Willard/iStock via Getty Images

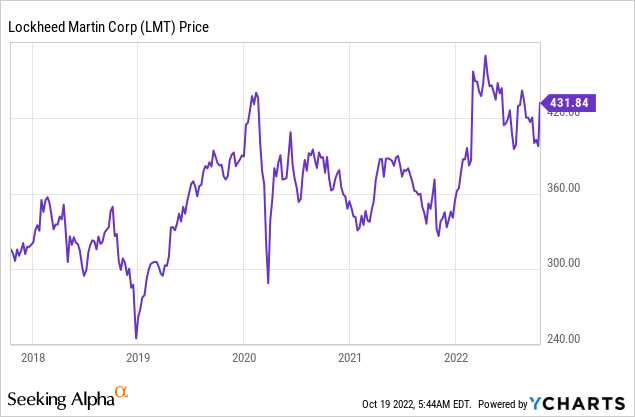

The Russia-Ukraine war is still raging on, which has increased geopolitical uncertainty and been a catalyst for defense spending increases. Lockheed Martin Corporation (NYSE:LMT) is poised to benefit from these tailwinds as a supplier of best-in-class armaments.

The company is a military powerhouse that produces battle-tested products for land, air, sea, and even space defense applications. Lockheed Martin announced solid financial results for the third quarter of 2022, as the company beat earnings estimates. With consistent government contracts and a strong backlog of orders, Lockheed is poised to continue to grow. In this post, I’m going to break down the direct Russia-Ukraine war tailwinds, its financials, and valuation.

Let’s dive in.

Business Strategy and Tailwinds

Lockheed Martin is the largest defense contractor in the U.S. and effectively a play in the U.S. defense budget and the defense of the western world. The company has stable and recurring government contracts with the U.S. department of defense, which make up approximately two-thirds of the business’s total revenue. With approval from the U.S., Lockheed also sells its weapons and systems to U.S. allies across the world.

The company is most well-known for its F-35 fighter jet, which is regarded as the most versatile fighter jet in the world. This jet is popular with tactical bombing, air defense missions, and uses stealth technology to help avoid detection by radar. For example, the Israeli version of the F-35 was used to attack targets in Syria that were nearby to Russian military bases. Russia’s air defense systems (S-300 and S-400) couldn’t detect or destroy any of the jets.

The Russia-Ukraine war has heightened the need for defensive weapons. In early 2022, as the Russia-Ukraine war began, Germany ordered 35 F-35 jets to increase its security. With each F-35 jet having a hefty price tag of ~$78 million, this is no small order. The Pentagon has recently announced an increase in the cost to procure and develop its F-35 fleet to a staggering $412 billion, up $398 billion previously.

Lockheed Martin is also fantastic at spotting organizations with best-in-class weapon systems and then acquiring the companies. For example, in 2015, Lockheed Martin acquired helicopter designer Sikorsky for $9 billion. It is famous for developing the iconic Black Hawk Helicopter.

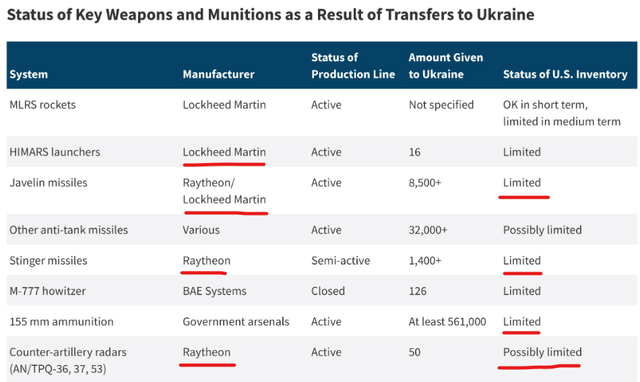

On October 14th, the US DoD offered $725 million in additional security assistance to Ukraine. This brings the total value of military equipment sent to Ukraine to $18.2 billion. This extensive amount of aid has consisted of a large number of weapons produced by Lockheed Martin. For example, the Javelin Anti-Tank Missile launcher has proven to be extremely popular and effective. Many experts believe Javelins have been a “vital” tipping point in holding off Russian advances.

Javelins made by Lockheed Martin (military aerospace)

The Javelins have a range of 2.3 miles and use state-of-the-art infrared technology to focus on the tank target. The system uses a double warhead setup that can penetrate steel armor of up to 31.5 inches thick, which is astonishing. According to U.S. statistics, out of the first 112 Javelins which were sent to Ukraine, 100 hit the targets. The U.S. has sent one-third of its Javelin supply to Ukraine, but this now means the country needs to replenish its stockpile. As you can see from the fantastic table below, the U.S. has a limited supply of many Lockheed Martin and Raytheon armaments that were sent to Ukraine. These range from HIMARS launchers to MLRS rockets. Therefore, I forecast a large number of orders for these products coming from the U.S. DoD and its allies.

US Military Equipment Sent to Ukraine (CSIS)

Solid Financials

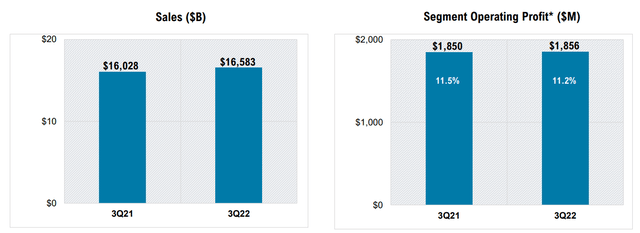

Lockheed Martin generated solid financial results for the third quarter of 2022. Revenue was $16.6 billion, which increased by a steady 7% sequentially and 3% year over year. This was driven by positive numbers in three out of four of the business segments. The main growth was driven by a $7.5 billion order modification for the production of 135 F-35 fighter jets for the U.S. Navy, Marine Corps, and Air Force. In September, the Swiss Government signed a deal for 36 F-35 fighter jets, which looks to have been driven by European Tensions around the Russia-Ukraine War. This is a landmark deal as it makes Switzerland the 15th F-35 customer.

Revenue and Profit (Lockheed Martin Q3 Report)

The company’s total backlog increased by $5 billion to a staggering $140 billion, which offers consistency and peace of mind for investors. Overall operating profit was $1.856 billion at an 11.2% margin. Profit increased slightly from $1.85 billion in Q3,21 but its margin was squeezed from the 11.5% generated in the prior year. This was mainly driven by mark-to-market accounting adjustments and a pension transfer transaction. However, I noticed when adjustments are made for these factors Earnings Per Share (EPS) increased by 4% year over year to $6.87 which beat analyst consensus estimates by $0.16.

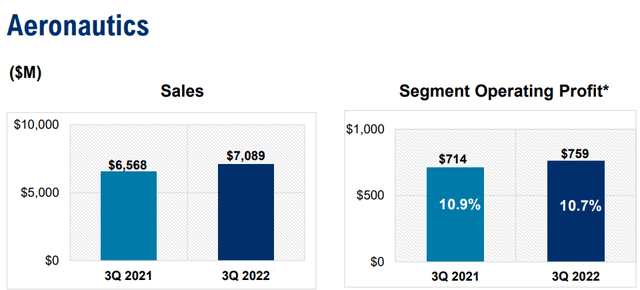

Breaking the results down by business segment, the Aeronautics segment was the strongest, with sales increasing by 8% year over year to $7 billion, driven by the aforementioned F-35 tailwinds. The company also saw an increase in its classified programs at “Skunk Works,” although these programs tend to have lower margins. In addition, Aeronautics’ operating profit popped by 6% year over year.

Aeronautics (Q3 Earnings Report)

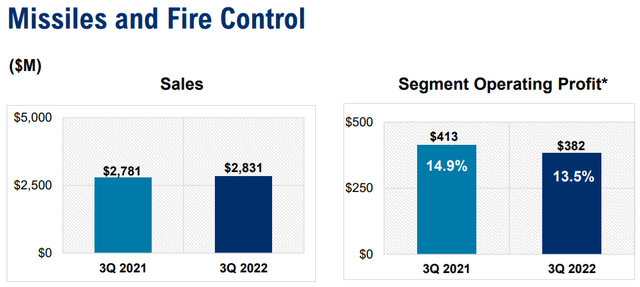

The Missiles and Fire Control segment grew by 2% year-over-year to $2.8 billion. This was driven by the increased volume for its state of the Art PAC-3 Missiles and Javelins. Lockheed Martin has also had an order of two THAAD systems and 96 interceptor missiles approved for the United Arab Emirates by the state department. Once this deal is finalized, it is expected to be worth over $2.2 billion.

The Rotary and Mission systems segment had a 5% decline in sales to $3.78 billion, which was driven by lower production of Black Hawk Helicopters. However, Australia did order 12 MH-60R “Seahawk” Navy Helicopters.

The Space segment generated sales of $2.8 billion, up 7% year-over-year and an operating profit boost of 14%. This was driven by the ramping up of the interceptor program.

Lockheed Martin generated an overall free cash flow of $2.7 billion and returned over 121% of this to shareholders through buybacks and dividends. Lockheed has recently announced a dividend increase to 7% or $12 per share. Management showed confidence in the future of Lockheed as they reached their $4 billion buyback target in 2022. In addition, the board has approved $14 billion in share buybacks moving forward. On its balance sheet, Lockheed has $2.4 billion in cash and cash equivalents with long-term debt of $11.48 billion, which is manageable given the strong cash flow and consistency.

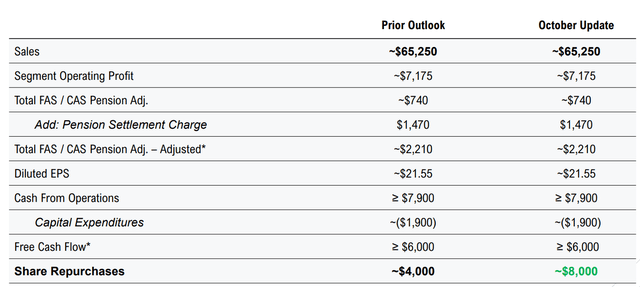

The defense industry looks to be relatively protected from macroeconomic issues, as management has kept guidance unchanged, apart from a $4 billion increase in share buybacks.

Lockheed Martin (Outlook 2022)

Advanced Valuation

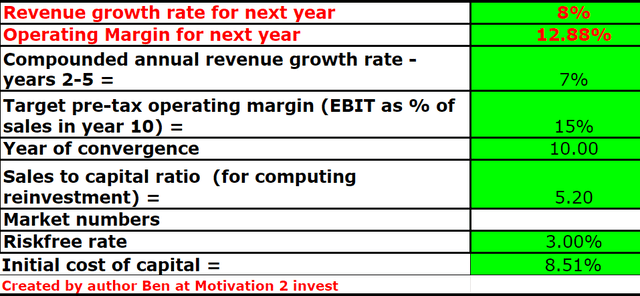

In order to value Lockheed Martin I have plugged the latest financial results into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 8% revenue growth for next year and 7% per year for the next 2 to 5 years. I forecast this to be driven by the aforementioned tailwinds, from Russia-Ukraine, U.S.-China-Taiwan tensions and increased global uncertainty.

Stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted a target pre-tax operating margin of 15% in 10 years. I expect this to be driven by supply chain issue resolution and a greater number of U.S. manufacturing facilities coming online, such as those in the Semiconductor industry by Intel (INTC) and Micron (MU).

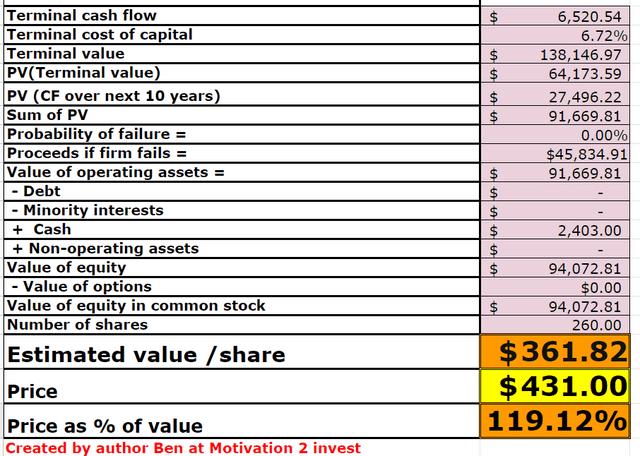

Stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $361 per share. The stock is trading at $431 per share at the time of writing and is thus 19% overvalued. This is expected, as this is a high-quality company with consistent revenue. In addition, its stock price popped by 8% on earnings date alone.

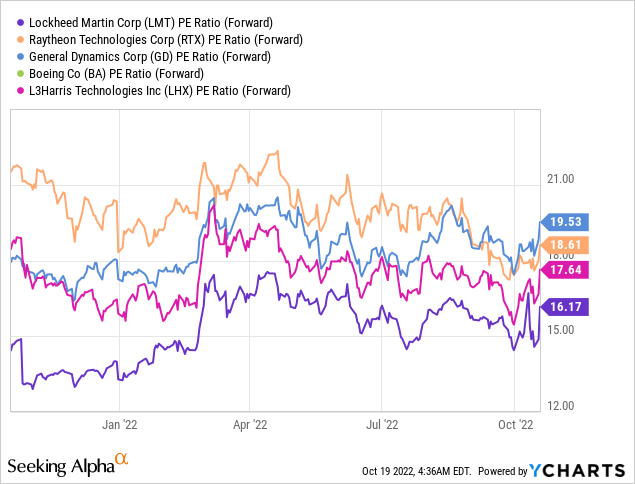

The stock also trades at a forward Price to Earnings ratio = 19.9 which is 16% higher than its 5-year average. However, Lockheed does trade at a cheaper P/E ratio (purple line) than competitors in the industry.

Risks to LMT

High Valuation/Supply Chain Issues

As mentioned above, Lockheed Martin is not exactly a cheap stock, especially after the recent price action. Given the macroeconomic conditions, some countries may delay defense spending, although we are not seeing signs of this yet. During a war scenario with a country such as China over Taiwan, Lockheed may struggle to get the necessary components it needs to develop its weapons. These supply chain issues could be a major issue for U.S. defense and Lockheed.

Final Thoughts

Lockheed Martin produces state-of-the-art technology which has proven itself in real-time war scenarios. The company is the ideal defensive stock for your portfolio, and the recent dividend hike to 7% makes it even sweeter. The stock isn’t exactly cheap, thus one may wish to wait for a pullback before entering. But I will still label this stock as a “buy” overall, as share prices can correct in a matter of days.

Be the first to comment