Caziopeia

When making an investment, clearly, you want the underlying assets that you are acquiring a part of to perform exceptionally well. But the beauty about buying cheap companies is that, sometimes, you don’t even need financial performance to be all that great in order to justify upside. When the market is behaving irrationally, there are plenty of opportunities to capture significant swings higher even when financial performance shows signs of weakening. A great example of this can be seen by looking at Hamilton Beach Brands (NYSE:HBB). This fairly small firm, with a market capitalization of just $176.6 million, is an iconic producer of branded, small electric household and specialty houseware appliances, as well as of commercial products used in restaurants, food chains, bars, and hotels.

Despite posting results for the first quarter of its 2022 fiscal year that, in some ways, fell short, the stock was cheap enough that performance recently from a share price perspective has been robust. Now, with the stock having risen, it makes sense for investors to start asking whether they should sell, or hold on, or even buy more. Based on my assessment of the firm, the easy money has most certainly been made. But shares are still cheap enough that they could offer some decent upside moving forward. As such, I have decided to retain my ‘buy’ rating on the business at this time.

The beauty of buying cheap shares

On April 24th of this year, I wrote an article detailing the investment worthiness of Hamilton Beach Brands. In that article, I acknowledged that recent performance by the company had been mixed. But overall, it had been attractive. Shares at that time were trading cheap and, for value investors, I felt it would make for an attractive opportunity that would offer some nice upside in the months or years to come. As a result of this, I ultimately rated the business a ‘buy’, reflecting my belief that the company’s returns would likely outpace the returns of the broader market moving forward. So far, that call has proven to be correct. While the S&P 500 is down 9.3% since the publication of that article, shares of this business have generated upside for investors of 16.6%.

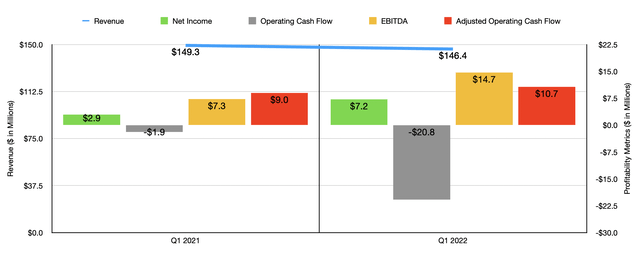

This upside was not without cause. However, the data provided is somewhat deceptive. But before we get to the bottom line results, we should touch on revenue. During the first quarter of the company’s 2022 fiscal year, the only quarter for which data is now available that was not available when I last wrote about the company, revenue came in at $146.4 million. According to management, this 1.9% decrease in sales compared to the $149.3 million reported one year earlier was driven largely by lower sales volume in the US and Canadian consumer markets compared to what the company achieved the same time one year earlier. At the same time, however, revenue in the Latin American and global commercial markets increased thanks to strong demand.

Even though revenue decreased, profitability for the company increased. Net income during the quarter came in at $7.2 million. That’s almost triple the $2.9 million reported for the first quarter of 2021. Operating cash flow did worsen, dropping from negative $1.9 million to negative $20.8 million. But if we adjust for changes in working capital, it would have risen from $9 million to $10.7 million. Meanwhile, EBITDA for the company more than doubled from $7.3 million to $14.7 million. While this looks great and makes it seem as though the enterprise successfully pushed all of its inflation-associated costs onto its customers and then some, the fact of the matter is that this performance has been somewhat distorted. That’s because included in this figure for the year is a $10 million insurance recovery that the company recognized in the latest quarter. Management ultimately reflected this in its selling, general, and administrative expenses as a reduction in those costs. Without that, the company’s bottom line results would have worsened year over year.

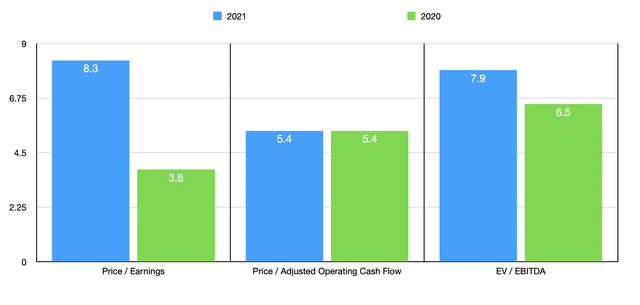

So if it was not the top line and real bottom line results to the company that pushed shares higher, investors should be right to question what ultimately did. In my opinion, it’s the fact that shares of the business were just so cheap that the market was adjusting for the prior overreaction that pushed the stock down so far. Even after seeing its share price rise nicely, the company still looks cheap. Using our 2021 results, we can see that the firm is trading at a price-to-earnings multiple of 8.3. This is higher than the 3.8 reading that we would get using 2020 results. But even so, it’s still quite cheap on an absolute basis. Meanwhile, the price to adjusted operating cash flow multiples should be 5.4, while the EV to EBITDA multiple is 7.9. These figures compare to the 5.4 and 6.5, respectively, that we get if we use data from 2020.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. These are the same five companies I compared it to in my last article. On a price-to-earnings basis, these firms are trading at multiples of between 9.9 and 63. And when it comes to the price to operating cash flow approach, the four firms with positive results traded at between 13.9 and 84.9. In each of these instances, Hamilton Beach Brands was the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range for the four companies with positive results was from 7.2 to 157.2. In this case, only one of the companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Hamilton Beach Brands | 8.3 | 5.4 | 7.9 |

| Viomi Technology (VIOT) | 9.9 | N/A | N/A |

| iRobot (IRBT) | 63.0 | 43.4 | 157.2 |

| Cricut (CRCT) | 13.2 | 84.5 | 7.2 |

| Helen of Troy (HELE) | 15.4 | 24.4 | 14.4 |

| National Presto Industries (NPK) | 23.7 | 13.9 | 13.9 |

Takeaway

In recent months, Hamilton Beach Brands has performed exceptionally well from a share price perspective even as its fundamentals, adjusted for its insurance recovery, were somewhat disappointing. Given current economic conditions, it wouldn’t be surprising to see financial performance suffer some in the near term. But so long as management can continue to generate attractive cash flows in the long run, the company should be fine. I do think that the easiest money has been made. But given how cheap shares are on both an absolute basis and relative to similar firms, I feel comfortable keeping it as a ‘buy’ prospect at this time.

Be the first to comment