Ksenia Shestakova/iStock via Getty Images

Main Thesis/Background

The purpose of this article is to evaluate the Nuveen Dynamic Municipal Opportunities Fund (NYSE:NYSE:NDMO) as an investment option. This is a diversified municipal bond fund with a variety of sector allocations and credit ratings. It’s primary objective “seeks total return through income exempt from regular federal income taxes and capital appreciation”.

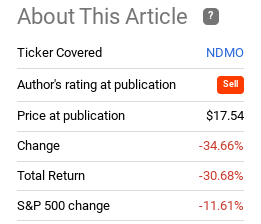

This is a fund I have covered a few times, as I am always on the look-out for value within the municipal bond sector. However, when I first initiated coverage, I actually placed a “sell” rating on this particular CEF. I saw limited value, and expected a drawdown in price. As we approach the one year mark of publication of that review, we see that the sell thesis has been proven right:

Fund Performance (Seeking Alpha)

Unfortunately, most of this weakness has come in 2022, but a drop of this size has caused me to reflect on this fund again to see if a change in outlook is warranted.

After review, I do see a much brighter story for this particular fund. Primarily because the sell-off seems too large, too fast and a turnaround is probably in the cards. In fact, NDMO has already bounced off its year-to-date lows, but I see a high probability of more gains ahead. Therefore, I am placing a “buy” rating on the fund at this time, and will explain why in detail below.

Valuation Story Has Improved Considerably

As readers are surely aware, 2022 has not been kind to investors in equities or fixed-income alike. The losses have been steep, and general risk-off mentality has prevailed. Inflation in particular has taken a toll on bonds, and funds like NDMO that have an above-average duration have been hit especially hard.

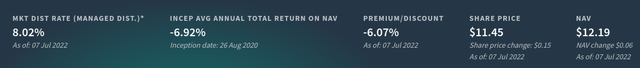

While this backdrop may not seem very favorable, one positive that has come out of it is that investors who buy in now are getting a much better price. While that seems obvious since the share price is down so dramatically, I am actually referring to the fund’s market price compared to its underlying value, or net asset value. Back in 2021, I actually saw this metric as a bearish sign for NDMO, as the fund had a premium to NAV above 6%. Fast forward to today, we see that story has reversed, with the fund now sitting with a discount to NAV in excess of 6%:

Right off the bat we see a much more favorable picture emerge. While a discount to NAV in no way guarantees a positive return going forward, it theoretically should help limit downside. With investors being much more discerning in their positions right now, I think this value will draw in some new buyers. If so, the share price should rise throughout the second half of 2022.

NDMO Very Interest Rate Sensitive

While the valuation is a net positive right now in my view, it is worth considering one of the reasons why NDMO has had such a terrible year. In fairness, most corners of the market are heavily in the red. But still, a drop of 30% in just under a year for a muni CEF is quite poor no matter how we look at it. So understanding why this happened is critical in the evaluation of whether or not there is merit to buying here.

Aside from the general market sell-off, NDMO has fallen for two key reasons. One, the fund is heavily leveraged. This leverage has worked against NDMO, as well as most CEFs, in 2022 because short-term interest rates having been rising faster than long-term interest rates. When this happens, (known as yield curve inversion), the short-term borrowing costs for the fund are rising faster than the “yield pick-up”, pressuring fund earnings. Simply, a fund will borrow money to reinvest it in longer dated securities which should be paying a higher interest rate. When the yield curve inverts, expenses are going up while yield earning is not doing the same at the same degree. This was compounded by the fact that leverage makes a fund more sensitive to general market fluctuations – so when market action is negative, a fund is going to drop in a disproportionate manner. This all has weighed heavily on NDMO.

The second reason is that NDMO was, and is, very interest rate sensitive. The duration level of the fund is a whopping 13 years:

NDMO’s Duration (Nuveen)

This is another key reason why I advocated selling off this fund last year. If inflation remained high and interest rates rose, NDMO was going to be hit hard. As we know now, both of these events did occur, and NDMO unsurprisingly suffered as a result.

This is an especially important point because this means NDMO is still at risk for further declines. While I will support the ultimate conclusion for a “buy” rating on this fund, I do not want readers to walk away with the conclusion this is a risk-free play. As the duration level indicates, there is plenty of downside potential if interest rates rise further. While I personally believe the Fed can raise rates maybe .75 – 1.5% more before it has to stop, that alone will be a headwind for NDMO and an important consideration to evaluate before buying.

Why The Duration Scares Me Less Today

Expanding on the prior paragraph, I will explain why this 13 year duration metric is not deterring me from being bullish on this fund. Clearly, NDMO could still see big losses – so why would investors want to take this gamble now?

There are two reasons for this. One, the market is expecting that inflation has or will soon peak. If true, a softening of inflation metrics will give the Fed more breathing room on rate hikes. This will help to stem the tide of losses in the fixed-income market. Personally, I think the sell-off in munis has been a bit overblown as it is, so a softening of inflation and rate hike expectations will probably do more than just limit losses – it should spark gains.

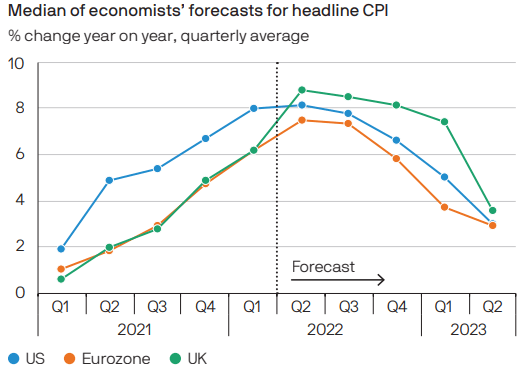

Further, this inflation view is expected to carry over in to 2023. As we push deeper in to 2022, investors need to start determining how their positions are going to perform next year. We all know the market is forward looking, so implications for 2023 should be playing some role in the decision-making process right now. As it stands, economists expect inflation to normalize in the coming months across the developed world. After that, it is expected to fall in 2023, as shown below:

Inflation Expectations (JPMorgan Asset Management)

My thought here is that there is much less risk buying NDMO now than a year ago. Beyond the price having fallen in to bear market territory, the forward outlook is less of an issue for this particular CEF. Last year, I expected inflation to keep rising going in to 2022. This did happen and NDMO paid the price. By contrast, the expectation is inflation will start to ease going in to the new year, and that should have a reverse (positive) effect on NDMO’s market price.

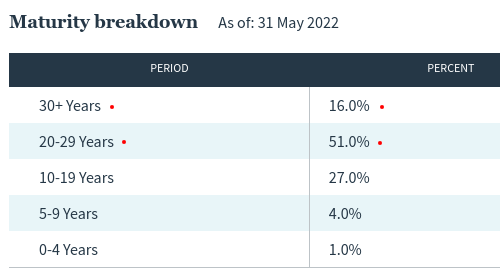

A second reason why I am undeterred by the duration level right now is that long-dated muni bonds actually have some relative value. As NDMO’s duration suggests, the fund is overweight securities will long-term maturity dates:

NDMO’s Maturity Profile (Nuveen)

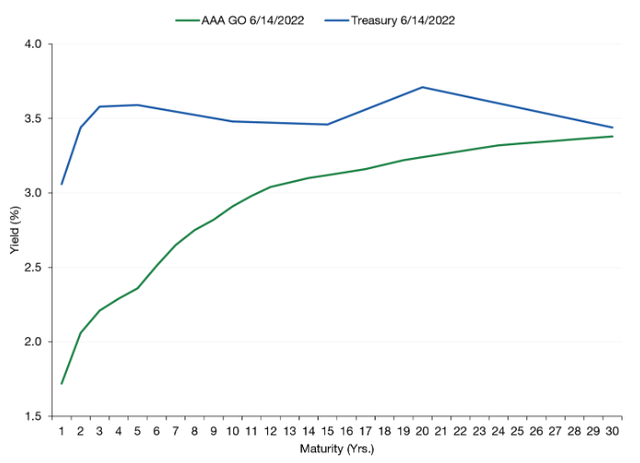

In fairness, this still does present a risk to monitor carefully. One does not want to get too over-exposed to long duration assets right now – whether fixed-income or equity. But if we consider munis against other safer asset classes, such as treasuries, we see the value emerge. Specifically, while the treasury yield curve has flattened out, the muni yield curve remains markedly steeper. This means that muni investors are getting paid for taking on long-term assets to a larger degree than investors in the treasury sector:

Muni vs Treasury Yield Curves (Lord Abbett)

The conclusion I draw is that if one is going to buy long-dated maturity securities at this moment, munis are probably the way to go compared to treasuries. This again does not guarantee any type of positive return, but it does set investors up with a more favorable backdrop.

Economic Weakness Favors Safer Plays

I will now turn to the market more broadly. Clearly, when one is considering putting cash in the market they have a plethora of options. For me, I buy munis for two reasons – the tax-free income and as a hedge against equities. When equities sell off I am glad I have them, although 2022 hasn’t been great for this thesis. Still, when I have new cash to work with I often steer towards the equity market, as my portfolio is long-only and predominantly equities. But when the time is right I do add to my muni holdings, as I see such a time right now.

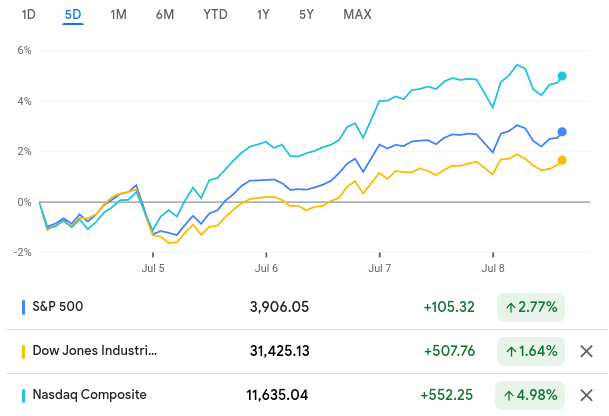

The reason being is that equities have had a nice short-term rally of late, and I want to protect some profits. We see that over the past five trading days the major indices have rallied, making me reluctant to amplify my position at the moment:

5-Day Performance (Google Finance)

Riding this momentum could continue to be fruitful. You won’t get any argument from me there. But maintaining current positions and initiating new ones are different things. With new money, I see some merit to taking on defensive plays. This can be through munis or other options, but stems from some economic metrics that are concerning.

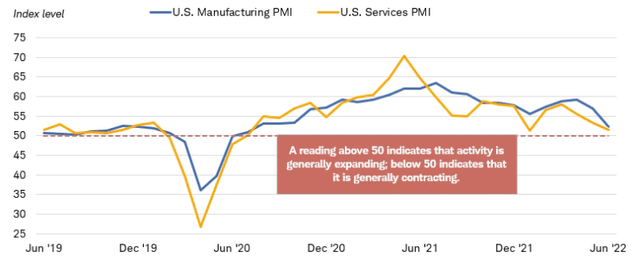

One in particular is the softening of business activity. The Purchasing Managers Index (PMI) shows that service and manufacturing activity is still in expansion mode. This is good on the surface, but activity is declining and is on its way to contraction territory for both areas:

PMI Index Measures (Charles Schwab)

My thought here is that economic conditions are being pressured by inflation, raising interest rates, and geo-political risks such as war in Europe. It strikes me that the recent rally offers investors a chance to take some risk off the table. I’m doing just that, and looking to park some proceeds in to a place where I can earn tax-free income. NDMO fits that bill.

Income Cut Could Be In The Cards

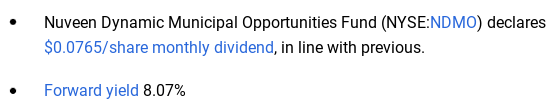

My final topic offers a mixed message. The concerns the fund’s income stream, which is probably of paramount importance for owners of the fund and those who are going to become owners. On the surface there is quite a bit to like. The current yield exceeds 8%, which is actually quite incredible when we factor in the tax savings that result as well:

Current Distribution Stats (Seeking Alpha)

The distribution has been steady for a while, and with this type of yield it seems like a no brainer. So what is the problem?

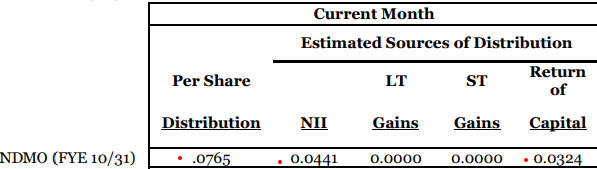

The probably is that I am not sure how much longer this distribution can last. The fund has done a great job maintaining it for a while, but it ultimately just is not earning enough to cover it. The most recent figures from Nuveen illustrate that NDMO is paying its distribution with over 42% of the income coming from return of capital. This is not a positive sign:

Income Stats (Nuveen)

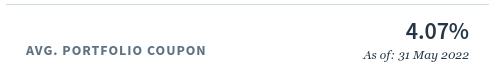

The takeaway is this yield just simply does not seem sustainable. With an average coupon within the underlying securities paying just over 4%, this 8% yield seems too good to be true:

NDMO’s Average Coupon Rate (Nuveen)

On the surface it raises eyebrows, and when Nuveen’s own figures show that a large chunk is coming from return of capital we know there is a problem. With this being the case, does it not make sense to avoid the fund for the time being?

That argument could certainly be made. Personally, I think a distribution cut for NDMO is a matter of “when”, not “if”. When that does occur, the share price could take a hit. But waiting for that could also be costly if the share price rises in the interim. There is no guarantee an income cut will see a meaningful sell-off the point where the future will give you a better price than what you could get it for today. When I factor in the 6% discount that becomes even more clear. Finally, with a current yield of 8%, NDMO can see a hefty income cut and still be paying a very attractive distribution. That suggests that if a cut does occur, it may not spark that big of a sell-off. After all, if you are still earning a tax-free yield in the 6-7% range, you may not be panic selling on the news.

Bottom Line

NDMO has been on a rough road, but I expect that road to be smoother in the second half of the year. The valuation story is positive, the yield is very attractive even with a distribution cut looming, and the credit quality for muni debt remains strong. Because of these factors, I am finally shifting my rating on NDMO to a “buy”, and I would suggest readers give this CEF some consideration going forward.

Be the first to comment