Shahid Jamil

Summary

At Cash Flow Compounders we have detailed why we view the next cycle of outperformers to be primarily small cap value equities. Big cap growth continues to trade at exceedingly rich multiples, while midcap and small cap names are at 20 year record cheap levels (see our recent blog post here). Smaller names already are likely pricing in a mild to moderate recession in our view. Among tech/growth, near term the bubble has largely deflated, but valuations remain still above long term averages in many cases.

In the overvalued/over-owned bucket is Apple (NASDAQ:AAPL). We view AAPL as a lower risk short/underweight for those hoping to capture big cap de-rating/slowing growth. Unlike other bad business models we have written up, Apple is a high quality Compounder with a track record we like. In fact, we have been long Apple in either funds I manage or personally for well over a decade.

I first wrote up Apple in on Seeking Alpha in 2011 here. I loved the stock, frankly, writing at the time “who wouldn’t pay a 9.4x multiple (or 11% FCF yield) for a stock that is growing by 30-40% and generating ROE’s of 74%.” I wrote it up multiple times in the ensuing years.

Today, AAPL trades at a 23x multiple with growth anticipated to be 5%.

And I am still a big Tim Cook fan; he is perhaps the best operator/CEO on the planet.

In FY 2011, the company earned $1.58 in EPS. In FY 2023 (year ending September), EPS is expected to be $6.24.

That is an 11 year CAGR of 13.2% in EPS, quite an impressive feat for such a large company.

Importantly, the stock is up almost 11x in that time, even though earnings are only up 3.9x.

The ubiquity of their products, massive free cash flow generation and dominance in iPhones and iGadgets certainly makes for a compelling case to own this stock in any account. Buy and hold has worked well with AAPL.

Not to mention that Berkshire Hathaway (BRK.A) (BRK.B) owns 5.75% of the stock, a huge endorsement of Tim Cook and Apple.

But the company faces many headwinds going forward, including cycle risk (upgrade and economic), valuation risk, regulatory risk, China risk, and slowing growth. We will outline each below.

We sold our last shares of Apple early this year and caution investors that forward returns look quite unattractive from current levels.

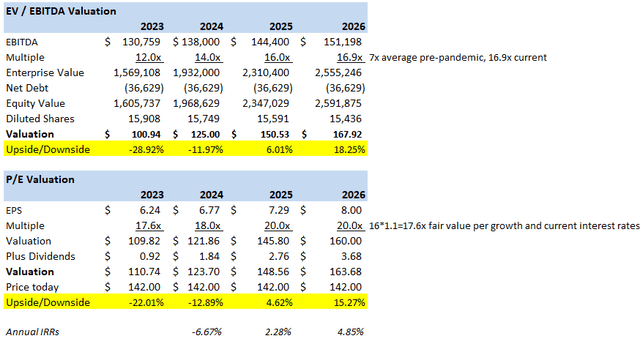

In our bull case, if we assume 2026 EPS estimates of $8.00 (above Street estimates of $7.63), and a healthy P/E multiple of 20x, we only see upside to $160, or 5% annual returns for Apple shareholders.

On the downside, it seems unlikely that Apple can keep its premium valuation forever. P/E multiples are collapsing all around Apple and among tech stocks in particular. Given slowing forward growth rates (under 5% over the next three years per Street estimates), and higher interest rates today, we deem fair value at a 10% premium to the S&P, or about 17.8x.

That implies almost 20% downside in a year, or a $110 on the stock.

Below we highlight risks worth considering.

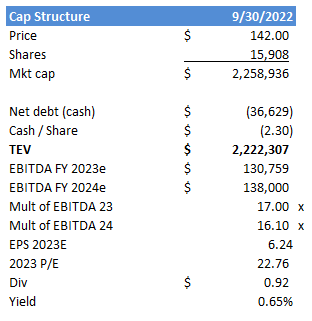

But first the cap structure for a quick background.

Capital structure (Author spreadsheet, company financials)

Cycle risk

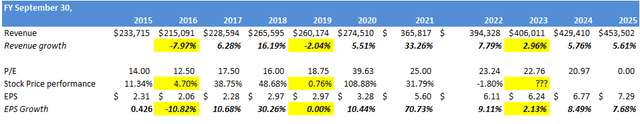

Apple revenue and earnings tend to go through boom and bust periods, just like any other company.

Author spreadsheet, company financials

Above we highlight in yellow the years post a phone upgrade cycle.

Typically, the transition from 3G to 4G, 4G to 5G et cetera have been big tailwinds to iPhone purchases. Upgrade cycles spur revenue growth of course, only to be followed by disappointing revenue/EPS growth and weak stock market performance the following year.

Analysts forecast only 3% revenue growth next year and 2% EPS growth. But, it could be far lower in 2023, especially should we have a recession. Note revenue declined in 2016 and 2019 after upgrade cycles ended.

5G rollouts have been ongoing since 2020. Indeed, the promises of 5G are incredible, with data throughput speeds of at least 1 gigabit per second (5x faster than current 4G speeds). Ultimately 5G could reach 20G/second speeds. Latency (delays) is also virtually eliminated from 100 milliseconds to only 1 millisecond with 5G.

The problem is that this could be the end all of upgrade cycles. Movies that took 7 minutes to download will only take 8 seconds with 5G speeds. And that is for ultra high definition 4k movies. How much faster will iPhone users need their internet to operate? Users visually will not be able to distinguish movies at much better than 4k levels, especially on a smaller device.

The use case for better than 5G speeds is largely limited to big data (self-driving cars perhaps being one application). But speeds beyond these are not likely to be ones you will ever need on your phone or laptop.

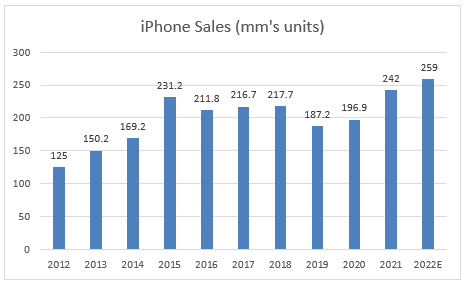

Below are iPhone unit sales which have been strong as 5G networks have been rolling out over the past 2-3 years.

iPhone Unit Sales (Author spreadsheet, Co financials)

But Apple iPhone sales are likely at cyclical peaks, with an estimated 259 million units shipped last year (FY ending September 2022).

Indeed, for the December 2022 quarter, Morgan Stanley (MS) estimates that iPhone shipments will fall 11% year over year (to 75.5 million units). While again this fall is partly due to supply chain issues, the cycle does appear to be weakening.

In 2023-2025, average analyst EPS growth estimates looks quite unimpressive at only 4.8% per year. The large of large numbers applies to Apple too. Growth gets tougher the bigger you become. Comps are very tough next year.

Interestingly, many investors view Apple as a consumer staple, deserving of a 20-23x multiple as a recession would not impact them as much as other technology players. We view this as not terribly likely. The secular growth story is fading especially as 5G buying demand is decelerating. Just because we have not seen a tech downcycle in a 3-4 year doesn’t mean that it isn’t out there. A weak upgrade cycle might indeed shock some investors.

Supply Chain Risk

A full 90% of Apple’s products are manufactured in China (and 98% of iPhones). With mounting tensions between the US and China plus ongoing lockdowns there (which do not appear to be abating as zero-COVID policies remain intact), there have recently been numerous delays in manufacturing Apple phones. Indeed, on November 6th, Apple reported that production of the iPhone 14s were at “significantly reduced capacity.”

While we view these as temporary headwinds, the reality is that Apple is desperate to reduce its manufacturing footprint in China. Their 2025 goal is to migrate 25% of their production to India.

But even then, 2/3s of production will come from China. Any global hiccup from the Chinese Communist Party, tariffs, crackdowns on Apple manufacturers, or especially risks related to Taiwan would be devastating to Apple. Nobody thought Russia would invade Ukraine, but the risk of China going after Taiwan is real and only a matter of time in our view.

Also, 19% of Apple’s revenue is within China. While military escalation surrounding Taiwan is probably a low probability risk, it is one that the market is entirely ignoring.

The pain that stocks like Alibaba (BABA) and Tencent (OTCPK:TCEHY) have struggled with is one to pay attention to.

Pandemic Demand Pull Forward

Certainly, a lot of demand was pulled forward during the pandemic. Services experienced particularly high growth as online shopping spurred food purchases online and a surge in app downloading.

As of today, consumers likely have purchased the Mac’s and iPads that they probably need for a while. iPhone sales did not really gather steam until 2021, but as we noted, iPhone unit growth will likely struggle with the 5G upgrade cycle now a couple years in.

So far revenue has been quite resilient. Even Apple’s CFO said in an interview with the Wall Street Journal that September quarter sales were “better than we anticipated at the beginning of the quarter.”

But Apple faces very tough comps heading into 2023 and consumers could also reduce spending on expensive Apple products in a recession.

Risk to Apple App Store and Services

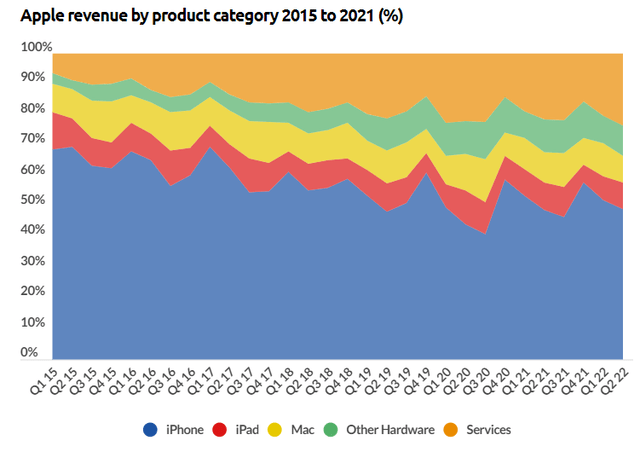

One element to the Apple bull story are its services, which are high margin and have been growing faster than any other part of the portfolio.

businessofapps

Services totals 20% of revenue at Apple, and probably are 25-30% of earnings. Korea, the UK, the US, and the EU are taking a hard look at the 30% commissions that app developers pay to Apple. If you open a coffee shop and sell through your app on Apple, Apple will get 30% of your revenue (with some exceptions its 15%).

We wonder why regulators continue to probe the card companies (Visa and Mastercard), who only charge 2-3% per transaction compared to the 30% platform fees that Apple takes.

We don’t know if there will be any kind of enforcement action, but the likelihood of fees falling and Apple paying fines is out there. Apple may reduce fees proactively in order to avoid government’s meddling here. Regulatory scrutiny against Meta Platforms (META) no doubt pushed that stock down (well before the iOS changes impacted its growth).

We also note the deceleration in services revenue last quarter as advertising revenue (Apple TV+) and online shopping slowed.

Valuation

The biggest risk to Apple stock is its persistently high valuation in the face of slowing growth. Cycle risk comes in two forms too as we see it: 1) economic cycle risk, as consumers are increasingly strapped and likely to reduce spending as inflation takes a toll, and 2) 5G upgrade risk as we have discussed.

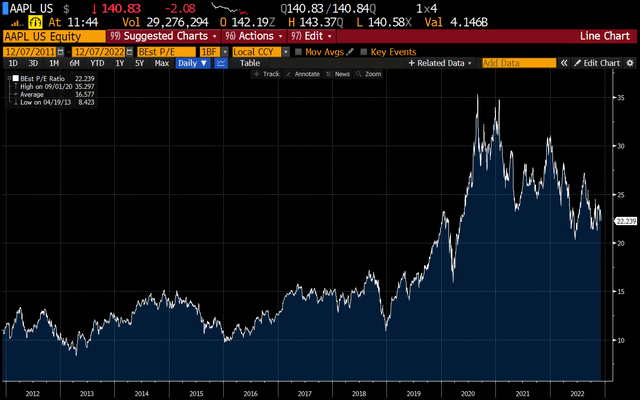

Today Apple is trading at 22.4x earnings (compared to 9.4x in 2011). High absolute and relative multiples on peak earnings, with slowing growth, seems a bad combination.

Below is Apple on a forward P/E basis since 2011.

Bloomberg

At 22.4x earnings with growth now looking slower than it has in years, the stock appears poised to re-rate lower.

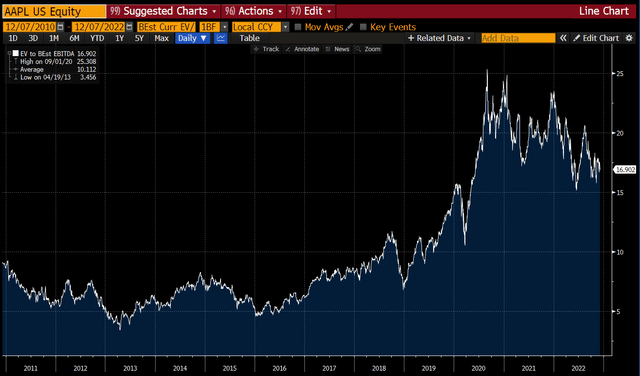

On an EV/EBITDA basis, AAPL now fetches a 17.0x forward 2023 multiple compared to its pre-pandemic average of 7.3x.

Today the S&P 500 trades at 12.0x 2023, putting Apple at a 40% premium to the S&P today.

Below is a graph of Apple’s EV/EBITDA valuation since 2011.

Apple EV/EBITDA Valuation (Bloomberg)

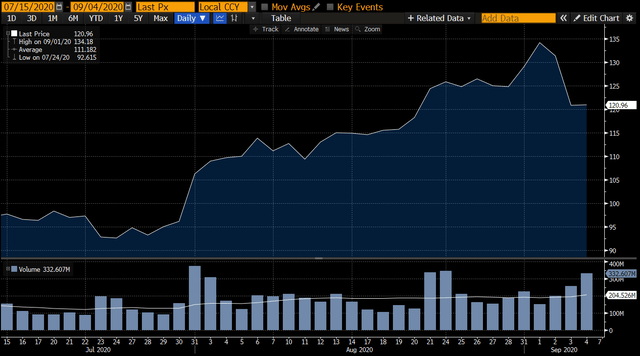

Notice how Apple’s valuation ran up in mid-2020. Many may or may not recall, but Apple split its stock 4-1 on August 31, 2020.

In the frenzied run up leading up to the split, Apple re-valued from 18.5x EBITDA to almost 25x EBITDA.

That 40% gain occurred in only 2 months, largely based on massive call buying from retail investors. The stock has stayed at elevated levels ever since.

Bloomberg

As we look at forward growth estimates, revenue is expected to grow by 3% in 2023, and 6% in each of 2024 and 2025. We are not going to pretend we can forecast earnings for a company as complex as Apple. But these are unimpressive figures for a company that trades at a growth multiple.

Assuming they hit these estimates and beat in 2026 ($8.00 in EPS vs $7.63 current estimates), then we come up with a number of valuation scenarios.

We see a range of $100 to $168 on Apple shares.

Valuation scenarios (Author Spreadsheet)

The bubble scenario might be 25x $8 in earnings, or $200 per share. That is roughly the highest analyst price targets, with an average of $173.

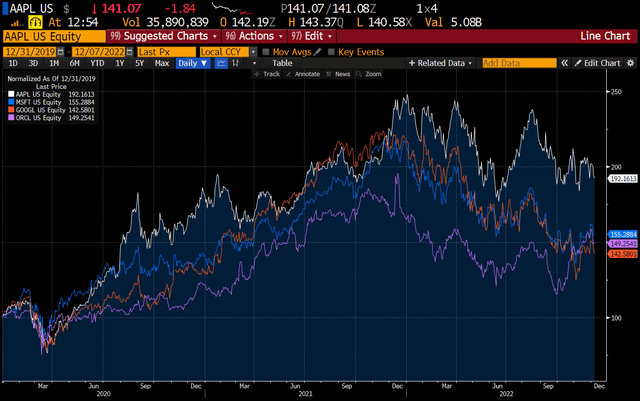

Other large cap tech names are probably the best comps. Google (GOOG) (GOOGL) trades at 10.2x 2023 EBITDA (40% cheaper than Apple). Microsoft (MSFT) trades at 15x 2023 EBITDA (15% cheaper) and Oracle (ORCL) trades at 11.6x 2023 EBITDA (35% cheaper). Google is expected to grow EPS over 2.5x as fast as Apple from 2023 to 2025. And, Oracle is expected to grow EPS over twice as fast as Apple in that time frame.

Note how Apple has outperformed the pack.

Bloomberg

Conclusion

The likelihood of continued valuation de-rating of Apple appears high as 1) higher interest rates and capital migration away from growth and into value names continues, 2) revenue and earnings growth appear to be slowing rapidly and 3) the market appears largely saturated with Apple products, with both the computer/iPad and iPhone upgrade cycles very long in the tooth.

On the downside, any hiccups with China would be a tail risk that could potentially devastate AAPL. While these are not likely scenarios, they are still non-zero probabilities, and not even remotely priced into the stock. Regulators may have something to say about Apple’s 30% take on their app store too. FWIW, Google, our favorite tech name, has zero exposure to China.

Valuation wise AAPL appears to be not quite at bubble levels anymore, but arguably Apple will not grow faster than the S&P 500, and yet trades at a 40% premium to the market.

Given the risks to the stock, we have no position in Apple and merely wanted to highlight the downside. If you are long, we recommend lightening here and selling above $150. Aggressive investors may consider a small short position between $150-160 per share, but admittedly there are better shorts among profitless tech companies with bad business models and excessive valuations.

Be the first to comment