Kristian1108/iStock Unreleased via Getty Images

In a previous report, I pointed out that The Boeing Company (NYSE:BA) had recognized cost growth on its fixed-cost Defense program in anticipation of its Investor Day, which took place on the 2nd of November. Not doing so would cast doubt on the projections provided during the Investor Day if Boeing were forced to recognize further cost growth in the future. So, the timing of recognizing the cost made sense.

In this report, I want to discuss the cash flow guidance that Boeing provided. There is a lot of interesting stuff that is also worthy of discussion, but the cash flow really was something that stood out. Boeing withdrew its guidance for 2019 following the second crash with the Boeing 737 MAX and has not returned to the practice of providing guidance ever since. This Investor Day was the first moment, Boeing provided more clarity on its performance this year and of the years to come.

As some of you might recall, earlier this year I started marking Boeing as a potential buying opportunity based on a turnaround driven by the Boeing 737 MAX and Boeing 787. Overall, that trajectory is at a slower paced due to industry constraints, but it had already paid off with Boeing shares appreciating over 17% compared to a 4% loss for the broader markets. The guidance that Boeing showed during the Investor Day very much underlined the reasons why it might be compelling to buy Boeing stock now. It largely reflected the reasons I consider it a buy. This provides a good moment for investors to decide whether the pace of the recovery and the magnitude of the recovery fits their investment horizon.

During the Investor Day, Boeing executives provided some valuable insights on the free cash flow generation this year and in the coming year, which the company believes are underpinned by its operational performance.

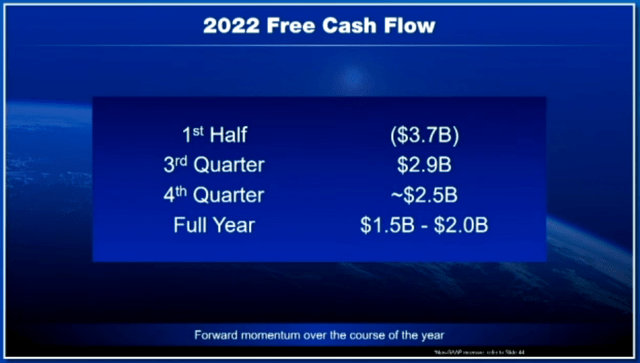

2022 Free Cash Flow: Positive

For the fourth quarter, Boeing expects free cash flow of $2.5 billion, which really signals strength as the free cash flow excluding the tax refund in the third quarter shows a guided sequential improvement of over 75%. For the full year, Boeing expects free cash flow in the range of $1.5 billion to $2 billion, which is also strong, but it should also be kept in mind that to a major extent this is driven by the $1.5 billion tax refund in the third quarter. The sequential improvement is driven by volume and mostly Dreamliner deliveries, according to Brian West, CFO of Boeing, validating my thesis from June 21st. As a reminder, last year cash outflow was $4.4 billion, meaning that year-over-year measured at the midpoint, free cash flow could improve by $6.15 billion, which I think is something that is not nearly recognized enough by investors, as some keep hampering on the past and project that into the future all while the performance is improving.

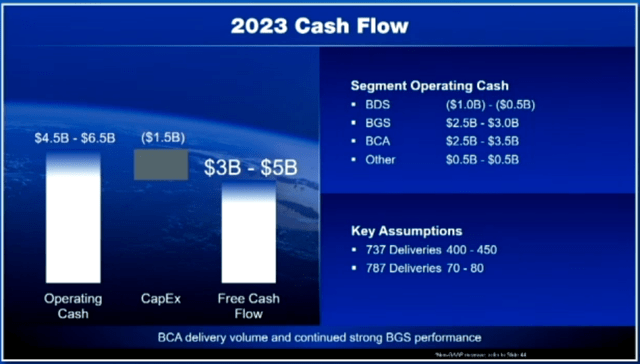

Free Cash Flow In 2023: Pressured by Defense and Conservative 737 MAX Deliveries

In 2023, Boeing expects free cash flow in the range of $3 billion to $5 billion. That might be a bit underwhelming given the $1.75 billion that is guided for at the mid-point in 2022. Nevertheless at $1.75 billion in 2022, the provided range for 2023 provides a 1.7x to 2.85x on free cash flow. That is significant, but lower than the $5 billion mid-range I was hoping to see.

This is driven by the Q3 non-cash charge on fixed price development programs that will cause cash costs in 2023 and erode the cash performance at the Defense segment, turning it negative for the year. Furthermore, the guide for 400 Boeing 737 deliveries is light given the 375 target this year, implying a 25-unit increase at the low end. That will bump revenues by $1.3 billion, but on cash flow level it will be much lower, contributing probably around $300 million to cash flow in the best-case scenario.

So, I was hoping to see a $4.5 billion to $6.5 billion range that is now a bit lower, primarily driven by Defense being a cash drag rather than a cash provider to the business in combination with soft guidance for MAX deliveries and expected compensation for Dreamliner delivery delays and cash cost for rework.

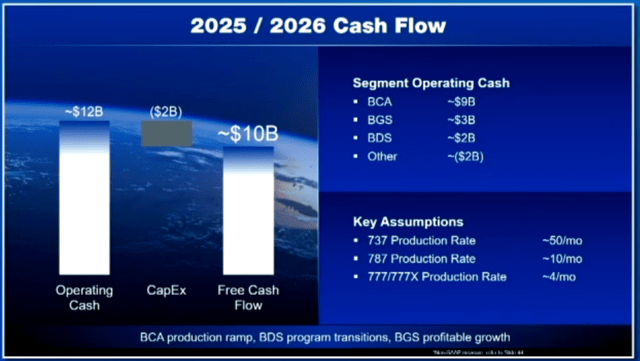

Operating Cash Flow To Hit $10 Billion In 2025-2026

In my analysis of the Q3 2022 results, I pointed out the following:

After going through the numbers, the earnings model and the Q3 2022 earnings call my conclusion remains that results were underwhelming. That was to a minor extent driven by Boeing Commercial Airplanes, where I was too pessimistic on margins and too optimistic on the cost side. Inventories are currently being reduced, but the pace at which this happens is not as fast as previously hoped for and recovery will stretch into 2025.

2025/2026 Cash flow guide (Boeing)

If we look at the presentation at the Investor Day, the recovery stretching into 2025 indeed seems to be the case. Boeing anticipates getting to $10 billion in free cash flow in 2025-2026 as a $100 billion revenue company, which would mark the company getting back to the levels it was previously at. Underpinning that are two key items, although Boeing mentions three, and those are a rate of 50 Boeing 737 aircraft per month and 10 aircraft per month in the 2025-2026 timeframe for the Boeing 787 Dreamliner. Comments from Boeing suggested that when it comes to engine shortages, talks are ongoing and CFM can support a rate increase by mid next year, but Boeing does not want to quite nail mid-2023 as a point for the rate to be hiked again.

Boeing sees demand strong enough to support rate hikes all the way up to 50 aircraft per month without China, which is a major bullish sign, and on the Boeing 787 program rates are anticipated to go up to 10 per month, whereas I had previously expected the company to get to 5 aircraft per month in 2023 and 7 aircraft per month by 2025. Boeing anticipates the rate to go 3 units higher monthly, which is a big item as it will produce 36 wide body aircraft more than I anticipated. Compared to the 2023 outlook, $6 billion in FCF (free cash flow) growth will be driven by Boeing Commercial Airplanes, $2.7 billion by the Defense segment, and $0.3 billion on the Services segment, with $3 billion in CapEx.

Also noteworthy is that by 2025-2026, the excess advance payments that Boeing received will be largely normalized, and that is something that does provide a cash headwind in 2023-2024, as Boeing burns off that excess of pre-delivery payments it has accumulated since 2019, and that is a cash flow headwind. So, given these excess PDPs, the significant improvement in cash flow in the coming years is a strong sign.

What Is Boeing Stock Worth?

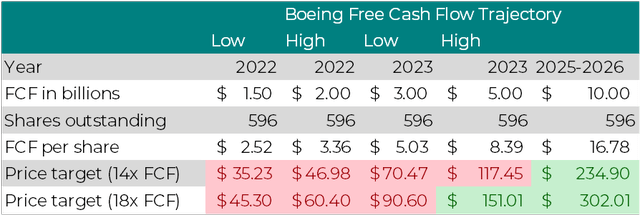

Free Cash Flow valuation Boeing (The Aerospace Forum)

With the trajectory that Boeing provided, we see free cash flow improve from $1.5 billion to $10 billion by 2025-2026. Boeing tends to be a company that trades on its ability to generate free cash flow. The past three years, obviously, have been the exception, as shareholders kept their shares hoping for better times as free cash flow imploded and became deeply negative. Overall, on a per share basis, the free cash flow will improve from $2.52 to $16.78. Going from the low estimate in 2022 to the low estimate for 2023 already includes a 2x on free cash flow and 2.5x on the high end, while for 2025-2026 there again is a 2x on the cash flow as measured from the high point in 2023.

For those that have followed my aerospace coverage, you probably know that I view aerospace investments as longer-term, and if we look at price to free cash flow we see that basically Boeing does not have a lot to offer in terms of free cash flow valuation for another year. The free cash flow multiples are not taken out of thin air but are the free cash flow multiples that Boeing was trading at prior to the first crash and prior to the second crash with the Boeing 737 MAX. In 2017, I determined a 13.7 multiple. Taking a 14x multiple as the conservative line gives us a $235 price target. Providing 60% upside and applying a discount to the cash flow, we get to a $510 per share, which is where I believe Boeing could be heading, providing nearly 240% upside based on the lower end of the ranges provided. If we average all the implied price targets based on the discounted cash flow through 2026, we get to an average of $239, roughly matching the 14x FCF per share by 2026. So, if Boeing can get it right, even when averaging out there is significant upside. I feel comfortable putting a $240 price target on Boeing shares.

Conclusion: Boeing Stock Is A Buy On Cash Flow Upside After Risk Retirement

It is certainly not the case that Boeing will start raking in cash tomorrow, but the reality is that Boeing is generating more cash than it did yesterday and it has retired risk in the Defense segment by recognizing the costs on fixed-price development programs and has embedded the cash pressures of that in its guidance. On Commercial Airplanes, Boeing is also turning a corner, and the company has retired the risk pertaining China in such a way that China is a “nice to have” element rather than a “must have” to meet the free cash flow objectives. Boeing has started to deliver on its commitment, and it still has to prove that it can fulfill the guidance rather than revising it every quarter like before, but with the risk-retirements announced I feel more comfortable that Boeing can deliver on its promises.

As a result, I continue to feel comfortable marking Boeing a buy. I now also feel comfortable providing a $240 price target. Boeing’s Investor Day gave a lot of food for thought, and I will be processing some of the numbers and comments provided in a future piece, but I believe the cash flow outlook and risk retirement were the biggest items worth addressing first. That combination of risk-retirement and forward-thinking make Boeing even more attractive today.

Be the first to comment