Nikada/iStock Unreleased via Getty Images

Thesis

I previously argued that it is unlikely that Apple Inc.’s (NASDAQ:AAPL) fiscal Q4 results would disappoint. And indeed they didn’t. Despite excessive “fearmongering” surrounding the iPhone 14 demand – see here, here, and here – Tim Cook said that “We continue to be constrained today and so we’re working very hard to fulfil the demand.”

That said, Apple beat analyst consensus with regards to both revenue as well as earnings; and the company once again proved that doubting the world’s most valuable consumer company is a fool’s errand.

Reflecting on another strong quarter from Apple, while Google (GOOG, GOOGL), Meta Platforms (META), and Amazon (AMZN) stumbled, I reiterate my “Buy” rating for AAPL stock. But, as a function of higher risk premia for Big Tech in general, and smaller EPS adjustments for Apple specifically, I lower my base case target price to $200.59.

Apple’s September Quarter

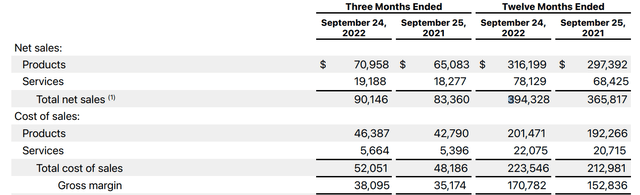

From July to the end of September, Apple generated record revenues of $90.14 billion, which represents an increase of 8% versus the same period one year earlier. For reference, analyst consensus had estimated Q4 sales at about $88.8 billion ($1.37 billion beat).

The strong topline number was driven by better-than-expected iPhone sales, which increased 10% year over year to $42.6 billion (accounting for about 47% of sales), as well as an exceptionally strong (record) demand for Macs. Interestingly, strong Mac demand was sustained while Gartner estimated PC sales to have fallen by 19.5% in the September quarter. Services also recorded record revenues: the segment increased to $19.2 billion and claimed more than 900 million paid subscriptions.

Tim Cook, Apple’s CEO commented (emphasis added):

This quarter’s results reflect Apple’s commitment to our customers, to the pursuit of innovation, and to leaving the world better than we found it …

… As we head into the holiday season with our most powerful lineup ever, we are leading with our values in every action we take and every decision we make. We are deeply committed to protecting the environment, to securing user privacy, to strengthening accessibility, and to creating products and services that can unlock humanity’s full creative potential.

But Luca Maestri, Apple’s CFO, also admitted in the analyst call that (emphasis added):

we believe total company year-over-year revenue performance will decelerate during the December quarter as compared to the September quarter

Profitability Expands

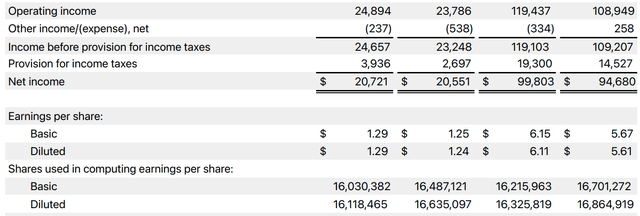

Apple’s profitability remained surprisingly strong. During the September quarter, the company generated operating income of $24.89 billion, as compared to $23.79 billion for the same period one year earlier. Net income edged higher to $20.72 billion (versus $20.55 billion in Q4 2021).

Notably, Apple was the only “Big Tech” player that managed to increase EPS in the September quarter. The company generated EPS of $1.29, up 4 percent year over year – while Amazon’s net income fell 9 percent, Microsoft’s dipped 14 percent, Alphabet’s declined 27 percent, and Meta’s slumped 52 percent.

This alone should clearly underline Apple’s business quality.

Shareholder Returns

During the September quarter, Apple returned more than $29 billion to shareholders – in the form of dividends and share repurchases. If such a number would be assumed for the next four quarters, which is not unlikely given Apple’s strong cash flow and balance sheet, Apple’s yield would approach 5% – higher than what 10-year treasury yields offer, while also offering exposure to growth opportunity.

With Q4 2022, Apple has also declared a cash dividend of $0.23 per share, which will be paid on November 10.

Valuation Update

I have previously valued Apple at $247.51/share, and I still believe that, long term, such a valuation would make sense. I continue to see the following (potential) value drivers: 1. New market opportunities including VR/AR and the Apple Car; 2. Accelerating strength in Apple’s service portfolio; and 3. Continued financial engineering. However, I also need to acknowledge that valuations for Big Tech are falling and other companies – notably Meta and Google – provide deep value opportunities, in my opinion.

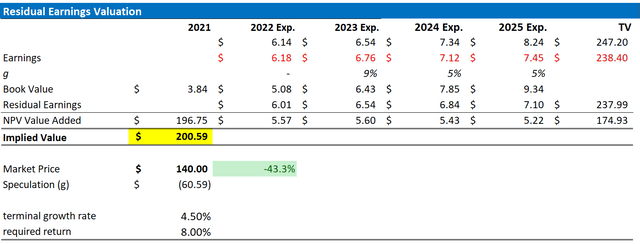

That said, I understand that a 7.5% cost of equity does probably not reflect an adequate return requirement, and I upgrade this number to 8.25%. Moreover, I slightly adjust my EPS estimates to reflect analyst consensus adjustments. I continue, however, to anchor on a 4.5% terminal growth rate.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $200.59.

Analyst EPS Estimates; Author’s Calculation

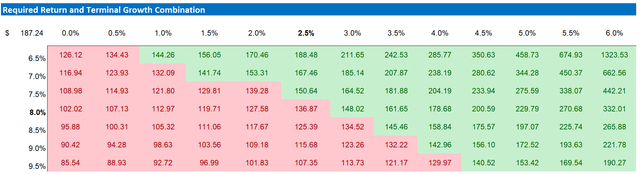

Below is also the updated sensitivity table.

Analyst EPS Estimates; Author’s Calculation

Conclusion

Following the Bloomberg report that Apple is apparently scaling down production of the iPhone 14 product line, investors were wary that Apple’s Q4 results would disappoint. But while other Big Tech companies crashed after reporting their September quarter, Apple was up slightly following the Q4 numbers (+0.5% after-hours trading reference).

However, it is also impossible to ignore that Apple stock remains closely correlated to the S&P 500 (SPY). Accordingly, if an investor expects more pain for the S&P 500, then it will be hard to argue that Apple will not suffer in lockstep.

Reflecting on another strong quarter from Apple, I am confident to reiterate my “Buy” rating for APPL stock. However, as a function of higher risk premia for Big Tech in general, and smaller EPS adjustments for Apple specifically, I lower my base case target price to $200.59 (versus $271.51/share prior).

Be the first to comment