metamorworks

Icahn Enterprises L.P. (NASDAQ:IEP) represents a well-diversified industrial conglomerate. The operations range from Energy (with oil extraction and fertilizers production) to Pharma passing through Automotive and Real Estate. Each business sector is independent and is supported by a financial investment segment that closely accompanies new business opportunities or integrates existing ones more efficiently. Starting in 2019, the company has paid a $8 dividend per share (15% yield at the moment), and this represents a very strong interest element for any investor.

By analyzing the company fundamentals, we can see that the main operating sectors are energy and automotive and that the first can produce excellent results both in terms of profit and growth. The second, on the other hand, has been suffering for many years on both parameters. In particular, it represents a major erosion in corporate profits. The investment funds also with extraordinary activities (asset trading) were able to support a large part of the dividend in past years and, therefore, represent an essential part of the business.

The high dividend yield context cannot be defined as stable and constant but is also accompanied by extraordinary and contingent events. I cannot assert that past conditions can be repeated with certainty in the future, but I can identify the attractive share price above all in the short term or very favorable conditions for the energy sector. The results obtained by the investment fund in a very bad general market condition also underline a good opportunity for management skills.

I think these tailwinds could continue over the next 1 to 2 years and with a very attractive valuation in terms of share price my rating is, just now, Buy.

General Overview

Icahn Enterprises celebrates 35 years of activity and produces revenues through 2 main different macro business areas.

The first is purely financial and deals only with investments transaction. In the last yearly report we can read:

“The investment strategy of the Investment Funds is set and led by Mr. Icahn. The Investment Funds seek to acquire securities in companies that trade at a discount to inherent value as determined by various metrics, including replacement cost, break-up value, cash flow, and earnings power and liquidation value.”

The thing that immediately catches the eye is the fact that this large company area is completely managed by Mr. Icahn independently. I will pick up on this concept later in the article.

The second macro business area is related to the production of goods and services and is currently divided into six different sectors. The main sectors are Energy and Automotive, which together represent 94% of the entire operating area.

The energy sector is completely managed through the subsidiary CVR Energy (CVI) – a public company – that leads the business of petroleum refining and fertilizer manufacturing.

The Automotive sector is managed through the subsidiary Icahn Automotive which is divided into two businesses: vehicle maintenance and repair, and the sale of spare parts and aftermarket products.

The other business sectors are: Real Estate (single-family homes), Home Fashion (through the subsidiary, WestPoint Home), and Pharma (through the subsidiary Vivus).

Financial and Highlights

Operating Segments – Revenue and Margin

Icahn Annual Report + Author Graph

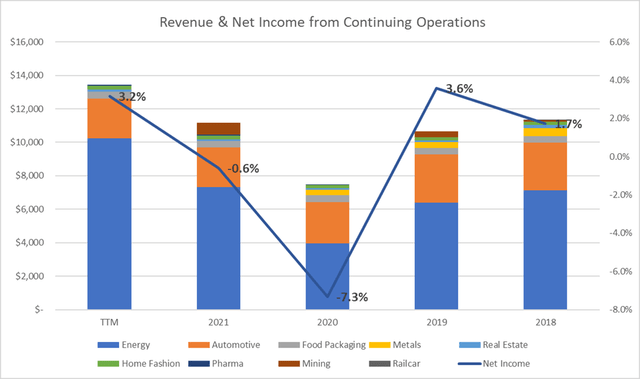

The graph shows the combined revenue trend (from 2018) with different colors for the various business sectors and the net income vs revenue deriving from the set of all the operations. There are more business sectors since they were present in past years while they were decommissioned in 2021.

The last 5 years’ revenue trend is not homogeneous and is strictly dependent on the energy trend, with strong fluctuations from $4B in 2020 to $10B in 2022 (TTM).

On the other hand, the margin (net income vs. revenue) follows the trend in revenue with an important negative peak (2020) of -7.3% and stands in 2022 at 3.2%, more or less in line with 2019 but much higher revenue.

We need to dig a little bit deeper.

Icahn Annual Report + Author Graph

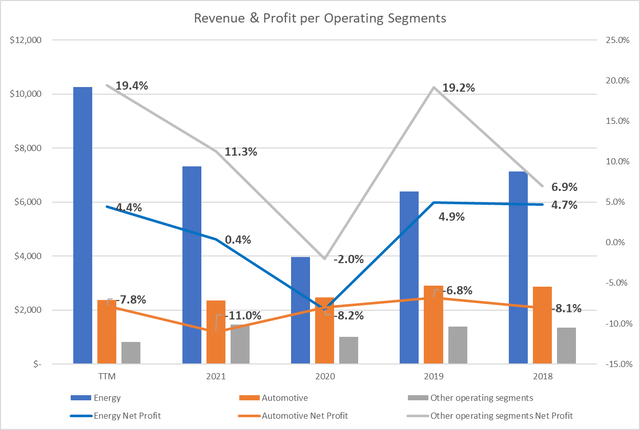

The graph shows the revenue trend and net profit margins by business segment. The first thing we notice is (in orange) the automotive sector: with a flat trend in revenue, it presents an equally flat trend in the Net profit Margin, which stands at -7.8% in 2022 compared to -8.1% 5 years ago. This trend represents a loss-making industry for years with no room for improvement.

Going a little bit deeper in 2022, automotive service has a revenue increase (compared to 2021) due to price and volume, but in the meantime, spare parts revenue decreased due to store closings. The total automotive revenue is in line with the previous year. In terms of profitability (as we can hear in the last Q3 earnings call), the company is focused on cost-efficiency actions in terms of personnel reduction and improvement in work processes. Other actions concern the suppliers’ relations improvement to optimize inventories and purchasing prices on one side. And investments in new store managers’ training to increase the service quality on the other side. Last but not least, there has been a great turnover in management with the new CEO and COO.

We can state that the company is implementing various actions whose results will probably take place in the next quarters.

As a counterpart, the energy sector is achieving important results with a TTM of 4.4% in net profit margin. Thanks also to the contingent period, this is the business area that leads to company profitability in 2022.

Investing sector

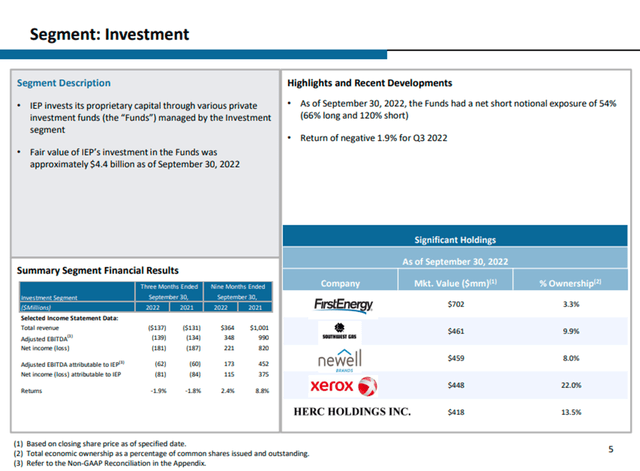

With $4.4 billion (Q3), the investment funds represent a sort of company safe.

If we analyze the year 2022, the investment fund reaches a cumulative 2.4% positive return (with a negative -1.9% in Q3). This is a great result, especially when compared with the S&P 500 Index (SP500), which in 2022 has totaled a negative return of -15% to date.

In Q3, the Company also increased the short position, reaching a net short notional exposure of 54%; in Q2 it was 28%.

As the Company said in the earnings call:

“Additionally, we strongly believe in hedging our positions to mitigate risk, especially in the volatile markets that we’re living in today.”

And it seems that the strategy is working well in 2022.

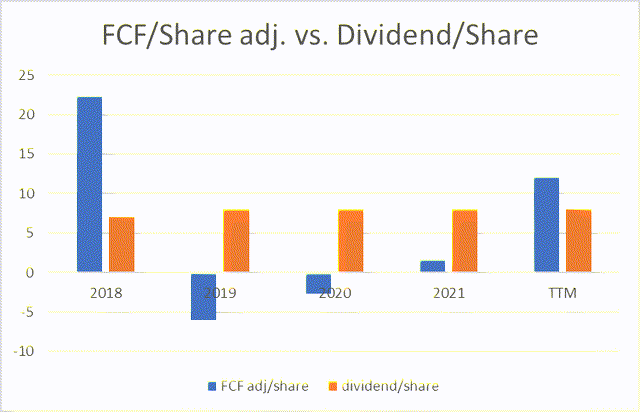

Free Cash Flow and Dividend

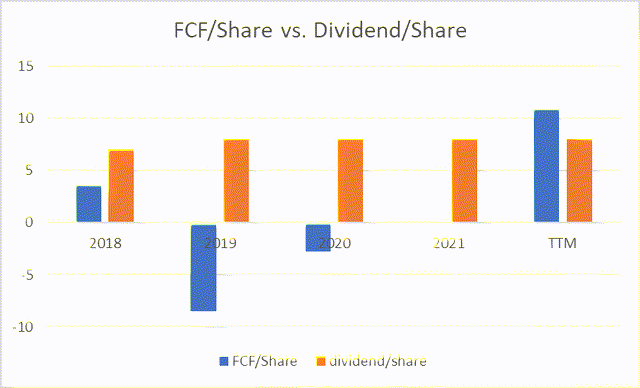

In an ideal world, the dividend flow should be “paid” by the free cash flow per share. If we represent this concept in a graph, we would like to see the FCF/Share bar greater than the Dividend/Share bar. But this does not happen for Icahn.

The question that naturally arises is therefore how does the company pay such a high dividend when the Free Cash Flow cannot support it?

To be able to give an answer, it is necessary to understand how Icahn generates profits and also cash flow through the sale of assets or subsidiaries. For example, in 2018 the company sold Federal-Mogul for $5.1B and Tropicana for $1.5B; in 2019, it sold Ferrous Resources for $550M; in 2021, it sold PSC Metals for $323M. These activities are usually not included in the FCF/Share, as they are (rightly) considered not exactly standard. In the case of Icahn instead, we could consider them as a standard operating activity and, therefore, it is advisable to proceed with an adjustment of the FCF in such a way that it can take into account these extraordinary matches.

As we can see, in 2018 the extraordinary activities generated a free cash flow to allow the dividend also in the following years. In 2022, however, the FCF is mainly generated by operating activities (energy mainly).

Over the years, the company has been and can manage such a high dividend yield mainly as a function of “extraordinary” activities with the help of years (such as 2022) where some operations generate a high FCF which cover a 15% dividend yield. We are not in the presence of a stable and constant distribution activity, but it depends on seasonality or “extraordinary” nature.

Will it continue in the future? In my opinion, in the short term, the energy sector will probably be able to continue what happened in 2022, while in the medium/long term the company will be able or will have to resort to other extraordinary activities. As they say (Q3 earning call):

“We maintain liquidity at the holding company and each of our operating subsidiaries to take advantage of attractive opportunities. We ended the quarter with cash, cash equivalents our investment in the investment funds, and revolver availability, totaling approximately $7.1 billion. Our subsidiaries have approximately $761 million of cash and $291 million of undrawn credit facilities to enable them to take advantage of attractive opportunities… In summary, we continue to focus on building asset value and maintaining liquidity to enable us to capitalize on opportunities within and outside our existing operating segments.”

If we look at what happened in the past and if we trust Mr. Icahn, we could reasonably hypothesize, with a high-risk level, a similar trend in the coming years as well.

Quantitative Valuation

Since cash flow, in my opinion, is the parameter that could be used to cover the dividend distribution, I decided to use it for the evaluation of the share price in terms of dividend yield sustainability. Using Cash Profit as the main metric to analyze and evaluate the share’s value, I decided to identify the cash yield or interest rate of return as parameters.

The evaluation formula is the following:

cash interest rate = cash profit per share/share price

at a current price of $50.5

cash interest rate= 10.87/50.5 = 21.5%.

21.5% is very high data and we have also to take into consideration that the future dividend yield could be seriously affected by the future FCF. Even if we use a risk/uncertainty index of 50% and, therefore, halve the valuation, we obtain an important result that identifies, at the moment, in my opinion, a good investment opportunity.

Peer Comparison

It is not easy to compare Icahn with similar companies due to its distinctive nature. In any case, I decided to make a comparison with the following companies belonging to the conglomerates’ industries sector:

• Smiths Group plc (OTCPK:SMGZY)

• Brookfield Business Partners L.P. (BBU)

• Hitachi, Ltd. (OTCPK:HTHIY)

• 3M Company (MMM).

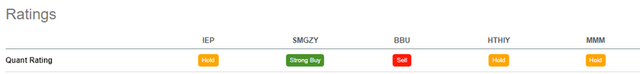

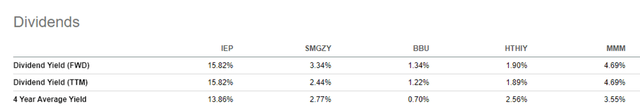

If we analyze the company using Seeking Alpha’s Quant Rating, we can see that it does not represent the best investment opportunity. Smiths Group achieves a “Strong Buy” primarily for growth and profitability reasons.

However, the article’s objective is to define a better opportunity in terms of dividend yield.

As we can see, with a 15.8% dividend yield Icahn represents by far the best investment opportunity. Also in terms of the average distribution of the last 4 years, Icahn represents the top choice.

Risks

Unfortunately, there are many high risks associated with investing in Icahn Enterprises. Anything that offers a 15% return can, by nature, be a safe investment. These are the main risks in my opinion:

Investing Segment

As we can read from the annual reports, the corporate part relating to investments is defined and managed at first by Mr. Icahn. This could represent a high-risk source if we think in terms of business continuity. Usually depending on a single man as a top player may not represent the best strategy if we talk about business continuity. Mr. Icahn is also 86 years old, and future investing profits could be on the high-risk side.

Automotive Business

With a net loss of $220M in 2021 and $185M in 2022 (LTM), the Automotive sector represents the company’s black sheep. Management is indeed implementing important actions to improve profitability, especially in terms of fixed expenses (staff) but it is equally true that the sector could experience a negative structural phase which has now been going on for several years. It may be very difficult to bring margins to positive or it may take too long. This sector represents a real risk today and likely tomorrow as well.

Energy business

With a 2022 (LTM) revenue of $10.3B and a net income of $452M, the energy sector represents the spearhead of the company. We can also state that the 2022 dividend is paid entirely by this sector. The highly positive scenario is also dictated by exogenous factors, and this could represent a major risk element in the coming years in the case of the general energy sector deteriorating conditions.

Bottom Line

Icahn Enterprises represents, with its 15% dividend yield, an interesting investment opportunity, especially in the short term. If we analyze the 2022 fundamentals, we can see how the company’s leading operating sector (the energy sector) can produce profits in a consistent manner, and such as to support the dividend. I believe that these conditions may remain in the short term (1 or 2 years) and therefore, supported by an attractive share price evaluation, I rate this Icahn Enterprises L.P. investment opportunity as a Buy.

I also consider it very important to carefully evaluate the future performance of the investment segment (as well as all other business areas) to understand dividend sustainability in the medium/long term.

Be the first to comment