Pgiam/iStock via Getty Images

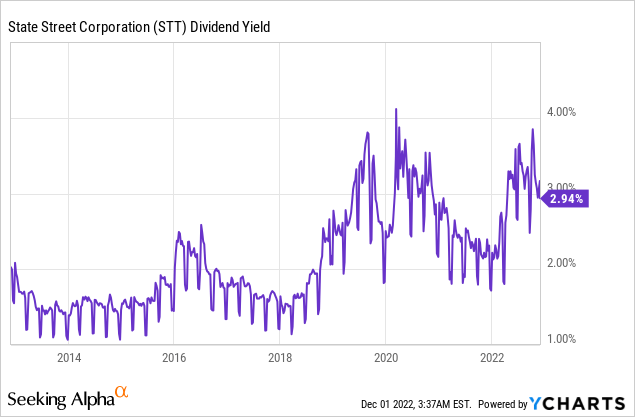

The stock market is going through a bear market, which is painful for most investors. However, investors should realize that bear markets offer great opportunities to purchase stocks with solid long-term fundamentals at bargain prices, which cannot be found during bull markets. This certainly applies to State Street Corporation (NYSE:STT). This high-quality financial services stock has rallied 33% off its bottom in October but it remains attractive, as it is still offering a nearly 10-year high dividend yield of 3.4% while it is trading at a nearly 10-year low price-to-earnings ratio of 10.3. As State Street is characterized by reliable business performance and promising growth prospects, investors should purchase the stock before it rallies further.

Business overview

State Street is a financial services company that traces its roots back to 1792. It is one of the largest asset management firms in the world, with $36 trillion of assets under custody and administration and $3.3 trillion of assets under management.

State Street is facing a strong headwind this year due to the ongoing bear market that has prevailed in most financial markets around the world. The bear market has reduced the average value of the portfolios of investors, and thus it has reduced the fee revenues of the company. In addition, the bear market has made investors more conservative, and hence it has reduced the number of transactions they have executed this year. This has taken its toll on the results of State Street.

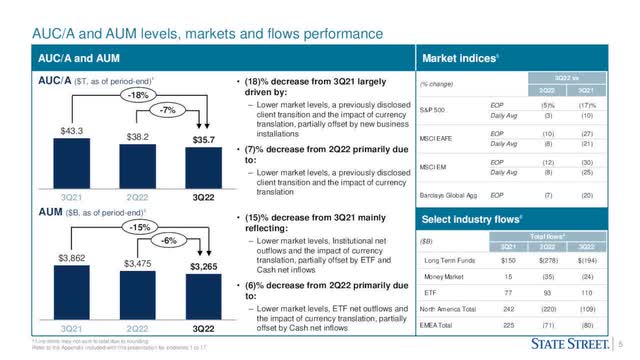

In the third quarter, State Street incurred an 8% decrease in its fee revenues over the prior year’s quarter due to the above headwinds. It also incurred an 18% decrease in its assets under custody and a 15% decrease in its assets under management.

State Street Performance (Investor Presentation)

On the other hand, State Street currently benefits from a strong tailwind in its business, namely the environment of fast-rising interest rates. The Fed is in the process of raising interest rates aggressively in an effort to restore inflation to its long-term target around 2%. Higher interest rates greatly enhance the net interest income of State Street, i.e., the difference between the interest rate it charges on its loans minus the interest rate it pays on its deposits.

Thanks to the interest rate hikes implemented by the Fed, State Street grew its net interest income 36% in the third quarter. It thus offset most of the above tailwinds and hence its earnings per share slipped only 7%, from $1.96 to $1.82, and exceeded the analysts’ estimates by $0.04. Even better, the company is on track to post nearly all-time high earnings per share of about $7.14 this year, just 4% lower than the previous all-time high of $7.44.

Most companies are facing great pressure on their margins due to the surge of inflation to a 40-year high this year. However, State Street has managed to keep its operating expenses flat this year. Moreover, the Fed has made it clear that it will exhaust its means to restore inflation to its target level. As soon as inflation begins to subside, global financial markets are likely to recover and thus State Street will enjoy a recovery in its revenue fees.

It is also important to note that State Street is one of the global leaders in its business of asset management and asset servicing, with an exceptional performance record. To be sure, the company has grown its adjusted earnings per share in 8 of the last 9 years. Since 2012, it has grown its earnings per share by 6.7% per year on average. The consistent growth record is a testament to the strength of the business model of State Street and its prudent management.

Moreover, State Street has ample room for future growth thanks to an expected recovery of global financial markets, the tailwind from high interest rates and its reliable business execution. Analysts seem to agree on this view, as they expect the company to grow its earnings per share by 12% next year and by another 11% in 2024.

Valuation

State Street is currently trading at a forward price-to-earnings ratio of 9.9, which is much lower than its 10-year average price-to-earnings ratio of 13.1. The cheap valuation has been caused primarily by the impact of inflation on the present value of the future cash flows of the company. The impact of 40-year high inflation on the valuation of stocks is the primary reason behind the ongoing bear market of the S&P 500.

However, as mentioned above, the Fed has definitely prioritized restoring inflation to its long-term target around 2%. As soon as inflation begins to moderate, the valuation of State Street is likely to revert towards its historical average. This means that the stock has significant upside potential thanks to the expansion of its earnings multiple.

It is also remarkable that the stock is trading at only 9.0 times its expected earnings in 2024. Moreover, State Street has exceeded the analysts’ earnings-per-share estimates for 15 consecutive quarters. It is thus likely to meet or exceed the analysts’ estimates in 2023 and 2024. If this proves correct and the valuation of the stock reverts to its 10-year average, the stock will rally 46% (=13.1/9.0 -1) from its current level.

It is also worth noting that management has noticed the cheap valuation of the stock and is trying to take full advantage of it. State Street has announced a share repurchase program of $1 billion just for the fourth quarter. At the current stock price, this program can reduce the share count by 4% in a single quarter. To cut a long story short, State Street is cheaply valued and thus it is likely to highly reward those who purchase it around its current stock price.

Dividend

State Street has raised its dividend for 13 consecutive years, but it has offered a lackluster dividend yield throughout most of the last decade. As a result, the stock passes under the radar of most income-oriented investors. However, thanks to its cheap valuation, the stock is currently offering a nearly 10-year high dividend yield of 3.4%.

Given the solid payout ratio of 32% and its reliable business performance, State Street can continue raising its dividend for many more years.

Risk

State Street has exhibited reliable business performance over the last decade. Even during the coronavirus crisis, the company has kept growing its earnings per share and thus it has proved its resilience to downturns. The only material risk factor is the unlikely event of a prolonged recession, which may cause a prolonged bear market. In such a case, global financial markets are likely to remain under pressure for a considerable period, and hence State Street will incur pressure in its fee revenues, which are closely related to the levels of global stock markets.

No one can rule out the unfavorable scenario of a prolonged bear market. However, as history has taught us, the odds do not favor such an adverse scenario. The average bear market has lasted 289 days. The duration of the ongoing bear market, which is about 11 months old, has already exceeded this time length. More importantly, the Fed has become much more reactive than it was decades ago and thus it is unlikely to let a prolonged recession play out without stimulating the economy. To cut a long story short, State Street will be vulnerable in the event of a prolonged recession, but the odds of such a recession are low.

Final Thoughts

State Street has rallied 33% off its bottom in October. Most investors hesitate to buy a stock after such a steep rally, but State Street remains cheaply valued, as it is trading at only 9.0 times its expected earnings in 2024. As the company benefits from high interest rates and has an exceptional record of beating the analysts’ estimates, investors should purchase State Street Corporation around its current stock price before it rallies further.

Be the first to comment