whitelook

Overview

Valuation in certain Central and Eastern European countries is beginning to look compelling. While these equity markets are not immune to broader emerging market turmoil, the current record-low valuation does offer a margin of safety. Furthermore, the dividend yield for equities in this market is well above the country’s sovereign bond yield in many cases. While noteworthy markets like the Czech Republic and Romania do not have US-listed ETFs, Poland provides US investors with an easy way to gain exposure to the equity markets. Poland looks like a solid market to follow, although there are several factors leading me to move slowly. Poland just called an emergency meeting, so political risks could escalate soon. The combination of political and macro risks could create an interesting entry point in subsequent quarters.

Accessing Poland on US Exchanges

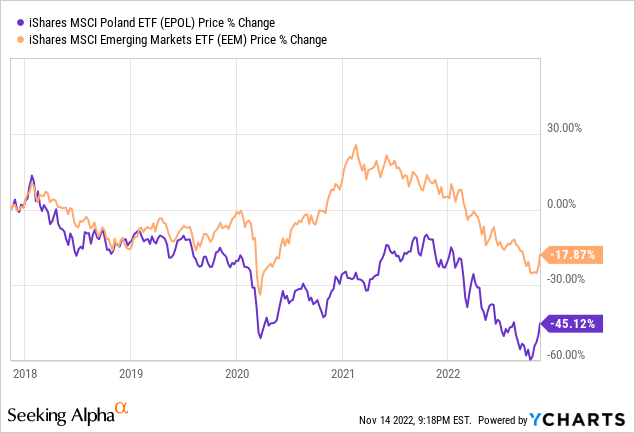

There are multiple ADR options available in Poland, but I prefer looking at the iShares MSCI Poland Capped ETF (NYSEARCA:EPOL) to avoid excessive trading fees on smaller positions. Furthermore, it definitely makes sense to initiate emerging market positions in smaller tranches during 2023, as there could be additional short-term bottoms driven by political and macro risks. The easiest way to do this is by investing in ETFs through brokerages that offer $0 fees on ETFs, while the ETF itself has a 0.61% expense ratio. Other emerging market ETFs only invest 15% or less of their assets in Poland, so this is essentially the only pure-play Poland fund available to US investors. Furthermore, Central Europe & Russia Fund (CEE), a closed-end fund, invest around half of its assets in Poland.

Central and Eastern Europe Look Intriguing

It was personally hard to justify excessive coverage of European equities prior to 2020, as I thought there was greater value in other Latam/Asian markets that could still be accessed at a lower valuation. However, many European markets like Romania and Poland look very attractive from a valuation standpoint, even though the majority of the index includes financial and energy companies, which typically trade at a discount to the broader index. Although Poland has its fair share of economic and political risks, it is hard to ignore at around 5x earnings (note: MSCI Poland traded at 4.5x earnings as of October 31, 2022, while the iShares Poland ETF trades at 5.7x earnings as of November 13th).

|

Index |

P/E |

P/B |

Financials |

Energy |

|

iShares Poland ETF |

5.72 |

0.82 |

38.21% |

16.95% |

|

MSCI Romania Index |

5.29 |

1.08 |

49.76% |

50.24% |

|

MSCI Czech Republic Index |

9.06 |

2.09 |

37.39% |

Remainder in utilities |

|

MSCI Colombia Index |

5.43 |

1.12 |

52.91% |

27.6% |

|

MSCI Chile Index |

7.02 |

1.42 |

23.68% |

7.79% |

|

MSCI Brazil Index |

6.00 |

1.62 |

27.61% |

17.07% |

|

MSCI Indonesia Index |

15.84 |

2.67 |

55.08% |

5.62% |

|

MSCI Malaysia Index |

16.33 |

1.46 |

41.82% |

3.3% |

|

MSCI Thailand Index |

21.35 |

2.00 |

8.81% |

14.46% |

|

MSCI Sri Lanka IMI |

4.26 |

0.51 |

35.25% |

N/A |

|

MSCI Pakistan Index |

4.07 |

0.83 |

19.28% |

22.96 |

Source: MSCI latest data/iShares Poland ETF Website

Some key trends that I noticed:

-

Poland trades in line with markets like Sri Lanka and Pakistan, which have extremely high risks because of the higher level of public debt/political risks. Sri Lanka even defaulted on its sovereign debt recently.

-

Poland trades at a slight discount to South American markets, which have mixed sentiment (commodity exposure is positive, but the political risks are high).

-

Southeast Asian equities trade at a huge premium to MSCI frontier markets, and it seems hard to justify despite the stronger political and economic narratives in these countries

I wouldn’t consider buying Poland at more than 11x earnings, which is the MSIC Emerging Market average. However, the current discount is very appealing, and it is worth monitoring and potentially accumulating. Poland has rarely traded below 10x earnings, and there is considerable room for multiple expansion if sentiment in Europe improves in the long run. Luckily, there are no any major catalysts ahead, so there is plenty of time to monitor Poland and Europe’s economic progress in the coming quarters. I plan to gradually build my position each quarter instead of trying to time the market. Political shocks in the coming month could create a nice entry point for contrarian investors.

Risks to Consider

Some of the key risk categories for investing in Poland are as follows:

1) Inflation/Growth Slowdown: This is an issue common to all emerging markets, and the relative value of equities in Poland is intriguing.

2) Strong EU exposure and high trade as % of GDP: This is a slightly unique issue within the emerging markets space, and one of the biggest risks.

3) Windfalls tax: Poland has been considering a windfall tax on energy companies for months. Banking stocks have also sold off in recent months, as this could also impact them.4) Political risks regarding Russia/Ukraine that may escalate.

Other risks include political risks and the country’s relatively high level of external debt. However, Poland has the potential to be a stand-out emerging market this decade, which may be able to outperform the index after a terrible YTD performance so far. The market’s return has exceeded 40% for three years following the GFC. Once there is more political and economic clarity, the market could double on multiple expansion alone.

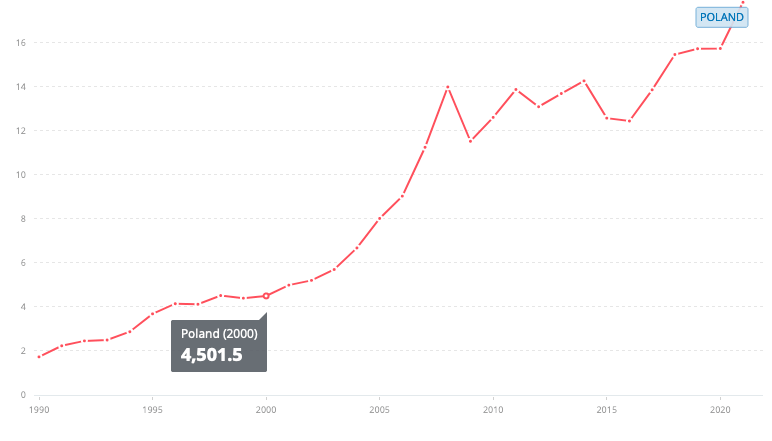

GDP Per Capita Lags Behind Regional Peers

Certain Eastern and Central European economies are solid long-term bets in terms of growth potential, due to the lower GDP per capita. Poland’s GDP per capita has increased from $4,501.5 in 2000 to its current amount of $17,840. This is still less than half of the EU average of $38,234.

World Bank

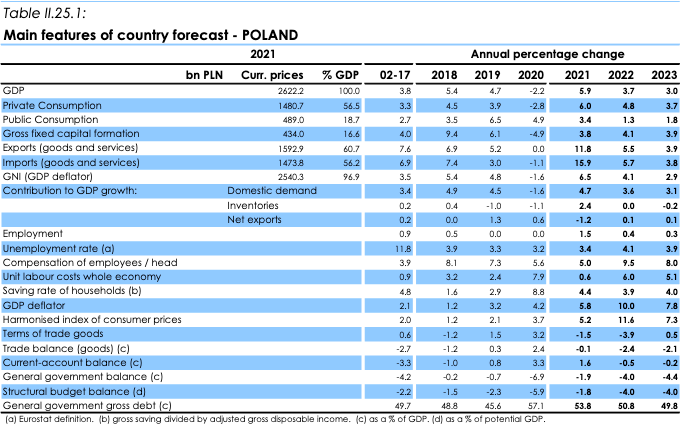

Economic Growth

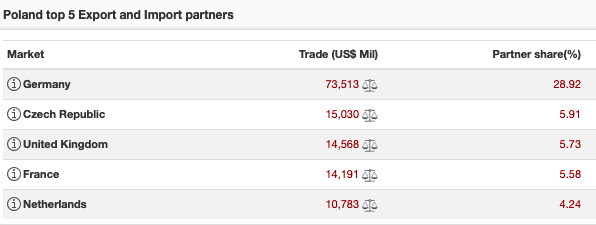

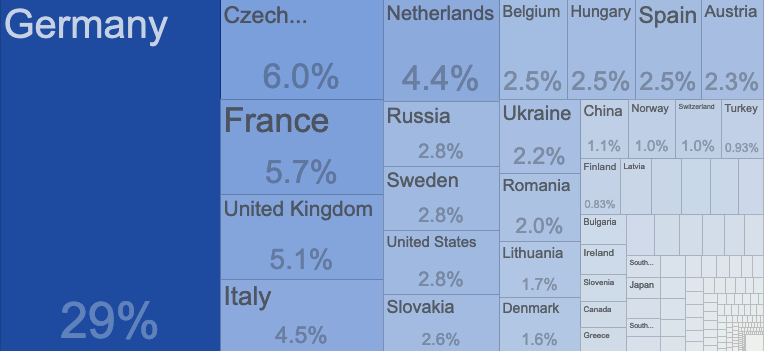

Poland’s economy contracted by 2.3% during Q2 2022, compared to the 5.3% increase in Q1 2021. I am still monitoring developments to see if 2-3% growth is a reasonable estimate during 2023, given that growth in Europe has the potential to surprise to the downside. Germany, its largest trade partner, will face weaker growth next year, and private consumption may be under pressure due to higher food and energy inflation.

EU

However, other factors have improved drastically since 2017. Unemployment will likely remain below 4%, compared to 11.8% in 2017. The country also ran a current account surplus in 2020 and 2021, compared to a CAD of 3.3% in 2017.

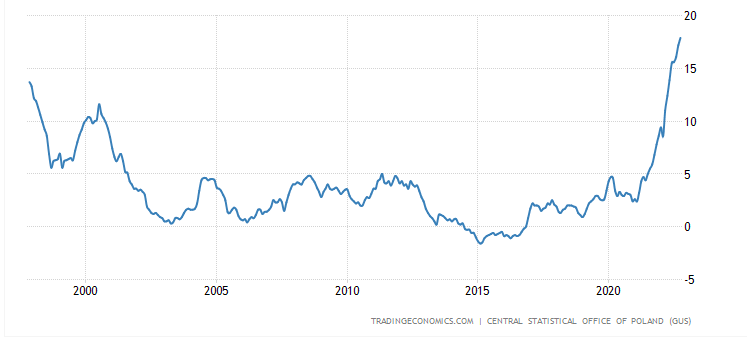

Inflation at a 25-Year High

Inflation in Poland recently reached 17.9% in October 2022, compared to 9.4% in January 2022. This has significantly outpaced other emerging markets that I have covered, including Colombia (12.2%), Chile (12.8%), and Egypt (16.2%).

TE

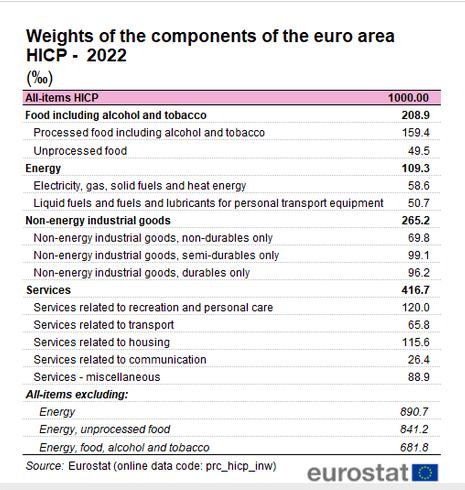

It is worth noting that around 40% of the ETF’s assets are invested in financials, which would benefit from higher rates, but also struggle due to deteriorating macroeconomic conditions. It looks like additional rate hikes will be needed, as energy inflation is still in the works, and Poland did not hike rates during the last Central Bank meeting. Poland still held its interest rate at 6.75% during the last meeting in November, but will likely have to hike slightly in the future. The average inflation rate in Europe is currently around 10.7%, and food and energy are some of the main drivers (30% of the total) of inflation.

Eurostat

Exports

Another key risk associated with investing in Poland is that its growth is heavily contingent upon the economic performance of the EU. Trade as a % of GDP is also relatively high, while private consumption represents circa 60% of GDP.

WITS

At the moment, there are no other strong regional bets (i.e. strong exposure to China or other Asian countries). However, nearly all of its top 20 export destinations are European countries.

Trading Economics

Poland’s trade as a % of GDP is 118%, nearly double the global average of around 60%. This is one of the biggest macro risks to consider, as its growth hinges on exports to the EU.

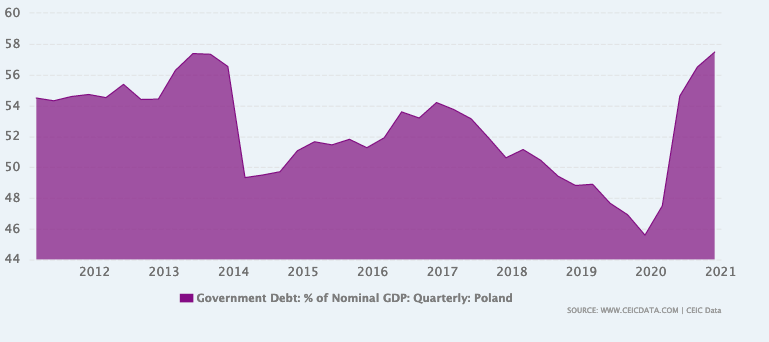

Debt Risk is Lower

Poland’s public debt as a % of GDP is lower than that of other emerging markets with similar valuation (4-7x earnings).

CEIC

Other cheaper markets have higher debt, including Egypt (89.2%), Pakistan (84%) and Sri Lanka (104%) have notably higher public debt. Sri Lanka recently defaulted on its sovereign debt, while other countries spend a significant % of government revenue on interest payments alone. While larger-scale sovereign defaults would negatively impact all emerging markets in the short term, this relative benefit is still worth pointing out, as it could allow Poland to outperform this decade.

Poland’s Borrowing Costs

Bloomberg

Poland’s borrowing costs are approaching a multi-decade high. One relative positive point is that interest payments as a % of revenue in Poland have remained below 10% since 2010.

Valuation/ETF Thoughts

Poland’s market has historically traded above 10x earnings, so the current valuation is also attractive based on historical standards.

MSCI

The iShares MSCI Poland ETF is down 50% YTD on the back of increased political and macro risks in Europe. The ETF invests in 34 companies, while the MSCI Poland Index only includes 14 constituents.

YCharts

I think the next decade will be very different in terms of relative performance, and that it makes sense to consider Poland over other emerging markets. At the very least, it makes sense to be extremely overweight Poland, especially since 75% of the MSCI emerging markets index is concentrated in only five different countries. I’d personally prefer for Poland to be around 6% of my emerging markets investments (in line with Brazil’s current weighting in the index). I plan to add to positions in the coming month, due to long-term weak macro data, or this week, if equities responded poorly to recent news.

Be the first to comment