Tasos Katopodis/Getty Images News

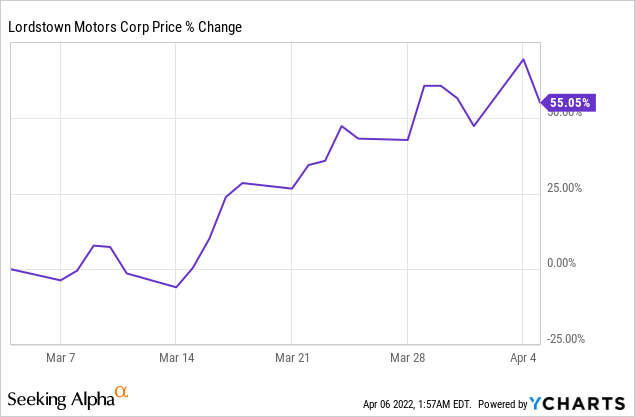

Shares of Lordstown (NASDAQ:RIDE) surged more than 55% lately on hopes that the EV startup will be able to execute on its manufacturing plan and start ramping up production in FY 2022 and FY 2023. While the electric vehicle startup still faces liquidity risks, I believe the firm is moving in the right direction and the start of customer deliveries this year could power shares higher. Lordstown has proven to be able to raise capital from Foxconn and liquidity concerns are likely still overvalued!

FY 2022 production update

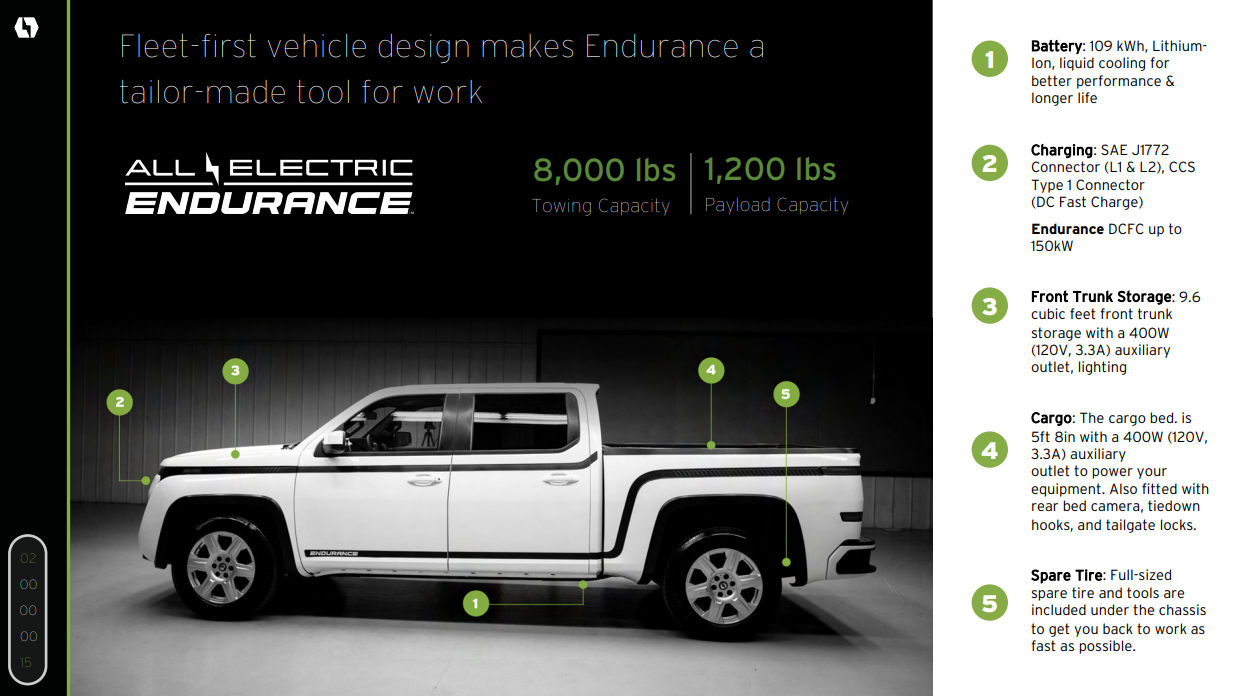

Liquidity concerns and a slower than expected production start have weighed on Lordstown’s shares in the last two years. Lordstown is still in the pre-production phase and generates material operating losses. However, according to Lordstown’s production update from February, the electric vehicle startup looks set to finally start production of its Endurance pickup truck which has been delayed more than just once. The last release date was set for September 2021, but it was pushed back due to continual product development and testing. The all-electric Endurance truck – Lordstown’s first-ever production pickup – is set to go on sale this year. The Endurance truck features a 109 kWh battery and has an estimated range of more than 250 miles.

Lordstown

Lordstown expects to start commercial production of its pickup truck in the third quarter of FY 2022. The firm is guiding for a total production volume of 500 Endurance pickup trucks in FY 2022 with manufacturing ramping up next year. For FY 2023, Lordstown now projects to produce up to 2,500 Endurance pickup trucks. The start of customer deliveries may be a catalyst for Lordstown’s shares to revalue higher, assuming the firm can calm nervous investors about its strained cash resources.

Cash resources and liquidity runway

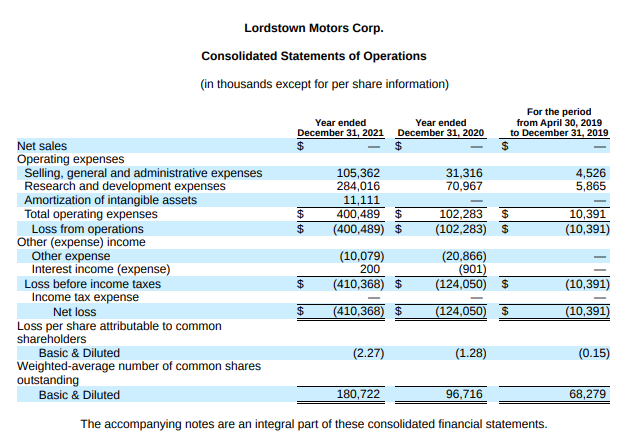

Because Lordstown is in the pre-production stage and spends heavily on product development, the electric vehicle company has very high operating costs. In the fourth quarter, Lordstown’s production generated an operating loss of $84.7M due to soaring research and development expenses. Operating losses for FY 2021 were $400.5M and almost quadrupled from FY 2020 levels. The electric vehicle startup also has no revenues (yet) and a high level of cash burn.

Lordstown

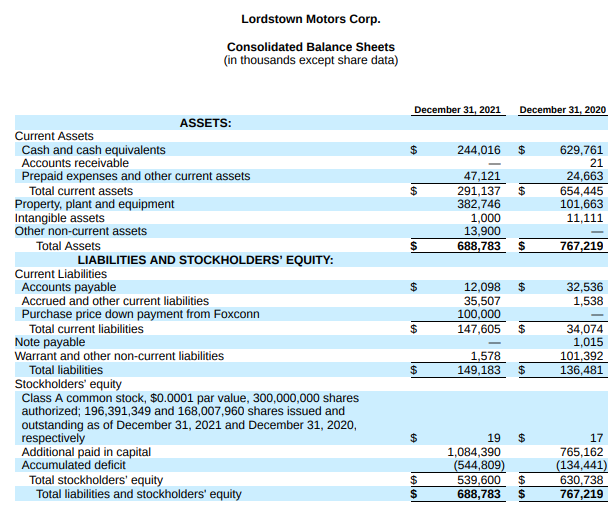

That cash burn has been a bit of a problem for Lordstown because the company has limited cash resources on its balance sheet. Because of increasing pre-production expenses in FY 2021, Lordstown’s cash pile has shrunk significantly in the last year. At the end of FY 2021, the EV startup had $244.0M in cash and cash equivalents available which means Lordstown burned through $385.8M in cash last year. On a monthly basis, this translates to about $32.2M.

Since Lordstown’s cash resources are down 61% compared to FY 2020, the firm has a short liquidity runway of perhaps 6-8 months. This means Lordstown will have to raise additional capital to finance its production start as well as the associated manufacturing ramp next year. Lordstown previously raised capital from Foxconn by selling a factory to the contract manufacturer. The startup raised $182M in new capital in the fourth quarter, with $150M coming from Foxconn ($100M from the sale of Lordstown’s factory and $50M from a common stock sale to the company). As current cash resources dry up, however, Lordstown may be forced to raise additional equity capital which would dilute shareholders.

Lordstown

Risks with Lordstown

Lordstown has two big risks in FY 2022: Timeline/production risks and liquidity risks. As a startup in the increasingly competitive electric vehicle industry, Lordstown competes for EV sales with businesses such as Tesla (TSLA), Rivian (RIVN) and traditional automakers like Ford which are starting to move into the electric vehicle industry and have much better balance sheets. Lordstown expects to produce only 500 electric vehicles this year, so the firm is very much at the beginning of what will be a multi-year production and delivery ramp. Additional production delays are likely to have a negative effect on shares of Lordstown going forward.

An additional risk for the EV startup is the firm’s short liquidity runway. Lordstown doesn’t have the best balance sheet in the EV industry – as opposed to Rivian and Lucid (LCID) – and the company could be forced to raise equity and dilute shareholders to ensure that it can finance its production ramp in the coming years.

Final thoughts

Shares of Lordstown have been treated very harshly in FY 2021, but I believe liquidity concerns are overblown. The EV startup has shown an ability to raise capital in the past and Lordstown is just on the brink of starting production and customer deliveries. While the risks are higher with Lordstown than with the average electric vehicle startup – because of the firm’s weaker balance sheet – the reward could also be bigger if Lordstown avoids further production delays and starts customer deliveries this year!

Be the first to comment