anatoliy_gleb

Published on the Value Lab 11/10/22

Owens Corning (NYSE:OC) is still seeing phenomenal quarters, but it is being substantially driven by pricing. Volumes are beginning to see pressure. The prime culprit is reverting inventory management practices, but it is also softening in some key markets, especially Europe and China, affecting composite businesses but also insulation more broadly. Natural disasters are helping roofing a little, and this segment appears to be strong together with North American insulation. The foreign exposures are currently an idiosyncratic weight, and margin pressure is expected in composites. Backlogs remain strong in aggregate across composites but cost is catching up. Nonetheless, cracks aren’t exactly showing, the secular picture is strong and it is supporting current outlook and fundamentals.

Quick Q3 Note

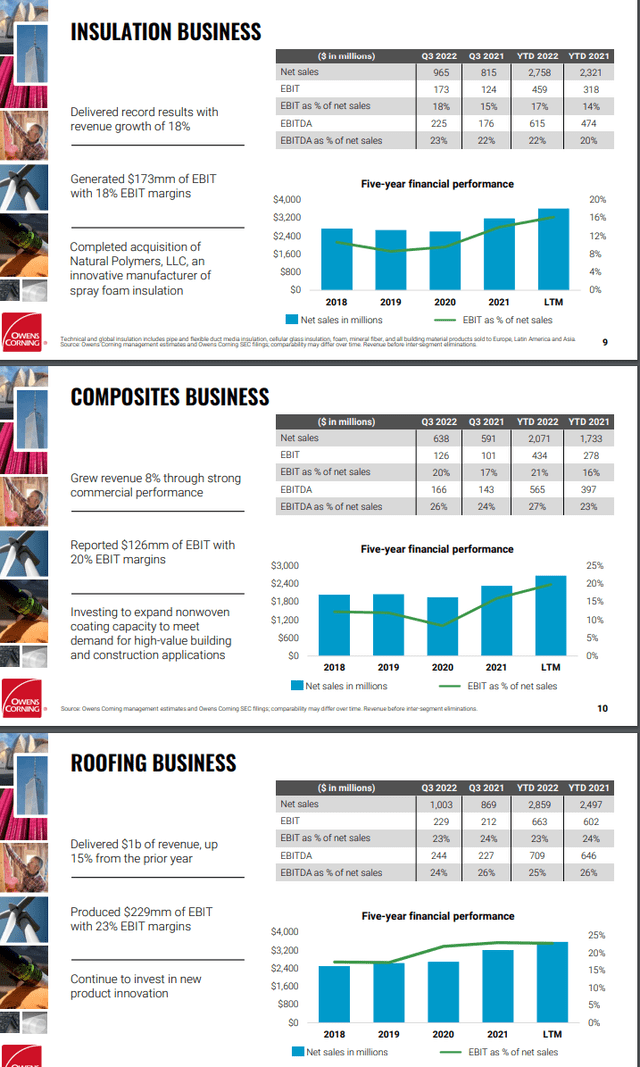

Every segment saw growth in terms of volumes, even composites which saw a divestment of the DUCS (chopped strand for fiberglass) business in Europe which accounts for about 4% of the segment revenue. For composites, growth continued despite pressure from China, which is almost 10% of that segment’s revenue too and drives the majority of the China exposure in the mix, where the other big APAC market is India which has been going strong. Revenue growth was 8% and EBIT growth was 25%. Pricing was responsible for all of growth, volumes declined YoY. Still, on aggregate backlog is more or less the same as six months ago despite pressure from China and Europe, with the help of good US development and development in India. This backlog will however be liquidated at incrementally lower margins as price cannot continue to outpace rampant European inflation, and volumes struggle in a COVID lockdown China. Still, strong backlog evolutions are a good sign for a generally more cyclical segment, and indicates that a portion of the current volume effects are more temporary related to reversal in conservatism in inventory management.

Segment Slides (Q3 2022 Pres)

All other segments saw declining volumes except for the North American insulation business which saw flat volumes. Pricing was necessary to offset all volume pressure and was constructive in all segments, driving almost all of the revenue growth. Roofing, while it saw volume declines, together with insulation is expected to produce higher revenues for the Q4, and therefore for the full year. Roofing was supported somewhat by incidence of hurricanes but that was offset by lessened hail in other markets like Colorado.

Remarks

Roofing and insulation drive North American revenues in the mix. In general, the macro question about differentials between Europe and North America are essential. North America is sporting a shrinking current account deficit as it weaponises the dollar and creates value out of its commodities, and it is clear across our coverage that US markets are not demonstrating typical recessionary declines, where Europe and of course China, which is still being affected by lockdowns, clearly is.

North America continues to demonstrate strong secular fundamentals. While there will be a reset in the market as rates do affect the housing and construction industry as it is by definition leveraged, housing starts are still outpacing completions, which means inventories are still low for housing, and engagements are still high for residential construction, clearly being driven by the bottleneck of completion. OC capacity is still running at top rates, and this is likely to continue. On Seeking Alpha we cover Westlake (WLK) with a similar view, and while they operate at a later stage in the building cycle, and new gulp of business is coming through for operators at the earlier stage like insulation and roofing players. The same cannot be said for Europe which lacks the same longer-term drivers while also faltering in the immediate term.

We attribute a premium to the North American exposures, where demographics as well as current housing shortages are a tailwind. OC trades at almost the same valuation as Saint-Gobain (OTCPK:CODGF) on a EV/EBITDA basis (both trade at a 4.3x), a company which is mostly Europe-focused. Deserving of a premium on geography alone, we’d say OC is relatively undervalued. Moreover, insulation is a more profitable market than the specialty chemicals and other building products that Saint-Gobain has in the mix. Moreover, Saint-Gobain has less defensible markets in automotive. All these are reasons why OC is likely to be more resilient, and perhaps deserving of an even heavier premium. Moreover, reversals in inventory management practices could smooth out volume declines even if the recession gets much worse in the US, which is could as layoffs do continue in some key industries. Still, the markets are volatile and housing is a dangerous area to call. We pass for now.

Be the first to comment