dan_prat

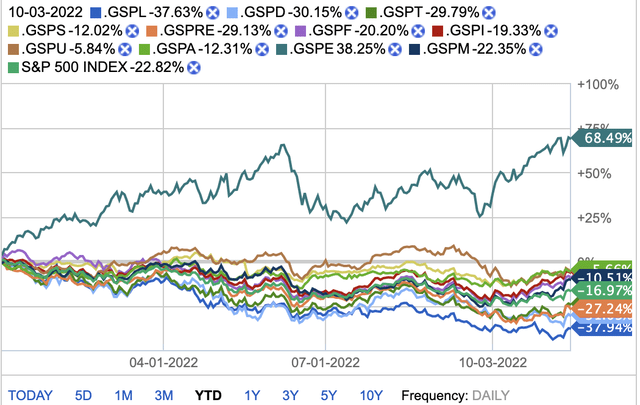

In a year stocks have given investors headaches, the energy sector has come to the rescue of many investors. As illustrated in exhibit 1, the S&P Energy sector has soared more than 68% this year while the index is down by almost 17%. With the energy crisis showing no signs of slowing down, as an investor, it seems rational to consider investing in energy stocks even at the current valuation level. Suncor Energy Inc. (NYSE:SU), the Canadian energy giant that was part of Warren Buffett’s portfolio for so long, stands out in this sector. In this analysis, the focus is on evaluating whether Suncor is still a good bet despite the 43% increase in its market value this year.

Exhibit 1: S&P 500 performance by sector

Fidelity

All Eyes on the Macroeconomic Outlook

In previous articles on Suncor Energy, I have highlighted a few reasons behind my bullish stance on the company.

- A high-quality management team with a proven track record leads Suncor.

- Suncor enjoys competitive advantages stemming from the long life of its oil sands assets.

- The strong refinery business of the company makes Suncor a truly integrated oil giant with sufficient scale to compete with market leaders.

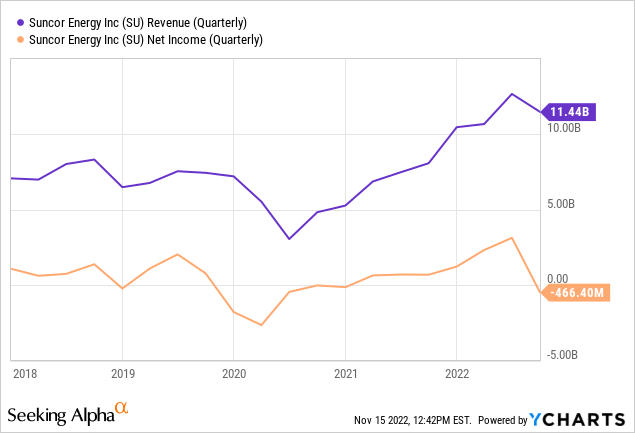

All these points remain intact today, but what has changed is its valuation. Although Suncor is still valued at a forward P/E of less than 5, this has a lot to do with the stellar growth in earnings in the last few quarters on the back of rising oil prices. To give some color, Suncor reported revenue of close to $31 billion in 2021 whereas the company has brought in more than $34 billion in revenue in just nine months this year. It’s the same with earnings as well. In comparison to a net income of $3.26 billion in 2021, Suncor has already booked more than $5 billion in net income in the first nine months of 2022.

Exhibit 2: Suncor Energy quarterly revenue and earnings

With favorable macroeconomic conditions having played a massive role in Suncor’s financial and stock market performance this year, it seems rational to evaluate the big picture for the oil industry to gauge a measure of where Suncor stock is headed in both the short and long-run. For ease of reference, two key macroeconomic developments will be discussed separately.

A shift in focus from supply to demand

The current energy crisis has a lot to do with supply shortages. The global economy rebounded sharply from the virus-induced recession but oil production did not recover as quickly. Oil giants introduced production cuts back in 2020 to support an equilibrium between the demand and supply for oil in a bid to stabilize prices, and the stellar recovery of the global economy caught the industry off guard. Making matters worse, Russia attacked Ukraine last February, which disrupted the Russian oil trade due to a slew of sanctions imposed on Russia. With 60% of Russian oil exports going to Europe, there was never a question about these sanctions hurting the global oil supply. The OPEC+ announced another production cut to the tune of 2 million barrels per day in October as well, which has added even more pressure on the supply of oil. All these reasons, collectively, have led to soaring oil prices this year.

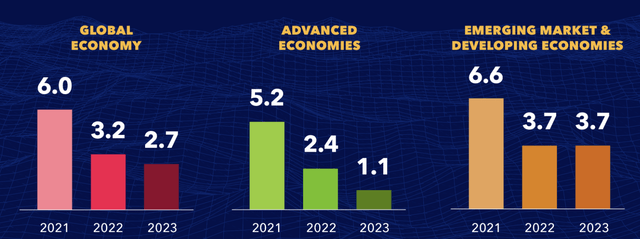

Going forward, however, the focus may shift from the supply side to the demand side. Last October, the IMF slashed its economic growth forecast for 2023 to 2.7% from 2.9% in July. In its report, the IMF goes on to claim that millions of people around the world will suffer from recession woes in the year ahead. Advanced economies, as illustrated below, are expected to suffer the worst in 2023.

Exhibit 3: IMF growth projections by region

IMF

With the global economy expected to slow down meaningfully, energy demand is likely to take a massive hit as well. Soon after the IMF published its latest report last October, the International Energy Agency slashed its oil demand expectations for next year by more than 20%. With the outlook for oil demand turning bleak, a recession will prove to be a balancing act for the global oil market. Because of demand-side challenges, average oil prices may trend downward in the next 12 months, wiping out some gains enjoyed by oil giants today.

That being said, investors need to remember that oil inventories are still tight globally amid a challenging supply environment. In a complicated macroeconomic environment, oil prices are likely to be very volatile in the short term before giving back some recent gains as demand declines gradually.

Financials might take a hit

Costs are rising across the board as a result of high inflation, and this will leave a negative impact on the cash flows of oil companies in the coming quarters. Recent actions of oil majors suggest they are placing an emphasis on distributing wealth to shareholders through dividends and buybacks, and with a hit on cash flows expected in the coming quarters, oil producers may have to cut back on planned growth investments. This will not be an encouraging sign for investors. In any case, we may have already hit a peak in corporate earnings with oil prices reaching record highs, and a moderation in growth will reflect poorly on the stock prices of oil companies.

Suncor Has Sunny Days Ahead but The Path Will be Rocky

Suncor is an oil producer with a disciplined capital allocation approach, and the company, historically, has proven its ability to withstand dire economic conditions. The company’s refinery business is likely to take the spotlight if global energy demand takes a hit in the coming quarters as this business segment will thrive amid low oil inventories and tight production capacity which are tailwinds for refinery margins.

Suncor’s investments in oil sands operations (the upstream business) will pay off handsomely in the coming years as well with the company now focusing on improving the performance of its mining assets. To make the most of these investments, Suncor will have to wait for the next upcycle in oil prices but the company is certainly moving in the right direction from this front.

Suncor’s ESG investments will also play a key role in helping the company win investors’ trust in the coming years. In addition to winning the approval of investors, Suncor will be able to avoid regulatory headwinds in the future with these ESG-oriented investments that target to reduce emissions by a staggering 10Mt per year by 2030.

Suncor, because of its efficiency, scale, and focus on green investments, appears to be a good pick for long-term-oriented investors. However, a few unfavorable changes in operating conditions might prove to be a drag on Suncor’s profitability in the short run, resulting in volatile stock prices.

Takeaway

Suncor Energy remains one of my high-conviction picks in the energy sector, but with challenges looming on the horizon, now may not be the right time to invest in the company. Although this analysis does not aim to promote timing the market, the findings highlighted above suggest investors should look for a better margin of safety before initiating a new investment at these prices.

Be the first to comment