Jason Doiy

Macy’s (NYSE:M) is gearing up to report Q3 results, as the earnings release is expected to come out ahead of the opening bell, on November 17. This could be a particularly important earnings season for the traditional retailer, as potential investors face a laundry list of opportunities and risks amid this pivotal moment for the US economy.

Below, I discuss what I believe to be the most important topics of conversation on earnings day. I wrap things up by explaining why, despite clearly seeing the bull argument here, I maintain my hold rating on this volatile, often unpredictable stock.

What to expect from Macy’s Q3: A quick look at the numbers

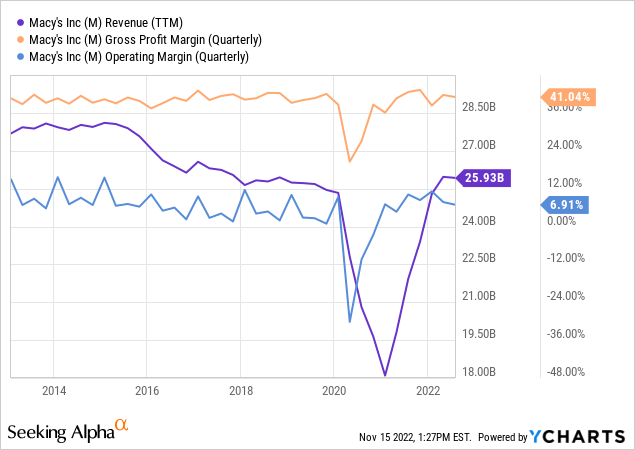

As usual, it will be important to track the Q3 headline figures. Sales of $5.2 billion are expected to decline 4% YOY, but off of very strong growth of 36% this time last year. As I mentioned in my most recent Macy’s article and as depicted by the purple line below, Macy’s has caught up with its pre-pandemic revenue growth trajectory — which, to be fair, had been unimpressive for years prior to COVID-19. Adjusted EPS is projected at 18 cents, well off last year’s $1.23 for some of the reasons that I will address next.

Regarding Q3 results, I don’t think that analysts and investors will be caught off guard by softening margins. Last quarter, the retailer warned of substantial inventory and other operational cost pressures through the end of 2022 at least, putting a lid on earnings firepower. Hopefully, by slashing full-year EPS guidance by a whopping 64 cents to $4.10 at the midpoint of the range, the management team has already lowered the bar enough ahead of the important holiday shopping quarter.

Inventory management will likely be one of the key topics of debate on Thursday. Macy’s is expected to clear aged inventory and turn the page on the Spring season. The quicker the company can do so with as little pricing impact as possible, the better for Q4 sales projections (by far the biggest quarter for the New York-based retailer) and for the stock.

The second big debating point will probably be the health of the consumer. In part due to successful initiatives that have led to improved visits and conversion in the digital channel, Macy’s has done fairly well from a top-line perspective. But it is still unclear if lingering inflation, a series of interest rate hikes, and the prospect of a recession ahead may hurt discretionary spending and, as a result, Macy’s P&L one or two quarters down the road.

Macy’s stock is too unpredictable

I am not a Macy’s bear, as I believe that the company has survived (even if not yet thrived through) a barrage of issues that put at risk the company’s own existence at some point:

- The rise of e-commerce and the “death of the mall”;

- A secular change in consumer preference toward athleisure, especially impacting the crucial women’s department;

- The pandemic-driven store shutdowns;

- Rapidly rising interest rates and white-hot inflation in 2022.

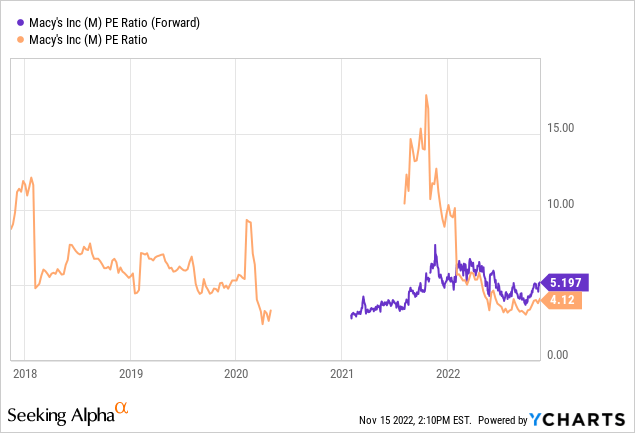

Then, there is the tempting forward P/E of only 5.2x that has often lured in value investors and that, in the case of “an economic all-clear”, could climb towards sustainable peaks in the high single digits (see history below).

But at least out of personal investment style, I choose not to own M. From my experience, volatile and unpredictable stocks are rarely a good addition to a balanced portfolio. For instance, M has climbed a respectable 13% since my article of three months ago. However, only five trading days ago, M was flat to slightly underwater for the trailing three-month period instead.

More broadly, the stock’s 30-day rolling annualized volatility has almost always stayed above 50% over the past three years. Meanwhile, the S&P 500 (SPY) only reached volatility levels like Macy’s during the thick of the COVID-19 crisis.

I think that Macy’s could be a decent stock for either (1) the ultra-short-term trader looking to place a bet on earnings performance and outlook, or (2) the die-hard believer and patient investor who sees the department store recovering and eventually thriving over the next decade or so. Because I am neither of them, I remain on the sidelines.

Be the first to comment