Marcus Lindstrom/E+ via Getty Images

“Let’s start fresh” is a term reserved in the social world for failed relationships that are giving it another go. A couple that has been happily married for 20 years wouldn’t seek a fresh start – they cherish their history and try to hang on to the memories.

A company name change is the business world equivalent of “let’s start fresh”. It is reserved for disappointments that hope the name change will obfuscate the failures of their past.

Long ago, when I was a child, I would occasionally earn bonuses to my allowance by helping my father with data entry on some spreadsheets and I distinctly remember typing in Lexington Corporate Properties. That was the name of Lexington Industrial (NYSE:LXP) a couple decades ago.

Many years later, in 2006, it changed its name to Lexington Realty Trust. This was a proper name change as it was the result of a merger between Lexington Corporate Properties and Newkirk Realty Trust. It paid homage to the merged entities by retaining the distinctive part of the Lexington name while taking on the Realty Trust portion of Newkirk.

Such merger-related name combinations are more akin to hyphenated last names upon getting married. It was the name change of December 2021 that was the true “let’s start fresh”.

The sell thesis

At 19X FFO and a discount to NAV, LXP Industrial looks like a good value. However, there are some serious quality issues. Quite simply, they buy properties poorly causing them to consistently underperform expectations.

Within the value industrial space, there are significantly better options.

It pays to know history

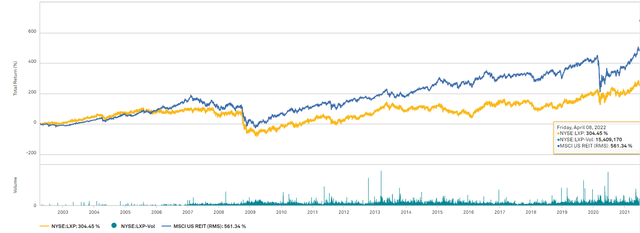

LXP has a long history of disappointing shareholder returns. Over the past 20 years, it has returned 304% compared to 561% for the REIT index.

S&P Global Market Intelligence

Notice on the graph above how the gap between LXP and the REIT index just slowly gets wider over time. It wasn’t any single catastrophic event, just a pattern of suboptimal choices. In real estate, a weak investment doesn’t always fail, sometimes it just generates a lower IRR than investing in a better property.

This happened throughout LXP’s history – seemingly random investments like golf courses and other entertainment venues. At one point, it stumbled upon a massive chunk of land in NYC with a long-term ground lease. It was an absolute gold mine, but they sold it for just a slight gain. After the dabbling in various sectors slowed down, they had a mixed office and industrial portfolio.

Eventually, office started to cool and industrial real estate became the hot asset class. LXP then decided to sell off its office and move toward becoming an industrial pure-play. Back in 2018, I wrote about this chasing of the puck. The crux of the problem is that when selling an out-of-favor asset for the hot asset it is not a 1 for 1 in terms of rental revenues.

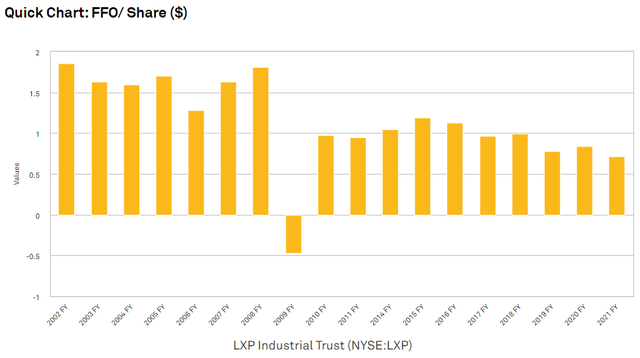

LXP ended up selling office at high cap rates and buying industrial at low cap rates, thereby losing a significant portion of its NOI. The result was a substantial decline in FFO/share.

S&P Global Market Intelligence

The late-inning switch to industrial from office accounts for much of the decline in FFO/share from 2016 to now, but you may notice that there was also a big drop from 2008 to 2010.

I get that there was a recession, and a severe one at that, with the great financial crisis. However, LXP was a triple net REIT and triple nets generally held up quite well during the financial crisis. The contractual revenues kept rent flowing as long as the REIT had good tenants.

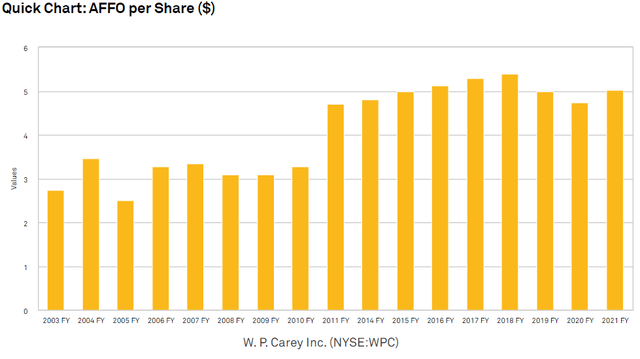

W. P. Carey (WPC) is a well-managed triple net REIT and here is how it fared through the crisis.

S&P Global Market Intelligence

It was a slight dip to AFFO in 08 and 09 followed by substantial growth as it used the low prices of the time to acquire assets accretively.

That is what good REITs do; they BUY when assets are cheap and sell when they are expensive.

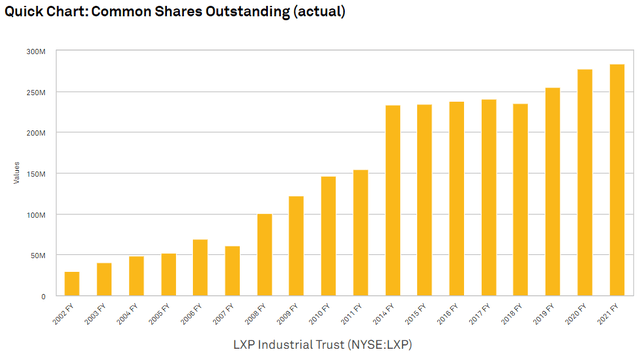

LXP has a long track record of doing the opposite. During the financial crisis, they suffered a bit more than most as some of their oddball assets ran into trouble and some tenants stopped paying rent. Rather than minimizing their losses by cutting or suspending dividends, they chose to pay dividends in stock.

During the crisis, REIT stock prices were remarkably low so paying a dividend in stock caused a massive number of shares to be issued at bottom of market prices.

S&P Global Market Intelligence

This is the dilutive equivalent of LXP selling assets at the bottom while WPC knew that it was a time to buy assets.

These mistakes added up over time and they summed to LXP’s nearly 260% underperformance over the past 20 years.

The hope of salvation

In January of 2022, activist investor Jonathan Litt offered to buy out LXP for $16 per share via his company, Land and Buildings. That is the approximate value of LXP’s real estate or perhaps even a bit discounted to the value of the properties. However, it is difficult to free the real estate from the long-standing management.

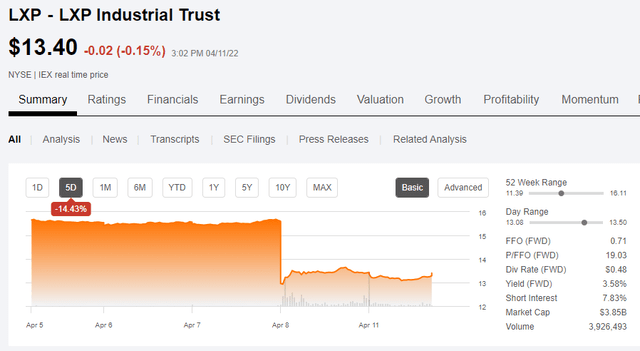

LXP responded to the buy-out offer with a strategic review in which they would consider Litt’s offer as well as looking into other strategic alternatives. The strategic review concluded on April 8th with the board unanimously deciding to remain as an independent company. I guess one of the perquisites of a cushy board seat is the ability to preserve one’s seat.

Shareholders were not happy.

So that leaves us with where LXP is today.

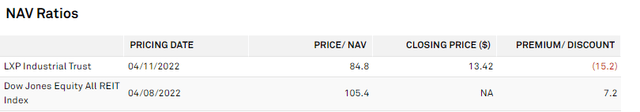

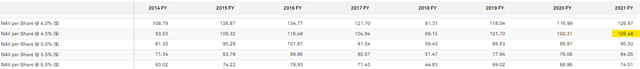

Industrial is still the hot sector, and LXP’s assets are valuable. Prima facie, it looks quite cheap, trading at 84.8% of NAV while the REIT index trades at a slight premium to NAV.

S&P Global Market Intelligence

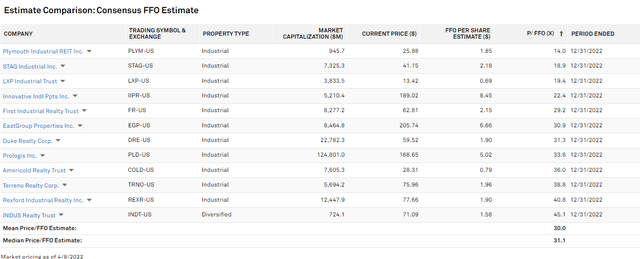

It also looks cheap on an FFO basis at 19X forward FFO, while the industrial REIT sector trades at a mean and median of 30X and 31X, respectively.

S&P Global Market Intelligence

Is LXP stock worth buying at this price?

I think the answer is a clear no. The reason other industrial REITs trade at such high multiples is because they are rapidly growing their FFO/share.

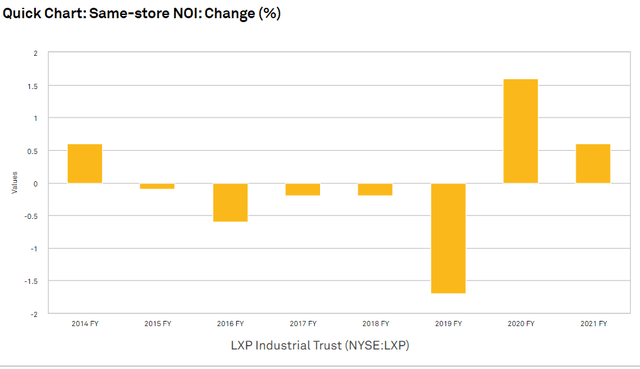

LXP has spent 20 years losing FFO/share. It went from over $1.50/share for most of the early 2000s to a paltry $0.69 estimated for 2022. 19X is a cheap multiple for an industrial REIT, it is not a cheap multiple for a stagnant or negative growth company. Lackluster same-store NOI looks nothing like that of industrial REIT peers.

S&P Global Market Intelligence

It was worth considering buying the real estate when there was a chance it would be taken over by a more responsible entity like Land and Buildings, but with it remaining under the long-term control of the same underperforming management, I do not see much appeal.

There are 2 better options in the same space. LXP is technically industrial properties, but it is still a mostly triple net REIT.

The better way to play triple net industrial

W. P. Carey is just an exceptional company. They acquire well, they underwrite tenants well, and they consistently make decisions that benefit shareholders. I don’t think I will get much pushback on the idea that WPC is a better company than LXP.

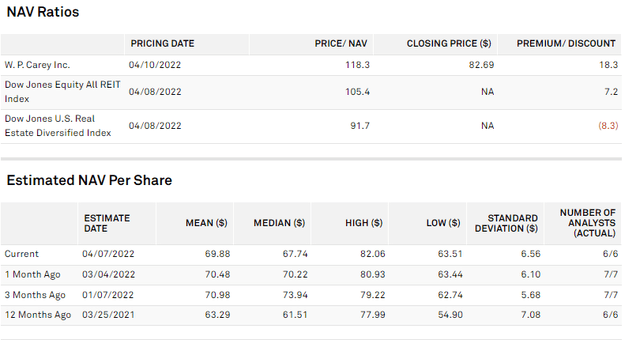

What is not known, however, is that WPC is actually cheaper than LXP.

See, WPC is still listed as a diversified REIT despite its portfolio moving toward majority industrial. As such, analysts have applied a diversified REIT cap rate to WPC, causing its NAV to be just $69.88.

S&P Global Market Intelligence

At this NAV, WPC is trading at 118% of NAV – quite a premium.

However, this is based on a 6.21% cap rate, while LXP’s NAV discount is based on a 4.45% cap rate. It is rather ridiculous to have such a cap rate gap when WPC’s properties are outperforming those of LXP.

If one were to value WPC at the same 4.45% cap rate, it would have an NAV of about $110 per share.

S&P Global Market Intelligence

At equal cap rate for calculating NAV, WPC is trading at 75% of NAV. It is actually cheaper than LXP.

One must be careful when looking at analyst NAV estimates because sometimes they use wonky cap rates.

The better way to play industrial

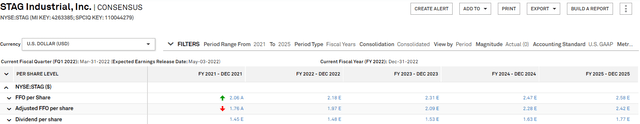

STAG Industrial (STAG) is trading at a lower FFO multiple than LXP by just a hair (18.9X).

The discount doesn’t make sense to me as STAG has a great track record of growing FFO/share and the forward estimates call for it to continue to grow nicely.

S&P Global Market Intelligence

The bottom line

I get the appeal of LXP. Industrial REITs are great, and with LXP’s new snazzy name, they make it intentionally obvious that they are an industrial REIT. Many of the industrial REITs have gotten pricey, so it is nice to have a value play within the space.

LXP is a value industrial play, just not a good one. STAG and WPC are stronger at roughly equivalent value but with far higher quality and growth.

Be the first to comment