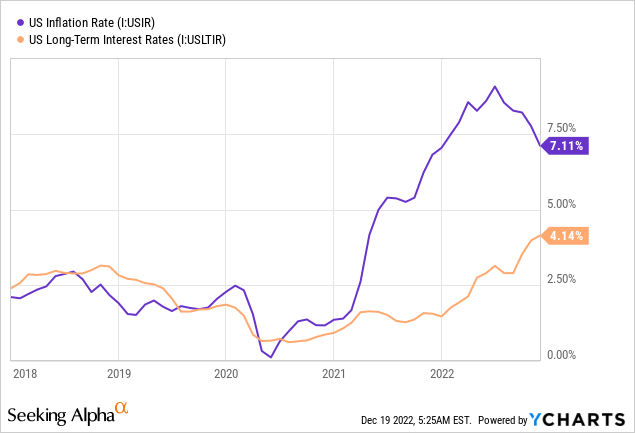

It’s easy to see why growth stocks performed well during the past decade. A period of stale inflation allowed for sustained low-interest rates, which supported a growth stock case as they typically outperform the market whenever monetary policies are expansionary.

However, today’s economy is plagued by resilient inflation, high interest rates, and a pivot in the global share of world resources. Thus, we believe the great moderation has finally ended, and stagflation could settle in over the next few years. If stagflation ends up being the central theme, credit spreads could rise, and investors’ marginal utility to consume could increase, subsequently adding substantial risk premiums to the equity market. Therefore, we could easily see investors back off from growth stocks for the next few years and prefer low volatility, high dividend, and value stocks.

An Argument for Quality

Although we remain skeptical of growth stocks, there’s a strong argument that Vanguard’s Growth ETF is co-integrated with “quality stocks“. Quality stocks refer to a market category with robust net incomes, large market shares, and high re-investment rates (some might argue against the last factor). Quality assets could outperform the broader market environment during a stagflationary environment as they might be able to generate excess residual value without much economic support.

Furthermore, at face value, the ETF’s top holdings are “best-in-class” picks. Investors could maintain exposure to stocks such as Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOG), Amazon (NASDAQ:AMZN), and Tesla (NASDAQ:TSLA), even when selling off much of their tech exposure.

| Stock | ROE | Net Income |

| Apple | 1.75x | 25.31% |

| Microsoft (NASDAQ:MSFT) | 42.88% | 34.37% |

| Amazon | 8.78% | 2.25% |

| Alphabet | 26.89% | 23.71% |

| Tesla | 33.44% | 14.95% |

| NVIDIA (NASDAQ:NVDA) | 26.39% | 20.85% |

| Visa (NYSE:V) | 43.18% | 51.03% |

Source: Seeking Alpha

Much of this section was explained based on our anecdote. Although financial literature will likely correlate with what I mentioned, I encourage investors to do their own research.

Concluding Thoughts

Even though there’s an argument that Vanguard’s Growth ETF hosts established assets that could rebound in 2023, we remain bearish on the ETF. The vehicle’s risk attribution ratios aren’t overly convincing and suggest a lack of value-additivity from a management perspective. Furthermore, growth stocks could be in a tough spot if stagflation had to occur amid the possibility of rising equity risk premiums.

We assign a sell rating with a twelve-month horizon.

Be the first to comment