mixmotive/iStock Editorial via Getty Images

Price Action Thesis

Paramount Global (NASDAQ:PARA) was in focus recently, as Berkshire Hathaway (BRK.A) (BRK.B) unveiled a recent purchase in May. However, even the Oracle of Omaha couldn’t prevent further digestion in PARA stock, as it continues to break lower lows.

Many investors focused on Paramount Global’s low EV/Sales multiple and concluded that it’s cheap. Well, considering its NTM revenue multiple of 0.98x, it’s hard to argue against the metric.

However, the market hasn’t agreed. Despite its extremely low revenue multiple, PARA stock is still mired in bearish bias, without indicating a double bottom bear trap to stanch its decline.

Furthermore, a series of bull traps following its early 2021 hype has hindered any recovery momentum from the dip buyers.

Our reverse cash flow valuation analysis also suggests that PARA stock is still expensive, despite its low revenue multiples.

Therefore, we believe it’s crucial for investors to consider why the market didn’t agree with their valuation framework.

As such, we rate PARA stock as a Hold for now.

2021’s Massive Bull Trap Continues To Haunt PARA Stock

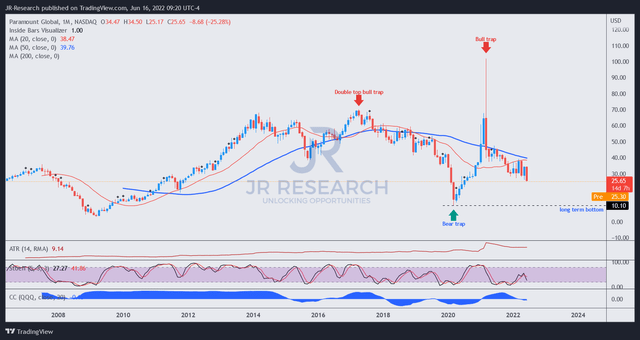

PARA price chart (monthly) (TradingView)

Despite its recent merger, bearish momentum has continued to dominate PARA stock. The pre-merger bull trap in early 2021 can be observed clearly above. Despite having a validated bear trap at its COVID bottom, the massive 2021 bull trap resolved its bullish reversal from March 2020’s bottom.

As a result, it sent PARA stock into negative flow (decisive bearish momentum), which it has failed to recover from. Therefore, investors must be aware that if they buy the dips in PARA stock now, they are going against its long-term flow.

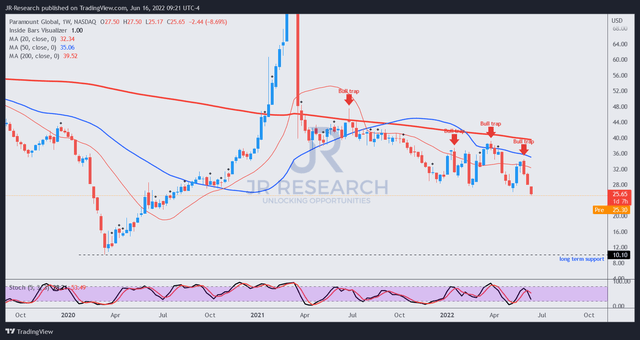

PARA price chart (weekly) (TradingView)

Zooming into its weekly chart, we observed a series of menacing bull traps clustered along its key moving averages. Notably, these bull traps formed after drawing in dip buyers over the past six months, breaking into lower lows after each sell-down.

Furthermore, we have not observed any significant bear trap that could stanch its bearish bias and reverse its momentum. Notwithstanding, we noted a potential bottom from its recent sell-off that could form in the near term.

But, we caution investors in buying the dip here. Despite its low revenue multiples, the market has not been convinced with its valuation (see the series of bull traps and bearish bias).

Valuation Doesn’t Seem Attractive

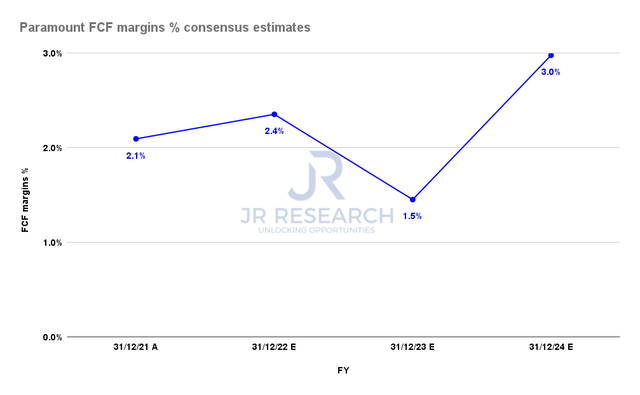

Paramount Global FCF margins % consensus estimates (S&P Cap IQ)

Paramount Global’s weak FCF profitability is highly sensitive to its revenue growth. As a result, the consensus estimates continue to see its revenue growth falling through FY23, given the weaker macro backdrop, before rebounding in FY24.

But, given its low FCF margins, the impact is estimated to be significant to its FCF margins, as seen above. As a result, its FCF margins are expected to decline to 1.5% in FY23 from FY22’s 2.4% estimates.

| Stock | PARA |

| Current market cap | $16.31B |

| Hurdle rate (CAGR) | 10% |

| Projection through | FQ2’26 |

| Required FCF yield in FQ2’26 | 4.5% |

| Assumed FCF margin in FQ2’26 | 2.5% |

| Implied TTM revenue by FQ2’26 | $42.97B |

PARA stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

Some investors may question whether a 10% hurdle rate is reasonable for PARA stock. We believe it’s the minimum that we require. Anything lesser, we would instead invest in the SPDR S&P 500 ETF (SPY) or an equivalent index fund. Therefore, we urge investors to be more stringent with their hurdle rates and don’t cut their preferred stocks any slack.

Notably, we used a 2.5% FCF margin, which may be conservative. But, we would rather be conservative, given its weak price action and bearish flow. Therefore, we leave it to PARA to surprise us by outperforming its FCF margins moving forward.

Moreover, investors should also ask themselves whether they are comfortable investing in companies like PARA with such weak FCF profitability.

Given our parameters, we require Paramount Global to post a TTM revenue of $42.97B by FQ2’26, an unlikely scenario. Therefore, PARA stock doesn’t seem attractive to us even at its current levels.

Is PARA Stock A Buy, Sell, Or Hold?

We rate PARA stock as a Hold for now. Our price action analysis suggests caution is warranted. However, a near-term bottom could form, but we do not envisage a double bottom bear trap price signal.

Our valuation analysis also suggests that PARA stock is unattractive, given its weak FCF profitability.

Therefore, we urge investors to give the market some time to deliver the double bottom bear trap trigger that indicates a sustained bottom.

Be the first to comment