MicroStockHub

LyondellBasell Industries N.V. (NYSE:LYB) is one of the most attractive high yield investments in the market today. While global inflation remains problematic and some analysts are bearish on the stock due to persistently high input costs, we are highly bullish on it for three reasons that we will share in this article.

#1. Defensively Positioned

While bears correctly point to rising input costs, potential recessionary impacts, and a natural gas shortage in Europe as risk factors for the business, LYB is actually fairly well positioned to weather all of these.

First and foremost, it is a leading producer of essential industrial materials and produces a pretty well diversified variety of them. As a result, it has some pricing power, and its diversification insulates it against severe circumstances for any single one of its products.

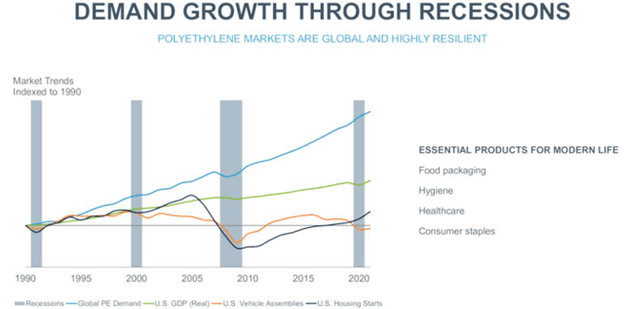

Second, its polyethylene business is fairly recession resistant. As the chart below illustrates, this industry generally weathers weak economic conditions better than other industrial sectors:

Polyethylene Demand (LyondellBasell)

Finally, in the event that Russia halts natural gas exports to Europe, LYB is fairly well insulated from the impacts with only 11% of its revenue really exposed to the worst of the impacts from such a scenario. On its latest earnings call, the CEO responded to a question about the company’s ability to handle a natural gas shortage in Europe with:

We have an internal crisis management team up and running that we are developing different business continuity plans…the integrated crackers that we have, they show a low dependency on nat gas, mostly supplied by oil-based fuels. I want to put it in perspective as where the biggest impact is eventually is in Germany and Italy, but German revenues for us are based upon last year’s revenue, about 7% of total revenue and Italy is about 4% of total revenue.

We believe that we can continue to run our crackers in Europe, but we have been doing at an 85-plus percent range. So from that perspective, believe that we — if everything runs, let’s say, in a normal way, we would be quite robust in continuing our operations independent of the fact the effective North Stream One returns, so back to 40% or would be lower than the 40%.

Essentially, what he is saying is that a natural gas shortage in Europe would hurt them, but not in a significant manner.

#2. Strong Balance Sheet

On top of its fairly stable cash flow profile, LYB has also significantly bolstered its balance sheet in recent years by deleveraging aggressively.

Its debt maturity calendar is well-laddered, which combines with its robust free cash flow generation to put it at little risk of financial distress moving forward.

As a result, LYB achieved a credit rating upgrade to a very solid BBB (stable outlook) from S&P and is positioned with significant flexibility to respond to various economic scenarios opportunistically.

#3. Gushing Free Cash Flow

At the moment, LYB is generating a massive amount of free cash flow, enabling it to accelerate shareholder capital returns via a combination of increased dividend per share growth and share buybacks.

In Q2, LYB generated a whopping $1.6 billion in cash from operating activities thanks in large part to a 24% return on invested capital over the past twelve months. On top of that, over the past twelve months, LYB has generated a whopping $8.3 billion in cash from operating activities with a 91% EBITDA to cash conversion ratio, good for a free operating cash flow yield of ~30%. Last, but not least, in just Q2 alone, LYB generated a very impressive $5.19 in adjusted diluted earnings per share. When compared with its sub $80 per share price at the moment, the value proposition is very clear.

These incredible results prompted management to pay out a massive special dividend during Q2, while prudently restraining share buybacks to just $45 million during the quarter. However, now with the share price dropping significantly, it is likely that LYB will accelerate buybacks further, which we view as highly accretive at current prices.

When you combine this aggressive and accelerating capital return program with its attractive growth project pipeline, LYB should be able to deliver substantial total returns for shareholders moving forward.

Investor Takeaway

While LYB is definitely not a low-risk investment in the current environment, the reality is that its business model is more stable and defensively positioned than the market is currently giving it credit for. Furthermore, it plays a mission-critical role in the energy value chain, which should enable it to weather input cost pressures fairly well moving forward. Between its BBB credit rating, ~30% free cash flow yield, ~6% dividend yield, and commitment to returning an increasing amount of cash flow to shareholders via a growing annualized dividend and a share buyback program, LYB is one of the most attractive risk-adjusted high yield investments in the market today.

Be the first to comment