JHVEPhoto

Dear readers/followers,

I’ve covered Loews (NYSE:L) before. It’s an interesting business. On a high level and on analyst sites, they’re primarily and most often described as being a P&C insurer. While the company does have operations in this segment, it has a multitude of other things as well. I’ve been asked to take a look at the business from the perspective of a dividend investor – and it remains tricky.

While some contributors call this one a good addition to an investor’s portfolio, I take a more careful stance on Loews – and here is why.

Reviewing & Revisiting Loews

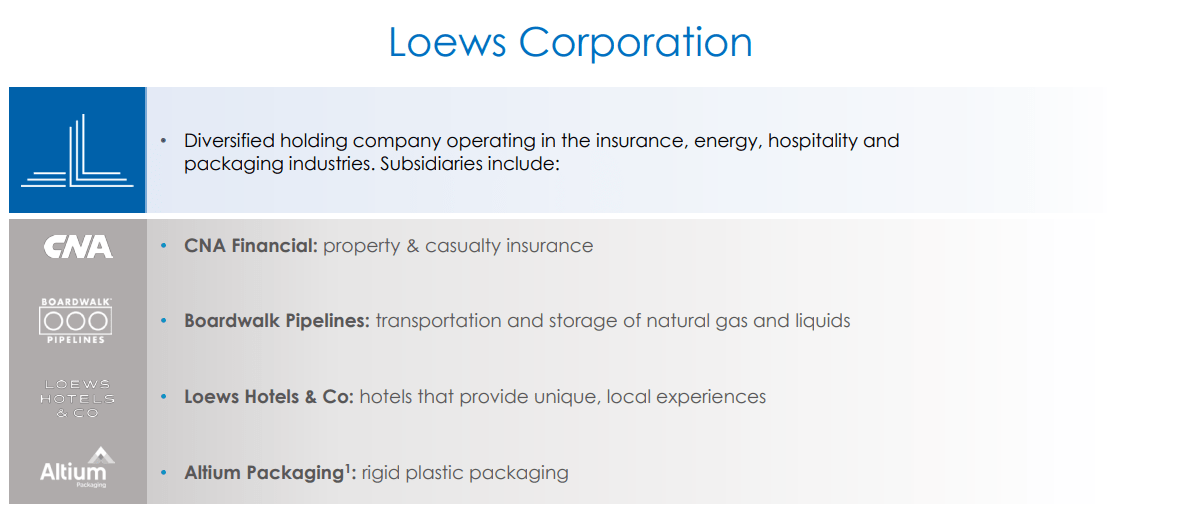

So, again. It does have P&C insurance and insurance overall – but there’s a lot more to Loews than just that. The company is a conglomerate with a variety of mixed businesses.

Now, these businesses are in no way ancillary to one another – including things like insurance and pipelines/packaging of all things.

Here is a good overview of what the company’s main operations comprise.

L IR (L IR)

For a full backstory of how Loews came to be, and why it is what it currently is, I refer you to my original article on the company where I cover this in a bit more detail – but the short version is that it’s a family sort of business. One of the more interesting tidbits for me as a watch/luxury enthusiast, is that at one point they owned the brand Bulova, which was sold to Citizen Watch in 2007.

The yield specifics and dividend remains an absolute no-go even at the recent drops of double digits since my last article. There is no/very little DGR over the past years since 2007. But Loews is A-rated, and there are some solid defensive fundamentals to be had here.

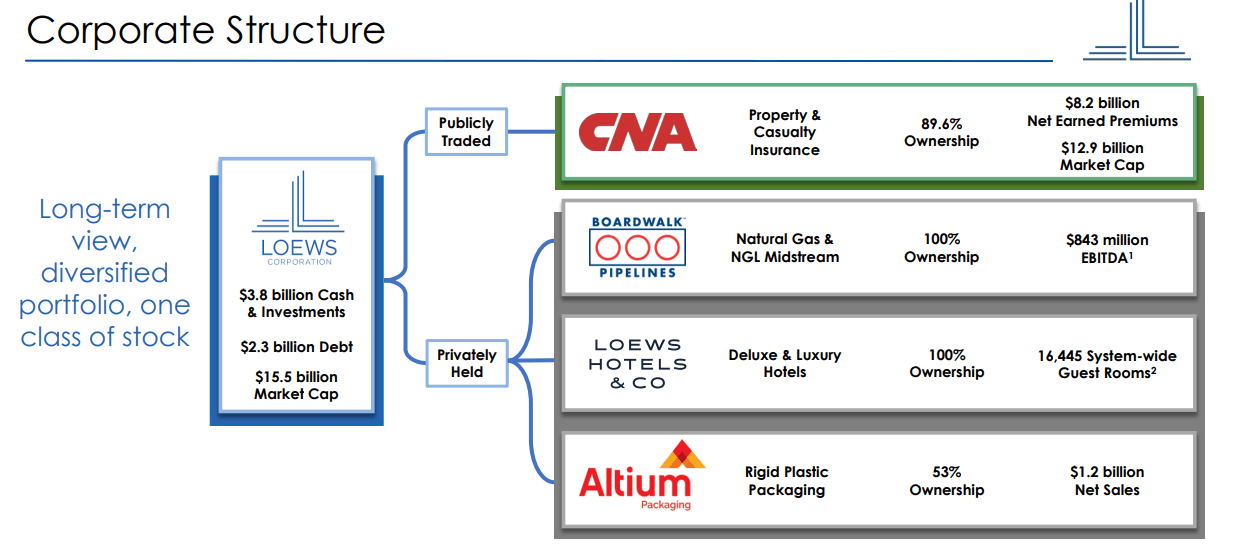

Take a look at the corporate structure and you will understand why some consider the company to be a good investment – access to businesses which you otherwise do not have easy access to.

L IR (L IR)

You can’t invest in most of the company’s portfolio without going via Loews. It’s also fair to say that most of the company’s current market cap is P&C insurance, at just below $13B in market capitalization. One of the primary arguments for investing in Loews, and it has been for some time, is that the share price represents a lower valuation than the NAV/SOTP of the company, as well as peer multiple discounts mostly across the board. The company also has over $1.5B of net cash available, and its private subsidiaries, while small, are highly qualitative. This argument has only been strengthened as of the recent 10%+ drop. A drop in share price after all means that what we pay for the cash and cash flows the company has, goes down.

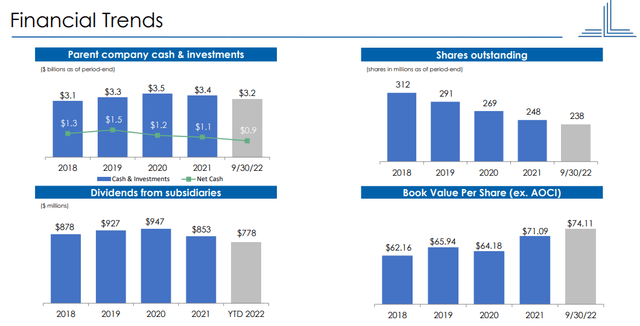

Recent results do not give any indication of immediate danger to any of the company’s basic business lines. The company reported $100M in dividends from subsidiaries, and a BV/share of $74.11, which now comes in at a significant overall discount to the market price for the company. net income was down by half, but this was mostly due to LP and common stock investment losses from fixed-income securities.

The company continued with its set strategy of repurchasing a significant amount of shares, which is a good strategy when the value of the share is lower than the estimated book value – and Loews continues to hold a massive $3.2B cash and investment position at parent-company level.

The company continues its trends of growing book value, lower share count, high liquidity, and good dividends from its various owned companies.

The company has a relatively unique strategy, which is clear once you look at the very flat yield and dividend for Loews. The strategy consists of repurchases, first of all, before investing in the existing subsidiaries using the profits, and third, acquiring new subsidiaries for the business that delivers more growth, allowing more share buybacks, and so forth.

This has resulted in Loews retiring nearly 38% of its common shares in less than 9 years. the company also maintains a cash/investment position that’s higher than the company’s total debt, resulting in a consistently positive net cash position.

The company’s subsidiaries are relatively self-sufficient and independent. Loews, as the owner, only really steps in and decides/exerts influence in three major areas or decisions:

- Major capital allocations

- Strategic planning for the mid/long-term

- The hiring of senior management

Beyond that, most of these businesses function on their own, with day-to-day operations outside of Loews’ interest (for the most part).

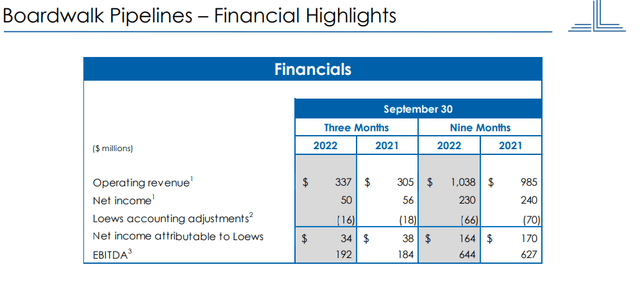

The various subsidiaries have done very well over the last quarter.

The company’s overall strategy is to grow while minimizing risks. Managing a nearly-$9B backlog, with most of the company’s contracts with investment grade, the company’s conservative profile is unchanged, added to strong liquidity.

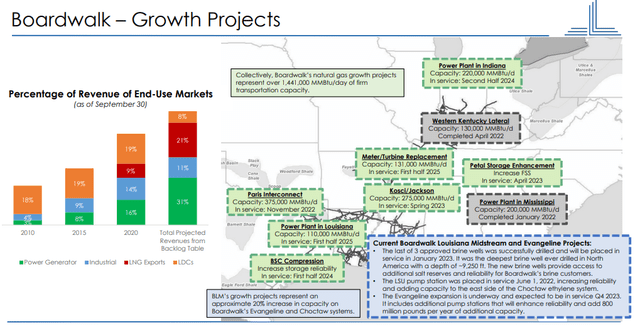

Turning to growth projects for Boardwalk, which is one of the major current drivers given the energy situation.

However, all of these components aside (and these are positive components given the trends that we’re seeing), one of the major arguments for Loews is the so-called Loews discount, meaning that the company’s market cap is less than the SOTP of the company. With CNA trading at a discount and no seeming value being assigned to its private subsidiaries, the company is now almost $20/share below where the book value trades it – and this is before looking at net cash. It also ignores the share repurchases, which are over 140 million shares lower than they were around 10 years ago. Cash flows are consistent and solid.

However, with the low yield, and the company’s strategy, actual returns matter – not just this continuing argument of undervaluation. If you have 5-8% dividends, you can overlook poor RoR for a while – but not here.

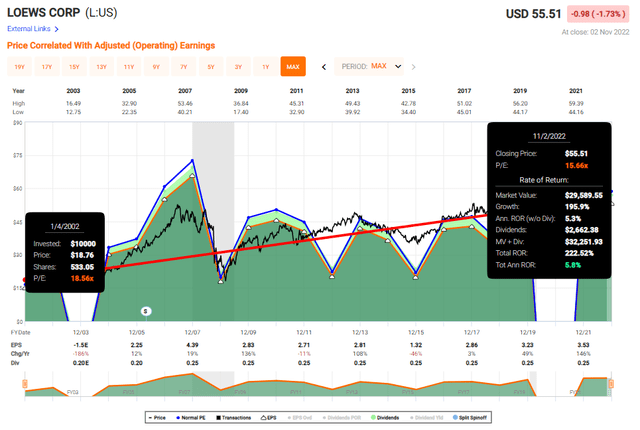

Long-term RoR is decent for the company, but not market-beating here.

Because returns aren’t market-beating, and because this company is extremely hard to forecast, and does not have a dividend, that means that we really want to buy the company a lot cheaper than we “think”.

Let’s look at what the valuation is for Loews, and where I would actually start considering buying the company.

Loew’s updated valuation

Loew’s has interesting valuation trends, in that it’s very similar to investments you find in some of the less-invested European geographies. It’s remarkably close to something like my PIGS investments, such as Leonardo (OTCPK:FINMY) since December. Loews is up almost 51% since early 2021.

However, the business is extremely tricky to evaluate properly. On a P/E-basis, due to (among other things) its buybacks, the P/E and valuation have a very volatile historic trend that’s nearly disconnected from standardized multiples.

This company continues to be extremely underfollowed. No S&P Global analysts exist that currently follow Loews. FactSet has 1 analyst following the company, currently calling for a restoration of the company EPS to 2019 levels. This would call for a higher valuation, but not for a higher one than we’re currently seeing.

All in all, it’s hard to shift from the picture where Loews is a company that continually calls to investors for attention, pointing to some very great fundamentals, but that in the end continually and equally fails to actually convince investors of its quality.

Dividends, or the lack of them, are a component of this market hesitation, I believe. There are few good reasons why Loews couldn’t re-allocate some of its impressive incomes towards instituting a proper dividend at maybe 1-2% – because aside from this and some of the ups and downs from earnings, there are no real arguments against Loews to be had.

All of the subsidiaries are well-managed and have good prospects. These are the positives, and they’re significant. I see significant upsides for the companies, provided we can get them cheap enough.

In my previous article, I said that the company was still too expensive. Because of its yield and the company’s very choppy trends, this is actually a stance that I continue to hold today. We’re still at a 15.66x P/E to normalized, which is still above the $49/share PT that I put in my previous article.

And that, mind you, is the highest I would be willing to pay for Loews, despite all of the upsides the company has today. The only way to make solid, market-beating returns from Loews has been to invest in it at dirt-cheap valuations, and then be very aware of how high things can, and do go before rotating.

Above 15x Pre-pandemic EPS is still an absolute no-go, despite good quarterly results and excellent fundamentals. There are too many good alternative options on the market today.

I’d be willing to consider it below $49/share, and that continues to be my thesis here.

Maybe in another 10% drop, I’ll be open for investing in Loews.

Thesis

My updated thesis on Loews is:

- Loews is still a quality business with expertly-managed subsidiaries with through-cyclic earnings stability. The fundamentals here are excellent, and therefore, at the right price, it’s a “BUY” even without a potential solid yield.

- This company is still slightly overvalued, despite dropping slightly. At any time, when you bought the company at 17-19X P/E, the company has delivered substandard, or below-market returns. The same goes true in some cases for the 15x+ P/E.

- Therefore, my stance is “HOLD” – I’ll wait until we’re back below $49/share.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment