hirun

(Note: This article was in the newsletter July 7, 2022.)

One of the more common thoughts about Enterprise Products Partners L.P. (NYSE:EPD) has been that the company was not going to grow. Therefore, distributions would probably edge up maybe 1% a year in a good year with some unforeseen help. After all, there was no capacity needed, so exactly why would the company grow?

But good management usually surprises on the upside. Mr. Market rarely prices in good management to a stock price because the term is so overused that it has become worthless to the market. There was absolutely nothing the market could see that would promote growth in the future. Therefore, there was no growth (period, end of statement, and do not bug me).

But that meant the market was projecting that the part of the cycle the industry was in would last forever. It is easily the most common thing done in analysis and the one thing many of my friends who teach analysis preach against when reviewing cyclical industries. Then, like me, they read analysis and shake their heads. It seems like it is forever “back to the drawing board,” because the one thing missing from most analysis it the continuing procession of the business cycle analyzed. This is what makes contrarian investing particularly challenging.

Capital Budget

All that analysis looked at the capital budget and thought they had a “sure thing.”

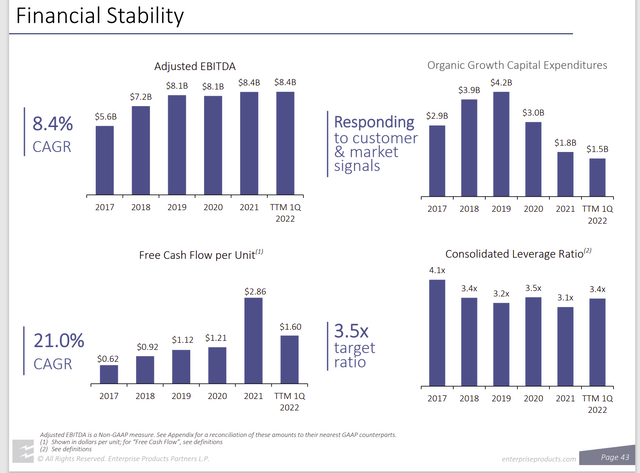

Enterprise Products Partners Operating History Key Ratios (Enterprise Products Partners First Quarter 2022, Earnings Conference Call Slides)

I cannot remember how many reviews I saw stating that capital project investments were declining as shown above. Therefore, it was a foregone conclusion that distributions would not grow nor would the business. There was adequate capacity, therefore growth was out the window. This was going to be a solid income play with no growth.

But good management that has a history of pushing forward does not stop growing just because they think like analysts. There are many ways to grow the business when the obvious growth tracks are not available. Some of us stated that it was far more likely that there would be the typical single-digit growth because management has long done just that. Now, admittedly, forward proof was lacking.

Growth History

But the history was there.

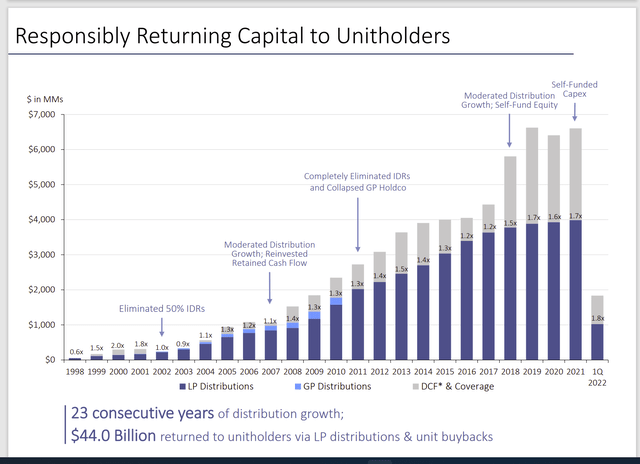

Enterprise Products Partners Growth Of Returns To Shareholders (Enterprise Partners Presentation At JP Morgan Energy, Power & Renewables Conference)

A management that has been increasing distributions since going public is unlikely to allow those increases to slow over time. Management will, of course, follow the business cycle, and so there will be slow years. But if that same management sees that distribution growth slows as a continuing trend, then investors can take advantage of the market projection (of continuing slow growth) to invest on a cyclical turnaround to faster distribution growth.

The distribution coverage is expanding because management knows that money will be needed to fund an increasing capital budget as the current capacity fills up. That leads to that inevitable takeaway expansion that has happened in the past. But that future expansion is unlikely to be priced into the common units until the market sees the capital spent for that expansion.

Growth From Acquisition

The other thing the market never priced into the common units is the buyers market that has been underway for some time. That buyers market is likely to fade as more takeaway capacity projects get underway.

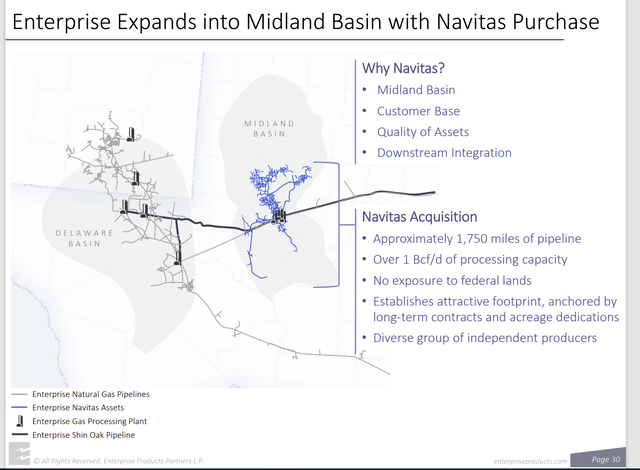

Enterprise Products Partners Description Of Acquisition Advantages (Enterprise Products Partners First Quarter 2022, Earnings Conference Call Slides)

The investors who based the no-growth forecast upon the lower capital budget had the correct analysis of low capital budgets for another year or two. But management found a small acquisition “in their own backyard” to make that would prove accretive to their far larger system.

Small acquisitions are often far less risky than larger acquisitions because the logistics of optimizing the acquisition into the existing assets are far less challenging. So, the optimization process happens faster with fewer hiccups and unpleasant surprises along the way.

The other consideration is that it does not take too many acquisitions to make for an improved outlook in distribution growth.

Distribution History

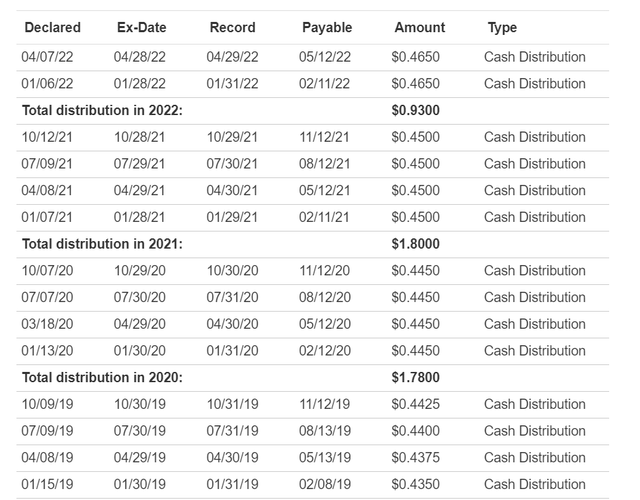

The result of that acquisition is faster distribution growth than the market expected. The next distribution will increase the annual rate to $1.90 per unit. The distribution has now increased twice in one fiscal year for the first time in a while.

Enterprise Products Partners Distribution History (Enterprise Products Partners Website)

But the announcement of another distribution increase now raises the rate of increase to the highest in the years shown. While the timing of the cyclical nature of higher increases may not be known, that higher increasing rate should be expected by any stock that services a cyclical industry. The good management benefit to unit holders usually means the acceleration of the rate of increase happens sooner rather than later.

Now what happens is exactly what management had predicted awhile back. Customers are asking about more capacity to begin to grow production as is what usually happens at this part of the cycle. Now that extra capacity is likely to be forecast 2 years out. But once the company has enough commitments and solid plans, then those capital budgets will likely translate into higher common unit prices.

The other thing is that while capital investments may have cyclically declined, the combination of the acquisition and capital expenditures actually led to a decent increase in business expansion. Counting on good management to take advantage of various parts of the business cycle is an intangible that the market almost never prices into the stock.

Conclusion

The hardest thing about analyzing any cyclical industry is knowing where the company is in the current cycle (and what is likely to come next). The overwhelming human tendency is to forecast “more of the same” instead of a continuation of the cyclical nature of the industry.

This leads to errors at the top of the market as well as errors at cyclical bottoms. Both can be very costly.

A simple example for me is how people out here in California are projecting higher land and housing prices. Yet in 2008, my house was worth about $125K. Now it is crossing the $400K mark. The projections do not take into account that we are probably near a typical California pricing peak. It is far more likely that prices will go down in the future as they have in the past than it is for them to go higher. All one has to do is ask how many people can afford the current price – and higher – to realize that the current pricing is unlikely to last.

It is the same in the oil and gas industry. The industry has just begun to really recover from a very bad fiscal year 2020. Whereas real estate out here has had 12 decent years (at least), the oil and gas industry has had about a year or two.

As long as money does not come rushing in as it did in 2018, then the oil and natural gas recovery is unlikely to derail. That means investors probably have quite a bit of upside potential in the common units of Enterprise Products Partners. I continue to believe that this management will provide a low risk return in the teens.

Midstream is often thought of as the utility part of the oil and gas industry. It is far less cyclical. But the common units often follow upstream down. That has provided an opportunity to get into a solid partnership on a pullback. This partnership does issue a K-1. So, investors are advised to fully research that type of distribution before investing.

Be the first to comment