jetcityimage/iStock Editorial via Getty Images

2022 has not been kind to CarGurus (NASDAQ:CARG); in fact, the entire period of the pandemic has been a challenge for this one-time high-flying internet growth stock. CarGurus, one of the best-known sites for used-car research and a critical marketing partner for used car dealerships across the U.S., has continued to struggle with sluggish dealer activity and reclaiming its prior profitability levels, especially as direct-to-consumer alternatives like Carvana (CVNA) and Vroom (VRM) boomed since COVID.

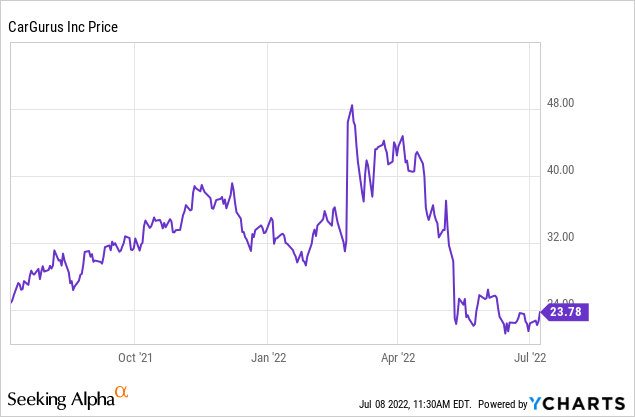

Year to date, shares of CarGurus have lost more than 30% of their value; and versus highs above $50 notched earlier this year in February, the stock has lost more than half of that high.

The bull and bear theses are now more balanced

I’ll admit that I was a bit too eager to buy CarGurus on the dip, and the trade has produced some stinging losses. Amid new information that the company shared during its Q1 earnings release, I’m a bit more hesitant on CarGurus’ fundamental story. Given the added risks (but also keeping in mind the precipitous drop in the share price since the start of the year), I’m shifting my recommendation on CarGurus to Neutral.

At this point, I see the stock as more of a mixed bag of positives and negatives. On the positive side:

- CarGurus has made itself essential for car dealerships. Even before adding CarOffer and Instant Max Cash Offer, CarGurus was long considered by dealerships to be a necessary partner due to the amount of web traffic flowing through its site nationwide. By adding the ability for dealerships to buy cars through the CarGurus network as well, CarGurus has effectively just doubled its wallet share within the used-car industry.

- CarGurus generates the kind of recurring revenue from dealers that Wall Street prizes. As the car dealership industry continues to heal, CarGurus will continue to enjoy a steady stream of fee income from these customers. Quarterly average revenue per car dealership also continues to rise.

On the flip side, however, new risks have emerged:

- Can CarGurus properly scale its new initiatives? CarOffer and Instant Max Cash Offer have dramatically grown CarGurus’ scale, at the expense of its profitability. These revenue streams may become more profitable as they scale, but at the moment they are crimping margins and producing the downside EPS forecast that Wall Street is leering at.

- Can CarGurus.com maintain its consumer dominance? The downward traffic trends are comping against a tough 2021, but we do want to see CarGurus continue to grow its site viewership.

Let’s now discuss each of these new risks in turn.

Margins are down, and EPS estimates came in way below expectations

One thing is for sure in the 2022 market: investors care way more about profitability than growth. Over the past year, CarGurus built up two brand-new revenue streams to chase growth to supplement its marketplace business. Its acquisition of CarOffer extended its dealer-to-dealer network and gave CarGurus a direct auto-sales business that complemented its existing services for car dealerships. Instant Max Cash Offer, meanwhile, gave website visitors a way to immediately offload their cars to participating dealerships.

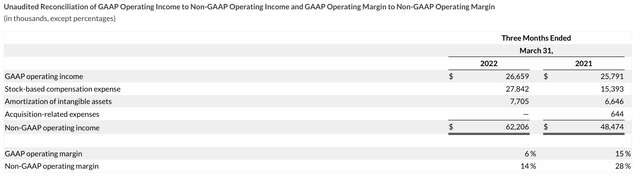

The downside here: lower margin revenue streams, as well as the absorption of all of CarOffer’s operating costs. In Q1, CarGurus reported a 14% pro forma operating margin, half of its operating margin in Q1 of last year.

CarGurus margins (CarGurus Q1 earnings release)

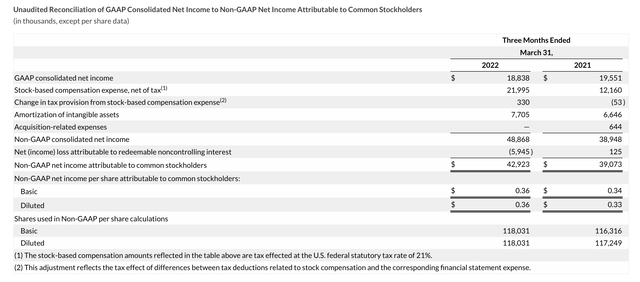

Now, the company still grew earnings, but at a fairly measly pace. Pro forma net income grew 19% y/y to $42.9 million, while EPS also grew 9% y/y to $0.36.

CarGurus earnings (CarGurus Q1 earnings release)

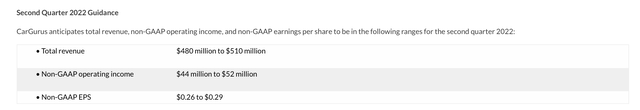

The forward outlook, however, gave investors some pause. The company is forecasting a sequential decline in pro forma operating income as well as EPS (despite sequential growth in revenue):

CarGurus outlook (CarGurus Q1 earnings release)

The $0.26-$0.29 EPS outlook is well below the $0.38 that Wall Street had hoped for. Given that valuation metrics for CarGurus have largely shifted to earnings-based, this downside guidance spurred a huge revaluation in CarGurus stock.

Top-line fundamentals also showing signs of a slowdown

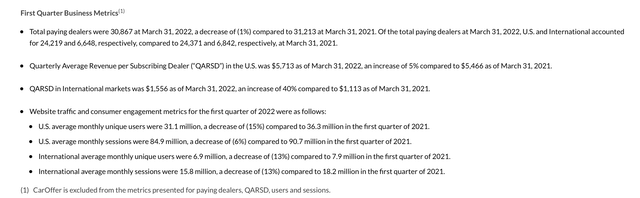

It’s not just the sliding profitability that investors are concerned about, however: we also have to watch out for declining traffic behavior. CarGurus’ biggest draw is that it is the #1 site for consumer research on used cars. But now, the company is reporting that site visits are down:

CarGurus traffic metrics (CarGurus Q1 earnings release)

As shown above, average monthly visitors are down -15% y/y and average monthly sessions were down -6% y/y. Continued inflation in used car prices, plus the spike in gasoline prices that will weigh more on Q2, will be major influencers behind a cool-down in used car demand.

Outside of the consumer space, wholesale activity (CarOffer) is also starting to see signs of risk. Per CEO Jason Trevisan’s prepared remarks on the Q1 earnings call:

Two factors drove relatively more subdued dealer wholesale behavior in Q1. One, dealers witnessed wholesale prices start to retreat throughout Q1; and two, retail consumer demand continued to moderate as a result of historically high prices, rising auto loan rates, inflation and delayed tax refunds. Nonetheless, our dealer-to-dealer business generated $105 million in revenue in the first quarter, growing approximately 12% quarter-over-quarter and over 575% year-over-year.”

With CarGurus’ key growth drivers pointing south, and with margin trends also weakening, it’s clear to see why nervousness is building.

Valuation and key takeaways

This all being said, however – there’s already a good deal of pessimism built into CarGurus’ stock. At current share prices near $24, CarGurus trades at just a 14.8x forward P/E multiple versus consensus FY23 EPS estimates of $1.61. FY22 is expected to be the trough year for earnings ($1.36 in consensus EPS) before returning to growth, which is highly doable if CarGurus can optimally scale its new wholesale arm.

The bottom line here is: CarGurus is cheap, but it’s also cheap for a reason. Unfortunately, I don’t view CarGurus as having any easy near-term catalysts to bring it out of its current doldrums; and for that reason, I prefer moving to the sidelines.

Be the first to comment