Michael Vi/iStock Editorial via Getty Images

Introduction

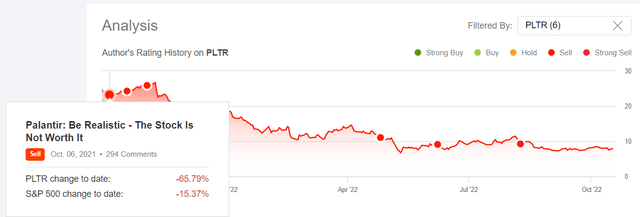

I have been covering shares of Palantir Technologies Inc. (NYSE:PLTR) on Seeking Alpha since early October 2021 and have been increasingly pessimistic about the company’s prospects ever since.

Seeking Alpha, author’s profile

I have been betting on a decline in PLTR stock from the beginning of my coverage, despite massive support from retail investors on Seeking Alpha, Reddit, and other platforms. As you can see above, my bet paid off, even though I did not short the company, but simply ran past it after it fell 20%, then 30%, 40%, 50%, and so on.

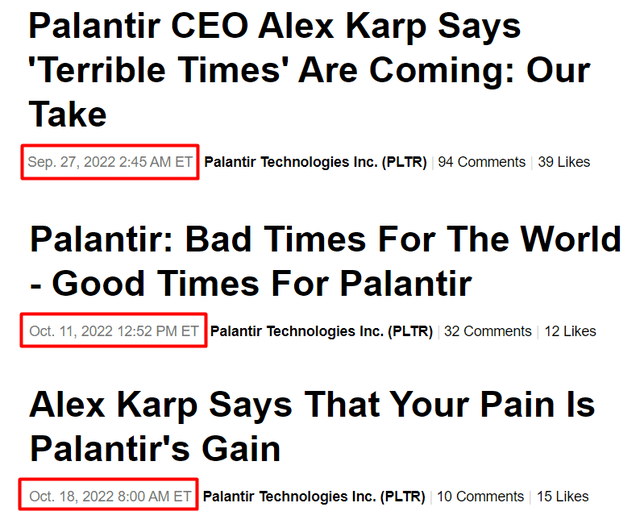

Lately, however, PLTR has been experiencing a new wave of optimism that miraculously coincided with Alex Karp and Stanley Druckenmiller’s YouTube discussion on September 13, in which the CEO and the great (no sarcasm) hedge fund manager argue that the company is on the right track and will have a once-in-a-lifetime opportunity to grow sales and profits over the next few years because of the geopolitical situation in the world.

Since then, bullish articles on Seeking Alpha have quoted almost verbatim how Karp tried to position his offspring during that discussion with Druckenmiller, and the number of bullish articles relative to neutral/bearish takes has also increased significantly.

Seeking Alpha, PLTR, author’s notes

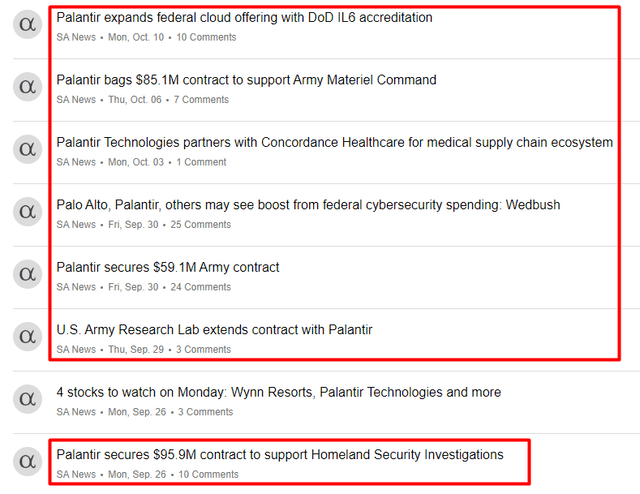

“Optimism from pessimism” has been fueled by the abundance of positive news that has reached PLTR shareholders on an almost weekly basis since then:

Seeking Alpha News, PLTR, author’s notes

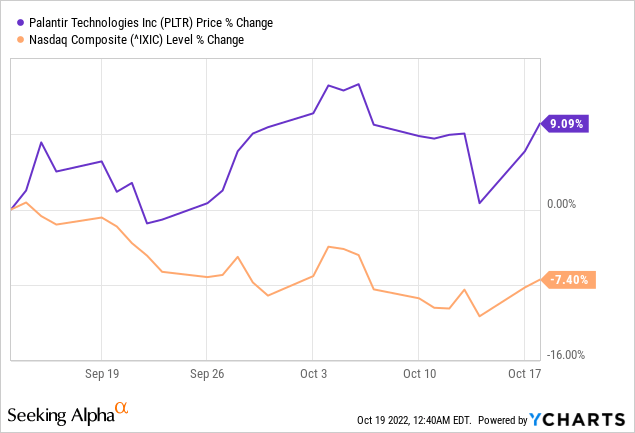

Of course, this could not help but lead to a rapid recovery in the stock – since September 13, PLTR is up >9%, which is quite an outperformance compared to the Nasdaq Composite Index (COMP.IND), which is down 7.4% over the same period:

In the context of all the above, I was wondering – should I finally change my Sell rating to at least Neutral due to recent events?

Updated Thesis

I have decided not to change my Sell rating because I believe in a further multiple contraction of Palantir with its astronomically high valuation that in my opinion cannot be justified by forward growth rates.

Why I Don’t Follow Druckenmiller?

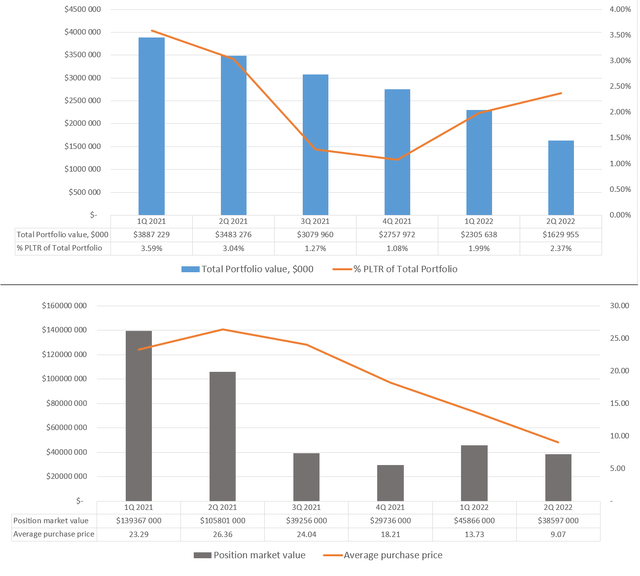

Druckenmiller increased his PLTR position from 3,340,537 shares in 1Q2022 to 4,255,412 shares in 2Q2022 (the most recent reporting period), with a purchase price ranging from $6.7 to $14.65 per share, meaning the manager saw an average loss of 23.6% on his new purchase.

A quarter earlier, Mr. Druckenmiller more than doubled his position from 1,632,937 shares to 3,340,537 shares at prices ranging from $10.50 to $18.50, down 22.3% and 55.9% from yesterday’s close.

Assuming that the manager did not buy anything in Q32022 – based on the market value from the latest 13-F filing – the average purchase price is approximately $9.07, which represents a loss of approximately 10%. This is a great example of why the buy-the-dip strategy no longer works for high-growth companies in 2022.

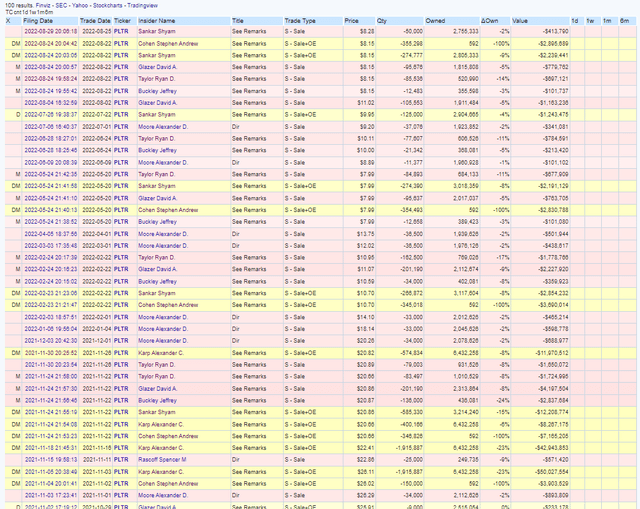

Author’s work, based on John Vincent’s and SEC’s data

Druckenmiller caught a falling knife by buying more PLTR stock on its dips, undermining the overall value of his family office’s portfolio, which is down about 41% since 1Q2022 (the Nasdaq Composite index and S&P 500 index (SPX) are down 25.54% and 13.24%, respectively).

At the same time, we have never seen company insiders, including Alex Karp himself, do the same.

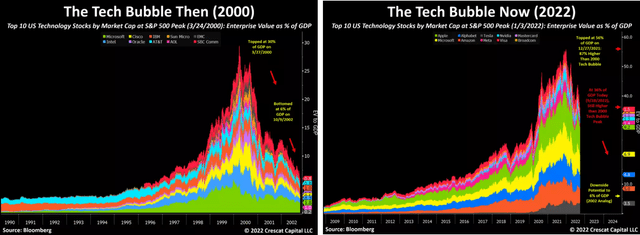

I have the utmost respect for Druckenmiller’s career, but it’s important to remember reasons why he left Soros in 2000 – that was after making big losses on technology stocks. Buying drawdowns in PLTR, Opendoor (OPEN), Coupang (CPNG), and Workday (WDAY) – something Druckenmiller has been doing since the beginning of the year – could be a fatal mistake if the 2000 tech bubble scenario repeats itself. And that’s entirely possible, despite the already steeply negative performance, according to Crescat Capital, one of the most successful macro-oriented hedge funds I often refer to in our newsletters for Beyond the Wall Investing.

To do well in the stock market investors should strive to overcome their recency bias by searching across multiple business cycles for the macro analogs that apply best today. While there are no perfect comparisons, there are many useful guides. The early 2000’s tech bust is a period with many parallels to the current market environment. Tech stocks continued to fall all the way into October of 2002, but the great buying opportunity for precious metals mining stocks started at the end of 2000. That was the major deep-value secular bottom and beginning of a 10-year bull market for gold and silver stocks as well as the beginning of a commodity super-cycle.

Source: Crescat Capital’s recent newsletter

Crescat Capital, Sept. 28, 2022

The most interesting thing is that Druckenmiller is aware of the risk hovering over the market, judging by his interview on CNBC 2 weeks after the discussion with Karp.

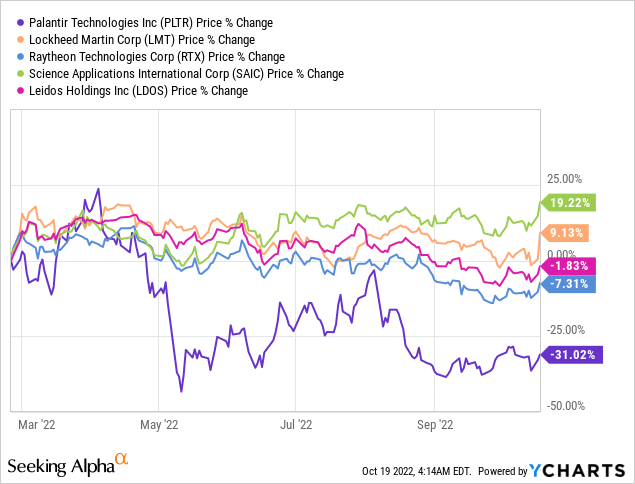

His vision is most likely that Palantir is a unique provider of IT solutions to the U.S. defense sector, and therefore, against the backdrop of all geopolitical events, order intake for the company should grow rapidly, resulting in revenue growth and ultimately bottom-line profits. Let us assume that this is indeed the case. Then the question becomes logical – why has the stock not grown since the beginning of hostilities in Eastern Europe?

[performance since the beginning of the Russian-Ukrainian war]

Other companies in the sector – Leidos (LDOS) and Raytheon (RTX) – also seem to have fallen due to rising interest rates. But judging by the extent of their fall, this was almost the only reason for the sell-off. So why has not the market rewarded Palantir for the innovative potential that will help Ukraine and all of Europe resist Putin’s onslaught, and on which Druckenmiller and other bulls are pinning their hopes?

Palantir’s Valuation Should Still Concern The Bulls

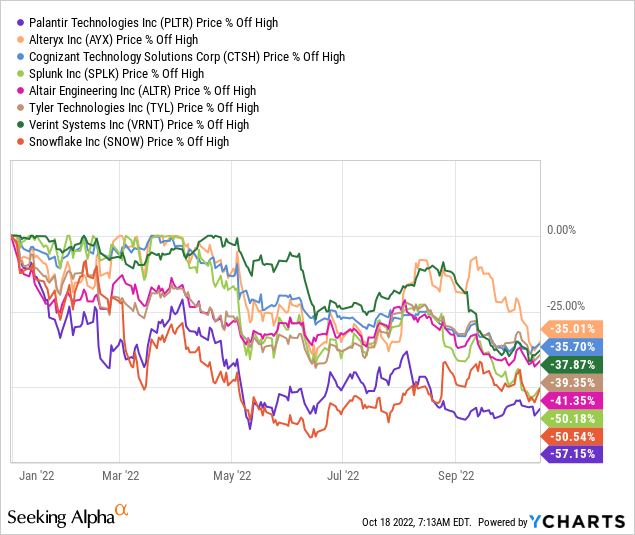

Palantir not only fails to outperform stocks from the defense industry – even against the backdrop of high-growth data analytics companies, its year-on-year performance lags badly:

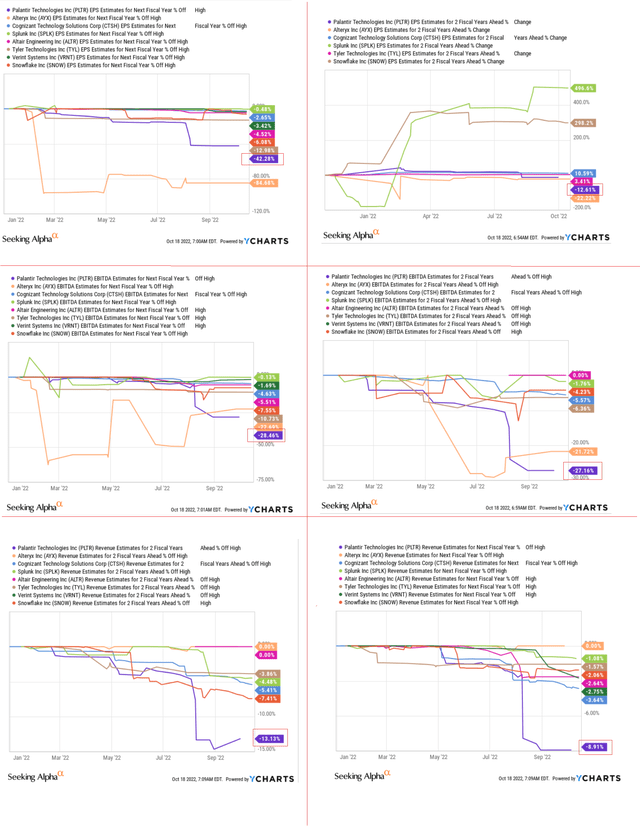

But why has PLTR fallen so deep? The crux of the matter is revenue, EBITDA, and EPS expectations, which began to change very sharply, and not in the direction of the company – even against the backdrop of the other “commercial peers” mentioned above, downward revisions continue to exert significant pressure on quotes:

YCharts, Seeking Alpha, author’s notes

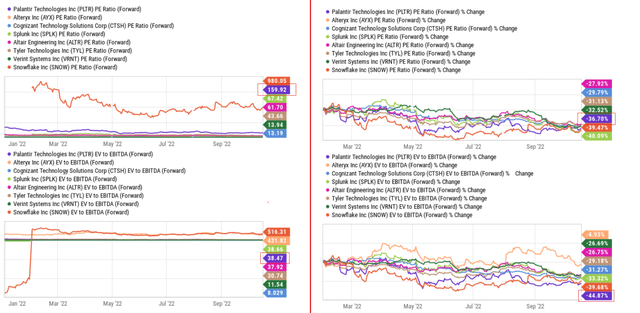

When the trajectory of forward estimates changes so dramatically, we should theoretically see a sharp contraction in multiples that brings absolute valuation multiples below the values for which other peers are trading.

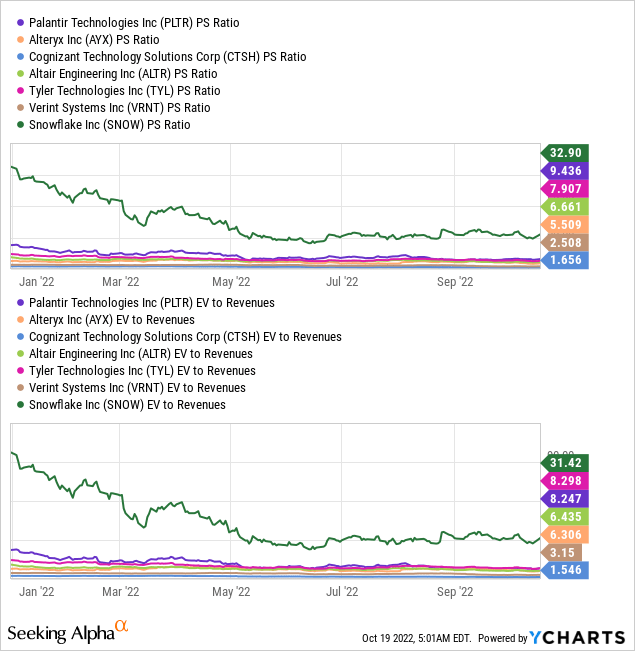

However, this theory does not apply to Palantir stock, which, despite having one of the fastest rates of multiple contraction in the analyzed sample, has absolute values that are many times higher than the group’s averages/medians:

YCharts, Seeking Alpha, author’s notes

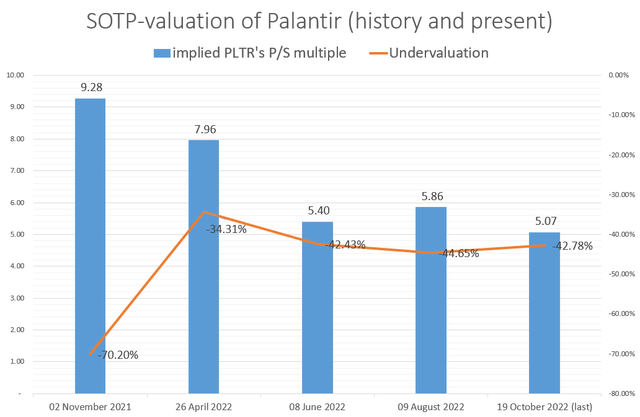

If you have read my previous takes on PLTR, you may recall the SOTP valuation model I first presented in early November 2021 – since then I have updated and presented the results in each new article on the company. Today I updated this model again – with the Q2 2022 data (not quite fresh yet) we can see that the overvaluation has only dropped by about 2%, despite the 11.78% drop in PLTR since the last assessment:

| Government = | 55.60% | |

| Company name | P/S (FWD) | Sales growth, last quarter, YoY |

| Booz Allen Hamilton (BAH) | 1.476 | 13.10% |

| Science Applications International Corp. (SAIC) | 0.715 | -0.27% |

| Leidos Holdings | 0.899 | 4.32% |

| Average | 1.030 | 5.72% |

| Commercial = | 44.40% | |

| Company name | P/S (FWD) | Sales growth, last quarter, YoY |

| Tyler Technologies (TYL) | 7.582 | 15.99% |

| Verint Systems Inc. (VRNT) | 2.439 | 3.86% |

| Splunk Inc. (SPLK) | 3.658 | 31.86% |

| Cognizant Technology Solutions Corp. (CTSH) | 1.588 | 7.00% |

| Alteryx (AYX) | 4.568 | 50.43% |

| Average | 3.967 | 21.83% |

| Gov’s P/S per 1% sales growth | 18.02 | |

| Com’s P/S per 1% sales growth | 18.17 | |

| Palantir’s Gov growth, 2Q, YoY | 13% | |

| Palantir’s Com growth, 2Q, YoY | 46% | |

| implied PLTR’s FWD P/S | 5.07 | |

| vs. current P/S (FWD) | -42.78% |

Author’s calculations, based on YCharts data

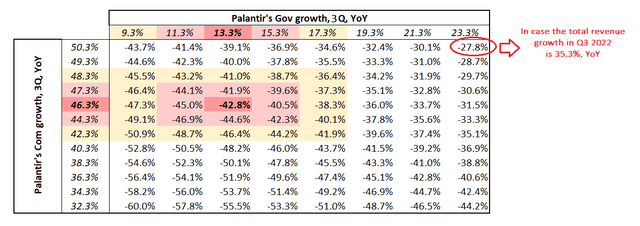

Palantir Technologies is once again highly overvalued compared to its peers in the Government and Commercial segments. But it’s just based on Q2 2022 financial results (revenue growth by segments, to be more precise). I propose to go a step further and create a sensitivity table where we try to identify a range of values at different levels of revenue growth for 2 segments in Q3 2022. The consensus forecast from 10 analysts for total revenue growth is 21.12% (YoY) – most likely due to the commercial segment. But what if PLTR beats those numbers and reports a 35% increase in total revenue in Q3 2022? Then, to the chagrin of PLTR shareholders, the stock might still be overvalued by about 27.8%:

Risks And Bottom Line

There are of course some upside risks to my bearish thesis. First, according to many indications, we are in the local oversold zone of the market, and Palantir, like Nasdaq, is also in this zone I suppose, so it makes no sense to short the stock purely tactically because of the risk of a bearish rally. Second, a large number of new contracts as well as the launch of Apollo can really be a good trigger for growth in the upcoming months. However, the successful commercialization of Apollo, analogous to other products of the company, is doubtful, so this fact does not convince me personally. Ultimately, I may be wrong about the innovativeness of the company’s product line – I wrote about that in more detail in my earlier articles.

Be that as it may, I believe that the valuation of Palantir Technologies, even if I am wrong about the uniqueness of the company’s product, the sustainability of its business model, and its long-term prospects, raises a lot of questions. On the one hand, we have a rising interest rate environment and a hawkish Fed trying to fight high inflation by any means necessary. The risk that the central bank will break something is high, and it’s hard to disprove that thesis. On the other hand, we have the company’s growth rates, which seem to be slowing down and not leading to high-quality and profitable operational growth. In the current macroeconomic environment, companies cannot afford to run their businesses the way they did a year ago when financing costs were virtually zero. Investors’ required return is increasing, and when their shares are continually diluted, it hurts. Yes, Palantir is almost debt-free; yes, the company has a hugely positive net cash balance. But why should I, as a potential investor, overpay for it? Because of the vague prospects? That does not sound convincing enough. For this reason, I reiterate my previous Sell rating and do not recommend following Druckenmiller’s example of buying PLTR’s drawdowns and burning your portfolio value at 2-3 times a market decline as he did.

Thanks for reading! Please share your opinion in the comment section below!

Be the first to comment