comzeal/iStock via Getty Images

A Quick Take On Yoshitsu

Yoshitsu (NASDAQ:TKLF) went public in January 2022, raising approximately $24 million in gross proceeds from an IPO that was priced at $4.00 per ADS.

The firm sells beauty and personal care items to consumers in Japan and overseas.

TKLF needs to continue to transition away from a Japan-centric retail focus.

Until we see positive results of that transition, I’m on Hold for Yoshitsu.

Yoshitsu Overview

Tokyo, Japan-based Yoshitsu was founded to provide a range of health and beauty products for consumers in Japan and online.

Management is headed by Principal Executive Officer Mei Kanayama, who has been with the firm since January 2008 and was previously president of Hirona Co., a telecommunications company.

The company’s primary channels include:

-

Company-owned retail stores

-

Company online websites

-

Franchised stores

- Third-party online websites

The firm seeks customers through offline advertising, its retail store presence and through online and social media outreach efforts.

Yoshitsu’s Market & Competition

According to a 2020 market research report by Mordor Intelligence, the Japanese market for beauty and personal care products is expected to grow at a CAGR (Compound Annual Growth Rate) of 3.5% from 2019 to 2024.

The country is one of the largest markets for cosmetic and personal care products in the world, with highly sophisticated consumers.

The main drivers for this expected growth are products with natural ingredients and organic formulations as well as anti-aging and multifunctional products.

Also, the market remains highly fragmented, with local players and many global brands competing for consumer share of wallet.

Major competitive or other industry participants include:

-

Welcia Holdings

-

Tsuruha Holdings

-

Matsumotokiyoshi Holdings

Yoshitsu’s Recent Financial Performance

-

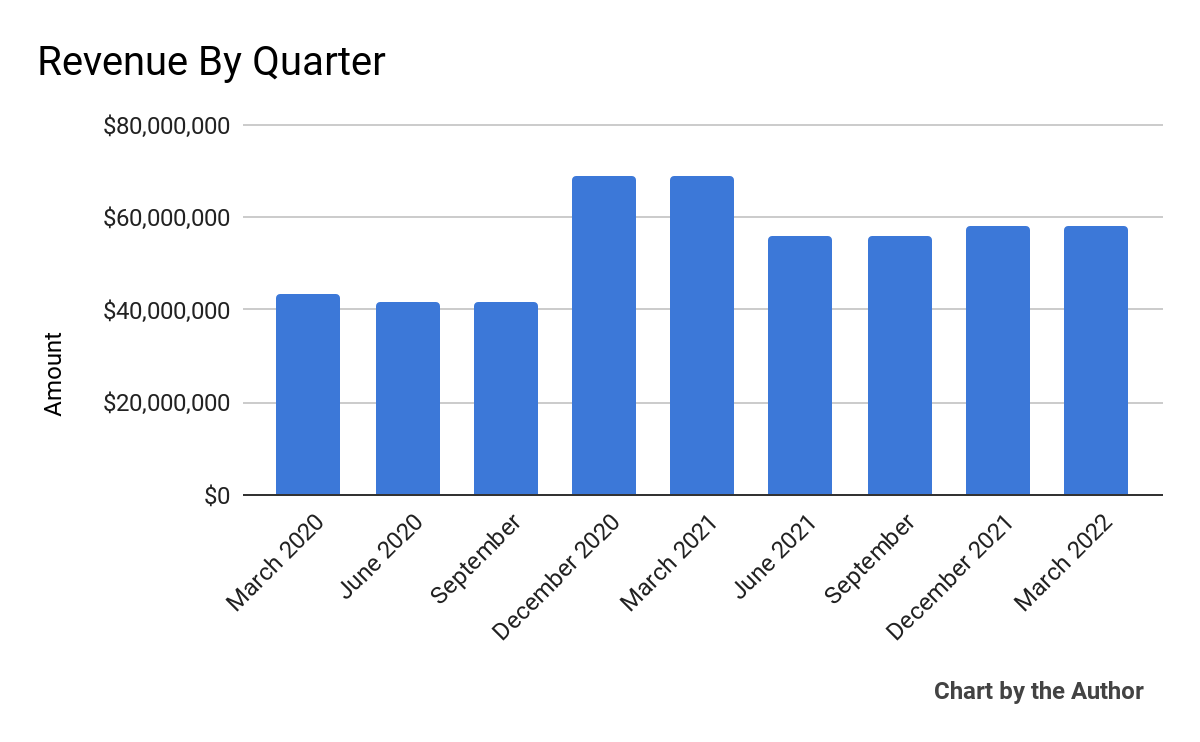

Total revenue by quarter has produced the following trajectory:

9 Quarter Total Revenue (Seeking Alpha)

-

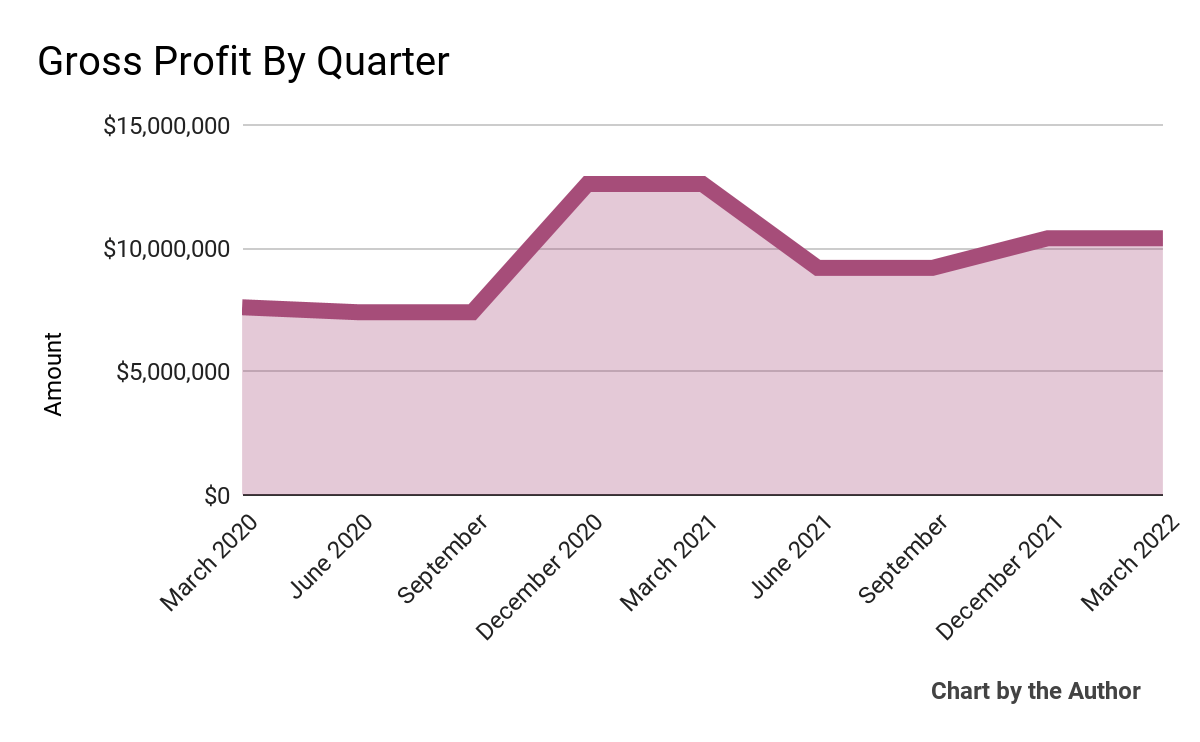

Gross profit by quarter has grown in a similar fashion to total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

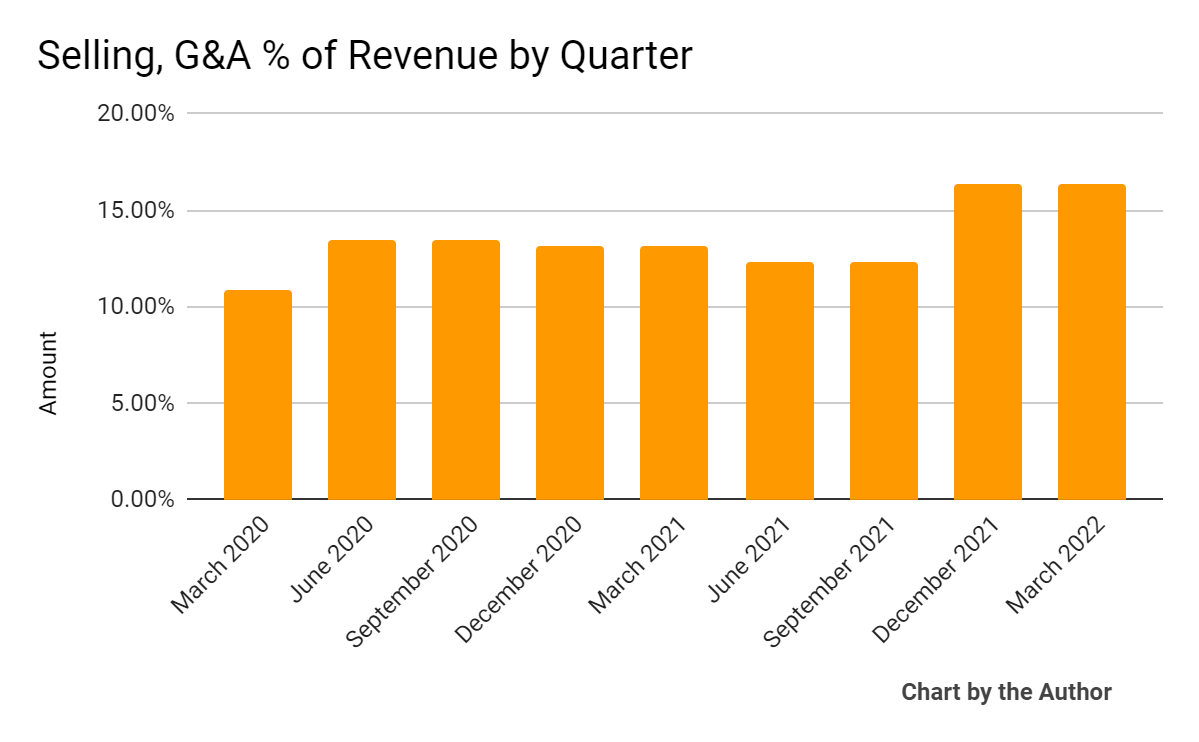

SG&A expenses as a percentage of total revenue by quarter have increased in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

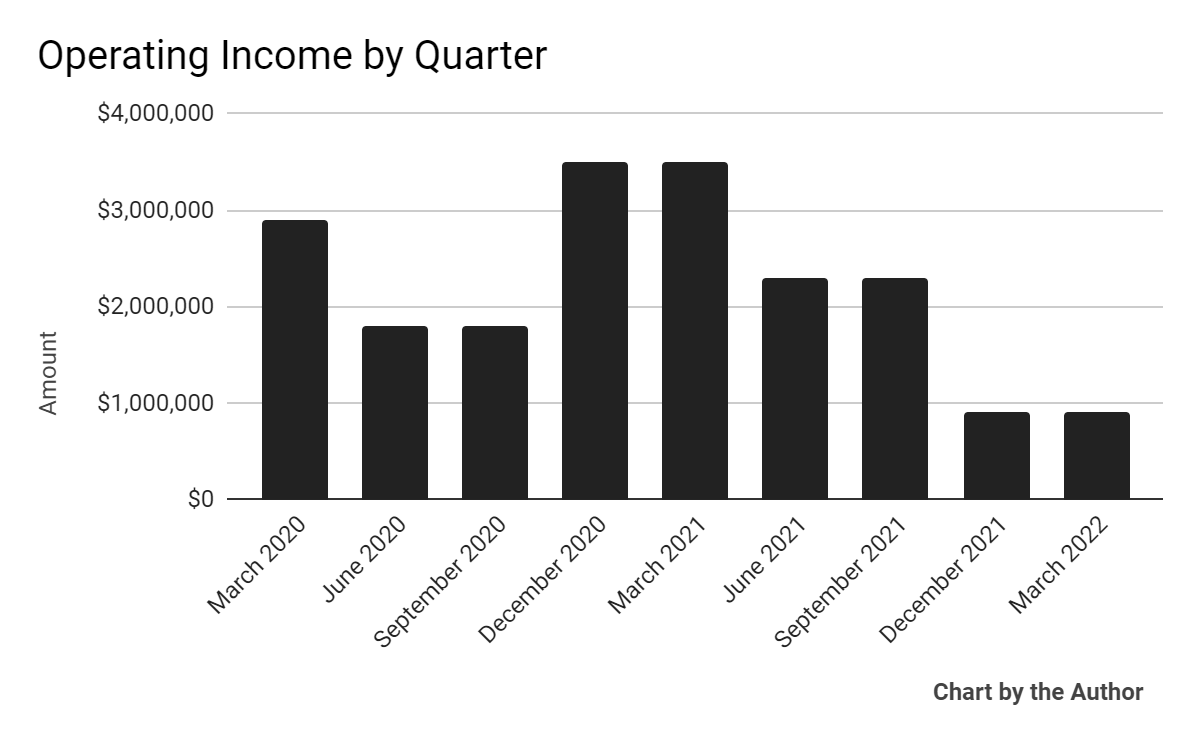

Operating income by quarter has dropped markedly recently:

9 Quarter Operating Income (Seeking Alpha)

-

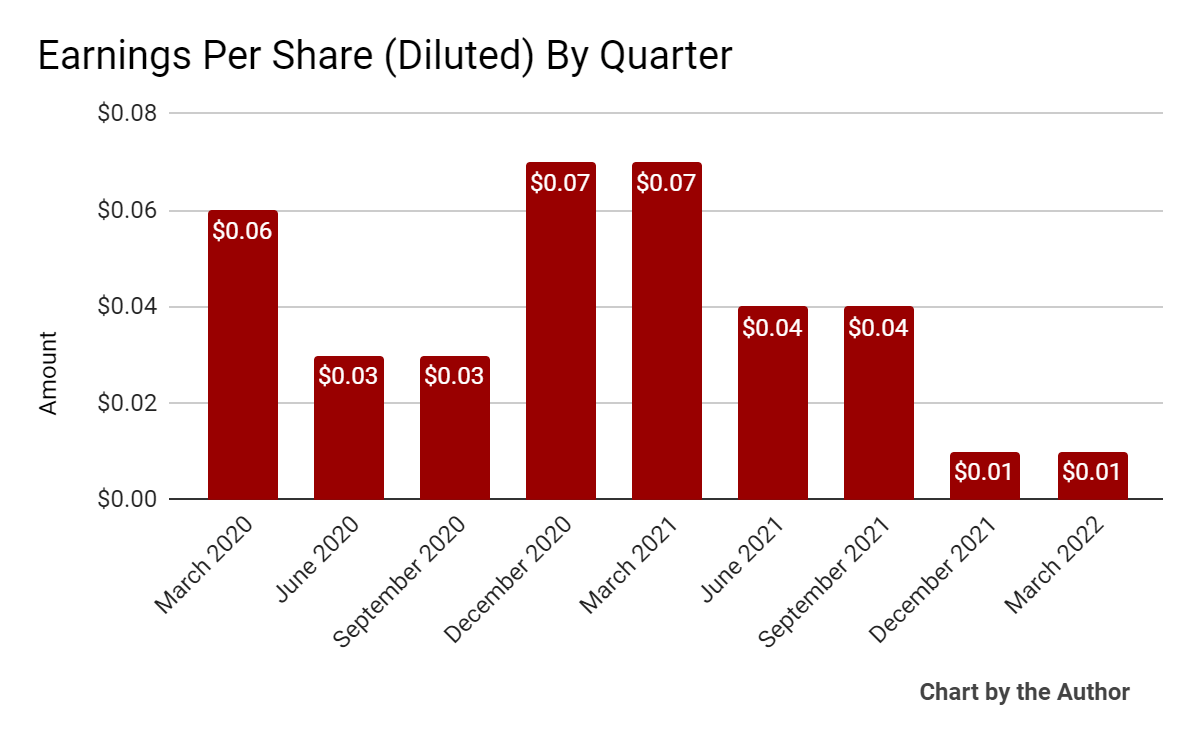

Earnings per share (Diluted) have also dropped accordingly:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

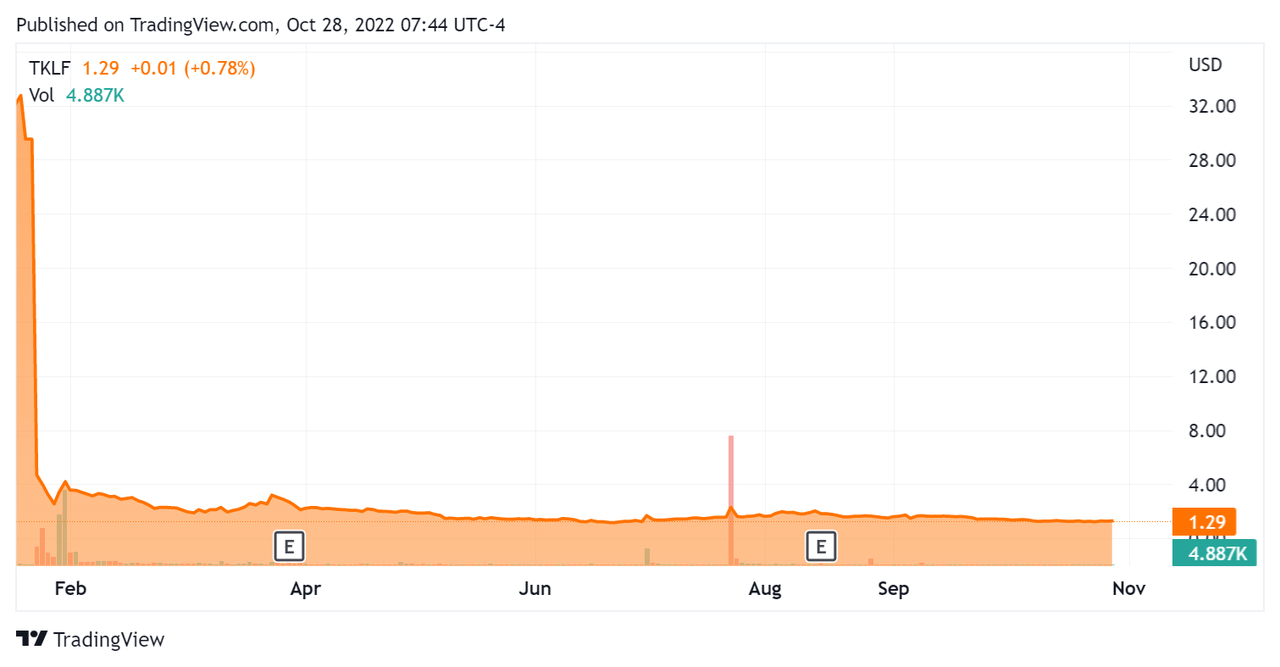

Since its IPO, TKLF’s stock price has fallen 95.6%, as the chart below indicates:

Stock Price Since IPO (Seeking Alpha)

Valuation And Other Metrics For Yoshitsu

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.41 |

|

Revenue Growth Rate |

3.1% |

|

Net Income Margin |

1.4% |

|

GAAP EBITDA % |

3.3% |

|

Market Capitalization |

$46,400,000 |

|

Enterprise Value |

$93,510,000 |

|

Operating Cash Flow |

-$12,280,000 |

|

Earnings Per Share (Fully Diluted) |

$0.10 |

(Source – Seeking Alpha)

Commentary On Yoshitsu

In its last earnings call (Source – Seeking Alpha), covering FQ4 2022’s results, management highlighted the addition of new stores and wholesale customers despite continued significant COVID-19 restrictions in Japan.

Additionally, the company is focusing on optimizing its warehouse operations in North America and diversifying its product base to provide more choices for its customers.

As to its financial results, revenue for the fiscal year rose 3.1% to $228.4 million, a record for the company.

Management responded to offline store closings by expanding its online store network in overseas regions less affected by pandemic lockdown policies in Japan.

Gross profit decreased slightly for the full fiscal year but operating expenses rose by 11.5% due in part to inflation in transportation costs.

As a result, earnings dropped as the fiscal year proceeded.

For the balance sheet, the firm finished the year with $17.7 million in cash and equivalents and $60.9 million in total debt.

Over the trailing twelve months, free cash used was $15.1 million, of which CapEx accounted for $2.8 million in cash use.

Looking ahead, while management is encouraged by Japan’s reopening to foreign visitors which have accounted for a substantial portion of its retail store sales, it realizes it needs to transition to a more domestic audience to grow.

Regarding valuation, the market is currently valuing the stock at an EV/Sales of around 0.31x, below the typical range for consumer retail stocks.

The primary risk to the company’s outlook is the firm’s need to transition away from its Japan-centric retail business to overseas and online revenue sources.

Until we see positive results of that transition, I’m on Hold for Yoshitsu.

Be the first to comment