Hispanolistic/E+ via Getty Images

US automotive retailers got a boost in 2021 from the drastic increase in new vehicle prices during the year. The disequilibrium between supply and demand, fueled by factors such as the chip shortage, pandemic-related supply chain shocks and recovering consumer demand, sent prices to unprecedented levels.

Not only did the average price of new vehicles in the US cross $40K in 2021 for the first time, but the pace at which prices increased year on year was also the fastest on record. The average price of a new car rose by just under $1800 in 2019, then just over $3301 in 2020, and then a whopping $6220 in 2021, according to data from vehicle valuation and automotive research company Kelly Blue Book.

Higher new car prices helped many US automotive retailers book supernormal growth in their revenue from new vehicle sales. However, even the most optimistic executives in the industry understand this is not a sustainable trend. Affordability has become a key issue – as has availability of units to sell – and many consumers are now turning to used cars.

Investors keen on adding automotive retail stocks to their portfolios need to consider names that have a winning used car strategy. They also need to look for names investing in initiatives that can grow the finance and insurance business line, as well the after-service business lines, both of which tend to have higher margins than new and used vehicle sales.

In our view, used cars, finance and insurance and after-sales will deliver future growth for auto retailers in the next 3-5 years given the challenges with affordability and availability in the new vehicle market.

The major auto retail stocks in the US are AutoNation, Inc (NYSE:AN), Penske Automotive (PAG), Murphy USA (MUSA), Lithia Motors (NYSE:LAD), Asbury Automotive (ABG) and Group 1 Automotive Inc (GPI).

These are all formidable and profitable players with operations in all the business lines in auto retail -that is, new vehicles, used vehicles, after-sales (parts and services), and finance and insurance.

However, AutoNation and Lithia Motors are the ones worth buying given how competitively positioned they are in relation to current market dynamics (used cars, after-sale and finance and insurance as current growth drivers). They are also undervalued with significant room for multiple expansion, despite strong revenue and EPS outlook for both.

Below are our main justifications for our opinion:

Solid used car strategy

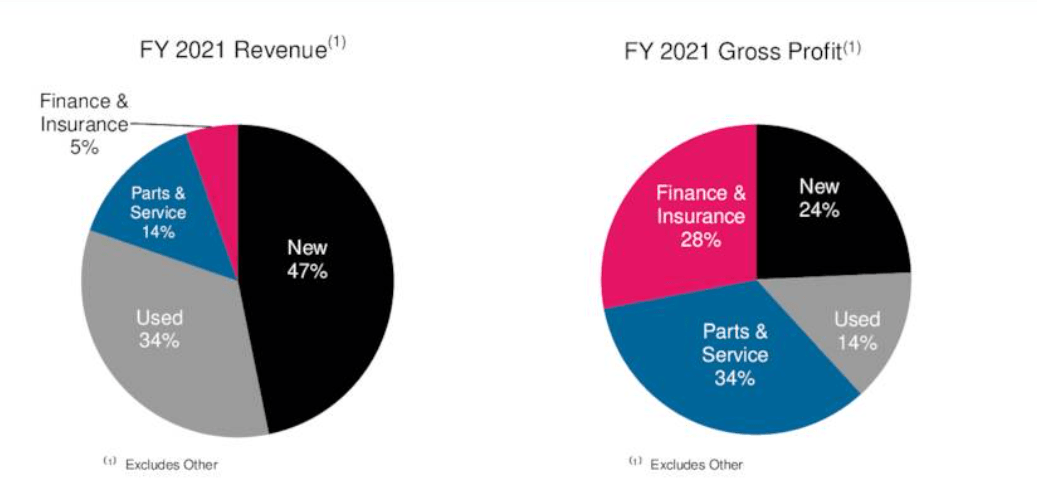

AN and LAD have similar profiles in terms of revenue mix and the contribution of their different business lines to their gross profits. Below is the data for AN as at December 31, 2021.

AN revenue mix and gross profit profile (Auto Nation Q4 Earnings Call Presentation)

By comparison, new vehicle sales accounted for approximately 49% of LAD’s revenue and approximately 29% of its gross profit in the year ended Dec 31, 2021. Used vehicle retail sales accounted for approximately 32% of its revenue and approximately 19% of its gross profit. Its parts and service and finance and insurance operations accounted for approximately 14% (combined) of its revenue and contributed approximately 51% of its gross profit (combined).

These numbers illustrate something very obvious but very important for this analysis – that is, used cars have lower margins than new cars. This means relying on them to offset the decline in new car volumes can only work if the strategy is intentional in terms of capturing new used car volume in a profitable way. AN’s and LAD’s used car strategies appear to have this important quality.

AN is building a strong focus on used car brands with AutoNation USA. The company has been aggressively adding new used car stores under the brand nation-wide, with a plan to add over 130 stores by the end of 2026.

According to CEO Michael Manley’s remarks in their February earnings call , all used car stores opened in 2021 were profitable within four months, ahead of plan. These stores, he noted, will serve as a pilot in terms of future store openings.

AN also has a sourcing strategy for used cars that enables it to maximize margins. As at Q4 2021, 90% of its used cars were self-sourced, limiting reliance on auctions which are more costly and negative for margins. Moreover, the company now has a “we’ll buy your car” program under which they source directly from customers. This carries better margins. Overall, the company sold 304,364 used cars in 2021, up 26.2% from 241,182 in 2020, and above the 2019 pre-pandemic baseline of 246,113 units, according to its 10-K.

LAD, by comparison, is growing its used car footprint primarily through its e-commerce platform. It sold 203,956 used cars in 2021, compared with 161,441 in 2020 and 159,295 in 2019. Used car same-store sales revenues increased 39% and volumes increased 11% in 2021.

LAD, like AN, is also focusing on sourcing directly from consumers, which carries higher margins and ensures it grows profitably.

We sourced 74% of used vehicles direct from consumers, and 26% were from other channels such as auctions, other dealers, or wholesalers,” said CEO Bryan Doboer during its February earnings call.

Digitization and expansion to boost F&I and after-sales revenue

Finance and Insurance and after-sales (parts, repairs and maintenance) generally yield higher margins than vehicle sales. For LAD, these business lines combined yield around 51% of the gross profit, and for AN, the figure is closer to 62% of Gross Profit.

After-sales revenue is largely a function of the size of a dealer’s customer base. As both LAD and AN continue to expand, albeit through different strategies, revenue from this business line will grow in tandem.

The big opportunity to supercharge growth is in finance and insurance (F&I), given the current interest rate environment with more hikes expected as well as the challenge with affordability; even used cars are getting more expensive as inflation gallops like never before.

LAD has been aggressive in growing Finance & Insurance revenue through its subsidiary Driveway Finance Corporation (DFC), which is integrated with its e-commerce platform. Through DFC, the company extends loans to consumers directly (captive lending), as opposed to arranging financing through a third-party. According to the company’s investor presentation, a loan originated with DFC contributed 3X the profitability of a loan arranged with a third party.

While the DFC loans are still in the early days, LAD is confident that penetration will grow exponentially without affecting its relationship with third party lenders. DFC’s penetration rate is approximately 4% and the company is targeting around 15%.

AN has not yet launched its own captive financing products, but is “aggressively looking” into it, according to statements from its CEO Michael Manley during its last quarterly call. “I think it’s important for the largest automotive retailer in the country to be able to offer finance through a captive where we can tailor make services, where we can make sure that the relationships that we build with our customers are deep, where we can be flexible to make sure that we account for different cycles,” he said.

These are clear indications that both AN and LAD stand to benefit from increased growth of their finance and insurance segments, which will be highly positive for their margins.

The two auto retailers’ respective expansions – AN by investing in additional used car stores and LAD through new acquisitions – will also boost after-sale revenues, which again, is a positive for margins.

Efficiently run business and smart capital allocation strategy

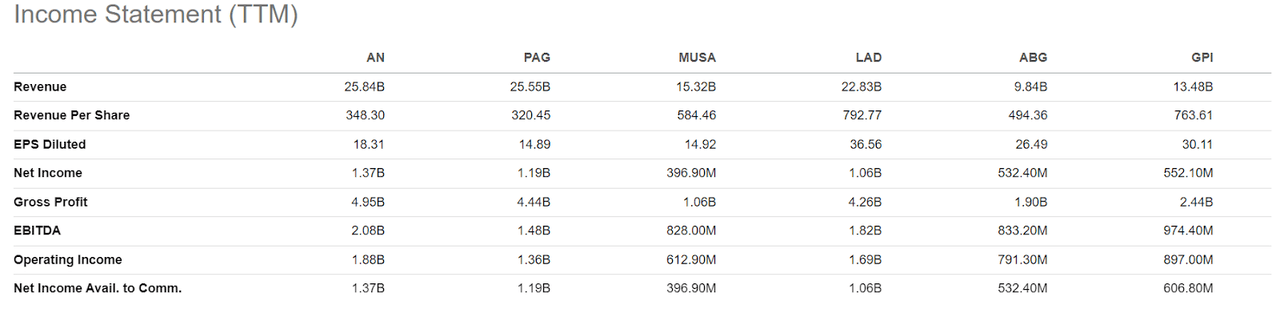

Last but not least, AN and LAD rank favorably relative to their peers when it comes to key profitability metrics, which gives them more flexibility financially to adapt to the many changes in their industry, (including growing EVs demand) without taking on unsustainable debt or diluting shareholders.

AN and LAD income statement vs peers (Seeking Alpha) AN and LAD profitability vs peers (Seeking Alpha)

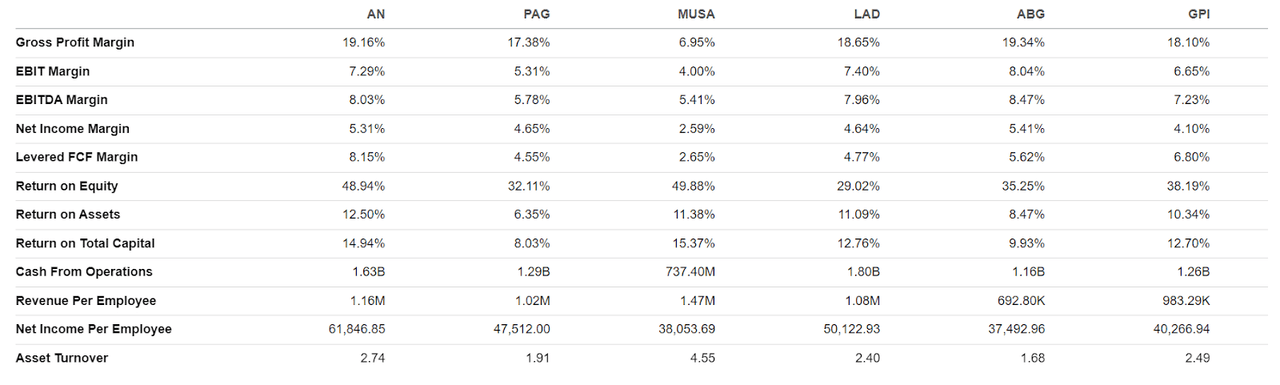

What’s encouraging is that AN continues to invest in digital capabilities to make its business more efficient and maximize margins.

AN Margin improvement (AN Q4 Earnings Call Presentation)

Longer term, AN expects the SG&A/Gross Profit to be in the mid-60% range, well below the pre-pandemic levels that were consistently above 70%.

These improved margins translate into rewards for shareholders as a key part of the company’s capital allocation strategy is share repurchases. The company repurchased 22.3 million shares in 2021, more than double what it repurchased in 2020 and 2019 combined. As of February 15, 2022, it had $776.3 million authorized for further repurchases. Repurchases reduce shares outstanding, rewarding investors by increasing the value of their existing shares and providing price support in the market.

LAD, on the other hand, uses its capital for M&A and has managed to maintain strong margins and generate good returns from its acquisitions thus far. While the company targets an annual after tax return of more than 15% for its acquisitions, it has averaged over a 25% return by the third year of ownership due to a disciplined approach focusing on accretive, cash flow positive targets at reasonable valuations, its 10 K states.

LAD in 2020 announced an ambitious five-year plan to yield $50 billion in revenues and $50 in earnings per share through 200 plus acquisitions. During 2021, it acquired 77 stores, opened one store, and divested nine stores. Assuming future acquisitions keep delivering the average return of 25% +, then the company looks well positioned to maintain and expand its above-industry margins. This is good for shareholders, considering LAD not only does buybacks (smaller than AN though) but also pays a dividend and has no plans to issue new equity (hence no dilution) to finance its acquisitions.

Conclusion

AN is up around 11% in the past month and 33% in the past 1 year, signaling some momentum. The fact that it has a short-interest of 12.61%, which is the highest in its peer-set, could also lead to short-term gains as short sellers cover their positions. LAD in comparison is down 11% in the past year, up 3.71% in the past month, but up 13.15% over the past three months, signaling some momentum as well.

Both are fairly cheap, with AN having a forward PE of 5.74x and LAD 7.89x. There is room for these two to grow from here. Given how competitively they are positioned in the current auto retail environment, and they look like attractive buys for long-term investors.

Be the first to comment