Mykola Pokhodzhay

Shares of Fidelity National Information Services (NYSE:FIS) have now lost about half of their value over the past 18 months. This puts them in the dubious category of stocks lower today than at the depths of the March 2020 bear market, and they have even lost 20% over of their value from five years ago. With just a 10x P/E and 2.4% yield, are they finally beaten up enough to consider buying?

Looking at the company’s second quarter, the results do not look bad enough at first to justify such poor share price performance, but there are concerns further under the hood. After all, revenue rose 8% on an organic basis to $3.7 billion, driving EBITDA up 5% to $1.6 billion and EPS up 7% to $1.73. EBITDA margins did contract 70bp to 43%, but the business is still growing. In fact, FIS grew revenue across each of its three business verticals. Fidelity is a fintech company that essentially helps manage the plumbing of the financial system, serving three primary groups of its customers.

First, its banking unit, which accounts for over 40% of the business, services everyone from money center banks to regional and community banks, helping them with risk management software, handling transfers between banks, across currencies, etc. This unit saw 6% revenue growth. Its merchant group services retailers with a particular emphasis on e-commerce. Here, revenue grew 14% led by strength in digital-first clients. FIS helps these companies process transactions, do FX transactions, and detect fraud. Finally, its capital markets group helps asset managers and brokers do derivatives analysis, record keeping, accounting, and risk management. Revenue growth was 7%.

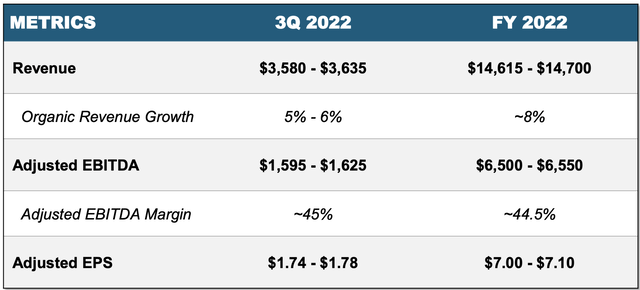

Alongside the quarter, the company provided Q3 and full year guidance. Organic revenue is expected to slow a bit in Q3 and then implied to rebound in Q4. The EBITDA margin is also expected to rise in Q3 by about 200bp and hold there in Q4 after contracting in Q2. If the company can achieve these objectives, adjusted EPS will finish the year around $7.05, giving the stock a sub-11x P/E.

Fidelity National Information Services

Looking at this guidance, I think investors need to be prepared for downside surprises to this forecast. First, about 24% of Fidelity’s business is overseas. 15% of the business is from UK and Europe, and currency was expected to be $200 million drag for the full year. With the dollar now up over 15% against many currencies, this could be an over $400 million drag given its $3.4 billion in foreign revenue. Now, over the long term, currency swings may cancel out, but in the near term, it is a headwind.

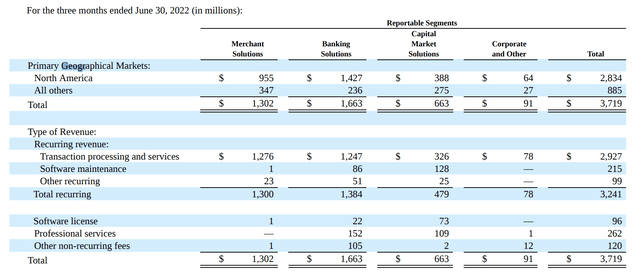

Second, over 80% of the company’s revenue is recurring in nature-a reason I believe some of the more existential doubts over the company are overstated (I will discuss more below)-but as you can see in the following table, 90% of its recurring revenue comes from transaction processing and services. Again, this is facilitating the movement of money from Point A to Point B. This revenue is recurring in that FIS is not bidding on each transaction to process. Rather, it has a contract to handle all transactions over a given period of time; however, the revenue will move up or down based on how many transactions occur.

Fidelity National Information Services

In the third quarter, Fidelity saw sequential volume decreases in its merchant segment of 5%. The company was still able to generate revenue growth thanks to pricing gains and new customer wins. If the economy slows, there will be pressure on volumes, which in turn poses downside risk to revenue. Expectations are for the holiday season to have a slowing in e-commerce growth. Given how much higher natural gas prices are in Europe, I would not be surprised to see FIS’s foreign revenue underperform its domestic business.

Finally, Fidelity’s balance sheet is a mixed bag. On the bright side, debt/EBITDA is now at the company’s 2.9x target, after it paid down $675 million in the quarter. After its WorldPay acquisition, FIS had to prioritize debt reduction and has now achieved that, which should open the door to greater shareholder returns. That is the good news. The bad news is that while its $18.5 billion in debt has a weighted average interest rate of 1.2%, 38% of its debt is variable rate. That means with the Federal Reserve, European Central Bank, and Bank of England raising rates, its interest expense will rise. Each 100bp increase in interest rates will increase interest expense by about $75 million per year, and based on the current dot plot, rates may get 1.5-2% higher than was estimated a few months ago. So while it is good FIS has brought its debt total down, its exposure to rising interest rates negates this to a degree.

If we assume, the company only achieves half of the EBITDA margin expansion given slowing transaction activity and the higher interest rates, Q3 EPS could be a bit below $1.70. For the next 12 months, given higher rates, a strong dollar, and less margin expansion, net income could face a $250-$325 million headwind. That is about a $0.48 cent hit to EPS, or about $6.60 in earnings power for an 11.5x forward P/E.

That multiple is not particularly expensive, especially considering it generated $806 million in Q2 free cash flow. With its leverage target achieved, it is turning on its buyback machine. During Q2, it bought back $300 million in stock, and it is targeting $3 billion for the full year, or about $2.6 billion in H2. Given management is targeting a 95% free cash flow conversion rate, that implies about $3.9 billion in free cash flow based on my run-rate earnings. Its dividend costs about $1.1 billion, so this buyback will be partially funded by cash on hand or incremental debt.

Still, this is a highly free cash flow generative business that will be able to take out 5-6% of its share count a year from free cash flow supported buybacks at the current share price. Over time, this can help support EPS growth.

There is also this concern that FIS is somewhat of a “melting ice cube.” For years, there has been speculation that decentralized finance, new fintech companies, a Central Bank Digital Currency, or blockchain technology could fundamentally alter how bank transactions occur, threatening the core of FIS’s business. Thus far, these threats have not really been realized. FIS also does sign contracts with its customers-again while it is exposed to transaction volumes, this is why its revenue is largely recurring. Even if a monumental shift were to occur, these contracts would slow erosion in FIS’s business and buy it time to adapt. Moreover, FIS’s software is embedded in bank and merchant systems; the cost of switching, both in terms of time and money, is not zero. As the economic outlook darkens, there will likely be less interest to take on cost to switch away from entrenched providers.

Finally, it is worth noting that Fidelity is powering Block’s (SQ) Cash App Card. Block is often cited as a leading fintech disruptor, but Fidelity is working with them, not being marginalized by them. This should be a source of relief for investors over the long-term.

In the very near term, I think it will be hard to change sentiment around the stock, particularly when risk to results over the next couple of quarters is to the downside given currency, interest rates, margins, and transaction volumes. While the share buybacks may be accretive over time, I do not think they are enough to lift the stock. Indeed based on guidance, the company has accelerated its repurchases in Q3 and shares have remained weak. At 11-12x earnings with downside risk and fears over long-term competitive threats, the stock is not yet compelling to step in. If shares fall into the mid-$60s, I would be a buyer as 10x earnings is too cheap given my view the company has sufficient long-term viability. But for now with about 15% of downside, investors should avoid FIS, which remains a value trap.

Be the first to comment