SimonSkafar

Eversource Energy (NYSE:ES) is a regulated electric and natural gas utility serving the New England states of Massachusetts, Connecticut, and New Hampshire. This is one of the most populated areas of the country so the company has quite a large customer base despite its comparatively small geographic area. The company still shares many of the same characteristics that have made most other regulated utilities reasonably attractive to conservative investors such as retirees. These characteristics are relatively stable cash flows coupled with a respectable dividend yield. Indeed, the company’s current 3.40% yield is certain to be attractive to most income-seeking investors, particularly in today’s market. The fact that Eversource Energy also has a reasonable valuation only makes it more attractive to investors. However, the company has made a number of changes since the last time that we looked at it, which have had a noticeable impact on our investment thesis. Overall though, the company still remains an investment that should appeal to most people that are looking for a relatively stable core holding that provides a reasonable source of income.

About Eversource Energy

As stated in the introduction, Eversource Energy is a regulated electric and natural gas utility that serves the New England states of Massachusetts, Connecticut, and New Hampshire. These states are among the most highly populated in the United States, serving approximately 4.4 million customers in the region. This makes the company one of the largest in the nation in terms of customer count. However, it still shares many of the characteristics that make utilities attractive to conservative risk-averse investors. One of the most important of these characteristics is that the company enjoys remarkably stable cash flow over time. We can see this by looking at the company’s trailing twelve-month operating cash flow in each of the past several quarters:

Seeking Alpha

It should be quite easy to understand why this would be the case. After all, most people consider electricity and natural gas services to be a necessity in our modern world. As such, they will usually prioritize paying their utility bills ahead of discretionary expenses during periods of time when money gets tight. This could be very important given the increasing number of signs that the United States is in a recession that could last for quite some time. The definition of a recession has always been two consecutive quarters of declines in the gross domestic product, which we saw in both the first and second quarters of 2022. Thus, the United States is technically already in a recession, despite media claims to the contrary. Furthermore, there are signs that the United States will see a third-quarter decline in the gross domestic product, which I pointed out in a recent article. The reason that this is important for Eversource Energy is that disposable incomes tend to decline during recessions, particularly among the most vulnerable segments of the population. As a result, investors may want to focus on reliable and stable companies in the near term as these companies will weather the economy better than those dependent on discretionary income. Eversource Energy certainly fits that bill.

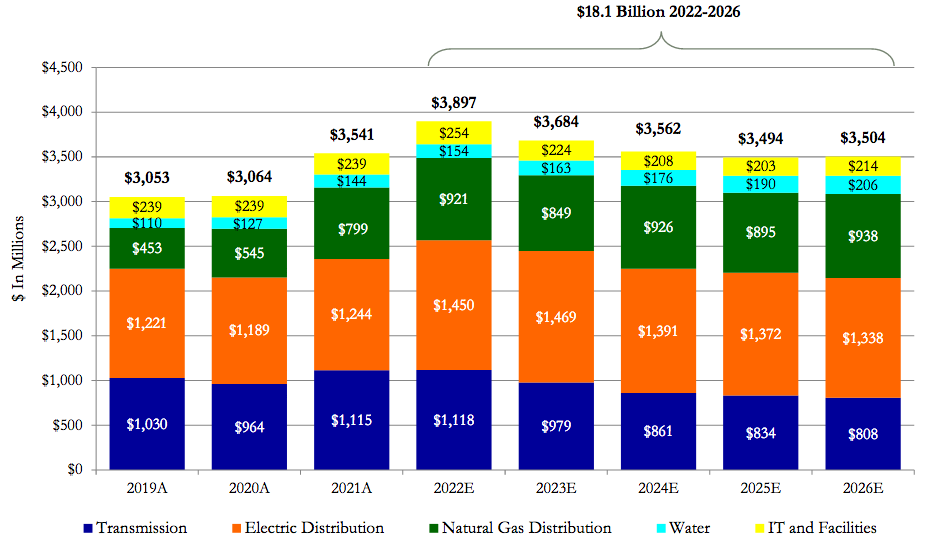

Naturally, as investors, we are interested in much more than mere stability. We also want to see growth. Eversource Energy is well-positioned to deliver this growth over the next few years. The company will accomplish this by growing its rate base. The rate base is the value of a utility’s assets upon which regulators allow it to generate a specified rate of return. As this rate of return is a percentage, any increase in the value of the rate base allows the company to increase the prices that the company charges its customers in order to earn that specified rate of return. The usual way that the company accomplishes this rate base growth is by investing money into upgrading, modernizing, and possibly even expanding its utility-grade infrastructure. Eversource Energy is planning to do exactly this. Over the 2022 to 2026 period, Eversource Energy will be investing $18.1 billion into growing its rate base:

Eversource Energy

This should allow the company to grow its earnings per share at a 5-7% rate over the projection period, which is admittedly lower than a few other utilities in the sector as when we combine this with the current 3.40% dividend yield, it only gives investors an 8% to 10% total return over the period. The company also narrowed its guidance for 2022 as a result of its second-quarter results. The company now expects to earn $4.04 to $4.14 for the full-year period, which is a 4.66% to 7.25% increase over the $3.86 per share that the company earned during the full-year 2021 period. Obviously, the low end of this guidance is below the 5% minimum earnings per share growth that the company is projecting over the long term, which could be a sign that Eversource Energy’s actual growth rate will be closer to 5% than 7% over the 2022 to 2026 period.

The New England states tend to be among the most progressive in the country and as might be expected, these states have some of the most stringent standards for greenhouse gas emission reductions over the coming years. Indeed, the region as a whole is requiring that greenhouse gas emissions be reduced by 80% by 2050. As might be expected then, Eversource Energy is very active in developing various renewable energy projects. As is the case with most other utilities, two of the areas that it is focusing on are wind and solar. However, the location of New England gives it a few opportunities in this area that other utilities cannot exploit. The most notable of these is offshore wind. As I have noted in various past articles on Eversource Energy, the company has entered into a 50/50 joint venture with Denmark’s Ørsted (OTCPK:DNNGY) to construct three offshore wind farms, two of which are intended to serve New York City and the third (Revolution Wind) will provide power to Connecticut and Rhode Island:

|

South Fork Wind |

Revolution Wind |

Sunrise Wind |

|

|

Service Territory |

NY |

CT, RI |

NY |

|

Output Capacity |

130 MW |

704 MW |

924 MW |

|

In Service Date |

Late 2023 |

Late 2025 |

Late 2025 |

One of the nice things about all three of these projects is that the joint venture has already obtained power purchase contracts for each of these projects. This is something that is quite necessary in order to make renewable projects viable due to the unreliable nature of renewables. After all, wind power does not work when the air is still. Thus, the power generated by these facilities can be rather variable, which results in the cash flow being variable if the electricity is just sold as it is produced. A power purchase agreement ensures that the cash flow from the project is stable over the long term (each of the three projects that Eversource is working on has a twenty to 25-year contract). This makes them economically viable. As the projects are all coming online over the 2023 to 2025 period, we should begin to see an impact on Eversource Energy’s cash flow around that time.

Unfortunately, Eversource Energy has announced that it will likely sell its stake in the joint venture, although few details have emerged. In fact, the company does not yet have a buyer for the business and despite management’s optimism that the projects will be sold; it is possible that nobody will ultimately emerge as a buyer. The company needs the assets to sell for approximately $3 billion in order to replace the revenues that the projects will generate for it. Thus, we can quickly see that it will be a very significant loss if the joint venture is actually sold. However, it may be for the best in the long term. Eversource has a substantial amount of debt coming due next year and $3 billion would go a long way toward helping it reduce its debt as opposed to needing to roll it over. When we consider that a rollover would significantly increase the company’s interest costs given our current environment, which would naturally be a drag on the company’s profits. Thus, the loss of these projects may not necessarily be a bad thing but it will still represent a reduction in the company’s growth prospects. There is also, once again, no guarantee that this sale will actually go through.

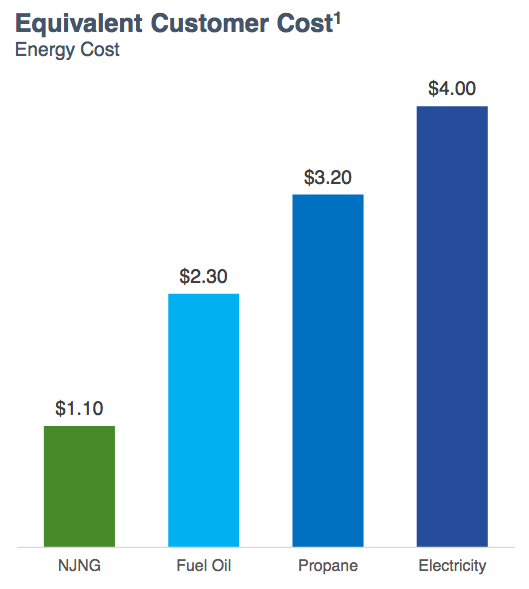

The loss of these projects does not mean that Eversource will be completely out of the renewable energy development space. The company will still have the onshore projects that it is working on. One of these is a networked geothermal project to provide both heating and cooling to a group of homes in Framingham, Massachusetts. This system could work quite well in New England given the climate of the region. Many sustainable energy activists are attempting to use electricity as a method of space heating to replace fossil fuels but this has a very big problem in cold climates like New England. Most notably, electricity is much less efficient at producing heat than fossil fuels and despite the steep increase in fossil fuel prices that has taken place over the past year, it is substantially more expensive to heat a home with electricity compared to fossil fuels:

New Jersey Resources/Data from EIA

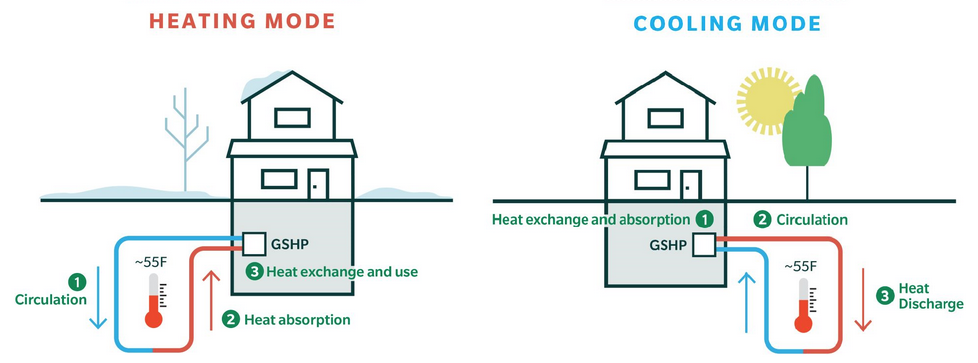

Geothermal heating and cooling rely on the fact that temperatures deep underground tend to be much more consistent year-round (approximately 55 degrees Fahrenheit):

Eversource Energy

This should make the system much more affordable to use than a traditional heat pump because the heat exchanger is relying on a constant temperature as opposed to having to heat up the outside air in the winter and cool it down in the summer. Eversource Energy will make money on this by charging the customers a fixed fee to access the geothermal network as well as charging the customer for the electricity that is used to power the geothermal heat pump that is in every customer’s home. As Eversource is paying an enormous amount of money to construct the network, it is uncertain how profitable it will ultimately be for the company, which is admittedly concerning. This is why the company is currently only covering a single neighborhood with this system. If it proves profitable, it could be well positioned to expand it elsewhere and ultimately provide a “green” source of heating and cooling that is far superior and more affordable than traditional electric heat pumps. This could thus be a growth area for the company over the long term as well as a significant competitive advantage for the company as no other peer company is currently using a technology such as this.

Financial Considerations

It is always critical that we analyze the way that a company is financing its operations before investing in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid. This can cause a company’s interest costs to increase after the rollover depending on marketing conditions, which is one of the big problems with the significant debt slug that Eversource Energy has coming due next year. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a decline in cash flows may push the company into financial jeopardy if it has too much debt. Although utilities such as Eversource Energy tend to enjoy remarkably stable cash flow, bankruptcies are not unheard of in the sector so this is still a risk that we should not ignore.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which the company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of June 30, 2022, Eversource Energy had a net debt of $21.3938 billion compared to $15.2128 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.41. Here is how that compares to a few of the company’s peers:

|

Company |

Net Debt-to-Equity |

|

Eversource Energy |

1.41 |

|

DTE Energy (DTE) |

2.23 |

|

AES Corporation (AES) |

4.06 |

|

FirstEnergy Corporation (FE) |

1.82 |

|

Exelon Corporation (EXC) |

1.60 |

As we can see, Eversource Energy is fairly conservatively financed compared to many of its peers. This is nice to see as it means that the company’s leverage should not pose any significant risks to the company’s investors compared to the risks also faced by the firm’s peers. This should overall provide some comfort to the company’s investors as there is nothing really to worry about.

Dividend Analysis

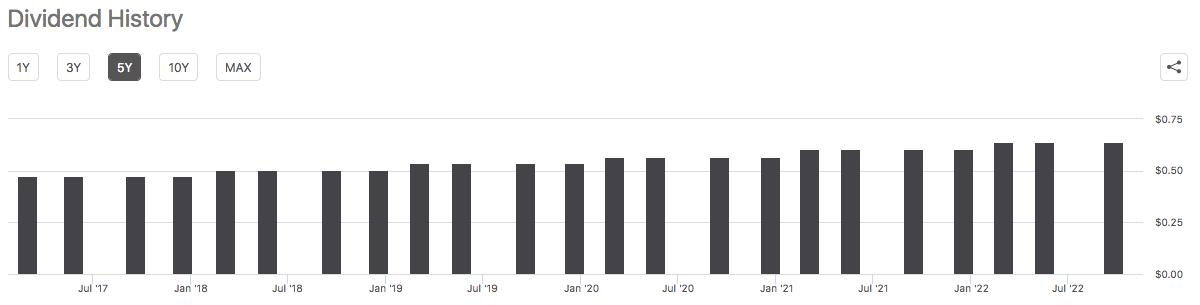

One of the primary reasons why many investors purchase utilities like Eversource Energy is because of the outsized dividends that these firms typically possess. Indeed, the stock yields 3.40% at the current price, which is substantially higher than the 1.72% yield of the S&P 500 index (SPY). Eversource Energy also has a long history of raising its dividend on an annual basis:

Seeking Alpha

The fact that the company is consistently increasing its dividend is quite nice to see in inflationary environments like the one that the United States is in today. This is because inflation is constantly reducing the number of goods and services that can be purchased with the dividend that the company pays out. This can make it feel as though one is getting poorer and poorer with time. This can be a very big problem for people like retirees that are depending on the income from their portfolios to pay their bills and cover their cost of living. The fact that Eversource Energy is giving its investors a raise every year helps to offset this effect and allows investors to maintain the purchasing power of the dividend that they receive from the company.

As is always the case, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want to be in a situation in which the company is forced to reverse course and cut its dividend since that would both reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we analyze a company’s ability to pay its dividend is by looking at its free cash flow. The free cash flow is the money that is generated by the firm’s ordinary operations and is left over after the company pays all its bills and makes all necessary capital expenditures. This is the money that is available to perform things such as reducing debt, buying back stock, or paying a dividend. During the trailing twelve-month period, Eversource Energy reported a negative free cash flow of $290.2 million. This is obviously not enough to pay any dividend, let alone the $831.2 million that the company actually paid out during the same period. This is almost certainly concerning at first glance.

However, it is not unusual for utilities to finance their capital expenditures through the issuance of both equity and debt while using their operating cash flow to pay the dividend. This is due to the remarkably high costs involved in constructing and maintaining a utility-grade infrastructure over a wide geographic area. In the trailing twelve-month period that ended June 30, 2022, Eversource Energy had an operating cash flow of $1.997 billion. This is more than sufficient to cover the $831.2 million dividend that the firm paid out over the period and leaves a great deal of money left over for it to cover other costs. Thus, the dividend does appear to be reasonably sustainable and investors should not really have anything to worry about here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of Eversource Energy, one metric that we can use to value it is the price-to-earnings growth ratio. This ratio is a modified form of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued given its forward earnings per share growth and vice versa. However, very few stocks have such a low price-to-earnings growth ratio in today’s market so it makes sense to compare the company’s ratio against that of its peers in order to determine which offers the most attractive relative valuation.

According to Zacks Investment Research, Eversource Energy will grow its earnings per share at a 6.34% rate over the next three to five years. This is relatively in line with the prediction that we made earlier based on the company’s rate base growth so it is likely a reasonably good estimate. This gives the stock a price-to-earnings growth ratio of 2.88 at the current price. Here is how that compares to the company’s peer group:

|

Company |

PEG Ratio |

|

Eversource Energy |

2.88 |

|

DTE Energy |

2.94 |

|

AES Corporation |

1.88 |

|

FirstEnergy Corporation |

2.27 |

|

Exelon Corporation |

2.34 |

Admittedly, this is somewhat discouraging as Eversource Energy appears to be rather expensive relative to its peer group. In fact, only DTE Energy is more expensive. However, as we saw earlier, Eversource Energy has a more conservative balance sheet than any of these companies so it may deserve a somewhat higher valuation due to the lower risk. Overall then, the stock may still be worth considering today.

Conclusion

In conclusion, Eversource Energy has quite a lot to offer a conservative investor despite some of the significant changes that it is currently seeing in its business. This is something that could prove valuable as the macroeconomic environment continues to weaken. The company is not without risk however as it does still have a significant amount of debt maturing next year and there are some questions about how it will be able to fully finance everything should the sale of its offshore wind projects not end up being consummated. There are also some risks surrounding its onshore projects but the company still has a very strong balance sheet overall and a respectable dividend yield. Overall, it may be worth considering for a portfolio.

Be the first to comment