Mykola Sosiukin/iStock via Getty Images

Investment Thesis

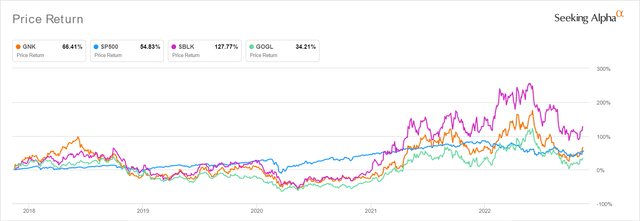

Genco Shipping & Trading Limited (NYSE:GNK) remains a buy, despite the slight premium from previous blood-bath levels. Assuming that its dividend policy holds, the company is likely to pay out dividends of $2.5 in FY2023, indicating similar levels YoY and impressive yields of 15.5%, against its 4Y average of 4.61% and sector median of 1.68%. Due to the cyclical nature of most shipping stocks (especially during the hyper-pandemic levels), GNK has done decently with a 2Y total price return of 160.3% and 5Y returns of 97.3%.

GNK 5Y Stock Price

In addition, GNK has a long runway for growth with a market cap of $0.68B, in comparison to other dry bulk peers, such as Star Bulk Carriers Corp (SBLK) at $2.15B and Golden Ocean Group Limited (GOGL) at $1.94B. The stock has also done relatively well over the past five years, with a return of 97.3% (after adjusting for dividends), against SBLK at 208.8% and GOGL at 111.2%. Though the former may seem to underperform thus far, we must remind investors that analysts expect the latter two to drastically cut their FY2023 dividends by -38.4% to $3.79 with forward yields of 18.04% and -45.5% to $0.94 with forward yields of 9.7%, against GNK’s minimal -1.1% cut to $2.50 and forward yields of 15.5%, respectively.

Thereby, indicating GNK’s defensive position in the face of worsening macroeconomics, with its stock performance expected to remain robust in 2023, while the other two would likely plunge at the speculative announcement of a dividend cut. If bottom-fishing investors wanted a good diversification of their shipping portfolio, they should wait until that catastrophic moment for an improved margin of safety, before adding the other two stocks. Then again, those stellar yields are nothing to sneeze at either, during these uncertain market conditions.

GNK Continues To Perform Well, Despite The Lower TCE Rates By FQ3’22

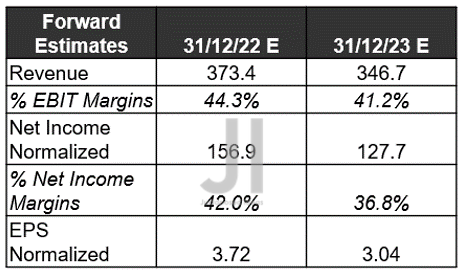

GNK Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

In its recent FQ3’22 earnings call, GNK reported revenues of $96.5M and EPS of $0.95, indicating a massive YoY decline of -17.87% and -34.02%, respectively. Thereby, justifying the normalization of its stock prices from hyper-pandemic levels by -37.22% since May 2022. However, investors must note the impressive expansion in its margins, since it directly contributed to its improved profitability against FY2019 levels.

On the other hand, GNK’s lower TCE rates of $20.45K in FQ4’22 have definitely caused some concerns amongst its investors. Market analysts have brutally downgraded its FY2022 top and bottom line growth by -19% and -25%, respectively, since our previous analysis in September 2022. Given how the company has missed consensus EPS estimates for the past two consecutive quarters, there is a growing possibility that FQ4’22 may indeed be temporarily brutal, massively impacting its stock performance if the Fed does not pivot by December.

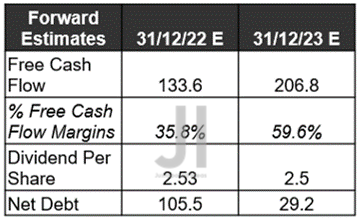

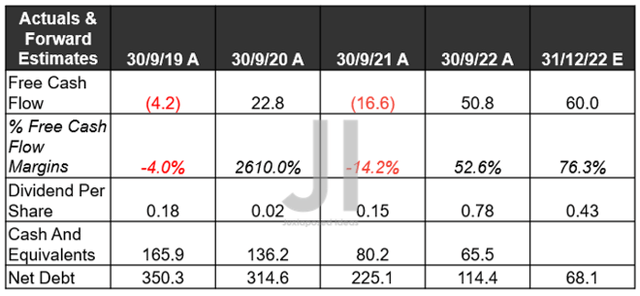

GNK Cash/ Equivalents, FCF ( in million $ ) % , Net Debts, and Dividends

Due to its improved cash from operations at $60.37M, GNK paid a handsome dividend of $0.78 in FQ3’22, indicating an excellent increase of 56% QoQ and 420% YoY. However, market analysts are expecting the company to pay out more debts than guided at $8.75M in the next quarter, due to the drastic reduction in its projected net debts of $68.1 in FQ4’22 against $114.4M in FQ3’22. Thereby, naturally triggering a lower projected dividend payout of $0.43 then.

However, we expect the GNK management to stick to its announcement and likely payout an approximate dividend of $0.67, since there will also be reduced dry-docking Capex of -$7.68M in FQ4’22. That would bring the sum to an excellent $2.74 paid and yields of 16.99% for FY2022. Otherwise, even at $0.43 for the next quarter, we are still looking at a more than decent yield of 15.5%. Therefore, investors should not be overly discouraged, since these are directly attributed to the company’s aggressive deleveraging efforts through the worsening macroeconomics and elevated interest rates.

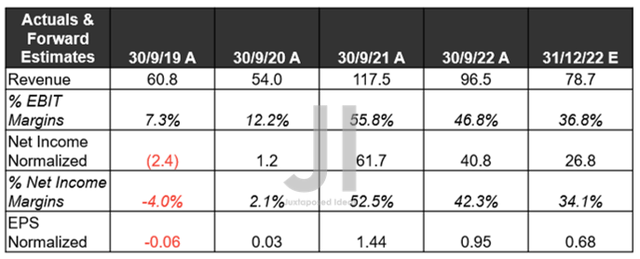

GNK Projected Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

S&P Capital IQ

Over the next two years, market analysts expect GNK to report a notable deceleration in revenue and net income growth at a CAGR of -7% and -16.10%, respectively. This is probably due to the lower TCE rates in FQ4’22 and weaker forecasts through 2023. However, we are a little more hopeful for sustained TCE rates ahead, due to the potential reopening efforts from China’s Zero Covid Policy. Assuming so, we may see higher iron ore imports by H1’22, since the country consumed 1.12B tons of the material in 2021, accounting for 43.07% of the global production then. Dry bulk shipping will also be further buoyed by the temporal increase in demand for coal through the difficult winter months.

Thereby, naturally lifting GNK’s top and bottom line growth in FY2023. We’ll see, though its projected normalized EPS of $3.04 remains excellent compared to FY2019 levels of -$0.68.

GNK Projected FCF ( in million $ ) %, Net Debts, and Dividends

S&P Capital IQ

Furthermore, GNK is expected to report improved Free Cash Flow (FCF) generation of $206.8M and FCF margins of 59.6% in FY2023, despite the peak recessionary fears. Thereby, sustaining its excellent dividends of $2.5 then, since we will also witness an impressive deleveraging of net debts from peak levels of $365.78M in FQ2’20 to $29.2M by FQ4’23. Therefore, investors who have failed to load up at previous rock-bottom levels would have missed the impressive 20.62% dividend yields by FY2023. Otherwise, these numbers still represent an excellent yield at 15.50% based on current stock prices, if not more, assuming a higher TCE rate then.

In the meantime, we encourage you to read our previous article on GNK, which would help you better understand its position and market opportunities.

- Genco Shipping: The 14.14% Reason To Load Up At Low Tide

So, Is GNK Stock A Buy, Sell, Or Hold?

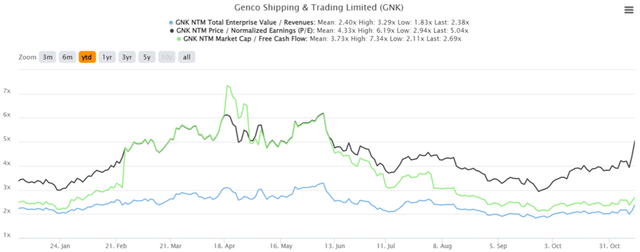

GNK YTD EV/Revenue, P/E, and Market Cap/ FCF Valuations

GNK is currently trading at an EV/NTM Revenue of 2.38x and NTM P/E of 5.04x, in line with its YTD EV/Revenue mean of 2.40x though elevated from its YTD P/E mean of 4.33x. The stock has obviously recovered from its previous slump at $16.12, though down -40.62% from its 52 weeks high of $27.15 and at a premium of 35.23% from its 52 weeks low of $11.92. Nonetheless, consensus estimates remain very bullish about its prospects, given their price target of $24.60 and a 52.61% upside from current prices.

Combined with the fact that GNK is trading modestly at NTM Market Cap/FCF of 2.69x against SBLK at 2.72x and GOGL at 5.01x, it is no wonder that the GNK stock remains a great buy at current levels, despite the recent recovery. Otherwise, bottom-fishing investors may try waiting for more volatility nearer to the Fed’s upcoming hike in December. Assuming another 75 basis points hike, we are sure in for a more tragic market-wide correction to previous bottom levels, since 83% of market analysts are projecting an earlier pivot with a 50 basis points hike. This is due to the upbeat October CPI reports, combined with the Bank of Canada’s earlier moderation. Only time will tell.

Be the first to comment