ngkaki/iStock via Getty Images

Investment thesis

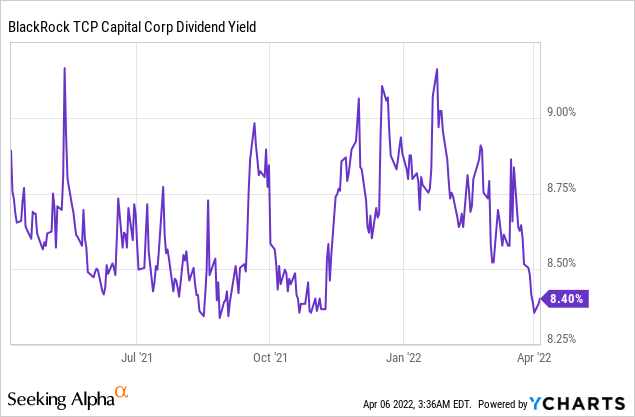

BlackRock TCP Capital Corp (NASDAQ:TCPC) closed a record year in 2021 with growing net asset value and record net interest income. All of this is combined with stable and reliable quarterly dividend payments. However, I am convinced that the current valuation is fair, as positive news and results are already priced in the stock, it is trading at 0.99x its book value, and it is almost at its lowest dividend yield point. TCPC is yielding 8.4%, which could be satisfying for income investors, but I would rather see it above 8.9% to seriously consider a position in TCPC.

Business model

TCP Capital is an externally managed specialty finance company focused on middle-market lending. The fund typically invests between $10 million and $35 million in other companies. TCPC has been classified as a business development company (BDC) since its 2012 IPO. 95.3% of its income comes from interest income and only 4.7% of its income is recognized from dividends and other income.

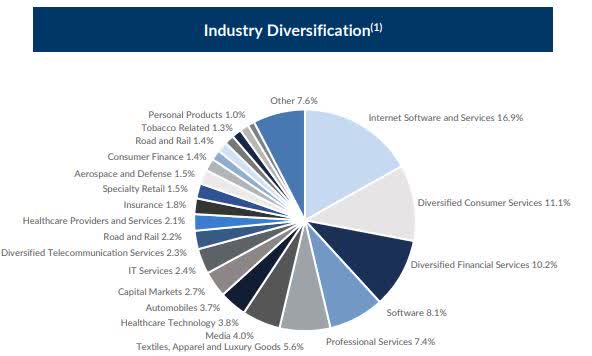

TCPC’s portfolio is well diversified among several sectors and includes 115 portfolio companies as of December 31, 2021. The company’s portfolio has predominantly first lien assets (75%). The rest of its assets are second lien loans (14%) and equity investments (11%).

Investor Presentation December 31, 2021

Financials and earnings

Q4 results and full-year results

TCPC’s net interest income declined in the fourth quarter by 3.1% compared to the third-quarter results. However, the company could grow its NAV by 1.9% to $14.36 per share. This growth was mainly fueled by unrealized gains in its portfolio. TCPC could also grow its NAV in the fiscal year of 2021 the NAV grew by 8.5% from $13.24 per share as of December 31, 2020, to $14.36 per share as of December 31, 2021. The majority of this growth was mainly due to investment income growth. Last year, the management focused on preparing the company for a higher interest rate environment in 2022, so they issued notes with yields of 2.85% and 2.475%.

As Chairman Raj Vig said during the Q4 2021 earnings conference call held on 24 February 2022:

We further optimized our balance sheet and liability profile during the year. We issued a total of $325 million of unsecured notes due February 2026 at attractive rates. As a result, we were able to redeem higher cost notes that were due in August 2022, before their maturity, thereby taking advantage of the attractive financing environment, to further reduce our cost of capital.

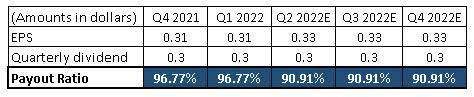

TCPC will announce its first-quarter results on May 3rd, 2022. Analysts expect an EPS of $0.31, the same as it was in Q4 2021.

Valuation

In short, TCPC is fairly valued, and several factors point in this direction. The company trades at its book value, actually slightly lower (0.99 P/B value),, and the company’s return on equity exactly matches the sector average. Its great 2021 performance has been priced into the stock because it trades only 3.6% below its 52-week high.

In terms of the company’s dividend yield, it is trading almost at its lowest point in a year. (This is not surprising, as the stock price went up and the dividend has not changed). However, this means that you could have bought TCPC at almost any random picked date over the last year and received a better dividend yield than now. Based on its dividend yield, I would consider a buy position in TCPC above 9%, but 8.9% would still be fine.

Company-specific risks

Sudden, unexpected, and severe declines in the market price of TCPC’s securities or net asset value could impact the company. This is what we experienced during the COVID-19 outbreak. These effects could impact the portfolio companies and their ability to make payments on their loans on a timely basis and meet their loan covenants.

An increase in interest rates could decrease the value of any investments the company holds which earn fixed interest rates, including subordinated loans, senior and junior secured and unsecured debt securities and loans, and high yield bonds. This could also increase TCPC’s interest expense, thereby decreasing its net income. Luckily, this is not a major risk factor, as 95% of the company’s portfolio assets are floating rate investments so they can and will capitalize on the rise of interest rates while their borrowing costs will remain low due to their fixed-rate loans.

However, an increase in interest rates available to investors could make an investment in the common stock less attractive if the management cannot correspondingly increase the dividend rate, which could reduce the value of TCPC’s stock.

Over the last 2 years, especially in the last one, TCPC outperformed its competitors and reported record growth, record NII and record NAV. However, thinking in the long term and applying John Bogle’s theory (which has been proven often), reversion to the mean cannot be escaped. This means that all companies will, over the long term, trend back towards their performance averages. We can all agree that two-folding a company’s NII and EPS is not sustainable in the long term when they are a business development company.

My take on TCPC’s dividend

Current dividend

TPCP has been paying dividends for 9 consecutive years (since its IPO). Management is committed to paying a stable and reliable dividend, and this has been the case throughout the last 10 years. There have been no extreme dividend increases and no extreme cuts except for the pandemic cut in the second half of 2020, when management had to cut the dividend by 16.67%. Since then, the dividend has remained the same, $0.3 per share quarterly. TCPC is yielding at 8.4% at the moment.

Future sustainability

TCPC’s payout ratio is 90-95% based on its actual net investment income. This might look a bit too high, but bear in mind that TCPC is a BDC and its payout ratio has never been much lower in its last 10 years than these figures. This is why I assume confidently that the current payout ratio is sustainable over the long term.

The only risk in its dividend coverage could be a rapid decline in asset prices due to an outside factor; we saw this scenario during the pandemic. Luckily, as Ray Dalio stated, the short-term debt cycles are between 5-8 years, so the next expected bust could be around 2026. That leaves plenty of room for income investors to buy TCPC stock for income purposes.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

TCPC is a good BDC company with great 2021 results, well run by its management, and prepared for a higher interest rate environment. Despite all these factors, I am neutral about the company, not because of its fundamentals, but because of its valuation. I would rather buy in at P/B below 0.95 and a dividend yield above 8.9%, but above 9% would be even better.

Be the first to comment