matejmo/iStock via Getty Images

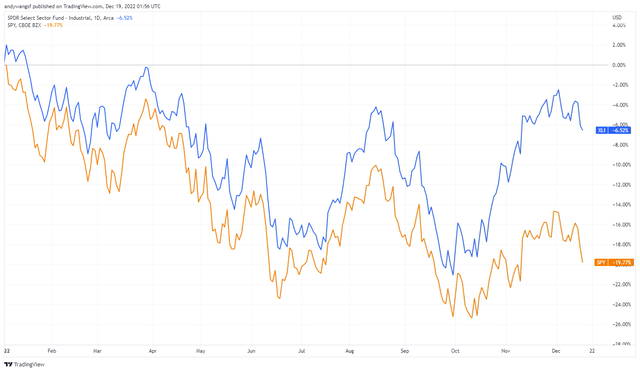

The Industrial Select Sector SPDR ETF (NYSEARCA:XLI) has significantly outperformed the broader SPDR S&P 500 Trust ETF (SPY) year-to-date, with the XLI down -6.5% compared to -19.8% for the SPY at the time of writing. However, we believe that the XLI’s stellar outperformance may begin to run out of steam in 2023.

To be clear, we continue to maintain our bullish call on the S&P 500 Index (SP500), a long-term view that we initiated on 13 October when the market bottomed out. However, within this broadly bullish view on the S&P 500, we identify XLI as one of the weakest links among U.S. equity sectors due to stretched valuations, especially for aerospace and defense stocks.

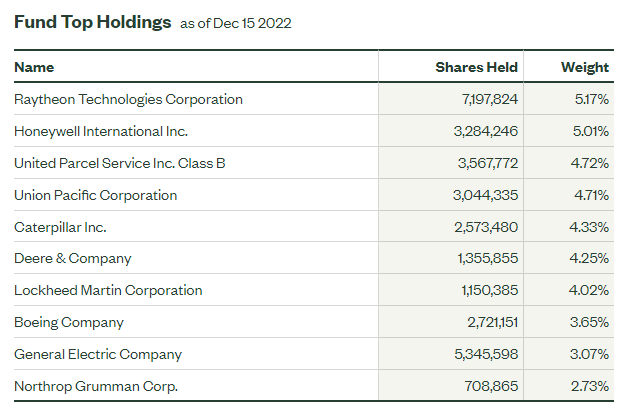

According to fund information provided by the issuer State Street Global Advisors, XLI traded at around 18.9x forward P/E and 4.6x P/B versus 17.1x forward P/E and 3.7x P/B for the SPY, as of 15 December. XLI’s higher valuation multiples were also accompanied by a much lower 3-5 year EPS growth estimate of 7.9% versus 11.4% for the SPY, further widening the implicit valuation gap between the two.

We view this valuation gap as a compelling opportunity for establishing a tactical relative value trade on the XLI and SPY with a 12-18 months trading horizon. Given that we have already established a bullish position on the S&P 500 with a “Strong Buy” rating since October, we now initiate our coverage of XLI with a “Sell” rating.

Stretched Valuations On Aerospace And Defense Stocks To Drag On XLI

The Russia-Ukraine war, which began on 24 February 2022 when Russia initiated a special military operation aimed at the demilitarization of Ukraine, appears to have evolved into a proxy war between NATO and Russia. Not only has the war created an immediate surge in demand for weapons to defend Ukraine, but it has also encouraged European countries and the Biden Administration to significantly increase defense budgets to bolster their armed forces.

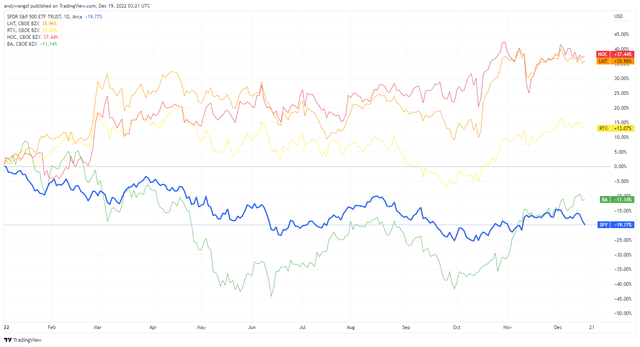

These developments are excellent news for aerospace and defense companies such as Lockheed Martin (LMT), Northrop Grumman (NOC), Raytheon Technologies (RTX), and to a moderate extent The Boeing Company (BA). As the accompanying chart shows, LMT, NOC, and RTX have not only outperformed the SPY but have also managed to achieve strong double-digit returns year-to-date. BA has only begun to outperform since October, as its defense business only makes up around one-third of revenues while its commercial airplanes business generates more than half of the total.

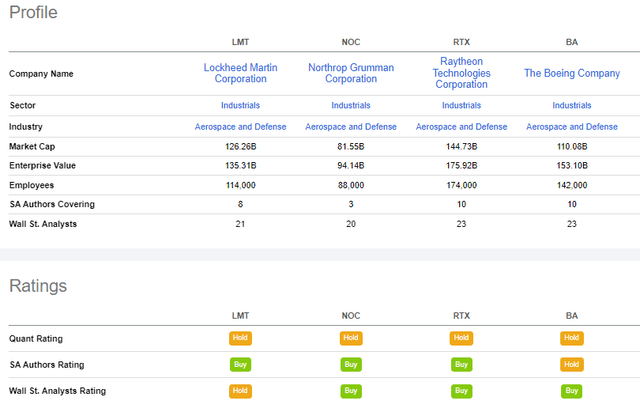

All four of these companies are among the top ten holdings of XLI’s portfolio, which helps explain the exchange-traded fund’s (“ETF’s”) spectacular performance of late. LMT, NOC, and RTX are trading at TTM P/E of 17.9x, 22.0x, and 21.4x, respectively, while BA is still struggling to turn profitable. Combined, these 4 companies make up around 15.6% of XLI’s portfolio.

State Street Global Advisors

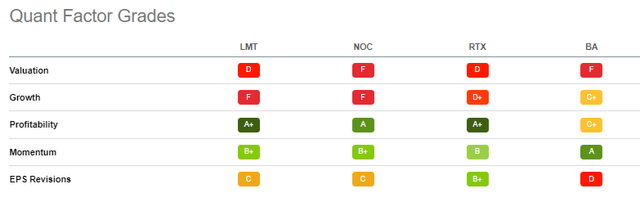

At the time of writing, Seeking Alpha’s proprietary Quant Ratings rate these four companies as a “Hold” with Factor Grades ranging from “D” to “F” for valuation and equally poor grades for growth.

These ratings highlight our view that valuations for aerospace and defense stocks have become stretched, especially given the limited scope for current earnings growth to be sustained in the coming years.

Although we acknowledge the possibility that geopolitical risks in Europe and Asia may intensify in the coming years, such risks seem to have already been reflected in earnings growth expectations and adequately priced into current valuations. Conversely, we think that the possibility of a moderation in China’s military spending or a Russia-Ukraine ceasefire may have been underappreciated by the market.

China Likely To Divert Spending Away From Military Expansion And Towards Stimulating Economy

The rapid modernization of China’s military capabilities and the country’s growing assertiveness over territorial claims in the South China Sea over the years, have encouraged neighboring countries in the region to boost military spending in response to escalating tensions. However, China’s military expansion has been extremely costly and is estimated to cost around US$229.47 billion in 2022, a 7.1% increase in defense spending from 2021. This level of defense spending also outpaces the country’s GDP growth target of 5.5% for 2022.

Given our existing view that China’s economy is likely to struggle to reopen meaningfully from the Covid-19 pandemic, and that the unfolding real estate crisis may have a lingering impact on the country’s economic growth, we see a good chance that Beijing may cut defense spending in 2023. At the very least, we see scope for a slowdown in China’s defense spending growth in the coming years as structural economic imbalances in China continue to unwind and weigh on economic growth.

More importantly, we suspect that the dynamics of recent geopolitical events – the condemnation of Russia’s invasion by the international community, China’s ambiguous stance on the war, and the U.S.’ renewed push to counter China’s economic clout and military presence in South East Asia – may have permanently shifted the geopolitical landscape in favor of a less assertive China in the coming years.

As China increasingly shifts its attention towards resuscitating and stimulating its economy, we certainly see the possibility of a more peaceful and uneventful geopolitical environment in the medium term. This should also reduce the impetus for defense spending growth across the region.

Russia-Ukraine Ceasefire A Wildcard For Defense Stocks

Although there appears to be little progress toward a peaceful resolution or a temporary ceasefire for the Russia-Ukraine war, the drawn-out war is looking increasingly unsustainable for Russia’s economy and politically precarious for Russian President Vladimir Putin. Thus, investors should not rule out the possibility of a Russia-Ukraine ceasefire in 2023, and the potential downside risks to aerospace and defense stocks that are trading at stretched valuations.

Industrial Select Sector SPDR ETF

Given how well XLI has performed year-to-date and the portfolio’s sizeable exposure to aerospace and defense stocks, the downside risks far outweigh the potential for further gains in the medium term.

Even investors who are adopting a more disciplined approach with a long-term allocation to XLI or the aerospace and defense sector should at least consider risk-mitigating strategies. Investors riding on substantial profits on these stocks may consider rebalancing portfolios to lock in gains, or to sell covered call options that limit upside potential in exchange for some downside protection.

For investors who are comfortable with taking short positions, our strategy of taking a long position on the broader SPY combined with a short position on the XLI is one of the most straightforward ways to execute a relative value trade. The high-risk alternative is to take a more direct approach by taking a short position on specific defense stocks, which we typically do not recommend and view as unnecessarily aggressive for our purposes.

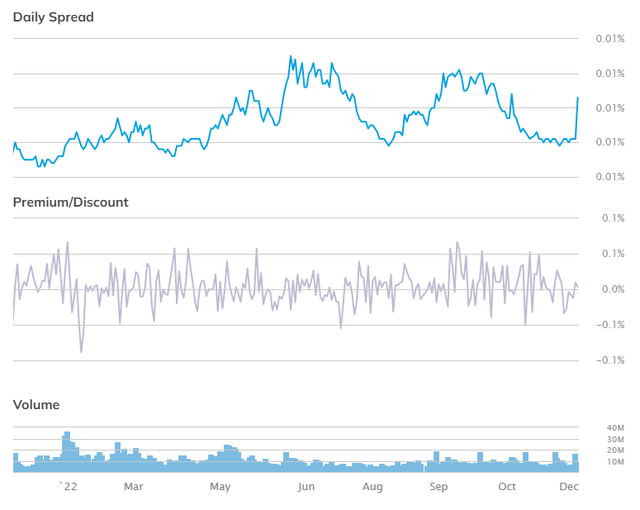

In terms of trading metrics obtained from etf.com, XLI is highly liquid and trades at very low and stable spreads with a high average daily volume of around US$942 million. XLI also trades very close to NAV with daily deviations of less than 0.1%.

In Conclusion

Despite our bullish view on the SPY, we identify XLI as the weakest link among U.S. equity sectors due to stretched valuations, especially for aerospace and defense stocks.

We view this valuation gap as a compelling opportunity for establishing a tactical relative value trade on the XLI and SPY with a 12-18 months trading horizon. We target a 10%-15% underperformance in XLI relative to SPY within this time frame.

Given that we have already established a bullish position on the S&P 500 with a “Strong Buy” rating since October, we now initiate our coverage of XLI with a “Sell” rating.

Be the first to comment