AntonioSolano/iStock via Getty Images

Well, there is really no sector hated more than semiconductors right now. When it rains in the market, it seems to pour for semis. One stock that has been absolutely crushed, but is a key supplier for Apple (AAPL), is Qualcomm Incorporated (NASDAQ:QCOM). Qualcomm saw its stock rise a bit with the October rally and then get crushed today with the market and the Fed raising rates again. But it is also struggling afterhours following its just-reported Q4.

Qualcomm stock has been left for dead by the Street, and is teetering just above levels not seen since we started to come out of COVID lockdowns in spring 2020. The just-reported earnings, show the earnings were mixed, but they are seeing weakening demand. They have planned spending reductions to ensure earnings hold up. They are tapped into the high-end phone market. The Apple relationship remains, but there are inventory issues. Semiconductor stocks as a whole have been absolutely decimated, and this report is another dagger in the hearts of shareholders. The quarter was fine, but the outlook for Q1 was horrendous. Let us discuss.

Qualcomm’s Q4 earnings were pretty good

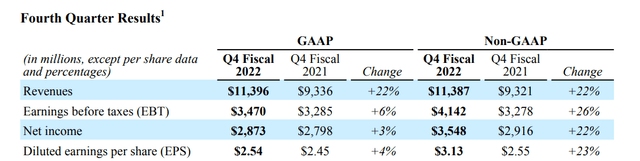

Make no mistake, we have seen a slowdown in the economy. Tech names are cyclical, but chips are bit more secular. Look, despite the collapse in shares, Qualcomm is not going bust. But it is not good either right now. We will say there are safer semiconductor bets out there, although the entire sector is out of favor. But with this report, the headlines were really tough to swallow. Even with such weak headlines, the yield on the stock is close to 3% now, and that will help attract some buyers who want risk. There are a lot of fundamental challenges the company faces, though Q4 itself was good:

So, as you can see, revenue was up 22% from a year ago. Margins narrowed again, though, as evidenced by the fact that net income barely moved higher, though when adjusted did track with adjusted revenue. The company has a spending issue and committed on the conference call to reduce expenses. That is a positive. Earnings were strong and came in at $3.13 per share adjusted and actually met estimates, while exceeding on the top line. But it was the outlook that just was poor, leading to after-hour selling.

Outlook disappoints

The market has priced in a lot of pain, but once again the Q4 earnings release documented an ongoing weakening environment and that their customers have inventory issues:

” Our calendar year 2022 3G/4G/5G handset volumes from a year-over-year mid-single-digit percentage decline, to a low double-digit percentage decline. The rapid deterioration in demand and easing of supply constraints across the semiconductor industry have resulted in elevated channel inventory. Due to these elevated levels, our largest customers are now drawing down on their inventory”

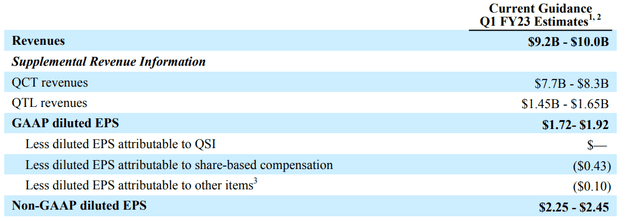

So, what does this mean? It means Q1 is going to see lower demand, pressure on the top line, and, of course, bottom line pressure. The guidance was reduced because their customers will be drawing down their inventory. They reduced their midpoint for earnings by $0.80. That is a nasty cut.

Folks, this reduced outlook is way below expectations. In fact, the outlook for revenues is 20% below the $12 billion consensus. That is really painful for longs, and earnings were guided lower, too, down from $3.43. There is not much to say on this, other than the company views the slowdown as quite temporary. Listening to the conference call, management said they are committed to reducing expenses to help preserve operating margin.

While the earnings reduction is tough to see, valuation, even if earnings are 20% lower for 2023 than first thought, shares are attractive especially since they will remain a key supplier for Apple. While the financial outlook is being temporarily impacted by elevated channel inventory, we believe that the company’s diversification strategy, cost reductions, and long-term opportunities suggest the stock is attractive under $100.

Looking ahead

Even with the destruction of shareholders over the last year, from where we are now, the valuation, even with the declines, is still pretty attractive. We think as far as P/E, PEG, EV/sales, EV/EBITDA, and price-to-cash flow metrics are concerned, the stock looks good, even with the forecasted Q1 decline. The company is not losing money, even though the outlook reduction justifies where the market was pricing this stock. We will have a 3% yield soon, we have a market that is looking toward rate hikes slowing down in 2023, and chips, while out of favor, are likely to catch strong bids next year ahead of the next cycle ramp up. The market will price these stocks higher well in advance.

The company is taking steps to improve its fiscal state. The dividend seems secure. The sector is cyclical despite ongoing secular demand. It has been a tough year for shareholders, but we think that as the stock dips under $100, we have a long bias.

Your thoughts matter

Do you think there is a lot more downside here? Is the stock still overvalued? Will handset demand collapse and further guidance be poor? Is sub $100 attractive in your opinion?

Let the community know below.

Be the first to comment