onurdongel

Kinder Morgan (NYSE:KMI) has been a surprising source of stability amidst great market volatility. The stock remains below pre-pandemic levels in spite of an attractive commodity pricing environment, though at least the stock has not plunged nearly as much as high-growth sectors. Yet the stock continues to offer a generous 6.5% dividend yield, one which gets safer by the day as its customers continue to generate excess cash from the high commodity prices. While I find some of its midstream peers to offer more compelling risk-reward propositions, KMI may be suitable for those looking for midstream exposure without the K-1 tax form.

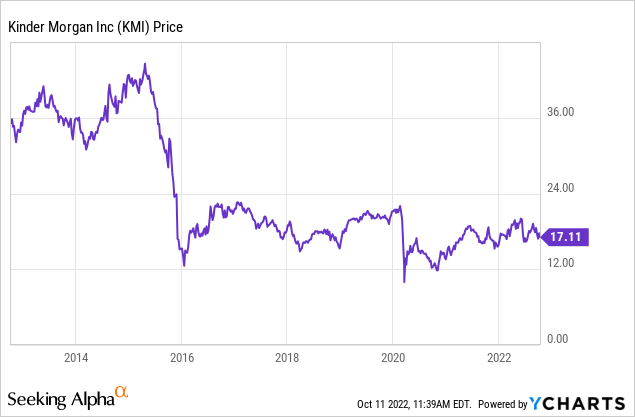

KMI Stock Price

Long-time KMI investors may still be sour about the poor returns over the past decade, but at the very least the stock has been quite stable over the past year, offering a safe haven from the tech crash.

I last covered KMI in July where I rated the stock a hold on account of there being better opportunities among peers. While I continue to hold that view, the sustained commodity pricing environment has likely improved the credit quality of its customers, helping to increase the safety of the dividend.

KMI Stock Key Metrics

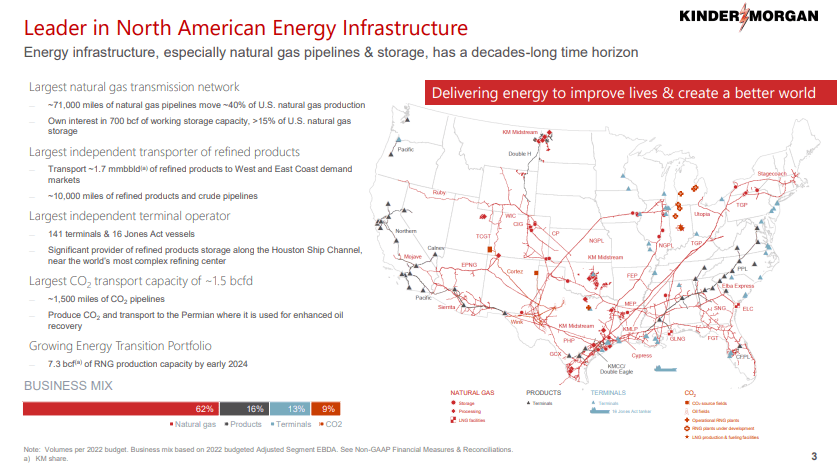

Not only is KMI a midstream operator without the K-1 tax form, but it also is one of the largest in North America. Of course, size is not all that matters, but it may help to justify a premium valuation.

September Presentation

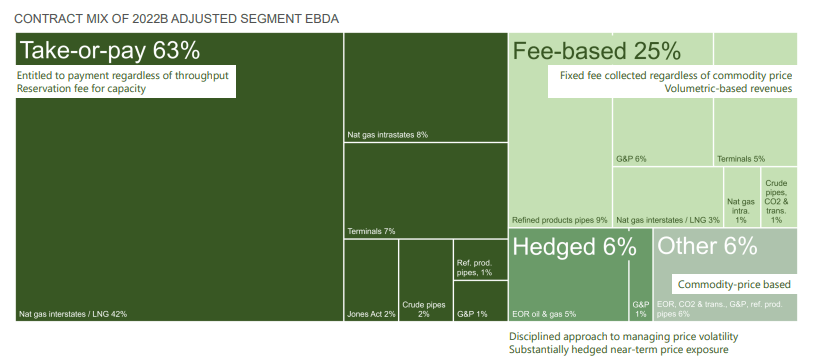

Amidst historic commodity prices, KMI’s earnings have not soared like E&P operators. That is because around 90% of its profits are either “take-or-pay” or fee-based. That payment structure helps to insulate KMI from fluctuations in commodity prices. Of course, in the current environment, some investors might not want insulation from commodity prices, but the downside protection enables the company to pay a consistent dividend.

September Presentation

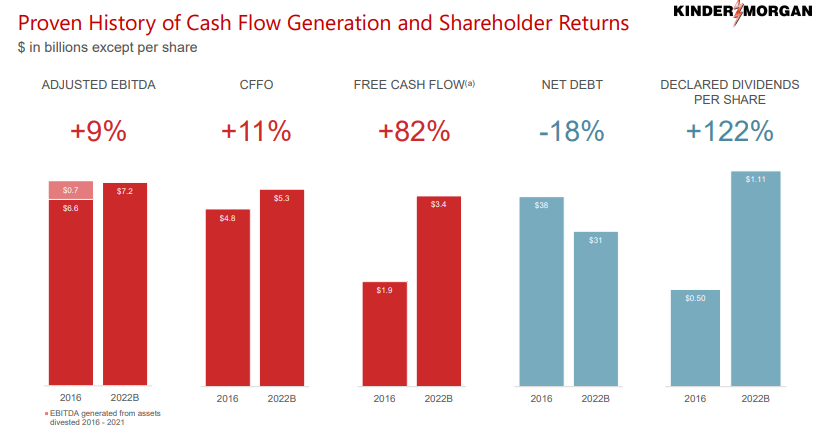

Since the 2016 crash in energy prices, KMI has made progress on increasing cash flows and reducing debt. Debt to EBITDA has declined from 5.8x to 4.3x, a notable achievement though still representing more leverage than high-quality peer Enterprise Products Partners (EPD). It is worth noting that much of the referenced progress was already achieved as of 2018, with much less progress since then.

September Presentation

The latest quarter saw distributable cash flow increase 15% to $1.176 billion. I welcome the company’s ongoing emphasis on DCF per share (which stood at $0.52) as this has historically been an industry which focused on nominal size as opposed to cash flow per share.

Leverage increased from 3.9x at year-end to 4.3x but the year-end leverage ratio was boosted by the Winter Storm Uri event of February 2021. Excluding that, leverage would have been 4.6x debt to EBITDA, reflecting improvement this year. Management continues to guide for around 4.5x debt to EBITDA, but in my view, the leverage target should come lower amidst a rising interest rate environment (but I am not running this business).

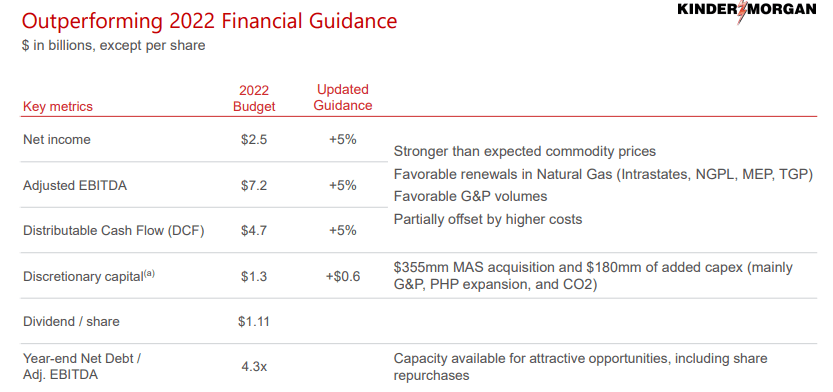

Looking ahead, KMI has increased its guidance for cash flows by 5%, reflecting the benefit from higher commodity prices. KMI does not directly benefit from higher commodity prices but stronger customer credit quality can lead to better renewal contracts.

September Presentation

So far this year, KMI has repurchased $275 million of stock at an average price of $17.09 per share, with much of those purchases coming in the latest quarter. That represents around 0.7% of shares outstanding, helping to complement the outsized dividend yield.

Is KMI Stock A Buy, Sell, Or Hold?

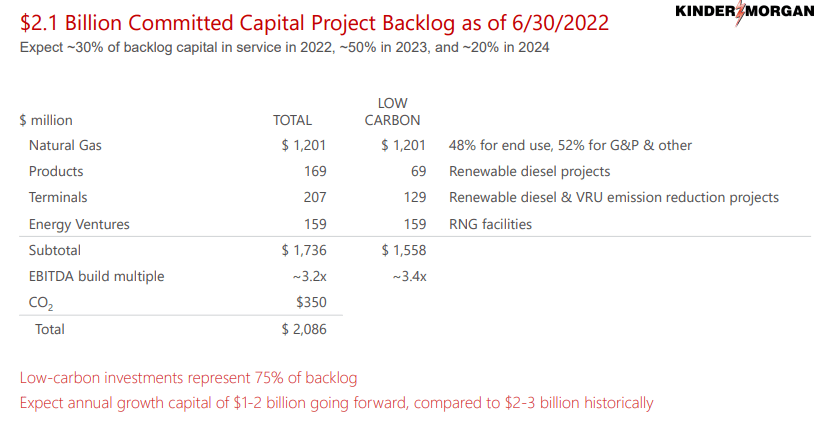

Like many peers, KMI has reduced its outlook for growth capital spending but has still maintained a focused pipeline on high-return projects.

September Presentation

The stock trades at a higher yield than it has over the past 5+ years.

Seeking Alpha

But that may be deceiving because KMI had previously reset its dividend following the 2016 oil crash. KMI had previously guided towards a $1.25 per share dividend by 2020, but the dividend currently stands at only $1.11 per share. It appears that management had been too optimistic in their dividend growth projections. That however does not mean that management has given up on the stock price.

On the earnings call, management stated the following with regards to what they plan to do with the stock price.

Well, I’ve learned a long time ago that the ability of management team to influence the stock price is pretty remote. But let me just say and the point of what I was trying to do is I think there — it’s not just Kinder Morgan. I think there’s a tremendous disconnect between the way the market is valuing midstream energy companies. For instance, there’s much more of a correlation with crude oil prices in our stock than there ought to be. As we tell everybody at the beginning of the year, exactly how much the impact is per dollar of change in crude and natural gas prices. And of course, that’s a relatively small number of lessons as you get further into the year. That’s just one example of, I think, kind of a knee-jerk reaction in the market.

I think the best thing we can do as a management and Board is to stress again and again the strength of our cash flow and the fact that we’re using it wisely. And I think we demonstrated that in this quarter in the way we’ve deployed our cash. So, that’s our game plan, pretty simple and not very imaginative really. But I think in the long run — maybe we’re the tortoise versus the hare. But in the long run, I think we get rewarded for the kind of performance we have produced now quarter after quarter after quarter.

In my opinion, shareholders have every right to be impatient with management here. The playbook for higher stock prices is not that complicated – reduce leverage and return to more aggressive dividend growth. But debt to EBITDA of 4.3x this year is barely changed from 4.5x in 2018, and management does not seem eager to bring that leverage ratio down lower. Yet valuation always matters at some point, and every passing month of high commodity prices helps to further strengthen the 6.5% forward dividend yield. As its customers continue to pile cash on their balance sheets, I expect the downside potential to narrow more and more, helping to justify higher multiples. I could see KMI re-rating to a 5.5% yield, representing 15% upside from multiple expansion alone.

What are the key risks? KMI shares all the typical risks of a midstream operator including that of tail-end secular headwinds in the energy sector. But unique to this name is that of management execution. I have already mentioned how leverage has been more or less unchanged over the past 4 years. Investors have been waiting for an acceleration in cash flow growth year after year but have been more or less met with disappointment. For this reason, I continue to favor names like EPD or Magellan Midstream Partners (MMP) as they offer higher yields and stronger management execution, though they do issue K-1 tax forms. Another risk is that of rising interest rates. Because KMI has a higher leveraged balance sheet, there is a likelihood that it will need to refinance debt maturities at higher rates. Its debt maturities are staggered, meaning that such headwinds should be gradual, but I reiterate that I would be more comfortable with management decreasing its target leverage ratio to the 3.5x range. I rate KMI a buy for dividend investors looking for midstream exposure without the K-1 tax form.

Be the first to comment