oatawa/iStock via Getty Images

Barely 8 months have passed since Lulu’s Fashion Lounge Holdings, Inc. (NASDAQ:LVLU), an online-only retail company founded by a mother-daughter duo, went public. Although the stock price is currently 11.49% under the original opening IPO price, the financial reports show promising growth on the top line and positive signs toward the bottom line improving, especially since completing a substantial long-term debt payment. Earnings per share have passed expectations for Q3 and Q4 2021 and met expectations for Q1 of 2022. Results have largely been driven by an increase in gross margin and growth in the number of active customers. As an asset-light company selling highly demanded clothing through strategic data analytical processes and supported by a large, growing and loyal online consumer base of over 7.5 million followers across various social media platforms, with positive cash flow in Q1 2022, there seems to be a lot going for this small-cap stock at a market cap of $451.62M.

Although it is not straightforward to analyze whether a retail company will make a good investment, by visiting the online store, exploring promotional activities on its social media platforms, examining financial reports and taking into consideration the management’s confidence in revenue continuing to grow in the range of $490 million for the full year, I hope to show that investors may consider taking a bullish stance on this company.

Company Introduction

LVLU is a women’s affordable fast-fashion luxury brand that competes with long-established brands by using digital, customer-driven data for every part of the business, including logistics, marketing, product planning, and customer relationships. Data-driven decisions are used throughout the creation and the curation cycle. Unlike traditional clothing companies, LVLU works on a low-risk, low-capital intensive testing, learning and reordering strategy. This competitive advantage allows it to compete against much larger fashion retail companies irrespective of their economies of scale benefits.

Whilst originally a small boutique shop, LVLU truly became a serious business in 2008 when it transitioned to an exclusively online retailer, relying on developing and growing its consumer base through SEO, meaningful interactions on social media platforms, and a high-level boutique-like online purchasing experience.

Lulu’s on Instagram (Instagram.com)

The online activity of its consumers is an essential part of its journey for growth and development. Consumers are long-term and loyal, Millennial and Gen Z women who see themselves as part of an interactive and engaging community, rather than just purely buying a piece of attire. The clothing prices range between $16 and $300.

Valuation

The IPO took place on November 11, 2021. The company sold 5,750,000 shares of its common stock at a price of $16.00. Whilst the stock price is currently 11.49% less, the company’s financials for Q1 2022, its online performance and future plans for the coming year are promising.

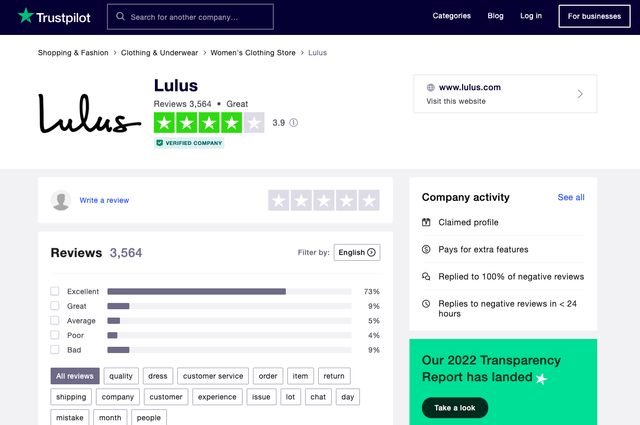

When analyzing retail companies it helps to get into the shopping aisles, in this case, the virtual store and social media platforms. Through third-party review websites, we can get an idea of how satisfied consumers are with the layout of the website, article prices, customer service and check-out process. Trust pilot and Sitejabber give us an indication that consumers are satisfied overall with a rating of 4 and 3.9 respectively.

Lulu’s Fashion Lounge Review (Trustpilot.com)

Another aspect to look at is the promotional activity. On social media platforms such as Instagram, we can see different types of promotional efforts. A big part of promoting articles is to highlight and showcase real consumers wearing and enjoying the company’s brand on posts and stories, this simultaneously increases the level of engagement. Moreover, we also see in the Q1 2022 financial report that the average order value (AOV) made an impressive increase of 20%, from $111 to $133, compared to Q1 of last year. Active consumers made a significant 58% increase from 1.9 million to 3 million over the same period. Active consumers include new and repeat consumers.

Lulu’s Fashion Lounge Online Shop (Lulus.com)

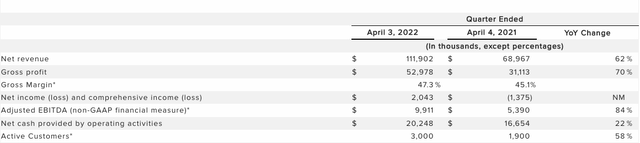

Gross margin is very important to look at when evaluating retail companies, and the seasonality of sales plays a big role in the company’s performance. Q4 tends to see a sale surge due to the holiday season. The gross margin increased by 47.3% and gross profit increased by 70% compared to Q1 2021. There is also positive information at the bottom line as adjusted EBITDA increased by 84% compared to last year. Revenues have increased by 62% from Q1 2021 to 2022. Net income has increased from negative $1,375 to $2,043. We have seen EPS grow from a negative $0.08 to $0.05 from Q1 2021 to Q1 2022.

Financial Overview (Lulu’s Fashion Lounge Financial Report Q1 2022)

Lastly, for companies looking to grow, a shortage of cash can become an issue. If we look at LVLU this is not the case we see that there is a positive net cash position. Furthermore, the company was also able to pay off 40%, $10 million of its credit in Q1 2022, which resulted in net cash of $4.4 million. As presented in the table above, net cash from operating activities increased by 22% year on year.

Risks

One of the biggest risks the company has is that it is fully reliant on its online activity as there are no traditional physical shop locations. The brand was built up by its community of online followers. If the community were to stop engaging with the company it would be detrimental to the brand. The company is highly reliant on acquiring its customers through social media platforms. The nature of these channels is always changing, which LVLU has very little control over.

The company needs to continuously build and maintain its relationship with these channels on acceptable terms for both parties. The manner in which it acquires customers for its own website has to remain cost-effective. Financially there would be a serious problem if the company would pay increasingly higher costs on things like paid searches, social media adverts, affiliated marketing, paid social, direct and personalised emails. Algorithms play an important role to drive consumers to the company. If there’s change, it can negatively impact the sales of the company. There are no contractual agreements when working and relying on social media for the base of your business.

Secondly, the industry is highly competitive, fashion trends are quickly changing and the consumer is impacted by many external environmental factors when deciding to purchase fashion wear. There is a low barrier to entry to the apparel industry for suppliers as well as marketers. The company is a modern, digitally built company; it has not used traditional advertising or physical shops for consumers to buy its apparel. The brand is critical as it protects them from the growing pressures of reduced gross margins across the various product lines.

Thirdly, increased growth and entering international markets could put a strain on the current business model. Operations have rapidly expanded over a short period of time. This means new territories, new learnings, and important managerial changes to be made to effectively and efficiently continue to run the company. On third-party shop review websites, such as Trustpilot, we can see a declining trend in overall customer satisfaction. The management in place along with the business model will have to develop alongside the ambitious growth plans.

Finally, as questions start to arise about the strength of the overall economy, looking at fashion companies we need to tread with caution as economic slowdowns will reduce the amount of customer discretionary spending. The company depends on repeat and frequent purchases by consumers, and with less financial confidence, consumer spending may decline and negatively impact expected growth and revenue.

Future and Final Thoughts

The company has a number of growth strategies including, a digital ambassador program and continued digital marketing strategies. Next, although not present yet there is the goal of an offline presence in physical stores for growth through in-store partnerships with third-party retailers, showrooms and pop-up shops. Additionally, there are plans to partner with other apparel brands and influencers, to open up category adjacent possibilities.

On top of that, the company wants to enter international markets. Currently, the majority of sales come from the United States. Without an international marketing focus, the company has already shipped its products to over 100 countries worldwide. Long-term plans include providing local shopping experiences, platforms available in multiple languages, currencies and alternative payment options.

LVLU has a proven performance track record through consistent and operation-wide data-driven decisions, in addition to building a strong connection to its consumer base. It is growing its consumer base and driving repeat purchases from existing consumers. The business model is profitable and looks to continue on an upward trend into the rest of the year. With a strong management team experienced in the retail sector, continuously improving its data collection methods and creating repeat purchase opportunities, the company looks set up to deliver. For this reason, investors may want to take a bullish stance on this company.

Be the first to comment