imaginima/E+ via Getty Images

Douglas Elliman Inc (NYSE:DOUG) is one of the largest residential real estate brokerages in the U.S. with a focus on luxury properties. The company became publicly traded following the completion of a spin-off from its former parent, Vector Group (VGR) in Q4 last year. From the pandemic-fueled housing boom between 2020 and 2021, the story now has been the shifting macro-environment defined by record inflation and surging interest rates. Indeed, shares of DOUG are off by nearly 50% from their IPO price with concerns of slowing growth and a hit to earnings.

Still, we think the stock looks interesting with a sense that the selloff has gone too far based on unjustified extreme pessimism. While there are signs housing has cooled with some downside to real estate prices, Douglas Elliman remains supported by overall solid fundamentals and recurring profitability. The potential that economic conditions improve going forward can jump-start a rally in the stock. We also like DOUG’s 3.9% dividend yield which highlights some compelling value at the current level.

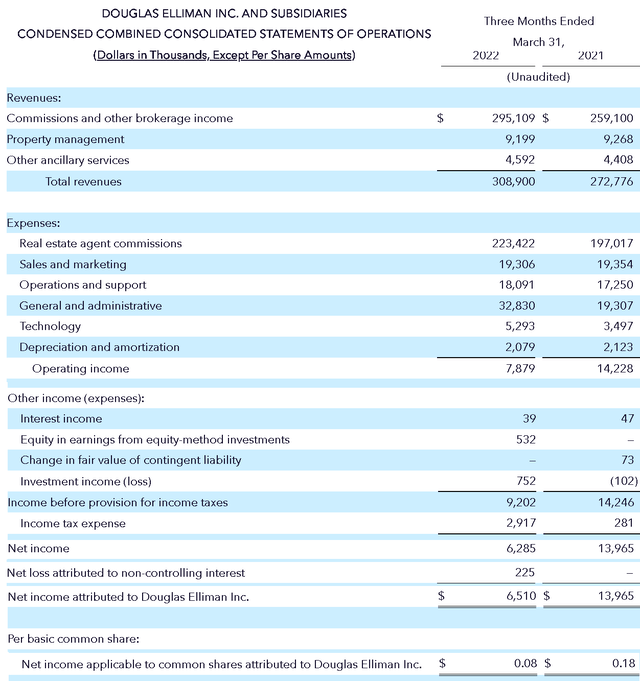

DOUG Key Metrics

The company last reported its Q1 earnings in early May, the first complete quarter as an independent company. EPS of $0.08 was $0.01 below the consensus while revenue of $308.9 million, up 13% year over year, was slightly ahead of estimates.

The business model here is simple, from each real estate transaction, Douglas Elliman receives a commission, typically around 3% of the property value. This segment represents over 95% of total revenues while the company also offers property management and other related services. From the brokerage commissions pool, the underlying agents receive a cut, around 75% of the total fees which on the income statement represent the bulk of operating expenses.

This quarter, growth in total revenues was driven by the real estate brokerage achieving a record gross transaction value of approximately $11.7 billion, up from $10.1 billion in the quarter last year. This trend reflects the momentum in the housing market over the past year and also higher average pricing.

On the cost side, extra expenses in part related to the IPO drove a 70% increase in corporate general and administrative expenses. The result is that the operating income of $7.9 million was down 45% from the period last year. The company also notes its adjusted EBITDA in Q1 at $12.7 million was down from $16.4 million in the period last year.

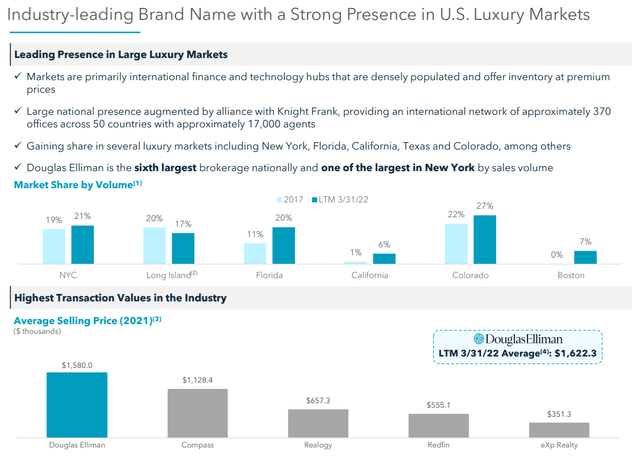

source: company IR

Management focused on its overall positive operating momentum. Douglas Elliman has captured a share in key markets over the last few years. In New York City, the brokerage represented 21% of all transactions over the last twelve months, up from 19% in 2017. The company has nearly doubled its presence in Florida which has been a real estate hot spot since 2020. While not providing official earnings guidance, the takeaway is that conditions were strong in Q1 with some strength carrying over into Q2.

Finally, we note that Douglas Elliman ended the quarter with a balance sheet cash position of $204 million against effectively zero long-term financial debt beyond lease liabilities. DOUG pays a quarterly dividend of $0.05 per share which represents an annualized distribution of around $16.3 million which we view as well supported by underlying cash flows and recurring profitability.

source: company IR

Housing Market Outlook

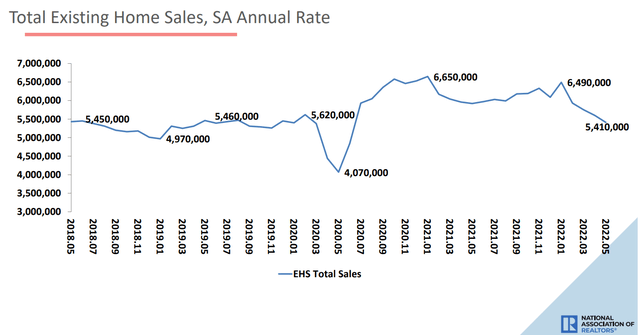

Economic conditions have deteriorated more recently into Q2 which explains much of the volatility in the broader market and also shares of DOUG. We mentioned the higher-than-expected inflation and climbing interest rates with all indications pointing to a slowdown compared to the exceptionally strong 2021. In housing, one of the biggest headwinds has been the rising 30-year fixed mortgage rate which has surged above 5% from a low of under 3% last year.

The trends are evident in existing home sales data for May from the National Association of Realtors showing a seasonally adjusted annual rate of 5.4 million home sales, down 8.6% year-over-year and well off the 6.5 million level as recently as January. At the same time, the report notes that even with the pullback, the rate of existing home sales is simply back to levels in 2018 that may be seen as normal.

source: National Association of Realtors

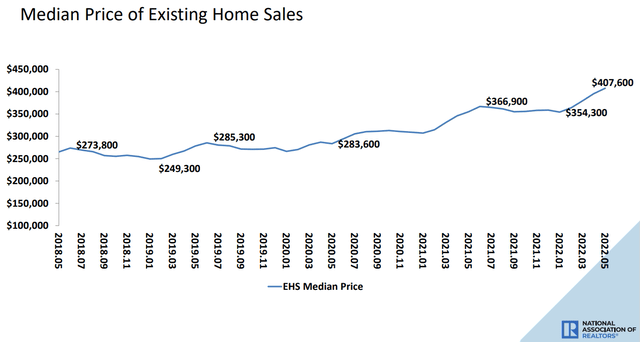

On the other hand, the median price of existing homes at $407k is up 14.6% year over year. The combination of record pricing with higher interest rates limits affordability leading to an expectation that there is some further downside in home sales and pricing as the market cools off.

source: NAR

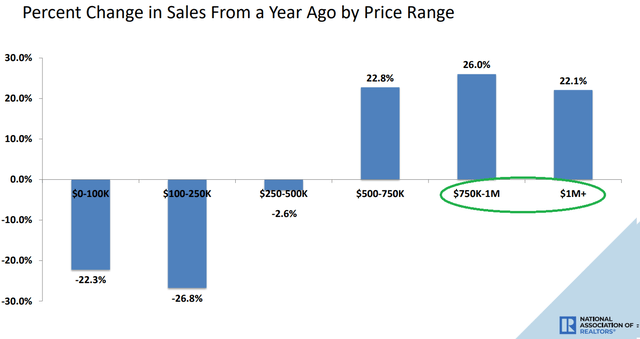

We mentioned the firm’s specialization in the luxury side of the market. This is important when thinking about how conditions are evolving this year. An average selling price of homes by Douglas Elliman approaching $1.6 million in 2021 is nearly 4x the national median average of existing homes closer to $400k.

Data through May shows that the high end of the market has outperformed in terms of price increases, up 22.1% y/y compared to declines in the average single-family home. The read here is that even as market conditions are more challenging, the data suggests DOUG is still benefiting from lingering tailwinds. This means that even as the total home sales slow, Douglas Elliman’s results should be a bit stronger based on the value of transactions.

The other dynamic is that for luxury properties, the portion of cash deals is often greater than what may be considered starter homes implying the company is less exposed to compared mass-market brokerages. This was a theme discussed during the earnings conference call:

Well, it varies from market to market, but the real fact is that in the higher-end deals, there is less talk of mortgage. And that doesn’t mean they are not ultimately getting financing on it after they purchase it… But we don’t really see interest rates having affected too much yet. And in fact, what I’ve seen in the past over the years is that as rates start going up, that brings people into the market quicker because they don’t want to be priced out of the market.

source: National Association of Realtors

DOUG Stock Price Forecast

Putting it all together, there are some good and bad signals on where the housing market is headed and the impact on DOUG. According to consensus estimates, the forecast is for 2022 revenue of $1.4 billion about 1% higher than last year. The market expects EPS of $0.59, 54% lower than the period last year, based on higher expenses which also includes an advertising push. For 2023, there is a view that revenues can climb 6% and earnings accelerate towards $0.69 per share. Again, all of this will depend on how economic conditions and the housing market progress.

Seeking Alpha

We’re taking an overall more optimistic type of view. The bullish case for DOUG is that economic conditions remain resilient, avoiding the scenarios of a deep recession that would translate into a “collapse” of the housing market. From a high-level perspective, signs that inflation is cooling off with interest rates stabilizing can provide a boost to consumer confidence to keep housing indicators buoyant. The latest June payrolls report showed the U.S. economy added a stronger than expected +372k jobs in June which is encouraging to the economic backdrop.

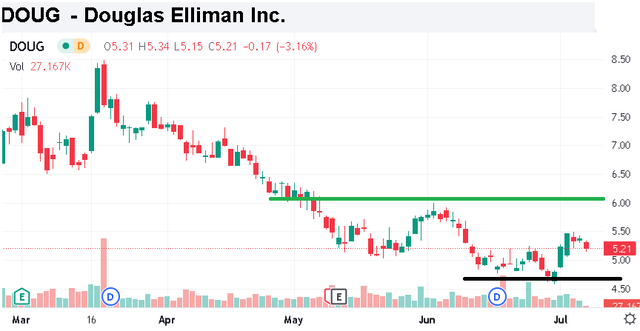

The way we see it playing out is that better than expected data going forward will help improve market sentiment making DOUG well-positioned to reprice higher as a category leader. From the stock price chart below, the cycle low at $4.57 is a critical level of support the share must hold in the near term. To the upside, a break above $6.00 per share can add new bullish momentum.

Seeking Alpha

Final Thoughts

The takeaway here is that despite the more challenging environment, DOUG remains profitable with a positive long-term outlook as it expands and consolidates its market share. The dividend yield approaching 4% highlights the underlying value of the stock. The main risk to consider would be the adverse scenario where economic conditions deteriorate further. Macro indicators across inflation, interest rates, and housing figures are key monitoring points.

We are bullish and rate DOUG as a buy with a price target for the year ahead at $7.50 representing an 11x multiple on the current consensus 2023 EPS. The upcoming Q2 earnings report, expected sometime in August, could be a catalyst for shares to rebound higher if it confirms financial conditions remain positive.

Be the first to comment