peshkov

(Note: This article was in the newsletter on July 5, 2022.)

Back in October 2021, I wrote in the newsletter that Ring Energy, Inc. (NYSE:REI) might need to merge to put the debt issue behind to the satisfaction of the market. That appears to be what is happening now with the Stronghold Permian Basin assets.

Fiscal year 2020 was a year no one predicted or could predict. But it did considerable damage to a lot of companies. Deals that looked realistic or even conservative at the time of the deal became highly speculative as lenders became very scared. The lending market is recovering from fiscal year 2020 (and another year like that is unlikely). However, lending terms have tightened considerably, and Mr. Market appears to be going for instant progress.

Therefore, a deal like this becomes a necessity because the option of the company to drill its way to a proper size disappeared with the coronavirus demand destruction and negative oil prices.

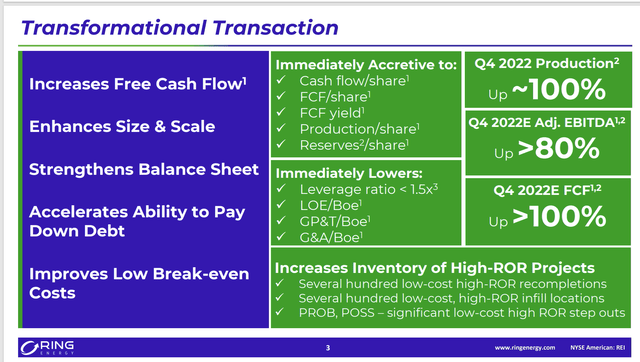

Ring Energy Presents Reasons To Acquire Stronghold Energy II (Ring Energy July 5, 2022, Acquisition Presentation)

Out of all the reasons above listed to acquire the company, Mr. Market, and likely the debt market as well, are most interested in that leverage ratio shown above. Fiscal year 2020 did a lot of damage to companies like this one that have not fully converted to an operating model (from essentially startup mode). This particular acquisition will likely put the company back on track after a disastrous year in the eyes of the debt market that no one saw coming.

The debt ratio shown above is much better in the eyes of the market. One thing about a series of unexpected downturns is that the debt market and the stock market become far more conservative. Production growth as a way out of a debt straight-jacket is often too slow for the market as well as an undependable solution. This solution, on the other hand, is immediate and definitely a material improvement for both companies in the eyes of the market.

There are so many solutions that went out the window because the last five or six years ending with fiscal year 2020 have been brutal. It did not help that the 2018 oil price rally was a real fast one. Any time you have a big price decline like 2015, followed by a very fast rally like 2018, and then the OPEC pricing war followed by the coronavirus demand destruction, the debt market is going to become far more conservative. A lot of lenders lost a lot of money during a very unprofitable time for the industry. Things will likely cycle around to a historically normal situation if this industry can demonstrate a normal cycle or two. Track records are extremely important to both Mr. Market and the lenders. Currently, the latest industry (profit and performance) track record is horrible by most accounts.

But that makes the latest Ring Energy proposal attractive. Ring Energy gains a valuable shareholder that likely has found a good pathway to “cash out” in some form in the future. But in the meantime, the advice from that new major shareholder is likely to prove invaluable. Many times, a shareholder like Putnam either can bring proposals, or has valuable connections that bring accretive proposals, to the company to consider. Right now, it is still considered a buyers’ market by many out there.

It should be noted that there is no guarantee that things will go “well.” But it does appear to be a good start. So many companies I covered considered their stock too cheap to use. The result was that shareholders usually got wiped out. This way appears to allow shareholders to continue to participate.

Companies with tight finances often do not have the funds to “keep up.” This industry has constantly changing technology. The need for a comfortable balance sheet (as opposed to tight finances) is compelling when that commodity industry has low visibility as well.

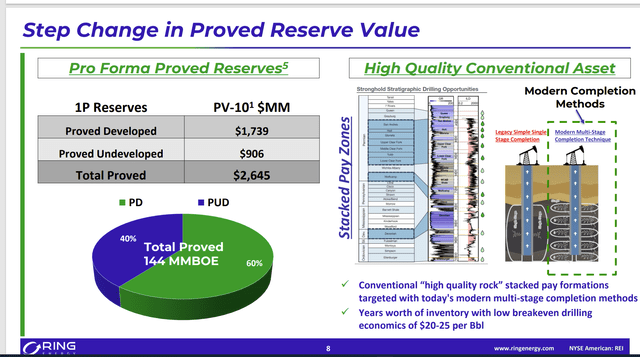

Ring Energy Presentation Of Upside Potential Of Acquisition (Ring Energy July 5, 2022, Acquisition Presentation)

One of the things not stated here is the potential for horizontal drilling. Generally, the more flexibility that management has, the more profitable the proposal. Long time readers may remember when the company was drilling vertical wells on its properties before horizontal wells became realistic in the eyes of management. So, the above presentation provides an immediate upside potential. But longer term, there are likely to be far more possibilities than are in the slide above.

The biggest deal here is that breakeven in the past has been based upon prices received. Even so, that breakeven point is better than many unconventional or even offshore deals I follow. REI has some of the most profitable wells in the business.

Yet the latest deal allows the company to acquire existing acreage with production for less than $20K an acre. There are many Permian locations that are less profitable, but the acreage costs more. This is exactly what shareholders pay management to do (find cheap acreage that is uncommonly profitable).

Summary

Coming out of a very traumatic fiscal year 2020 saw a lot of company adopt far more conservative lending strategies than I have seen in a long time. The debt ratio range has become so much more restricted than was the case before 2015.

Admittedly, oil production was not expected to grow as fast as it did about 20 years or so ago. That led to a demand to return money to shareholders and pay down debt. Those demands made sure production would not grow quickly. But, as happened in the 1990’s, once balance sheets were repaired, cyclical growth did resume. That is likely to happen in the future.

This company will pursue debt reduction. But that debt reduction should come faster because the higher production should lead to economies of scale. All the opportunities shown above may also lead to higher cash flow. A dividend is probably not a priority at the current time.

The result of this combination is a company that is far more likely to achieve the potential that the founders envisioned before all the challenges of the last few years. There were a fair number of companies that did not survive the challenges of fiscal year 2020. The fact that this one did is a positive statement to the conservativism of management so that the company handled an actual “just in case” scenario. As a result of that, the industry and management are likely to be very conservative for the foreseeable future.

Be the first to comment