Volha Levitskaya/iStock via Getty Images

One of our favorite small-cap companies is Littelfuse (NASDAQ:LFUS), we wrote about them at the end of last year. Since then the company has posted terrific operational performance, but the share price has decreased together with the market. We thought this would be a good time to review the latest results from the company, see how the company is performing, and if they have become a strong buy at this lower valuation.

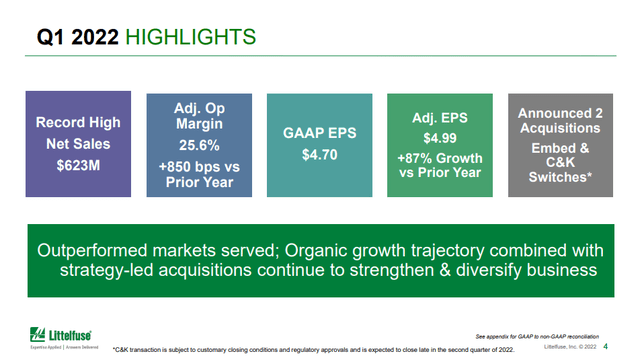

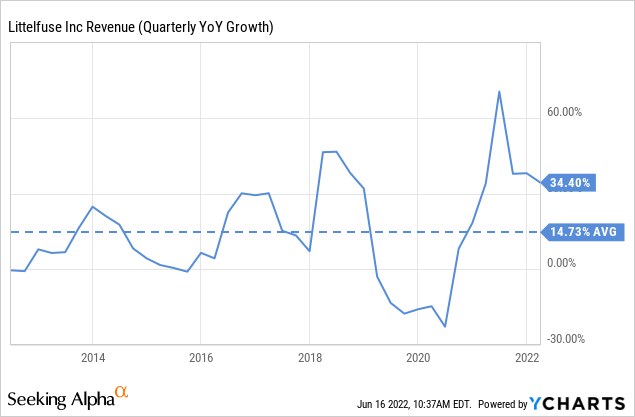

Littelfuse delivered outstanding Q1 results, significantly above expectations, with year over year revenue +34%, of which 22% organic, and adjusted earnings +87%. Adjusted operating margin was a remarkable 25.6%, and the company once again outperformed the markets it serves. This is a company that has delivered for years shareholder returns averaging +21% CAGR, and given the recent performance, we believe it might be able to continue doing so for still some time in the future.

Littelfuse Investor Presentation

Bolt-on Acquisitions

About half the growth for Littelfuse has been organic, and the other half has come through bolt-on acquisitions. In 2021, it completed two important ones, Hartland Controls and Carling Technologies. Hartland Controls added more than $100 million in sales, mostly in HVAC and e-mobility, while Carling added more than $180 million with a focus on commercial vehicles, 5G telecom, and data communications.

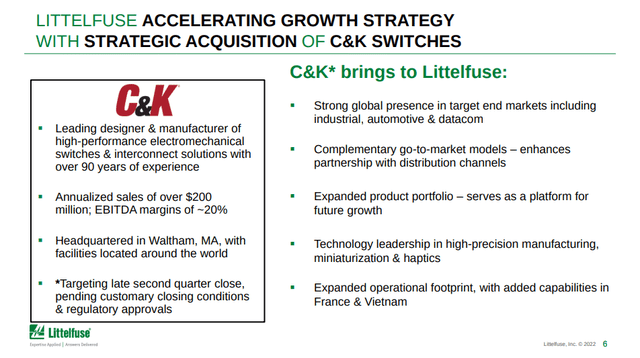

This year the company announced two other important acquisitions: embed, which is being purchased mostly for its technology, and C&K which is expected to bring over $200 million in sales. A more detailed description of C&K can be read in the slide below. What is important to remember is that historically the company has been able to make a success of exactly this type of bolt-on acquisition.

Littelfuse Investor Presentation

Financials

Littelfuse is very straightforward with investors on its financial framework detailing what investors can expect from the business. It guides to organic revenue growth of 5-7% CAGR and 5-7% growth coming from acquisitions. Earnings per share should grow faster than revenue, and operating margins should be in the 17-19% range. EBITDA margins are guided to be between 21-23%, with 100%+ free cash flow conversion. Capital expenditures should be ~4-5% of revenue.

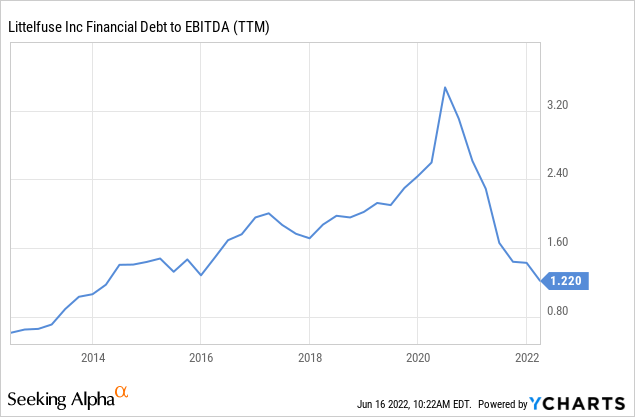

Littelfuse is looking to return ~40% of free cash flow to shareholders with the remainder to be used to help finance the acquisitions. It is currently in a great position to continue doing more bolt-on acquisitions, since it has deleveraged its balance sheet so much. Its target debt to EBITDA is between 1.5x and 2.5x, and it is currently below this target at ~1.2x.

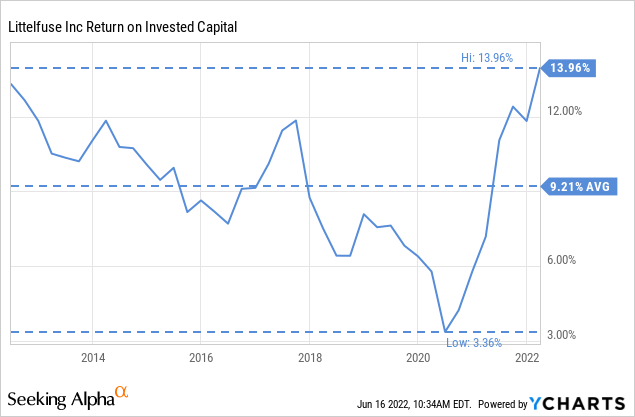

Its ROIC has been significantly improving the last few quarters, and it is now finally in the mid-teens again. For the last ten years, it has averaged 9.21%, which is quite respectable.

What has been more impressive is its revenue growth, which has averaged ~14% the last ten years, and has been running higher recently.

Valuation

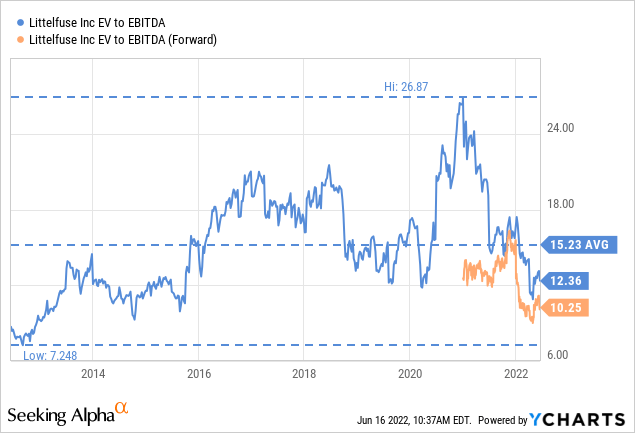

Thanks to the bear market we are currently in, the valuation has become a lot more attractive. At the end of last year EV/EBITDA was ~16x, it is now ~12x and the forward EV/EBITDA is even lower at ~10x.

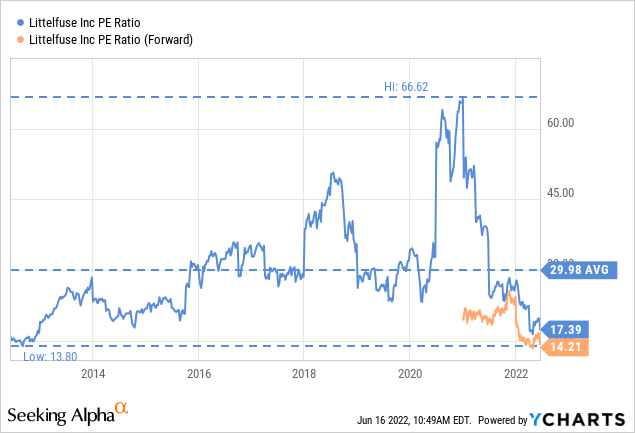

Similarly, when we covered the company at the end of last year its price/earnings ratio was ~27x, it is now 17x, and the forward p/e is only 14x. For a company that has been growing revenue and earnings as fast as Littelfuse we believe these are attractive multiples.

Growth & Guidance

Littelfuse’s best organic growth opportunities will come from vehicle electrification given that battery electric vehicles require five times the circuit protection content of an internal combustion counterpart. Charging infrastructure also presents a lucrative opportunity for the growing power semiconductor business.

With applications including wind and solar power, electric cars, and industrial equipment moving to higher voltages, there is a great opportunity to increase sales for the company.

With respect to the C&K acquisition, the company believes it will be accretive even after including non-cash deal amortization.

Risks

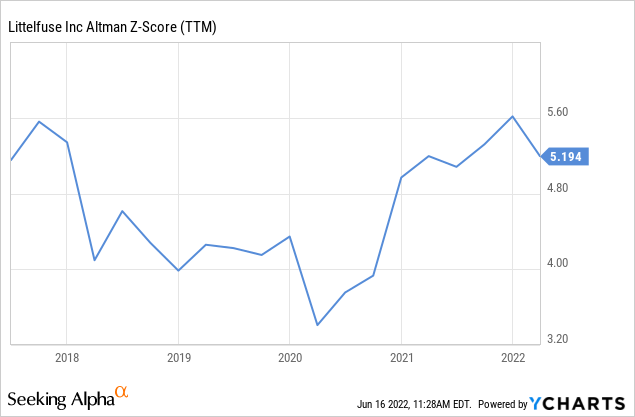

We do not see many risks except a continuation of the valuation compression, which can definitely make shares even cheaper given that we are now officially in a bear market. With respect to the company, we are not overly concerned since it is solidly profitable, and has a strong balance sheet. In fact, its Altman Z-score is safely above the 3.0 threshold considered safe. The main risk we do see is integration of all the bolt-on acquisitions.

Conclusion

Littelfuse has been very smart in aligning its portfolio toward the secular themes of safety, efficiency, and connectivity to pursue growth. Over the last ten years, the company has delivered impressive revenue growth, about half organic and half through bolt-on acquisitions, and given that the balance sheet is strong we expect further M&A to boost revenue and earnings. The most recent quarterly results from the company were impressive, and the company is now back to posting mid-teens ROIC. We see good prospects for further growth, especially as many applications continue to electrify and operate with increasingly high voltages.

Be the first to comment