grandriver/iStock via Getty Images

Sierra Wireless, Inc. (NASDAQ:SWIR) is an IoT (Internet of Things) solutions provider which sells IoT modules, wireless routers and gateways and IoT platform solutions. You can find an ample description of these and other use cases in the latest corporate overview and in a March fireside chat at the 34th Annual Roth Conference. They report in two segments:

- IoT Solutions

- Enterprise Solutions

The company brought in new management which isn’t going to focus on growth as such, the emphasis is shifting towards profitable growth (Q4CC):

What I expect to see going forward is a continued focus on minimum double-digit revenue growth with expanding profit margins and expanding EBITDA margins as we go throughout the year, kind of holding OpEx flat

Growth

But let’s start with the growth, because the company is sort of booming, experiencing strong demand in all product categories and having record backlog, with new orders coming in for the 2023 period already.

An emerging driver, albeit still small, for most of their revenue is the advent of 5G. It enables a whole new series of IoT solutions enabling remote management and monitoring of things, with the associated demand for connectivity requirements. This is a wave that will last a decade or more, from the Q4CC (our emphasis):

5G as you point out now, I mean, it’s a nascent small part of the business, but it’s starting to grow. And when I think about having, a decade or some long number like that of deployments behind us, excuse me, in front of us I just feel great. Low power LPWA is great, private networks, all of our enterprise business I mean, what I get excited about the long-term growth opportunities is just the number of things that we have, that are tailwinds from when you just think about smart infrastructure, smart meters, just of this whole idea of work from home in the IT space. This is just being now translated into the infrastructure energy space.. And I think that, I think there’s some tremendous growth opportunities there, not just in 5G, but 4G LPWA, routers gateways, manage connectivity… we are at the front end of a wave of demand as these markets will continue to grow for years to come, especially as more 5G applications emerge.

But it’s not just 5G (Q4CC):

We are seeing more customers wanting to add intelligence at the edge and doing more IoT monitoring in industrial, enterprise, energy and public safety markets. In modules, we’re seeing great demand for our LPWA products, particularly the infrastructure space with applications in smart meters, public lighting and asset management.

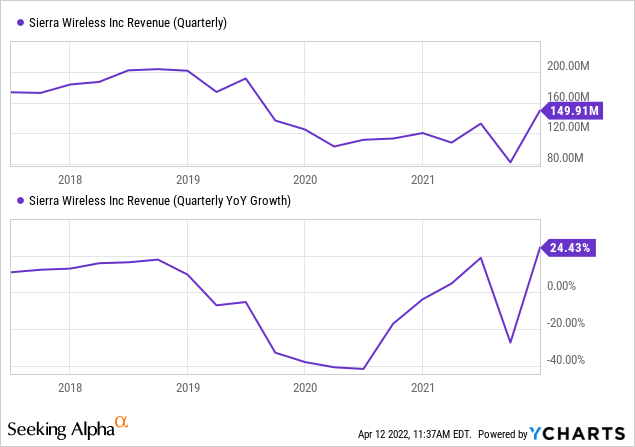

The company has recovered from the hiccup in Q3, when production had to be halted and showed strong revenue growth.

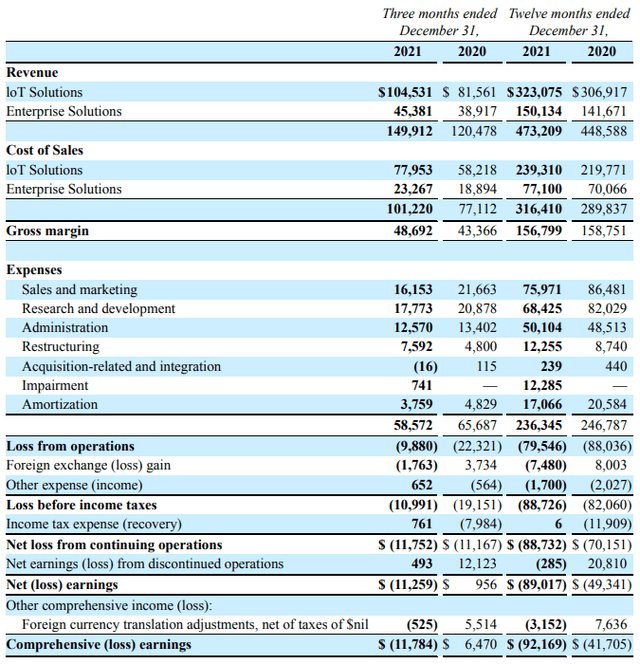

Q4 and FY2021 figures

A few noteworthy items:

- Sequentially, revenue was up 82% recovering from the downtime in Q3, y/y revenue growth was 24.4%.

- Q4 adjusted net earnings were $1.1M in the black for the first time in 2.5 years.

- The company has a record backlog

- Connectivity, software, and services revenue were $36.3M, +11.3% y/y.

- MRR (monthly recurring revenue or connectivity, software, and services as it’s now labeled) was $11.6M in December, a +10.5% y/y.

- For the year, connectivity, software, and services were 29.5% of revenue.

Guidance

Management is guiding a revenue range in Q1 of $135M to $150M midpoint of $142.5M. Q1 is always seasonally weaker than Q4, but this time there are other dynamics at play that counteract this. From the Q4CC:

What I expect to see going forward is a continued focus on minimum double-digit revenue growth with expanding profit margins and expanding EBITDA margins as we go throughout the year, kind of holding OpEx flat

Were Q4 was still constrained by manufacturing capacity, Q1 is probably component-constrained.

Margins

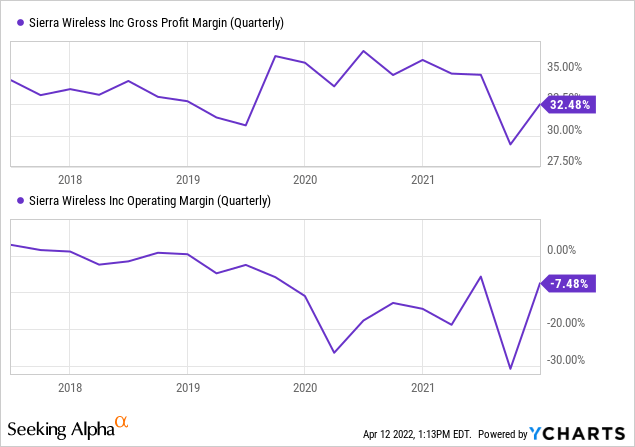

Profitability is a long-time ago, but the new management has a renewed focus on this. However, there are numerous variables here:

- Gross margins declined by 350bp y/y to 32.5% (but up 400bp q/q) on higher component costs as a result of the continued supply chain constraints.

- IoT Solutions’ gross margin was 25.4%, down 320bp y/y.

- Enterprise Solution’s margin was 48.7%, down 280bp y/y.

- Operating expenses were $58.6 million, a decrease of 10.8% resulting from improved expense control measures.

- Demand is strong, with a record backlog, setting the company up in principle for great operational leverage.

- However, Q4 was still suffering from capacity constraints, which the company started increasing last year in two facilities, that is now done.

- Q1 suffers from component shortages, but the company’s strong balance sheet enables building up inventories.

- The company is also managing to rise prices to maintain margins.

- It is also weeding less profitable business from recent acquisitions (and this before considering any additional M&A activity).

- OpEx is only going to be flat to 2-3% growth, setting the company up for considerable operational leverage with revenue growth expected in the double digits and capacity expansion already paid for last year.

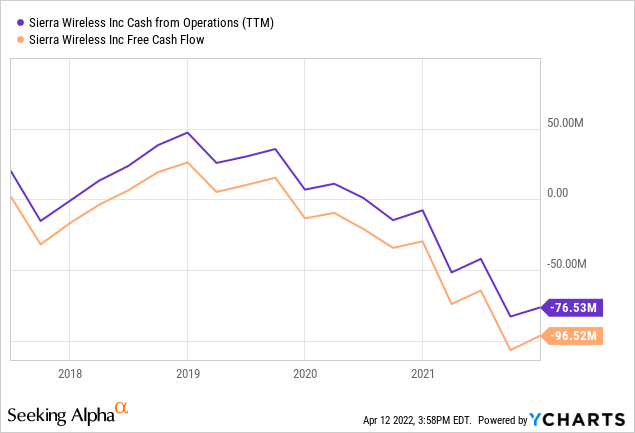

Cash

Cash flow is pretty bad, but half of this is the result of a build up of inventories of almost $50M. Cash flow improved a lot in Q4 as cash from operations was $7M and CapEx was $4.1M, providing actually positive free cash flow for the quarter.

The Q3 shutdown hiked inventories, but these are normalizing now, so this is at least in part responsible for the favorable cash flow. Cash improved $1.4M to $76.9M at the end of Q4, with long-term debt at $9.3M at the end of 2021

The company arranged a CAD$60M debt facility in January which has a four-year term and an ‘attractive interest rate.

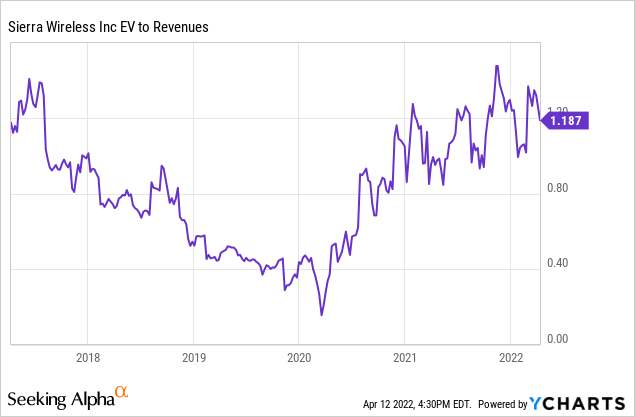

Valuation

Analysts expect EPS at $0.27 this year rising to $0.62 (with a high estimate at $1.18) in 2023 with revenue expected at $587M this year rising to $633.5M (+7.9%) in 2023. So on an earnings basis, the shares aren’t particularly cheap.

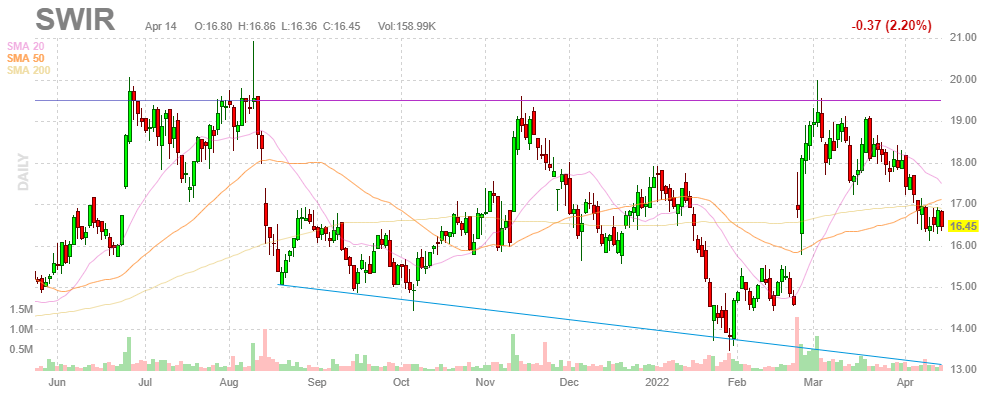

FinViz

Conclusion

We see multiple positives:

- Demand for the company’s products remains strong and IoT and 5G growth is still in the early innings.

- New management focuses on growth with profitability, not growth at all cost, and is pruning lower margin product lines.

- Production capacity has been added so the company can benefit from increased capacity utilization and run gross margin up to the more usual 35%+ level, component supply constraints, and pricing providing.

- Management has done a good deal of cost-cutting and OpEx will be flat to up a couple of points going forward, given the double-digit revenue growth expected this provides great operating leverage and improved cash flow.

- The company could start generating cash like it used to do before the pandemic.

But against that, there are some risks:

- Component availability and cost remain a constraint on sales, even if they manage to pass on some of the increased cost in pricing.

- An economic slowdown or even a recession is an increasing risk, although this might not slow down revenue growth all that much.

- Much of the turn-around seems already priced in even with the top EPS estimate for 2023 at $1.16, at the analyst average for 2023 ($0.67) the shares are fully valued. However, the company has a habit of exceeding analyst expectations and one could make a case that revenue growth is set for a multi-year ramp with much operational leverage built into the business model. So one could argue that this could be the low for the stock at present levels, as things are set to structurally improve.

The upshot:

- Given the present market climate, we see the shares as range-bound ($14-$20) for now. One can wait to buy for the shares to move to the lower part of the range (they are not that far off), or wait for a break-out of the top.

- We do think the shares will ultimately break out on the upside, but this could take a while.

Be the first to comment